China's Cryptocurrency Ban and Policies: What You Need to Know in 2025

Jul, 21 2025

Jul, 21 2025

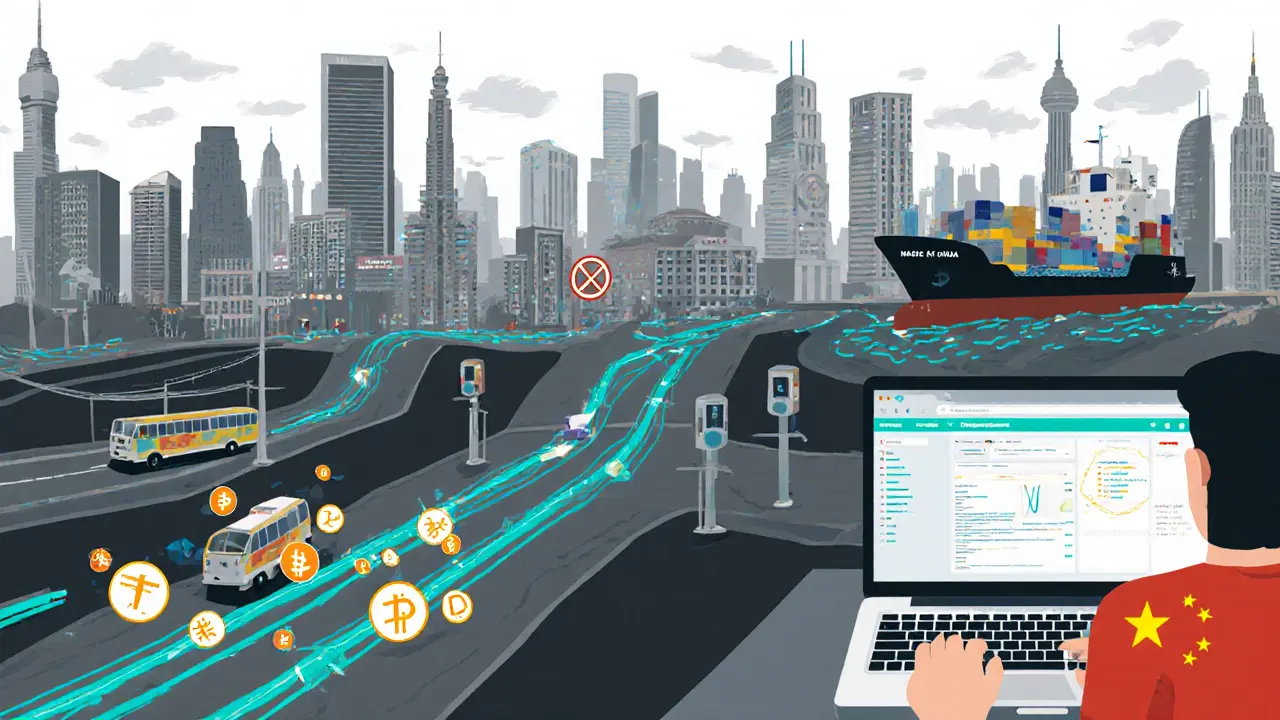

China doesn’t just regulate cryptocurrency-it bans it. And not just a little. Since 2009, the Chinese government has rolled out 19 separate cryptocurrency bans over 13 years, making it the strictest crypto regime on Earth. While the U.S. and EU debate how to tax or license digital assets, China has chosen total prohibition. If you’re holding Bitcoin, Ethereum, or any other crypto in China, you’re not breaking the law by owning it-but you are breaking the law if you trade it, mine it, or use it to buy anything. And the rules keep getting tighter.

How China’s Crypto Ban Evolved

It didn’t start with Bitcoin. In June 2009, China banned digital currencies from buying real goods-not because of Bitcoin, but because online game tokens were being used to bypass yuan controls. That small move set the tone: any money outside state control was a threat. Fast forward to December 2013, and the People’s Bank of China (PBoC) officially told banks: stop processing Bitcoin transactions. Bitcoin was labeled a "special virtual commodity," not money. No legal backing. No protection. Just a risky gamble. The market reacted instantly. Bitcoin dropped over 30% in days. BTCC, China’s biggest exchange at the time, stopped taking yuan deposits within days. The real hammer came in September 2017. During Bitcoin’s run-up to $20,000, China shut down every domestic cryptocurrency exchange and banned all initial coin offerings (ICOs). The PBoC called ICOs "illegal fundraising" and a threat to financial stability. All funds had to be returned. Exchanges like BTCC and ViaBTC shut down. Others moved to Singapore, Malta, or the Cayman Islands. But here’s the twist: Chinese traders didn’t disappear. They just went underground. Peer-to-peer platforms, offshore apps, and VPNs became the new normal.The 2021 Mining Crackdown

China used to dominate Bitcoin mining. By 2015, four Chinese mining pools controlled half of Bitcoin’s global computing power. Even with bans on trading, miners kept running. They used cheap hydroelectric power in Sichuan and Inner Mongolia. But in June 2021, everything changed. The government didn’t cite fraud or capital flight this time. They said mining was too energy-hungry. Too dirty. Too wasteful. And they ordered every mining operation to shut down. Within weeks, 90% of global Bitcoin mining left China. Most moved to the U.S.-Texas, Georgia, and Kentucky became new mining hubs. Chinese mining hardware companies like Bitmain and MicroBT didn’t vanish. They just started shipping machines overseas. Today, nearly every major mining rig sold in the U.S. or Europe was made in China. The ban didn’t kill China’s mining industry-it just relocated it.Why China Banned Crypto-And Why It Won’t Change

People assume China hates blockchain. They don’t. They love it. In October 2019, President Xi Jinping called blockchain a "core technology" and ordered state-backed development. But he was clear: no decentralized crypto. The government wants control. That’s why they built the digital yuan-a central bank digital currency (CBDC) that tracks every transaction, blocks illegal payments, and can freeze accounts remotely. The digital yuan isn’t an alternative to cash. It’s the ultimate surveillance tool. China’s ban isn’t about technology. It’s about power. When the yuan weakens, Chinese citizens rush to Bitcoin as a store of value. In November 2016, during a yuan devaluation, Bitcoin trading from China spiked. The government couldn’t control capital flight. So they cut it off. They also fear private money undermining monetary policy. If people stop using yuan for savings or payments, the PBoC loses control over interest rates, inflation, and credit. That’s unacceptable. Unlike the U.S., where the SEC and CFTC argue over whether crypto is a security or commodity, China doesn’t debate. It enforces. There’s no gray area. No licensing. No exceptions. Even offering crypto education or hosting a crypto podcast in China could trigger penalties.

What Happens If You Use Crypto in China Today?

If you’re a regular person in China holding crypto? You’re not getting arrested. But you’re not safe either. Banks monitor transactions. If they spot a pattern-like regular transfers to foreign exchanges-you could get flagged. Your account might be frozen. Your phone number could be blocked from using apps like WeChat Pay. Some users report being questioned by local police after large crypto transfers. Most people who still trade use VPNs to access Binance, Kraken, or OKX. They use peer-to-peer platforms like LocalBitcoins or Paxful, trading yuan for crypto through cash meetups or bank transfers. But these methods are risky. Scams are common. And if you’re caught, you could face fines or forced account closures. There’s no legal recourse. No protection. You’re on your own.China’s Global Influence Despite the Ban

Even with a domestic ban, China still shapes the global crypto market. Chinese companies make 80% of the world’s mining hardware. Chinese venture capital firms still fund blockchain startups in Singapore and Dubai. Chinese developers write code for DeFi protocols and NFT platforms. Chinese traders, now based in Thailand, Portugal, or Canada, still send money back home through informal channels. Before the 2017 exchange ban, Chinese users accounted for 80-90% of global Bitcoin trading volume. That dominance didn’t vanish overnight. It just went global. Today, if you use a crypto exchange, there’s a good chance it was built or funded by Chinese entrepreneurs-even if the company’s HQ is in the Cayman Islands.

What’s Next for China and Crypto?

Don’t expect the ban to lift. Not in 2025. Not in 2030. The digital yuan is now live in over 200 cities. It’s integrated into public transit, utilities, and government payments. Over 260 million people have used it. The PBoC is testing cross-border payments with Thailand, Hong Kong, and the UAE. This isn’t a trial. It’s the future. China’s goal isn’t to catch up to the West. It’s to replace it. They’re building a financial system where the state sees everything, controls everything, and owns the digital money. Decentralized crypto doesn’t fit. It’s a threat to their entire model. For the rest of the world, China’s approach is a warning. If you want total control over money, you don’t need to ban crypto-you just need to offer something better. And China is betting everything that the digital yuan is that thing.What This Means for You

If you’re outside China: China’s ban doesn’t affect you directly. But it does shape the market. Mining hardware prices dropped after 2021 because supply flooded the global market. Crypto volatility increased because Chinese traders moved their activity offshore. The rise of DeFi and privacy coins? Partially driven by users fleeing centralized control. If you’re inside China: Your options are limited. Holding crypto is low-risk. Trading it is high-risk. Mining? Impossible. Your best bet is to keep your assets in a hardware wallet, avoid linking them to your Chinese bank account, and understand that any movement could attract attention. If you’re a developer, investor, or entrepreneur: China’s story is a lesson in state power vs. decentralization. The world is splitting into two camps: open, permissionless systems and state-controlled digital economies. China chose the latter. The rest of us are still deciding.Is it illegal to own Bitcoin in China?

No, owning Bitcoin or other cryptocurrencies is not illegal in China. You won’t be arrested for holding crypto in a wallet. But using it to buy goods, trade on exchanges, or mine it is banned. The government only targets transactions, not possession.

Can Chinese citizens use Binance or Coinbase?

Officially, no. Since September 2021, Chinese authorities have blocked overseas exchanges from serving Chinese users. Binance and Coinbase have removed access for Chinese IP addresses. But many users still access them using VPNs. Doing so violates Chinese law, and accounts can be frozen or reported to authorities.

Why did China ban crypto mining?

China banned crypto mining in June 2021 citing excessive energy use and environmental damage. But the real reason was control. Mining was pulling power away from state priorities and enabling capital flight. The ban forced mining operations overseas, mostly to the U.S., while letting China focus on its own digital currency.

What is the digital yuan, and how is it different from Bitcoin?

The digital yuan is China’s central bank digital currency (CBDC), issued and controlled by the People’s Bank of China. Unlike Bitcoin, it’s not decentralized. Every transaction is tracked, and the government can freeze or limit usage. It’s designed to replace cash and strengthen state control over money-not to give people financial freedom.

Did China’s crypto ban hurt the global market?

Yes, but not permanently. The 2017 exchange ban and 2021 mining ban caused sharp drops in crypto prices and forced many Chinese investors to sell. But global markets recovered because demand shifted to other countries. China’s influence shifted too-from trading volume to hardware manufacturing and overseas development.

Can Chinese people still invest in crypto through foreign accounts?

Yes, many do. Chinese citizens with overseas bank accounts or residency in places like Singapore, Hong Kong, or the U.S. can legally trade crypto abroad. But transferring money out of China for this purpose violates capital controls. If caught, they risk fines, account freezes, or legal trouble-so most use informal channels, which carry their own risks.

stuart white

November 23, 2025 AT 16:47China didn't ban crypto because it's dangerous-it banned it because it's *too* powerful. The state doesn't want people holding something they can't track, freeze, or tax. The digital yuan isn't progress-it's a leash with a microchip. And honestly? It's terrifying how efficiently they pulled it off. No debate. No hearings. Just shutdowns. The world's watching, and half of us are still pretending decentralization matters.

Jenny Charland

November 24, 2025 AT 01:56lol imagine being so scared of money you ban it 😭

preet kaur

November 24, 2025 AT 18:44As someone from India, I see parallels. Our government also pushes UPI like it's the only way to pay-but we still have people using crypto through WhatsApp groups and cash trades. It's not about tech. It's about control. China just does it cleaner. Still, I feel for the traders. No one should be punished for wanting financial freedom.

Omkar Rane

November 26, 2025 AT 10:29you know what's wild? the mining rigs made in china are still powering half the world's bitcoin network, even though they banned it at home. it's like they built the weapon, then took away the ammo but kept selling the guns. bitmain and microbt are just global ghost factories now, shipping boxes to texas and kentucky while their own citizens get fined for using binance. and the digital yuan? it's basically a surveillance app with a wallet icon. no one's talking about how it can freeze your money just because you bought too much rice or talked to the wrong person. scary stuff. also typo: 'banning' not 'bannin' lol

Amanda Cheyne

November 26, 2025 AT 20:54They're not banning crypto. They're banning freedom. The digital yuan is a backdoor to track your every purchase, your friend's opinions, your medical spending-even your political donations. This isn't about energy use. It's about the CCP building a real-time totalitarian ledger. And guess what? The U.S. is quietly testing something similar. They just call it 'CBDC research.' Don't be fooled. The same tech is coming. This is the first domino.

Sky Sky Report blog

November 27, 2025 AT 22:00The ban isn't irrational-it's strategic. China recognized early that decentralized money undermines monetary sovereignty. Unlike Western regulators who argue over labels, China acted decisively to protect its economic model. The digital yuan isn't a threat to innovation-it's a redefinition of public infrastructure. And yes, the mining exodus created global supply shifts, but that's market adaptation, not defeat. The real story is how efficiently they pivoted from control to influence-without ever needing to legalize crypto.