Bitcoin's Declining Block Reward Schedule Explained: How Halvings Shape Supply and Value

Jan, 3 2025

Jan, 3 2025

Bitcoin Block Reward Calculator

Block Reward Calculator

Enter a block height or date to calculate the Bitcoin block reward at that point in time.

Calculating...

Block Reward Details

Block Height:

Date:

Block Reward:

Halving Number:

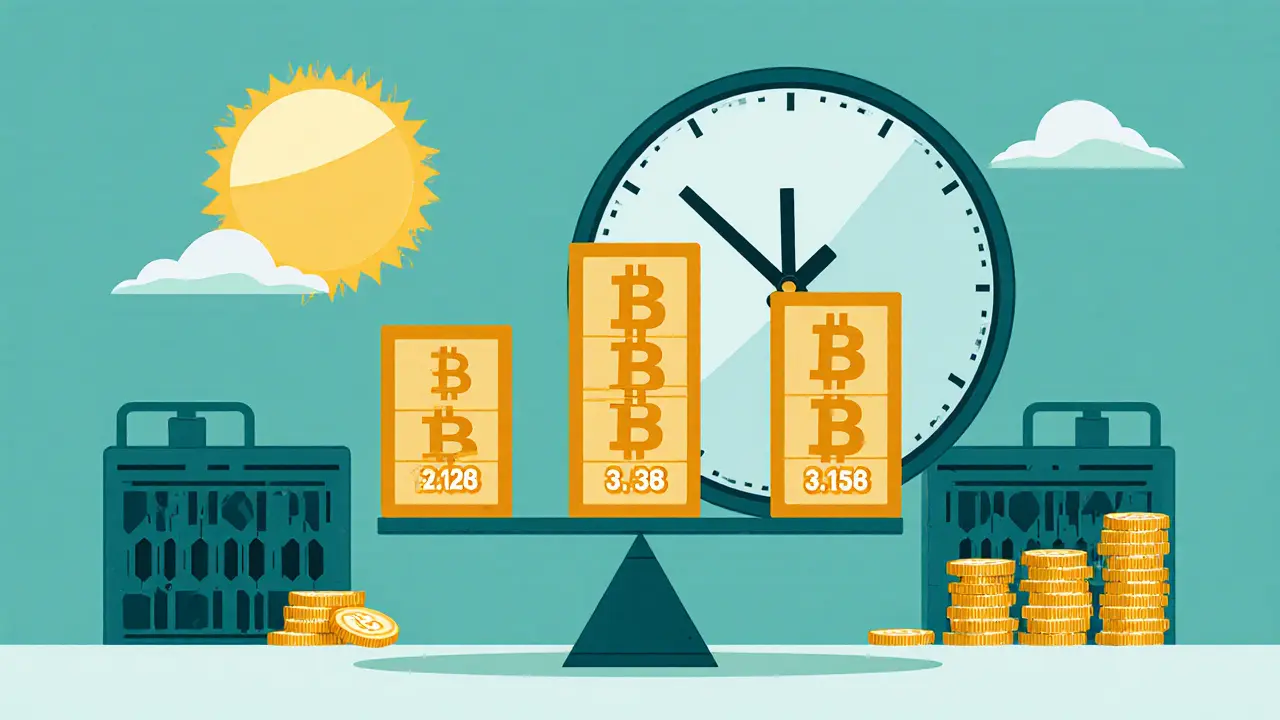

Timeline of Block Rewards

Total Bitcoin Mined to Date: 19.7 million BTC

Time Until Next Halving: ~2 years

When Bitcoin launched in 2009, miners got 50 BTC for every new block they added to the chain. Today, that reward is 3.125 BTC. And it’s going to keep dropping-every four years, without fail. This isn’t a glitch or a policy change. It’s the core design of Bitcoin’s money supply. The declining block reward schedule is what makes Bitcoin unique: a digital asset with a fixed, predictable, and ever-decreasing supply.

What Is the Block Reward, and Why Does It Matter?

The block reward is the new Bitcoin created and given to miners each time they successfully validate a block of transactions. It’s the only way new Bitcoin enters circulation. Alongside this, miners also collect transaction fees from users who want their payments processed faster. But for the first decade of Bitcoin’s life, the block reward made up over 99% of miner income. Transaction fees were barely noticeable. The block reward isn’t set by a central bank or a CEO. It’s written into Bitcoin’s code. Every 210,000 blocks-roughly every four years-the reward gets cut in half. This event is called a halving. It’s automatic. It’s predictable. And it’s irreversible without a network-wide consensus that’s nearly impossible to achieve. Why does this matter? Because it creates scarcity. Unlike the U.S. dollar, which the Federal Reserve can print whenever it wants, Bitcoin has a hard cap: 21 million coins. And the declining block reward is the mechanism that gets us there, slowly and steadily.The Halving Timeline: From 50 BTC to Zero

Here’s how the block reward has changed since Bitcoin’s start:- 2009-2012: 50 BTC per block

- 2012-2016: 25 BTC per block (first halving)

- 2016-2020: 12.5 BTC per block (second halving)

- 2020-2024: 6.25 BTC per block (third halving)

- 2024-2028: 3.125 BTC per block (fourth halving)

- 2028-2032: 1.5625 BTC per block

- 2032-2036: 0.78125 BTC per block

This pattern continues until around 2140, when the block reward drops below 0.00000001 BTC-effectively zero. At that point, no new Bitcoin will be created. The total supply will be locked at 21 million.

That’s not just a number. It’s a monetary policy unlike anything in human history. No central bank can change it. No government can print more. Even if every miner on Earth agreed to change the rules, they’d need the approval of every single node running Bitcoin software. And most nodes are run by people who believe in Bitcoin’s scarcity. They won’t vote to break it.

How Halvings Impact Price and Market Behavior

Every time the block reward has halved, Bitcoin’s price has eventually surged-sometimes dramatically. After the 2012 halving, Bitcoin rose from under $10 to over $1,000 within a year. After 2016, it climbed from $600 to nearly $20,000. In 2020, it went from $8,000 to $69,000 by late 2021. But correlation isn’t causation. Halvings don’t magically make Bitcoin go up. What they do is reduce the rate at which new Bitcoin enters the market. If demand stays steady-or grows-while supply slows, prices tend to rise. It’s basic economics. Analysts at Coinbase have pointed out that halvings reduce the “new supply” of Bitcoin by half. If institutional investors, countries, or everyday users are still buying Bitcoin, but fewer new coins are being released, the imbalance pushes prices up. That’s why many investors treat halvings like a calendar event: they buy ahead of time, expecting price action. But history doesn’t guarantee future results. In 2022, after the 2020 halving, Bitcoin dropped over 70% in a bear market. The halving didn’t prevent the crash. It just meant fewer new coins were being sold into the market during the downturn.The Real Challenge: Mining After the Rewards Fade

Miners are the backbone of Bitcoin’s security. They spend billions on hardware, electricity, and cooling to keep the network running. Their reward? New Bitcoin and transaction fees. Right now, the block reward still dominates. But as it shrinks, transaction fees must grow to keep miners profitable. That’s the big question: Will users pay enough in fees to replace lost block rewards? In 2024, average transaction fees hovered around $1-$3. That’s low. But during peak demand-like when NFTs exploded or memecoins surged-fees spiked to $20 or more. That’s a sign the system can scale up. But it’s also a sign that most users don’t want to pay high fees. They want cheap, fast transactions. That’s where the Lightning Network comes in. It’s a layer on top of Bitcoin that lets users send payments instantly and for pennies. Most of those transactions never hit the main Bitcoin blockchain. So they don’t generate fees for miners. That’s good for users. Bad for miners. The mining industry is already adapting. Companies like Marathon Digital and Riot Platforms now operate like Wall Street firms: they hedge Bitcoin prices, lock in electricity contracts, and use sophisticated analytics to predict profitability. Some even sell their Bitcoin as soon as they mine it to cover costs. The real risk? If fees don’t rise enough, some miners will shut down. That could reduce Bitcoin’s hashrate-the total computing power securing the network. Less hashrate means more vulnerability to attacks. Experts at Nervos and EY warn this could threaten Bitcoin’s security model if the transition to fee-based mining isn’t smooth.

Why This Design Is Revolutionary

Bitcoin’s declining block reward schedule isn’t just a technical detail. It’s a social contract. It says: Money shouldn’t be diluted by central authorities. Scarcity is a feature, not a bug. Compare this to the U.S. dollar. Since 1971, when the U.S. abandoned the gold standard, the dollar has lost over 95% of its purchasing power. Inflation is built in. Bitcoin is built to be the opposite. It’s not just about being “digital gold.” It’s about creating a monetary system that can’t be manipulated. No printing presses. No emergency bailouts. No quantitative easing. Just math. And time. This is why institutions like Fidelity, BlackRock, and MicroStrategy have bought billions in Bitcoin. They’re not just betting on price. They’re betting on a new kind of money-one that can’t be debased.What Comes Next? The Long Game

The next halving is expected in 2028, when the reward drops to 1.5625 BTC. After that, it’ll be 0.78125 BTC in 2032, then 0.390625 BTC in 2036. By 2040, miners will be earning less than 0.2 BTC per block. By 2080, it’ll be under 0.01 BTC. By 2140, the block reward will be effectively zero. All miner income will come from transaction fees. Will that work? No one knows for sure. But Bitcoin’s design allows for it. The protocol doesn’t require new coins to function. It only requires enough miners to keep the network secure. That’s why developers are already working on solutions: better fee market designs, improved block compression, and even proposals for dynamic fee adjustment based on demand. The community is preparing. What’s certain is this: Bitcoin’s scarcity is real. Its supply is finite. And its reward schedule is unchangeable. Whether you’re a miner, a holder, or just curious, understanding the declining block reward schedule isn’t optional. It’s the foundation of everything Bitcoin is.What is the current Bitcoin block reward?

As of April 2024, the Bitcoin block reward is 3.125 BTC per block. This was reduced from 6.25 BTC after the fourth halving. The next halving, expected in 2028, will cut it to 1.5625 BTC.

How often does the Bitcoin block reward halve?

The Bitcoin block reward halves approximately every four years, or every 210,000 blocks. This schedule is hardcoded into the Bitcoin protocol and has been consistent since 2009. The next halving is projected for 2028.

Why does Bitcoin have a block reward halving?

The halving was designed to create scarcity and mimic the limited supply of precious metals like gold. By reducing the rate of new Bitcoin issuance over time, the system ensures that only 21 million coins will ever exist. This contrasts with fiat currencies, which can be printed indefinitely.

Will Bitcoin mining stop after the block reward reaches zero?

No. Mining will continue as long as users pay transaction fees. Once the block reward reaches zero around 2140, miners will rely entirely on fees to cover their costs. The network’s security depends on enough miners staying active, so fee structures will need to evolve to support this transition.

Do halvings always cause Bitcoin’s price to go up?

Historically, Bitcoin’s price has risen after each halving, but halvings don’t guarantee price increases. Market sentiment, macroeconomic conditions, adoption rates, and regulatory changes also play major roles. Halvings reduce new supply, which can increase price pressure if demand holds steady-but they don’t control the market.

How does the block reward affect Bitcoin’s total supply?

The block reward is the only way new Bitcoin enters circulation. With each halving, the rate of new supply slows. After 2140, no new Bitcoin will be created, and the total supply will be capped at 21 million coins. As of 2025, over 19.7 million BTC have already been mined.

jocelyn cortez

November 23, 2025 AT 08:03Been holding since 2017 and honestly never thought about the math behind it until this post. Just knew it was rare. Feels weird to think we’re watching something get more scarce by design while everything else just gets cheaper.

Still, I sleep better knowing my bitcoin isn’t being diluted by some bureaucrat’s spreadsheet.

Tyler Boyle

November 24, 2025 AT 12:19Let’s be real - the halving narrative is sexy but oversimplified. Yes, supply drops every four years, but so does miner profitability, and if fees don’t scale, you get a fragmented network where only whale-sized operations survive. We’re already seeing consolidation: Marathon and Riot aren’t mining for the long game, they’re mining for quarterly earnings reports.

And don’t get me started on Lightning. It’s a brilliant hack, but it’s not Bitcoin. It’s a sidechain with its own trust assumptions. If you’re routing payments through it, you’re trusting intermediaries - the exact thing Bitcoin was meant to eliminate.

Also, the idea that ‘mining will just transition to fees’ ignores that fee markets are volatile. During bear markets, users don’t pay premiums. Miners get squeezed. Hasrate drops. Then you get 51% attack fears. It’s not a clean handoff. It’s a cliff. And no one’s built the safety net yet.

Meanwhile, institutions buy Bitcoin not because they believe in scarcity, but because they’re hedging against fiat collapse. The fact that BlackRock filed for a spot ETF says more about central bank incompetence than Bitcoin’s code.

And yes, 21 million is fixed - but what if the next halving coincides with a global recession? Demand plummets. Miners shut down. Network security weakens. And suddenly, the ‘unbreakable’ system has a single point of failure: human behavior.

Don’t mistake predictability for invincibility. Math doesn’t care about panic. Or liquidity crunches. Or regulatory crackdowns. Bitcoin’s design is elegant, sure - but elegance doesn’t protect you from the real world.

Jennifer Morton-Riggs

November 26, 2025 AT 11:32ok but like… if we’re all just waiting for the next halving to make us rich again, are we really any different from people who buy lottery tickets?

also why does everyone act like the 2021 boom was ‘because’ of the halving when it was literally just meme coins and retail FOMO?

and why do we pretend fees are gonna magically save mining when no one wants to pay $10 to send a pizza?

also also - who even uses bitcoin for transactions anymore? it’s just a speculative asset with a cult.

but hey, at least it’s not inflationary. i guess?

Gus Mitchener

November 26, 2025 AT 21:43The declining block reward is not merely an economic mechanism - it is an ontological assertion. Bitcoin’s architecture enacts a metaphysical constraint upon time itself: scarcity as a temporal invariant. The halving is not a policy adjustment; it is a cryptographic liturgy, a ritualized decrement that enforces the axiom of finite being upon a medium previously subject to infinite reproducibility.

Whereas fiat currencies operate under the hermeneutics of inflation - a continuous negation of value through the sovereign’s fiat - Bitcoin imposes a negative theology of value: the divine is not created, it is revealed, slowly, through computational entropy.

The transition to fee-based mining is not a technical problem - it is a hermeneutic crisis. Will the network’s participants accept that value must be extracted not from creation, but from transactional friction? Will they consent to the death of the minting god, and embrace the priestly function of the miner as a steward of consensus, not a beneficiary of issuance?

The 21 million cap is not a number - it is a covenant. And like all covenants, its endurance depends not on code, but on belief. The real question is not whether fees will suffice - but whether humanity is capable of sustaining belief in an unchangeable rule, in an age of perpetual revisionism.

Kathy Alexander

November 27, 2025 AT 08:35Halvings don’t cause price increases - they’re just a convenient story people tell after the fact to feel like they predicted something.

Every time the price goes up after a halving, someone points to the halving. When it crashes? Nobody mentions it. Confirmation bias with a blockchain.

Also, the ‘21 million cap’ is meaningless if no one uses Bitcoin for anything but speculation. You can’t call it money if no one spends it.

And Lightning Network? More like Lightning Scam - it’s just centralized hubs with custodial wallets pretending to be decentralized.

Bitcoin’s ‘scarcity’ is just a marketing tactic for people who don’t understand monetary policy. The real scarcity is attention - and everyone’s running out of it.

Soham Kulkarni

November 28, 2025 AT 08:46in india we dont care much about halving but i see my uncle buy btc every time price drop

he say bitcoin like gold but no one steal it

he dont know what miner or fee mean but he trust the number 21 million

he say if money can be print then why not bitcoin cant be print

he right in some way

we all want something that dont lose value

even if we dont understand how it work

just trust the code

and wait

that all