Decentralized vs Centralized NFT Marketplaces: What You Really Need to Know

Jan, 15 2025

Jan, 15 2025

NFT Marketplace Fee Calculator

Compare Marketplace Costs

Understand real costs for NFT transactions - platform fees, gas fees, and hidden risks

When you buy an NFT, you think you own it. But do you really? Or does the platform you bought it from still hold the keys - literally and figuratively? That’s the core question behind the split between decentralized and centralized NFT marketplaces. One gives you control. The other gives you convenience. And right now, convenience is winning.

What Exactly Is a Centralized NFT Marketplace?

Centralized NFT marketplaces act like digital eBay or Amazon, but for digital art and collectibles. Think OpenSea, Coinbase NFT, or Binance NFT. These platforms are run by companies. They own the servers. They set the rules. They decide who can list, who gets banned, and what gets removed. These platforms are easy to use. You sign up with an email. Connect your wallet. Buy or sell with a few clicks. No need to understand gas fees, smart contracts, or blockchain validators. That’s why OpenSea handles over $22 billion in sales and has more than 1.3 million buyers. Most people don’t care about decentralization - they care about not getting locked out of their account or losing their NFT because they messed up a transaction. But here’s the catch: you don’t actually control your NFTs on these platforms. When you "buy" an NFT on OpenSea, you’re not storing it on your device. You’re storing it on their system. They hold the private keys. If they shut down - or get pressured by regulators - your NFT could vanish overnight. And they take a cut. Most charge between 2.5% and 5% per sale. That’s money you’re paying just to use their platform.How Decentralized NFT Marketplaces Work

Decentralized marketplaces run on blockchain networks. No company owns them. No server can be shut down. Transactions happen directly between users, verified by code - not by a CEO or customer support team. Examples? Well, true decentralized marketplaces are rare. Even OpenSea uses some decentralized tech underneath, but still runs centralized front-end servers. Projects like SuperRare, Foundation, and Blur have moved parts of their infrastructure on-chain, but most still rely on centralized servers to store images and metadata. True decentralization means your NFT’s image, description, and ownership history live on a distributed network like IPFS - not on a company’s server. And your wallet holds the private key. No middleman. No account to recover. No support ticket to file. That sounds great - until you try to sell your NFT. On a decentralized platform, you need to understand slippage, gas fees, and transaction confirmations. If you send a transaction with too low a fee, it might sit for hours. If you send it with too high a fee, you waste money. And if you mess up the contract address? Your NFT could be gone forever.The Hidden Centralization Problem

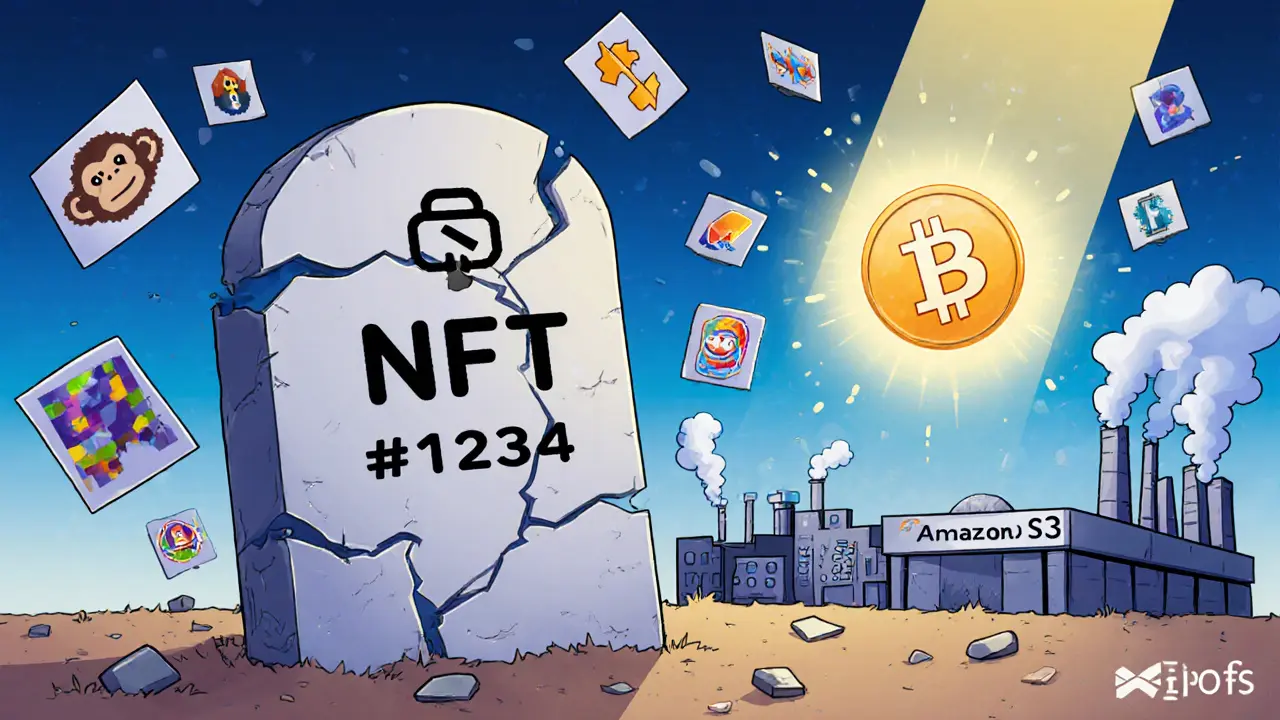

Here’s the dirty secret: most NFTs aren’t really decentralized - even if the marketplace says they are. Over 90% of NFTs store their images and metadata on centralized servers - Amazon S3, Google Cloud, or even regular websites. That means if the company hosting that server goes offline, your NFT becomes a broken link. You still "own" the token on the blockchain, but the image? Gone. Poof. This is the biggest contradiction in the NFT world. You bought something "on the blockchain," but the thing you bought - the art, the music, the meme - lives on a server owned by a startup in San Francisco. If they get bought by a big tech company? Or if they run out of money? Your NFT turns into a digital tombstone. Only a few projects use fully decentralized storage like IPFS or Arweave. And even then, most users don’t know how to verify it. They just see a pretty picture and assume it’s safe.

Security: Who’s Really in Control?

Centralized platforms are a single point of failure. Hack one server, and you get access to thousands of wallets, user data, and private keys. In 2022, OpenSea had a vulnerability that let attackers steal NFTs by tricking users into signing malicious transactions. The platform fixed it - but only after users lost assets. Decentralized platforms don’t have that problem. There’s no central server to hack. But they have their own risks: buggy smart contracts. Malicious code hidden in NFT listings. Scammers creating fake marketplaces that look real. And if you lose your private key? No recovery. No email reset. No customer service rep to call. On centralized platforms, you can reset your password. On decentralized ones, you’re on your own. That’s why most users stick with OpenSea - not because they believe in decentralization, but because they don’t want to lose everything over a mistake.Fees: Who Gets Paid?

On OpenSea, you pay a 2.5% fee every time you sell. That’s $25 on a $1,000 NFT. The company keeps it. No one else benefits. On a decentralized marketplace, fees go to the network. Liquidity providers earn rewards. Validators get paid. Developers get funded through protocol-level treasury systems. The money stays in the ecosystem. It’s not a profit grab - it’s a shared incentive. But here’s the reality: decentralized platforms often have lower liquidity. That means if you want to sell a rare NFT fast, you might have to drop your price. On OpenSea, you’ll find buyers instantly. On a decentralized platform? You might wait days. And gas fees on Ethereum? They can spike to $50 or more per transaction. That’s more than the platform fee. So even if you’re "saving" on marketplace fees, you’re paying more in blockchain costs.

Who Wins? The Users or the Platforms?

Right now, centralized marketplaces win. Why? Because they’re easier. They’re faster. They have apps. They have customer service. They have ads on YouTube. But the long-term risk? You’re trusting a corporation with your digital ownership. And corporations change. They get bought. They get regulated. They shut down. In 2023, a major NFT platform called NFTfi shut down after a lawsuit. Thousands of users lost access to their collateralized NFTs. No warning. No refund. Decentralized marketplaces are slower. They’re harder. They’re clunky. But they’re built to last. If the company behind OpenSea disappears tomorrow, your NFTs are still on the blockchain. You just need to find another way to trade them. The future isn’t about choosing one or the other. It’s about hybrid systems. Projects are starting to build their own white-labeled marketplaces - using decentralized tech, but with a clean UI that feels like OpenSea. This way, they keep control of their community, avoid platform fees, and still make trading easy.What Should You Do?

If you’re new to NFTs? Start with OpenSea. Learn the ropes. Understand how trading works. Get comfortable with wallets. Once you’re ready? Move your key NFTs to a wallet you control. Use IPFS or Arweave for storage. Trade on decentralized platforms like Blur or LooksRare for better fees and more control. And always check: where is the image stored? Is it on IPFS? Or on a company’s server? If it’s the latter, you don’t own the NFT - you own a ticket to a digital locker that someone else controls. Decentralization isn’t about technology. It’s about power. Who holds the keys? Who makes the rules? Who gets the money? The answer matters more than you think.Can I really own an NFT on a centralized marketplace like OpenSea?

Technically, yes - you hold the token on the blockchain. But you don’t control the metadata (the image, description, etc.) if it’s stored on OpenSea’s servers. If OpenSea shuts down or removes your NFT, the link breaks. You still own the token, but the NFT as you know it - the art - may disappear. True ownership means you control both the token and the data.

Are decentralized marketplaces safer than centralized ones?

It depends. Decentralized platforms have no central server to hack, so they’re less vulnerable to mass data breaches. But they’re full of smart contract bugs and scams. If you send funds to the wrong address or sign a malicious transaction, there’s no way to undo it. Centralized platforms have customer support - but they can freeze your account or get hacked. Neither is perfectly safe. Decentralized gives you control; centralized gives you a safety net.

Why do most NFTs still use centralized storage?

Because decentralized storage like IPFS is slower, harder to use, and more expensive to maintain. Most NFT creators use regular cloud servers because they’re cheap and reliable. Uploading a 10MB image to AWS costs pennies. Storing it permanently on Arweave costs $5-$10. Most artists and projects aren’t willing to pay that upfront - even if it means their NFTs could vanish later.

Do decentralized marketplaces have lower fees?

Yes - but only if you ignore gas fees. Decentralized marketplaces often charge 0.5% to 1% in platform fees, compared to 2.5%-5% on OpenSea. But Ethereum gas fees can spike to $20-$50 per transaction. So if you’re selling one NFT, you might pay more in gas than you save in platform fees. For high-volume traders, decentralized is cheaper. For casual buyers? Not always.

Will decentralized marketplaces ever replace OpenSea?

Not anytime soon. OpenSea dominates because it’s easy. Most users don’t care about decentralization - they care about not losing money. But as blockchain tech improves - faster networks, cheaper fees, better interfaces - more projects will build their own decentralized marketplaces. The future isn’t one platform replacing another. It’s hundreds of smaller, community-owned marketplaces coexisting alongside giants like OpenSea.

Jennifer MacLeod

November 22, 2025 AT 20:39I bought my first NFT on OpenSea last year and thought I owned the art until I read this post. Now I check every NFT's metadata storage before buying. If it's on AWS or Google Cloud? I walk away. I don't care how pretty it looks. If the company vanishes, so does my 'ownership'.

Decentralized storage isn't sexy but it's the only way to actually own something digital.

Linda English

November 23, 2025 AT 14:15It’s fascinating, really, how the entire NFT ecosystem hinges on this invisible tension between convenience and control-because, let’s be honest, most people aren’t technologists, they’re just people who like cool digital art, and they want to feel safe while enjoying it.

But safety, in this context, is a illusion built on corporate infrastructure, and when corporations change their minds-or get acquired, or face regulatory pressure-the entire foundation crumbles.

Meanwhile, decentralized systems, while intimidating and often clunky, offer something far more valuable: permanence.

It’s not about being a crypto bro or a blockchain purist-it’s about recognizing that if you’re going to assign value to something digital, you should have real control over it, not just a receipt.

And honestly, the fact that 90% of NFTs still rely on centralized servers feels like a betrayal of the entire premise of Web3.

It’s like buying a house and having the deed in your name but the keys held by a landlord who can change the locks whenever they want.

People need to wake up. Not everyone has to run their own node, but they should at least know where their art lives.

And if they don’t? They’re not owners. They’re renters.

And renters don’t get to decide what happens to the property.

It’s time to stop pretending that OpenSea is a vault. It’s a storefront.

And storefronts can close.

asher malik

November 23, 2025 AT 22:38centralized = easy

decentralized = real

most people pick easy

they just don’t realize how much they’re giving up

and then they cry when their NFT turns into a 404

its not the tech its the mindset

we built this whole thing to escape control

and then we handed the keys back to a startup in SF

irony is a beautiful thing

Julissa Patino

November 25, 2025 AT 06:36why are we even talking about this like its a big deal

opensea is fine

if you cant handle a wallet you shouldnt be buying nfts

stop overthinking

its just a jpeg

if you want decentralization go live in a cave with a ledger

the rest of us want to buy cool shit without reading 10k words of blockchain jargon

also ipfs is slow as hell

who even uses it

its 2024 not 2021

get over it

Tyler Boyle

November 25, 2025 AT 15:52Julissa’s comment is the exact reason why this whole ecosystem is doomed to fail. It’s not about whether NFTs are ‘just a jpeg’-it’s about the principle of digital ownership. If you reduce it to convenience, you’re reinforcing the very centralized systems Web3 was meant to dismantle.

And Tyler, you’re right to call out the jargon, but dismissing IPFS as ‘slow as hell’ ignores the fact that Arweave and Filecoin have made massive strides in permanence and cost efficiency. You can now store 100MB for under $2.50 forever. That’s cheaper than a Spotify subscription.

Also, the ‘just buy on OpenSea’ mentality is why we had that whole NFTfi collapse last year. People lost collateralized NFTs because they trusted a company’s UI over their own keys. That’s not negligence-it’s systemic failure.

And yes, gas fees are a pain on Ethereum, but Layer 2s like Polygon and Arbitrum have slashed those costs by 90%. You don’t need to be a dev to use them. The tools are here.

The real problem isn’t tech-it’s education. Most users don’t know how to verify storage. They don’t know what ‘on-chain metadata’ means. And platforms like OpenSea don’t care to educate them-they just want the 5% cut.

So yeah, maybe decentralized marketplaces are clunky. But they’re the only ones that won’t disappear tomorrow when the VC funding dries up.

And if you think ‘it’s just a jpeg,’ then why are you even here? Why not just screenshot it and call it a day? Because you want to own it. Not just see it. That’s the whole point.

So stop blaming users for being lazy. Blame the platforms for making it easier to be ignorant.