Bird Finance BIRD Airdrop: Current Status and How to Avoid Scams in 2026

Feb, 5 2026

Feb, 5 2026

If you've heard about the Bird Finance BIRD airdrop, you've probably seen conflicting information. Multiple projects with similar names have caused confusion, making it hard to know what's real. This article breaks down the facts about Bird Finance's BIRD token and airdrop, current status in 2026, and how to avoid scams.

What is Bird Finance?

Bird Finance is a decentralized finance (DeFi) platform that uses smart pools to optimize yield farming across multiple blockchains. It automatically finds the best mining pools to maximize returns for users. The platform runs on its native token, BIRD the governance token with a deflationary tokenomics model, which powers everything from rewards to community decisions.

How BIRD Tokenomics Work

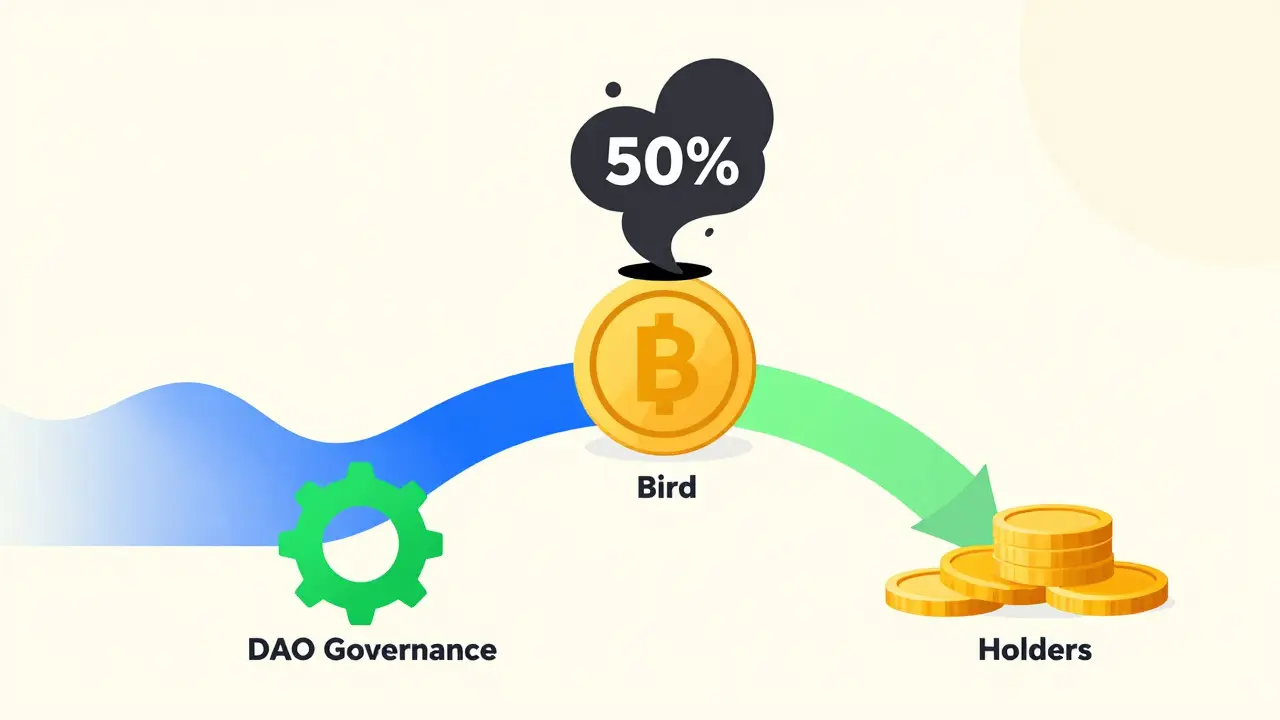

When Bird Finance launched, 50% of the total BIRD supply was burned and sent to a blackhole address. This created immediate scarcity. Every time someone trades BIRD tokens, a 6% fee is charged. Here’s how it breaks down: 2% goes to liquidity pools on decentralized exchanges, 2% funds the DAO governance pool for community decisions, and 2% is distributed to all existing BIRD holders. This system keeps burning tokens with every transaction, which could increase value over time.

Airdrop Eligibility: What You Needed to Do

For the BIRD airdrop, participants had to complete several steps. First, they needed to connect their cryptocurrency wallet to the official airdrop platform. Then, they had to follow Bird Finance’s verified social media accounts on Twitter and Telegram. Some reports said users also needed to hold specific tokens like $BIRD or other assets for a minimum period. Finally, filling out registration forms with wallet addresses was required to confirm participation. But here’s the catch: these requirements varied across unofficial sources, adding to the confusion.

Timeline Confusion: What Actually Happened?

Initial announcements said the BIRD airdrop would launch on November 30, 2024. Later, the team postponed it to the first quarter of 2025. As of February 2026, there’s no official confirmation that the airdrop ever happened. Bird Finance’s website, Twitter, and Telegram channels haven’t shared updates about token distribution. This lack of transparency leaves participants wondering: Did the airdrop occur? Or was it canceled? Without clear communication from the project team, it’s impossible to know.

Why the Name Confusion? Other Projects Using "BIRD"

| Project Name | Blockchain | Token Symbol | Key Details |

|---|---|---|---|

| Bird Finance | Multi-chain (Solana, HECO, OKExChain, Ethereum) | BIRD | DeFi platform with smart pools; tokenomics include 50% burned, 6% transaction fee |

| Birdchain | Various | BIRD | Instant messaging app; airdropped 1M tokens in 2024 |

| Birds (Sui Mini App) | Sui blockchain | BIRD | Game requiring level 10; airdrop scheduled for Dec 2024 |

Other projects using "BIRD" have made things worse. Birdchain is a separate instant messaging app that conducted its own airdrop in 2024. Participants needed to follow social media accounts and join Telegram groups. Meanwhile, Birds is a game on the Sui blockchain that planned a December 2024 airdrop. It required players to reach level 10 and keep their wallets connected. These projects share the same token symbol, so new users often mix them up.

Risks of Participating in Airdrops

Airdrop scams are common in crypto. Many fake "Bird Finance" sites ask for wallet private keys or charge "processing fees"-real projects never do this. Also, cryptocurrency prices are volatile. Even if you get tokens, their value could drop fast. Smart contract bugs could freeze funds, and regulatory changes might affect eligibility. Always double-check official channels before sharing wallet details. If something seems too good to be true (like "guaranteed high returns"), it probably is.

How to Verify Legitimacy

To avoid scams, follow these steps. First, go directly to Bird Finance’s official website-no Google search links. Check the URL for typos (e.g., "birdfinance.com" vs. "birdf1nance.com"). Then, look for verified social media accounts: Twitter profiles with blue checkmarks and Telegram groups with official badges. Never click links sent via DMs or unverified community chats. Finally, search for audit reports from reputable firms like CertiK or OpenZeppelin. If they’re missing, the project might not be secure.

Is the Bird Finance airdrop still happening in 2026?

As of February 2026, there’s no official confirmation that the BIRD airdrop occurred. The original dates (November 2024 and Q1 2025) have passed without updates. Bird Finance’s official channels haven’t shared details about token distribution, suggesting possible delays or cancellation. Always verify through their verified website and social media before assuming anything.

How can I spot a fake Bird Finance airdrop?

Fake airdrops often ask for private keys, charge fees, or use urgent language like "limited time only." Legitimate projects never request passwords or send money. Check for official links: Bird Finance’s real site is birdfinance.com (not .net or .org). Look for blue checkmarks on Twitter and Telegram. If a site has poor grammar, misspelled words, or unprofessional design, it’s likely a scam.

Why do multiple projects use "BIRD" tokens?

The name "BIRD" is short and catchy, so many projects use it. However, they’re unrelated-like Birdchain (messaging app) or Sui’s Birds game. Crypto’s lack of trademark rules means anyone can claim a token symbol. This creates confusion, especially for new users who don’t check project details carefully. Always research the team, blockchain, and official documentation before participating.

What happened to Bird Finance’s smart pools?

Bird Finance’s smart pools automatically find high-yield farming opportunities across blockchains like Solana and Ethereum. However, recent audits show limited transparency about their current status. As of 2026, the platform’s website hasn’t updated pool performance data, and user reports suggest some pools are inactive. Without clear communication, it’s hard to trust ongoing operations.

Should I participate in airdrops like this?

Only if you’ve done thorough research. Start by checking if the project has a live mainnet, published audits, and active community support. Avoid anything that asks for private keys or upfront payments. Remember: most airdrops have low value, and scams often mimic real ones. If you’re unsure, skip it-better to lose a small chance than risk your funds.

Mendy H

February 6, 2026 AT 05:38Transaction fees allocated to liquidity pools are only 2%. For a DeFi platform, this is woefully inadequate. Proper liquidity requires at least 5% to maintain market depth. The tokenomics model here is a joke. No wonder the airdrop never happened.

Deeksha Sharma

February 7, 2026 AT 04:34Despite the confusion around Bird Finance's BIRD token, DeFi innovation continues. Smart pools have potential if transparency improves. Many projects face early challenges, but this one has a solid foundation. Community support can drive adoption. Let's focus on the future rather than past confusion. Crypto is about experimentation. Patience is key. The project might yet succeed. Stay informed but stay hopeful.

sabeer ibrahim

February 8, 2026 AT 21:20BIRD tokenomics is fine. You're just salty bc u don't understand. 2% to liquidity is standard. DAO and holders get 2% each. India is building better DeFi projects. This scam? No way.

Mrs. Miller

February 9, 2026 AT 21:34Oh look, another 'BIRD' project causing chaos. It's like a crypto version of 'The Three Musketeers' but with more scams. Seriously, how many BIRDs are there? Birdchain, Birds on Sui, Bird Finance... it's a birdcage of confusion. Maybe they should all merge and call it 'The Bird Union' to avoid this mess. But seriously, always check the blockchain. Don't be fooled by the name.

Robin Ødis

February 10, 2026 AT 12:11While Deeksha's optimism is admirable, it's crucial to understand the risks inherent in DeFi projects like Bird Finance. The lack of transparency regarding their smart pools' current status is a major red flag. Without regular updates or audits, users have no way to verify if the platform is operational. The tokenomics model, with only 2% allocated to liquidity pools, is insufficient to ensure market stability. In reality, most successful DeFi protocols require at least 5% for liquidity to prevent slippage and maintain trading volume. Furthermore, the project's history of missed deadlines and unfulfilled promises suggests a lack of competence or intent. The fact that multiple projects share the BIRD token symbol only adds to the confusion and potential for scams. Users must be vigilant and never trust a project without thorough due diligence. I've personally encountered numerous instances where seemingly legitimate projects turned out to be rug pulls. The crypto space is rife with these dangers, and naive optimism can lead to significant financial loss. It's better to be cautious than to lose everything. Additionally, the 6% transaction fee structure seems arbitrary and lacks clear justification. The 2% to liquidity, 2% to DAO, and 2% to holders doesn't align with industry standards where fees are typically higher for liquidity. This structure suggests the project may not have a solid economic model. Moreover, the absence of any official audits from reputable firms like CertiK or OpenZeppelin raises serious concerns about security vulnerabilities. Without these checks, smart contract exploits could lead to catastrophic losses for users. The project's website and social media channels have been silent since early 2025, which is highly unusual for an active DeFi platform. This silence indicates possible abandonment or a deliberate attempt to hide failures. In conclusion, while the concept of smart pools is innovative, Bird Finance's execution is deeply flawed and poses significant risks to participants. It's essential to prioritize security and transparency over speculative gains.

Brittany Novak

February 11, 2026 AT 16:27The entire Bird Finance project is a government-backed scam to collect personal data. They're using the airdrop to harvest wallet information for surveillance. Every time you connect your wallet, they're tracking your transactions. This is part of a larger plan to control cryptocurrency users. The 'smart pools' are just a front for data mining. The 6% transaction fee is a way to funnel money to hidden entities. The tokenomics model is designed to fail, creating a false sense of security. The project's silence since 2025 is intentional to avoid scrutiny. The authorities are monitoring all DeFi activity to regulate it into oblivion. This is why you should never trust any airdrop.

Taybah Jacobs

February 13, 2026 AT 10:23It is imperative to approach DeFi projects with due diligence. Bird Finance's BIRD token has generated considerable confusion due to similar-named projects. However, verifying official channels and conducting thorough research is essential. The tokenomics structure, while unconventional, may have merit if properly executed. It is advisable to consult reputable audit reports before participating. Transparency and community engagement are key indicators of a legitimate project. Caution is warranted, but outright dismissal may be premature without sufficient evidence. A measured approach is recommended for all participants.

Brittany Coleman

February 14, 2026 AT 23:30Scams everywhere always verify

laura mundy

February 16, 2026 AT 07:36Scams everywhere check official channels Bird Finance legit confusion others dont be gullible