Cross-Chain Bridge Technology Evolution: How Interoperability Is Reshaping Blockchain

Jun, 5 2025

Jun, 5 2025

Cross-Chain Bridge Risk Calculator

How Secure Is Your Bridge?

Select a bridge type to see its security rating based on historical data and architectural risks from the article.

Before 2020, moving Bitcoin to Ethereum wasn’t just hard-it was nearly impossible. You had to sell your BTC, buy ETH on an exchange, and hope the exchange didn’t freeze your funds. That changed with cross-chain bridges. These aren’t just tools; they’re the invisible highways connecting isolated blockchain islands. Today, over 50 bridges link more than 100 networks, moving billions in value every day. But behind the convenience lies a dangerous game of risk and reward.

The Rise of Cross-Chain Bridges

Cross-chain bridges emerged because blockchains speak different languages. Bitcoin uses Proof of Work. Ethereum moved to Proof of Stake. Solana runs on a different consensus model entirely. They can’t talk to each other natively. So developers built bridges-software middlemen that let assets jump from one chain to another. The first big player was Wrapped Bitcoin (WBTC), launched in October 2019. It didn’t move Bitcoin. It created a token on Ethereum that represented Bitcoin, backed 1:1 by real BTC locked in a vault. By mid-2022, WBTC had over $1.2 billion locked in it. That was the signal: users wanted to use Bitcoin in DeFi, and they’d pay the gas fees to make it happen. By 2021, the market exploded. Bridges like Multichain, RenVM, and Polygon Bridge were handling tens of billions in total value locked (TVL). But then came the crashes. In 2022, over $2.1 billion was stolen from bridges. The Ronin Bridge hack took $625 million. Wormhole lost $320 million. Suddenly, everyone realized: bridges aren’t just convenient-they’re the weakest link in the chain.How Bridges Actually Work

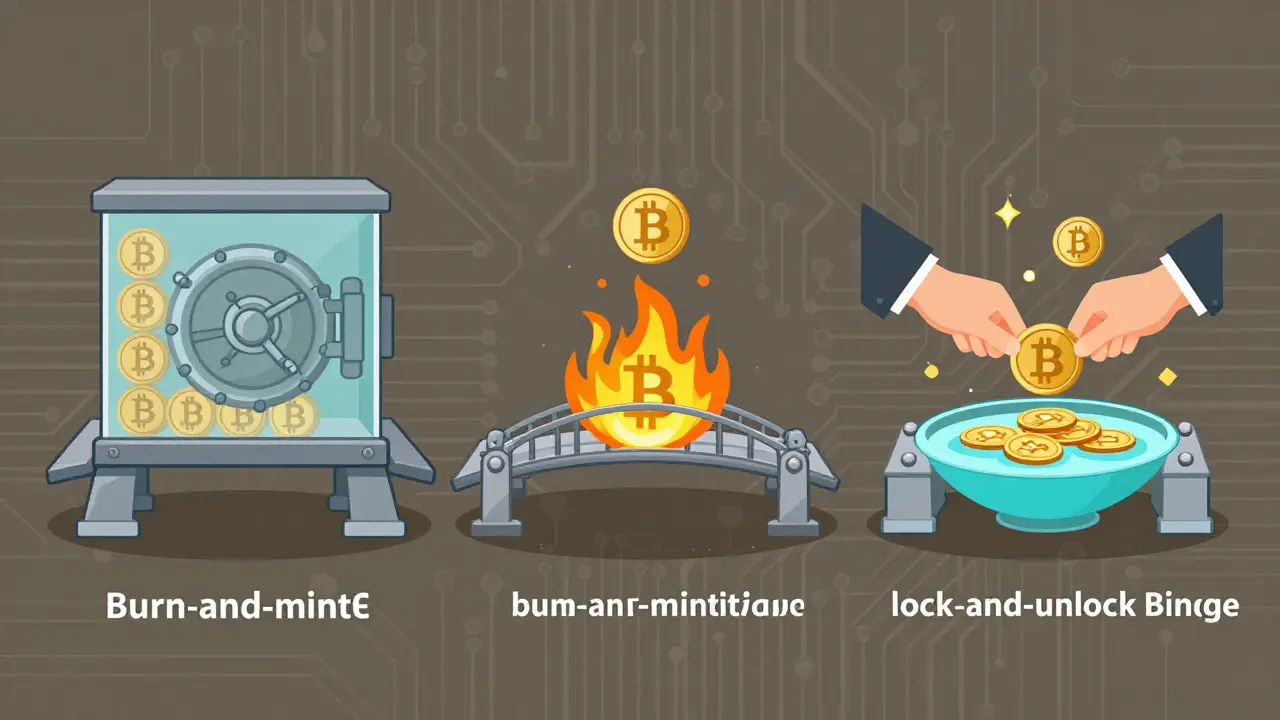

Not all bridges are built the same. There are three main types, each with different trade-offs:- Lock-and-mint (68% of TVL): You send BTC to a smart contract. The bridge mints WBTC on Ethereum. Your BTC sits locked. This is simple, but if the contract is hacked, your BTC is gone.

- Burn-and-mint (17% of TVL): You burn your BTC. A new BTC token is created on the target chain. No custody risk, but you lose the original asset. Hard to reverse if you send to the wrong address.

- Lock-and-unlock (15% of TVL): Used by THORChain. No wrapped tokens. You send BTC. Someone else on the other side sends you BTC from a shared liquidity pool. It’s trust-minimized, but slower and subject to slippage.

Security: The Biggest Weakness

Security models fall into three buckets:- Custodial (12%): A single company holds the keys. High risk. Nomad Bridge was custodial-and collapsed in August 2022, losing $190 million because a single private key was leaked.

- Semi-custodial (31%): A group of validators, often 10-20, sign off on transfers. If 6 out of 10 go rogue, funds are stolen. Polygon Bridge had this model until 2022, when a flaw could have let anyone mint unlimited tokens.

- Trust-minimized (57%): Uses math, not people. Zero-knowledge proofs (ZK-SNARKs) verify transfers without trusting anyone. Gravity Bridge and LayerZero use this. They’re slower and cost more, but they’re the only ones that don’t rely on human error.

Real-World Use Cases

Most people don’t use bridges for speculation. They use them to earn more. In November 2023, USDC on Ethereum paid 1.2% APY in DeFi. On Arbitrum? 4.7%. That’s why users moved $8.3 billion from Ethereum to Arbitrum in just three months using the official bridge. Gas fees dropped from $15 to under $0.15 per transfer. That’s not just savings-it’s financial freedom. THORChain lets you swap BTC directly for SOL without touching a centralized exchange. It processed $5.7 billion in Q3 2023. No KYC. No withdrawal limits. Just direct peer-to-peer swaps across chains. Enterprises are catching on too. Forty-three Fortune 100 companies now use bridges to move data and value between private and public blockchains. Banks use them to settle cross-border payments faster. Insurance firms use them to verify claims across chains.What Goes Wrong-and How to Avoid It

Users aren’t dumb. But they’re often unprepared. A UC Berkeley study found that first-time users take 45-75 minutes to complete their first cross-chain transfer. Why? Three things trip them up:- Gas on the destination chain: You send ETH from Ethereum to Polygon. You need MATIC to pay for gas on Polygon. Many users run out of gas halfway and lose their funds.

- Wrong address: Sending USDC to a BTC address? Your money is gone. Forever.

- Wrapped asset confusion: You get WBTC. You think it’s Bitcoin. But you can’t send WBTC to a Bitcoin wallet. You have to unwrap it first.

The Future: Less Bridges, More Native Interoperability

The best bridges are the ones you never see. That’s the goal. Polkadot’s XCM protocol now connects 47 parachains with native interoperability. No bridges needed. Cosmos IBC links 56 chains using a shared communication standard. Both avoid the risks of custody. Chainlink’s CCIP is becoming the industry standard. Over 15 major DeFi protocols are integrating it. If it succeeds, we’ll stop thinking about "bridges" and start thinking about "cross-chain actions"-just like we think about sending an email across the internet. But here’s the hard truth: bridges aren’t going away soon. Native interoperability takes years to build. Ethereum’s shared sequencing is still in testing. Bitcoin will never adopt smart contracts. So bridges will remain the glue-for now. By 2026, experts predict 75% of bridge TVL will be in trust-minimized systems. The custodial ones? They’ll be gone or regulated out of existence. The EU’s MiCA law already requires 1:1 backing for wrapped assets. The SEC is watching. The market is consolidating. Of the 78 bridge projects in 2023, 42% are already inactive.Final Thought: Bridges Are a Necessary Evil

Vitalik Buterin called bridges a "necessary evil." He’s right. They’re a workaround for a broken system. But they’re also the most powerful tool we have today to unlock the full potential of blockchain. They let you use Bitcoin in DeFi. They let you trade Solana for Avalanche without an exchange. They let institutions move value across private and public ledgers. The future isn’t one blockchain. It’s many. And bridges are how they’ll talk to each other-until they don’t need to anymore.What is the safest cross-chain bridge?

The safest bridges use trust-minimized architecture with cryptographic proofs like ZK-SNARKs. Gravity Bridge and LayerZero have shown strong security records since 2021, with no major protocol exploits. Cosmos IBC is also considered highly secure because it doesn’t rely on custodians at all-it uses native chain-to-chain communication. Avoid bridges that hold your assets in centralized wallets.

Can I lose money using a cross-chain bridge?

Yes. You can lose money from hacks, human error, or technical failures. Over $2.1 billion was stolen from bridges in 2022 alone. Common mistakes include sending to the wrong address, running out of gas on the destination chain, or not unwrapping tokens properly. Always test with a small amount first. Use bridges with clear transaction trackers and strong community support.

What’s the difference between Wrapped Bitcoin and a cross-chain bridge?

Wrapped Bitcoin (WBTC) is a type of asset created by a cross-chain bridge. A bridge is the system that moves value between chains; WBTC is one product of that system. WBTC is a token on Ethereum that represents Bitcoin, locked in a vault. Other bridges might burn Bitcoin and mint a new token, or use liquidity pools instead. So WBTC is one example of how a bridge works-not the bridge itself.

Do I need a different wallet for each blockchain?

No, but you need the right assets in each wallet. MetaMask can connect to Ethereum, Polygon, Arbitrum, and others. But to interact with those chains, you need their native gas tokens: ETH for Ethereum, MATIC for Polygon, ARB for Arbitrum. If you don’t have the right gas token, your transaction will fail. Always check what token you need on the destination chain before transferring.

Are cross-chain bridges regulated?

Regulation is still developing. The EU’s MiCA law requires wrapped assets to be 1:1 backed and audited. The U.S. SEC hasn’t issued specific rules yet, but Chairman Gary Gensler has said bridges creating wrapped securities fall under existing securities laws. Expect more regulation in 2025-2026, especially for custodial bridges. Trust-minimized bridges may face less scrutiny because they don’t hold user funds.

What’s next for cross-chain technology?

The next phase is trust-minimized, programmable bridges that move both assets and data. Chainlink CCIP and Polkadot XCM are leading this shift. By 2026, most new bridges will use cryptographic verification instead of centralized validators. Long-term, experts predict native interoperability will replace bridges entirely-making them obsolete within 7-10 years. But until then, they’re the only way to unlock value across blockchains.

Jay Weldy

December 6, 2025 AT 01:37Man, I remember when WBTC first dropped and everyone was losing their minds trying to get it. I thought it was magic at first-like, how are they even doing that? Then I saw the hack news and realized it was just a fancy middleman with a vault full of Bitcoin. Still, I’d rather use it than sell my BTC on Coinbase again. At least now I know to test with $10 first. Learned that the hard way after I lost a few bucks to a gas error.

Melinda Kiss

December 6, 2025 AT 10:58Thank you for this incredibly clear breakdown. I’ve been avoiding bridges because of all the horror stories, but this helped me understand the real risks vs. the hype. I especially appreciated the breakdown of lock-and-mint vs. trust-minimized. I’m now using LayerZero for my small transfers and feel way more at ease. Also, the gas token tip? Game-changer. I used to think ‘why can’t it just work?’-now I know I’m just forgetting MATIC. 😅

Christy Whitaker

December 7, 2025 AT 05:15Of course you’re all acting like this is some groundbreaking revelation. Everyone who’s been in crypto since 2021 knows bridges are a dumpster fire. You’re just now realizing that the ‘convenience’ was built on sand? And you’re still using them? Honestly, if you can’t wait for native interoperability, maybe you shouldn’t be in crypto at all. Just sayin’.

Nancy Sunshine

December 8, 2025 AT 09:08While I appreciate the technical depth of this exposition, I must emphasize that the underlying architectural paradigm remains fundamentally flawed. The continued reliance on intermediary consensus mechanisms-even those labeled ‘trust-minimized’-represents a persistent epistemological vulnerability in distributed ledger ecosystems. The emergence of ZK-SNARKs, while mathematically elegant, does not eliminate the ontological risk of front-end exploits or user error, which remain statistically dominant vectors of capital loss. Furthermore, the regulatory trajectory outlined, particularly under MiCA, suggests an inevitable convergence toward institutionalized custody models, thereby undermining the decentralization ethos that originally motivated blockchain adoption. One must therefore ask: are we engineering interoperability, or merely automating centralization?

Alan Brandon Rivera León

December 8, 2025 AT 19:19Just wanted to add-THORChain is wild, but the slippage on big swaps can kill you. I tried swapping 5 BTC for SOL once and ended up with 4.8 because the pool was thin. Took me three tries. But no KYC? No waiting? Still worth it. Also, don’t sleep on Cosmos IBC. It’s not flashy like Wormhole, but it just works. I’ve used it to move between Osmosis and Juno a dozen times. Zero issues. No wrapped tokens. Just pure chain-to-chain. If you’re serious about staying decentralized, this is the way.

Ann Ellsworth

December 9, 2025 AT 12:05Y’all are still talking about WBTC like it’s not just a synthetic asset? It’s not BTC. It’s a token. A liability. A derivative. And you’re treating it like it’s the real thing? And then you’re all shocked when the bridge gets hacked? Pathetic. Also, LayerZero? More like LayerZero-Trust-Then-Pray. The oracle feeds are still centralized. The devs are still in Silicon Valley. The ‘trust-minimized’ label is marketing fluff. If you want real security, use Bitcoin. Stay on Bitcoin. Don’t touch anything else. End of story.