Future of Deflationary Cryptocurrencies: Scarcity, Burns, and What Really Drives Value

Jul, 13 2025

Jul, 13 2025

Deflationary Cryptocurrency Burn Calculator

Calculate how burn mechanisms affect cryptocurrency supply over time. Enter key parameters to see how different burn rates impact circulating supply.

Results

After months, the circulating supply will be coins.

That's a 0.00% reduction from the current supply.

Deflationary cryptocurrencies aren’t just about running out of coins. They’re about scarcity as a design choice - a deliberate move to make digital money behave more like gold than paper cash. If you’ve heard that Bitcoin’s 21 million cap makes it “digital gold,” you’re halfway there. But the real story today isn’t just Bitcoin. It’s a whole ecosystem of tokens burning, reducing, and restructuring their supply in ways that challenge old assumptions about money, demand, and value.

How Deflationary Cryptocurrencies Actually Work

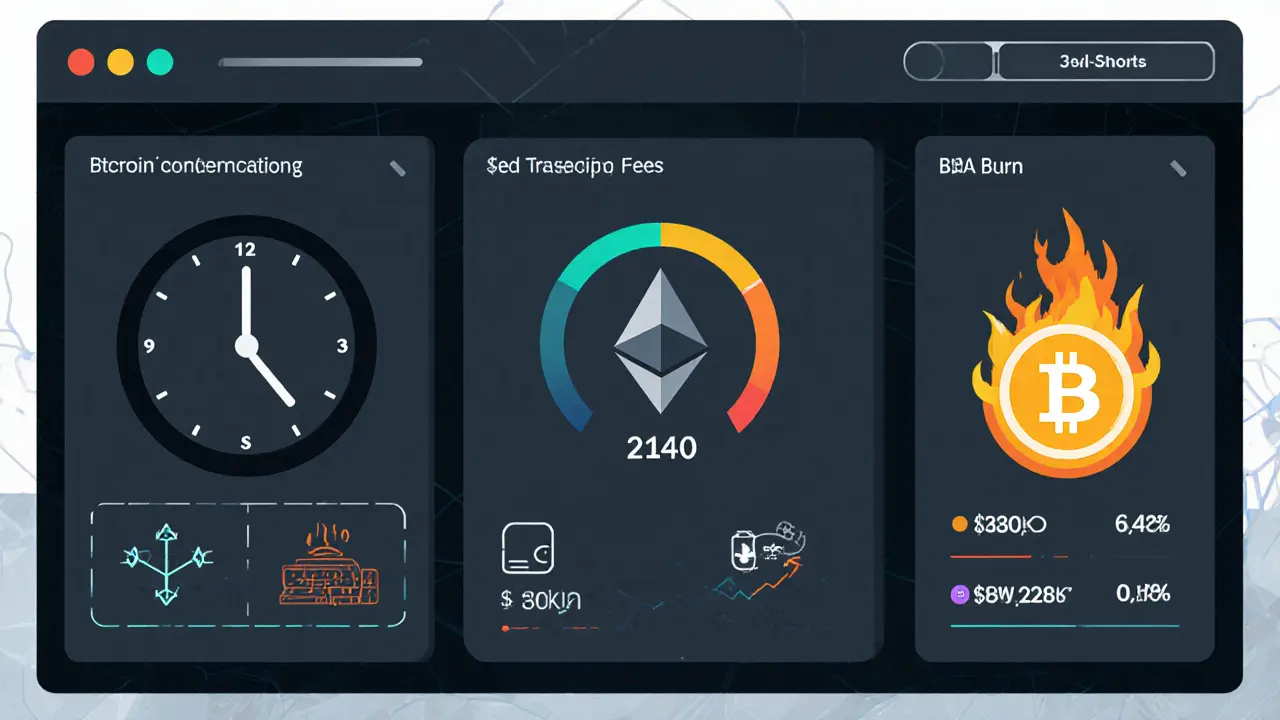

Not all deflationary coins are built the same. The simplest model is Bitcoin’s: a fixed supply, with new coins slowing down over time through halvings. Every four years, miners get half as many new BTC for securing the network. That’s it. No burning. No complex rules. Just math. As of April 2024, the block reward dropped to 3.125 BTC per block. That means annual issuance fell from 328,500 BTC to 164,250 BTC - and it keeps halving until 2140, when the last coin is mined. Other projects took this idea and turned it into a machine. BNB Chain, for example, burns tokens automatically every quarter. In October 2025, they burned 1.44 million BNB - worth over $1.2 billion - bringing the total supply down to 137.7 million. Their goal? 100 million. That’s not just a marketing stunt. It’s a programmed reduction, tied to trading volume and network activity. Each burn shrinks the supply. If demand holds steady, price pressure builds. Ethereum is different. It doesn’t have a hard cap. But since EIP-1559 launched in 2021, every transaction fee gets partially burned. In the first nine months of 2025, Ethereum burned 1.2 million ETH - $3.8 billion worth - and went deflationary for 127 days. That means more ETH was destroyed than created. For the first time in its history, Ethereum’s circulating supply actually shrank. Then there are the wildcards: tokens like BullZilla ($BZIL) that use a “Roar Burn Mechanism.” Every transaction burns a percentage of the amount sent - anywhere from 0.5% to 5%, depending on market conditions. Add in a staking platform offering 70% APY, and you’ve got a system designed to both reduce supply and lock up coins. It’s aggressive. It’s risky. But it’s real.Why Scarcity Doesn’t Always Mean Higher Prices

The theory is simple: less supply + same demand = higher price. But reality is messier. Take Bitcoin. It’s held by 97 of the top 100 institutional investors. Its scarcity narrative is rock-solid. Yet, its transaction fees jumped from $1.89 in 2024 to $4.27 in 2025. Why? Because people are hoarding, not spending. When users think a coin will go up, they stop using it. That’s the paradox of deflation. Instead of driving adoption, scarcity can kill utility. Crypto Basic’s data shows deflationary tokens had 22% lower transaction volume during bull markets than inflationary ones. Users aren’t trading them. They’re sitting on them. That’s great for price if everyone believes in the long-term. But terrible for network health. A cryptocurrency that isn’t used isn’t a currency - it’s a speculative asset. And then there’s “burn theater.” A lot of new tokens claim to burn tokens. But many burn less than 0.1% of supply per year. That’s like removing a single grain of sand from a beach. Dr. Sarah Chen from CoinDesk called it “psychological deflation” - it looks good on paper, but doesn’t move the needle. Investors are catching on. In 2025, projects with burn rates below 0.5% saw 60% lower community engagement than those with meaningful burns.BNB vs. Bitcoin: Two Paths to Scarcity

Bitcoin is the conservative choice. Stable. Proven. Slow. BNB is the aggressive one. Fast. Dynamic. Built for use. Bitcoin’s model is passive. It doesn’t care what you do with your coins. It just limits supply. BNB’s model is active. It burns more when the network is busy. When trading volume spikes, so does the burn. In September 2025, BNB burned over $1.2 billion in a single quarter - and its daily trading volume hit $4.2 billion, all without market makers. That’s organic demand driving supply reduction. BNB also has lower volatility during market crashes. Blockpit’s September 2025 analysis found deflationary tokens like BNB were 47% less volatile than non-deflationary ones. Why? Because holders believe the burn will eventually push price up. They’re less likely to panic-sell. But Bitcoin still dominates. It has $589 billion in market cap - 69% of the entire deflationary crypto market. BNB sits at $89.4 billion. That’s a big gap. Bitcoin’s edge isn’t just scarcity. It’s trust. It’s the first. It’s the most audited. It’s the one everyone agrees on.

The Rise of Hybrid Models

The next wave of deflationary crypto isn’t just about burning. It’s about combining scarcity with utility. Solana redesigned its tokenomics in Q1 2025. Now, 50% of every transaction fee is burned. When the network is busy - like during an NFT minting frenzy - it burns millions in SOL. That’s not just deflation. It’s a feedback loop: more usage → more burns → scarcer supply → higher value. Hyperliquid launched cross-chain burns in September 2025. You can burn tokens on Ethereum, and the burn is reflected on Solana. This is the first time scarcity is being synchronized across blockchains. Projects like BullZilla are even experimenting with “burn-to-stake.” Instead of destroying tokens, you can lock them into a staking pool where they’re permanently removed from circulation - but you earn rewards. It’s deflation without giving up yield. And then there’s NFT-integrated deflation. Some tokens now burn NFTs to reduce supply. If you own a rare digital collectible, you can burn it to shrink the total coin supply - and get a share of the rewards. It’s a new kind of ownership economy.What’s Holding These Coins Back?

Deflationary models are powerful, but they come with real problems. First, confusion. 68% of support tickets for deflationary tokens are about supply tracking. Users don’t understand the difference between total supply, circulating supply, and burned supply. They see a “burn” announcement and think their coins just got more valuable. They don’t realize burns are often small, delayed, or automated. Second, complexity. Setting up a wallet for Bitcoin takes 8.7 minutes on average. For BNB Chain, it’s 7.8 minutes - and that’s after configuring a custom network. BullZilla? You need to understand presales, staking pools, burn trackers, referral systems, and tokenomics docs that are 30+ pages long. That’s not user-friendly. That’s a barrier. Third, regulation. The EU’s MiCA framework recognizes deflationary burns as legitimate. But the U.S. SEC warns that automated burns could be manipulated. If a team controls the burn algorithm, can they fake scarcity? That’s a legal gray zone. Projects are now adding real-time burn disclosures to stay compliant.

What’s Next? Seven Trends Shaping 2026

The future of deflationary crypto isn’t about more burns. It’s about smarter ones. 1. Hybrid models - 65% of new projects in 2026 will combine burns with staking, rewards, or utility. Scarcity alone won’t cut it. 2. Algorithmic burns - 12 projects now tie burns to real-world data: stock prices, inflation rates, even weather patterns. The goal? Make scarcity responsive, not static. 3. Community-governed burns - 37% of DAO-managed tokens let holders vote on burn rates. If you own the token, you decide how much gets destroyed. 4. Cross-chain burns - Burning on one chain affects supply on another. This could unify scarcity across ecosystems. 5. Burn-to-stake - Instead of destroying coins, lock them forever in exchange for yield. It’s deflation with a return. 6. NFT-integrated deflation - Burn an NFT, reduce token supply, earn rewards. It’s digital ownership meets tokenomics. 7. Regulatory transparency - Projects must now publish real-time burn logs, verified by third parties. No more secret burns.Should You Invest?

If you’re looking for a long-term store of value, Bitcoin is still the safest bet. Its scarcity is proven, its network is unmatched, and its institutional backing is unmatched. If you want exposure to innovation, BNB is the strongest ecosystem token. Its burn mechanics are real, its trading volume is high, and its team is transparent. Avoid tokens that promise 100% APY with no utility. If the only thing backing the coin is a burn mechanism, it’s a gamble. Crypto Basic found that 83 out of 100 pure deflationary tokens with no real use case failed within five years. The key isn’t just “deflationary.” It’s “meaningful.” A burn that reduces supply by 0.0001% per year? Useless. A burn tied to real usage, voted on by holders, and verified publicly? That’s the future.Getting Started

If you want to participate:- For Bitcoin: Download a wallet like BlueWallet or Electrum. Buy BTC on a regulated exchange. Hold. Don’t trade unless you understand the halving cycle.

- For BNB: Use MetaMask. Add the BSC network. Buy BNB on Binance. Watch their quarterly burn reports. Don’t chase price spikes after burn announcements - whales often dump ahead of them.

- For new projects like BullZilla: Read the whitepaper. Check the burn tracker. Look for third-party audits. Avoid presales with no public team or code.

Are deflationary cryptocurrencies better than inflationary ones?

It depends on your goal. Deflationary coins like Bitcoin are better for long-term value storage. Inflationary coins like Dogecoin or newer utility tokens are better for daily use, because they encourage spending instead of hoarding. Neither is universally better - they serve different purposes.

Can a deflationary cryptocurrency crash in value?

Yes. Scarcity doesn’t guarantee price. If demand drops - because the project loses utility, gets hacked, or regulators crack down - the price can still fall hard. BNB dropped 30% after a burn announcement in 2025 because whales sold ahead of the burn. Deflation helps, but it doesn’t protect against fear.

How do I know if a burn is real or just marketing?

Check the blockchain. All burns happen on-chain and are publicly visible. Use tools like BscScan or Etherscan to look up the burn address. If the project claims to burn 1 million tokens, but the address only shows 10,000, it’s fake. Also, look for third-party audits and real-time burn trackers. If they don’t exist, be skeptical.

Is Ethereum really deflationary?

It’s hybrid. Ethereum doesn’t have a supply cap, but EIP-1559 burns transaction fees. In 2025, it burned more ETH than it issued for 127 days. So yes, it’s deflationary during high-usage periods. But during quiet times, new ETH is still minted through staking rewards. It’s not pure deflation - it’s dynamic.

Why do some people say deflationary coins hurt adoption?

Because if people think a coin will go up, they stop spending it. That’s human behavior. If you believe your Bitcoin will double next year, you’re not going to use it to buy coffee. That’s why transaction volume for deflationary tokens dropped 22% in bull markets - users held, didn’t trade. Real adoption needs utility, not just scarcity.

What’s the biggest risk with deflationary tokens?

The biggest risk is fake scarcity. Many tokens claim to burn tokens, but the burn rate is so small it has zero impact. Some burn less than 0.0001% of supply per quarter. That’s not deflation - it’s theater. Always check the actual burn numbers on-chain, not just the press releases.