Crypto Adoption in China Despite Ban: How 59 Million Still Trade Underground

Jan, 15 2026

Jan, 15 2026

China officially banned cryptocurrency in 2021. No exchanges. No mining. No trading. The government said it was illegal. Banks were told to cut off crypto-related transactions. Apps were blocked. Yet, by 2025, 59 million Chinese citizens are still using crypto. That’s more than the entire population of Canada. And it’s the second-largest crypto user base in the world-after India.

How Is This Even Possible?

The Chinese government didn’t just say "no"-they went all in. They shut down mining farms in Sichuan and Inner Mongolia. They forced Binance, OKX, and other exchanges to leave the mainland. They pressured tech companies to block crypto wallets and DeFi apps. But they never banned private ownership. That tiny loophole became the backbone of a massive underground economy. People didn’t stop using crypto. They just got smarter. Most Chinese users now trade through offshore exchanges like Bybit and OKX, accessed via VPNs. A 2024 Chainalysis report found that 78% of Chinese crypto users rely on virtual private networks just to get online. It’s not a secret. It’s a necessity.The Rise of Peer-to-Peer Trading

Forget centralized exchanges. The real action is on WeChat and QQ groups. These are private chat networks where strangers meet to trade crypto face-to-face-digitally. Here’s how it works: A buyer and seller agree on a price for USDT (Tether). The buyer sends yuan to the seller’s bank account. The seller releases the crypto from an escrow service. The whole thing happens in under 10 minutes. No exchange. No paperwork. No traceable transaction logs. According to a June 2025 Lightspark analysis, 63% of all crypto trades in China happen through P2P channels. Of those, nearly half-45%-are handled through encrypted WeChat escrow bots. These aren’t random guys on the street. They’re organized, verified, and often have reputations built over years. One user on Zhihu, China’s version of Quora, shared a step-by-step guide to avoid scams: verify the seller’s ID, check their transaction history across six different platforms, use a temporary phone number, and only trade during daylight hours when banks are open to reverse fraudulent transfers. That post got over 14,000 upvotes.Why Stablecoins? The Real Reason People Use Crypto

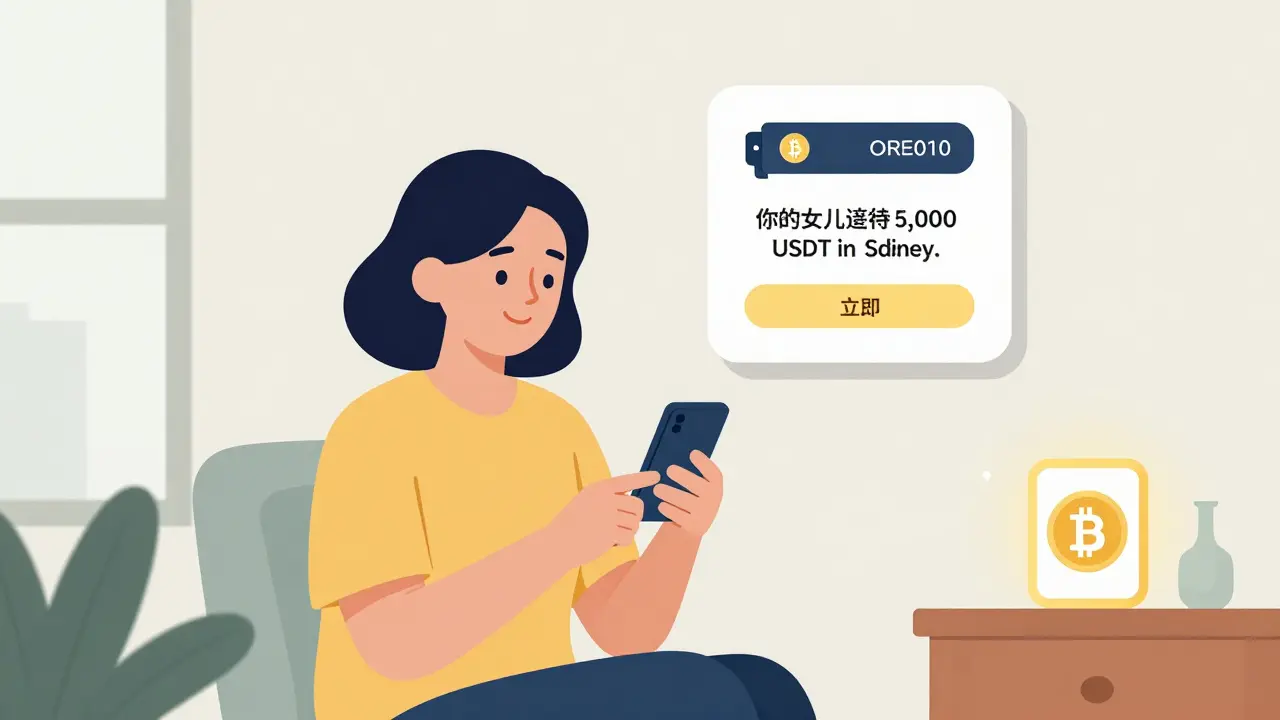

Bitcoin? Ethereum? Those are speculative. Most Chinese crypto users don’t care about mooning prices. They care about one thing: getting money out of China. The government strictly controls how much cash you can send abroad. Sending $10,000 to your kid studying in Australia? It takes three days, costs 12% in fees, and requires a mountain of paperwork. Enter USDT. Buy it in China. Send it to a friend in Sydney. They cash it out locally. Done. Takes 15 minutes. Costs less than 2%. Chainalysis data shows 38.7% of all crypto transactions in China are now stablecoins, up from just 21.7% in 2024. A woman on a WeChat crypto forum wrote: "I used to send money to my daughter through Western Union. Now I use USDT. I save $400 every semester. And she gets it the same day. No one asks questions."

The Hidden Tech: Privacy Coins and Encrypted Wallets

Some users go further. They use Monero (XMR), a privacy coin that hides transaction details completely. Others use DeFi protocols through browser extensions that bypass government filters. Apps like "CryptoBridge" and "Silk Road Wallet"-not official, not on Google Play-have been downloaded over 8.7 million times in the first half of 2025. These apps use domain fronting and encrypted tunnels to slip past firewalls. They’re built by Chinese developers, for Chinese users, and they’re constantly updating to stay ahead of crackdowns. DappRadar reported 1.2 million monthly active users on Chinese-language DeFi platforms in Q2 2025. These aren’t speculators. They’re people using automated lending, staking, and yield farming to protect their savings from inflation and capital controls.The Government’s Double Game

While cracking down on Bitcoin and Ethereum, China is pushing its own digital currency: the e-CNY, or digital yuan. By the end of 2024, over 260 million individual wallets and 15.5 million corporate wallets were active. The government now uses it to pay civil servants in pilot cities. It’s integrated into public transport, utility bills, and even some B2B trade deals. The message is clear: "We don’t want private money. We want control." But here’s the contradiction: the e-CNY is centralized. Every transaction is logged. Every user is tracked. Crypto, by contrast, is anonymous. That’s why it thrives. Dr. Li Wei, an economist at Tsinghua University, said in a March 2025 Bloomberg interview: "The ban is unenforceable at the individual level. About 15-20% of Chinese adults have traded crypto at least once. They know the risks. They don’t care."Who’s Using Crypto in China?

It’s not everyone. It’s not even most people. But it’s a very specific group. - Age: 37.5% of users are between 25 and 34. That’s higher than the global average. Older people? Only 12.8% of users are over 45. Crypto is a young person’s game. - Gender: 89.2% of users are male. That’s even more skewed than the global average (86.9%). - Location: Most activity is in big cities-Shanghai, Shenzhen, Beijing, Hangzhou. Rural areas? Almost none. - Income: Users are typically tech workers, freelancers, or small business owners. People who deal with international clients or need to move money fast.

Ashlea Zirk

January 16, 2026 AT 16:00While the technical ingenuity described here is impressive, it's important to recognize the systemic risks involved. The absence of regulatory oversight exposes participants to irreversible financial loss, identity exposure, and potential legal repercussions. The normalization of circumventing capital controls through encrypted channels may appear pragmatic, but it undermines the stability of financial infrastructure at a macro level.

Moreover, the reliance on stablecoins as a de facto foreign exchange mechanism creates unintended dependencies on centralized issuers like Tether, whose reserve transparency remains contested. This is not freedom-it’s vulnerability dressed as innovation.

Chris Evans

January 18, 2026 AT 11:18Let’s be real-this isn’t about crypto. It’s about the collapse of epistemic authority. The state claims monopoly over monetary expression, but the people have repossessed the means of value transmission through decentralized protocols. This is the ontological revolt of the digital age.

Every USDT transfer is a Derridean trace-erasing the sovereign signature of the yuan, replacing it with cryptographic consensus. The e-CNY isn’t currency-it’s surveillance infrastructure dressed in blockchain aesthetics. And yet, the 59 million? They’re not traders. They’re hermeneutic actors rewriting the ledger of sovereignty one peer-to-peer transaction at a time.

Pat G

January 19, 2026 AT 18:10So what? Let them play with their digital toys while we build real infrastructure. China’s ban is the only sane policy in a world gone mad. These people aren’t heroes-they’re fools risking prison for a crypto fantasy. And don’t pretend this isn’t laundering. It’s all money laundering with a side of delusion.

Why should the U.S. care about people breaking laws to send cash overseas? They’re not victims. They’re enablers of chaos. The government should be applauding the ban, not pretending it’s failing.

Bryan Muñoz

January 19, 2026 AT 22:51Andre Suico

January 20, 2026 AT 23:08The data presented is compelling and aligns with observable trends in digital finance under authoritarian regimes. However, the conclusion that crypto represents "survival" may oversimplify the broader socio-economic context.

Many users are not resisting state control-they are adapting to it. The preference for stablecoins reflects rational risk mitigation against inflation and currency depreciation, not ideological opposition. The infrastructure enabling this-VPNs, escrow bots, encrypted wallets-is commercially driven, not politically motivated.

It’s less rebellion, more resilience. And while the government’s inability to fully suppress this activity is telling, it doesn’t imply moral victory. It implies regulatory exhaustion.

Nishakar Rath

January 22, 2026 AT 07:49Alexis Dummar

January 22, 2026 AT 12:56you know what’s wild? the fact that these underground systems are more reliable than the official banking system for cross-border needs. i used to work with a freelancer in shanghai who sent me payments via wechat escrow bots. no delays, no fees, no questions. the government bans it but can’t stop it because the system works better than theirs.

also-privacy coins? monero is the real MVP. the fact that chinese devs are building domain-fronted wallets that auto-update to evade firewalls? that’s not just tech. that’s art.

kristina tina

January 23, 2026 AT 19:18This made me cry. Not because it’s dangerous or illegal-but because it’s so human. These aren’t speculators. They’re mothers sending money to their kids. Freelancers paying for software. Students avoiding 12% fees just to eat.

They’re not breaking the law to be rebels. They’re breaking it because the law doesn’t care about them.

Every USDT transfer is a quiet act of love. And that’s more powerful than any blockchain.

Michael Jones

January 24, 2026 AT 03:15It's worth noting that the persistence of crypto usage despite state suppression is a textbook example of market demand overriding regulatory intent. The Chinese government’s focus on centralized digital currency reflects a desire for control, not innovation. The underground crypto economy succeeds not because of technological superiority, but because it meets a fundamental need: financial autonomy.

Any policy that ignores human behavior is doomed to fail. The fact that 82% of users continue trading after account freezes confirms this. Regulation must evolve-or become irrelevant.