Future of Distributed Ledger Technology in Digital Economy

Feb, 9 2026

Feb, 9 2026

By 2026, distributed ledger technology (DLT) isn’t just a buzzword anymore-it’s running the backbones of global finance, supply chains, and even government systems. You might think of blockchain as just Bitcoin’s underbelly, but today’s DLT is something far more powerful: a shared, tamper-proof digital ledger that lets multiple parties update and verify data in real time-no middleman needed. And it’s not just startups using it. Major banks, logistics giants, and even central banks are building real systems on it. The question isn’t whether DLT will change the digital economy-it already has. The real question is: how deep will it go?

What DLT Actually Does (And Why It’s Not Just Blockchain)

People often say "blockchain" when they mean "distributed ledger technology." But DLT is the umbrella. Blockchain is one type of DLT, and not even the most efficient one anymore. Think of DLT as a shared spreadsheet that updates automatically across hundreds of computers at once. Every change is verified by the network, recorded permanently, and visible to everyone with permission. No single entity controls it. That’s the core idea.Before DLT, financial transactions relied on layers of intermediaries-banks, clearinghouses, auditors. Each step added cost, delay, and risk. A cross-border payment used to take 3-5 days. Now, with DLT, J.P. Morgan’s Onyx system settles $2.1 trillion in tokenized assets annually with a 98.7% success rate. Settlement? Done in seconds.

It’s not just about money. DLT lets you tokenize anything: real estate, art, carbon credits, even shares in a small business. Once an asset is tokenized, you can split ownership into fractions. A $1 million building can be divided into 10,000 digital tokens, each worth $100. Investors buy tiny pieces. That’s fractional ownership-something previously locked to the ultra-rich.

Real-World Use Cases That Are Already Working

DLT isn’t stuck in labs. It’s live in production, and the results are measurable.

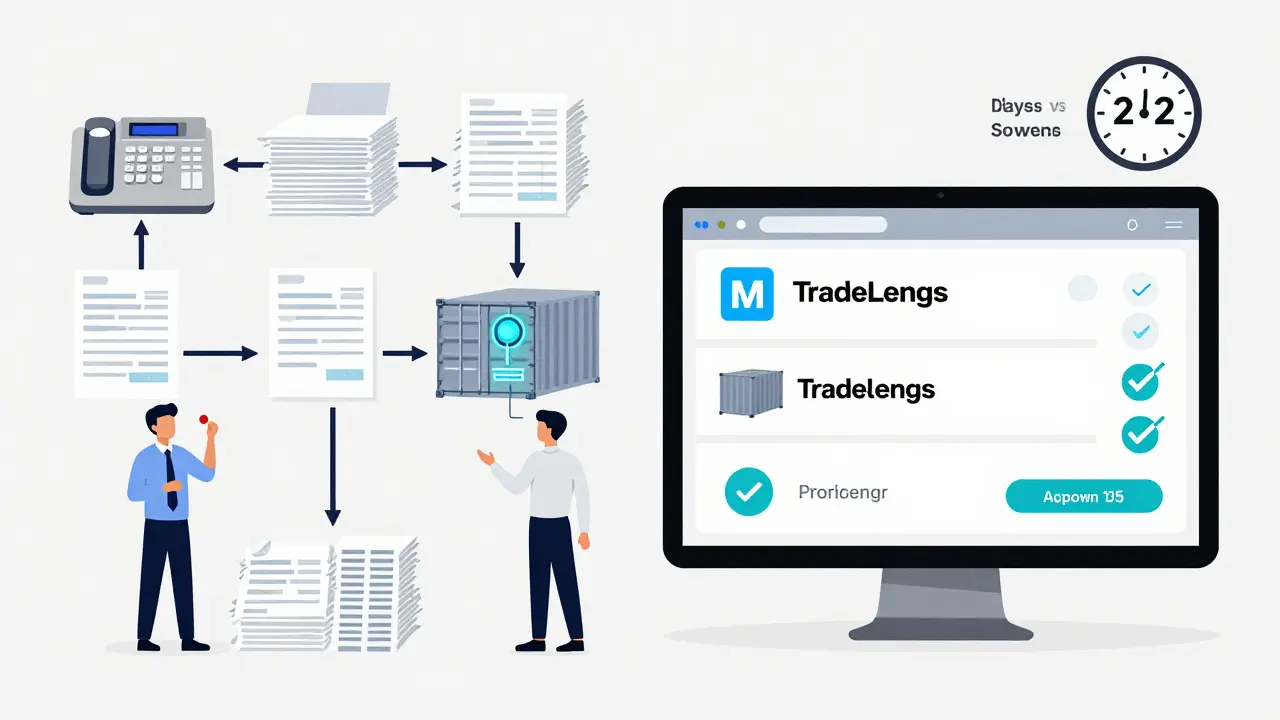

- Supply chains: Maersk’s TradeLens cuts documentation time from 7 days to under 2.2 seconds. Over 300 shipping partners now share bills of lading, customs forms, and cargo manifests on a single DLT network. No more lost paperwork. No more fax machines.

- Payments: RippleNet processed $50 billion in cross-border payments in Q2 2025. Average settlement time? 3.2 seconds. Traditional banking? 2-5 business days.

- Healthcare: Hospitals in the U.S. and EU now use DLT to securely share patient records across systems. Patients control access via private keys. No more waiting for faxed records from another clinic.

- Government: The Bank of England launched its upgraded Real-Time Gross Settlement system using DLT in October 2025. It now processes £1.2 trillion daily with same-day settlement-something the old system could never do reliably.

These aren’t pilot programs anymore. They’re core infrastructure. And the numbers back it up: 63% of Fortune 500 companies now use DLT in some form. Financial services lead at 82% adoption. Supply chain is next at 67%.

Why DLT Beats Traditional Systems (And Where It Still Falls Short)

Let’s be honest: DLT isn’t magic. It doesn’t replace everything.

Where it wins:

- Trust without intermediaries: No need for a third party to verify a transaction. The network does it.

- Speed: 10,000+ transactions per second on optimized networks like Solana. Compare that to Visa’s 65,000 TPS-but Visa takes days to settle. DLT settles in seconds.

- Transparency: Every change is logged. Audits happen in real time.

Where it struggles:

- Speed for tiny transactions: Ethereum’s mainnet handles 15-30 TPS. Visa handles 65,000. For buying coffee, DLT is overkill. Centralized systems still win here.

- Interoperability: Only 12% of enterprise DLT systems can talk to each other. If you’re on Hyperledger Fabric and your partner is on R3 Corda, they can’t easily share data. That’s a huge roadblock.

- Integration with legacy tech: Most companies still run on 20-year-old mainframes. Connecting those to DLT is expensive and messy. That’s why 45% of disruptors have gone live with DLT, but only 25% of big enterprises have.

The lesson? DLT isn’t about replacing everything. It’s about replacing the parts that are broken-slow settlements, opaque supply chains, centralized control points.

The Rise of Blockchain-as-a-Service (BaaS)

You don’t need to build a blockchain from scratch anymore. Microsoft Azure, AWS, and Google Cloud now offer Blockchain-as-a-Service. It’s like renting a server-but for a distributed ledger.

Companies use BaaS to deploy private DLT networks without hiring a team of cryptographers. In 2025, this segment grew 47% year-over-year. Why? Because it lowers the barrier. A mid-sized logistics firm can now launch a DLT-based tracking system in under six months for around $1.2 million-down from $5 million just three years ago.

And it’s not just for big players. Startups use BaaS to build DeFi apps, NFT marketplaces, or tokenized loyalty programs without needing a PhD in cryptography. The tools are getting smarter. The documentation? Better. Hyperledger projects score 4.7/5 on developer clarity. Newer chains? Only 3.2/5. That gap is closing fast.

Smart Contracts and Tokenization: The Hidden Engine

DLT’s real superpower isn’t the ledger. It’s what you can do on top of it: smart contracts.

A smart contract is code that runs automatically when conditions are met. No human needed. Example: A farmer sells wheat to a processor. Payment is locked in a smart contract. When the grain arrives and passes inspection (verified by IoT sensors), the money releases instantly. No invoices. No delays. No disputes.

Tokenization turns physical assets into digital tokens on the ledger. A $500,000 warehouse? Split into 5,000 tokens. Anyone can buy one. Sell it later. Trade it like stock. This opens up investment to millions who couldn’t afford real estate before.

But it’s not flawless. Two major DeFi protocols collapsed in Q2 2025, costing investors $387 million. Why? Flawed smart contracts. One had a loophole in the code. Another didn’t check for duplicate transactions. These aren’t theoretical risks-they’re real, documented failures. That’s why audits matter. CertiK and OpenZeppelin now offer enterprise-grade smart contract reviews. Skipping them is like driving without brakes.

Regulation: The Wild West Is Getting a Map

Five years ago, DLT was a legal gray zone. Now, 78% of G20 countries have passed specific regulations. The EU’s MiCA framework went fully live in January 2025. It sets rules for stablecoins, exchanges, and token issuers. The U.S.? Still messy. The White House’s GENIUS Act (January 2025) allows 14 federally-chartered banks to issue USD-backed stablecoins. Total value? $87 billion by September 2025. But it also blocks a U.S. central bank digital currency (CBDC)-a move opposed by 67% of G20 central banks.

What does this mean? Regulation isn’t killing DLT-it’s enabling it. Clear rules mean banks can invest. Insurers can underwrite. Investors can sleep at night. The biggest risk now isn’t technology. It’s regulatory fragmentation. Companies operating across borders still face 15 different rulebooks. That’s why 72% of enterprise leaders say regulatory inconsistency is their top concern.

The Future: Convergence, Not Competition

DLT’s next leap won’t come from blockchain alone. It’s coming from fusion.

- DLT + AI: The blockchain-AI market hit $12.3 billion in 2025 and is growing at 92% CAGR. Why? AI makes decisions. DLT proves they’re honest. Imagine an AI that auto-approves loans-but the decision is recorded on a public ledger. No bias. No hidden rules. Just transparency.

- DLT + Quantum: Quantum computers could break today’s encryption. But they could also speed up DLT verification. The Bank of England warns this is a double-edged sword. Post-quantum cryptography is already being tested in new DLT networks.

- DLT + IoT: Sensors on shipping containers, wind turbines, or medical devices now feed real-time data directly into ledgers. No manual entry. No fraud.

By 2030, the World Economic Forum predicts DLT will add $1.76 trillion to global GDP. That’s not a fantasy. It’s based on real efficiency gains: faster payments, reduced fraud, lower administrative costs, and new markets opened by tokenization.

What’s Next? Three Paths Forward

For businesses:

- Start small. Don’t rebuild your whole system. Pick one painful process-like invoice reconciliation or supply chain tracking-and test DLT there.

- Use BaaS. Skip the infrastructure headache. Let AWS or Azure handle the heavy lifting.

- Train your team. Solidity (for smart contracts) and blockchain architecture are now high-skill fields. Salaries for these roles are 37% higher than average. If you’re not hiring for this, you’re falling behind.

For investors:

- Look beyond Bitcoin. Focus on real-world asset tokenization platforms.

- Watch regulatory shifts. Countries with clear DLT rules (EU, Singapore, UAE) are becoming hubs.

- Be wary of DeFi protocols without audits. The $387 million losses in 2025 weren’t accidents-they were preventable.

For everyone:

DLT isn’t about replacing banks. It’s about making them better. It’s not about killing intermediaries-it’s about making them transparent. The future isn’t decentralized chaos. It’s a system where trust is built into the code, not the contract.

Is DLT the same as blockchain?

No. Blockchain is one type of distributed ledger technology (DLT). DLT includes blockchain, but also other structures like directed acyclic graphs (DAGs) and hashgraphs. Think of blockchain as a chain of blocks; DLT is the broader category of any decentralized, shared ledger system.

Can DLT be hacked?

The ledger itself is nearly impossible to hack because it’s distributed across thousands of nodes. But the applications built on top-like smart contracts or wallets-can be vulnerable. Most major losses in crypto come from code flaws, not broken ledgers. Always audit your smart contracts.

Why are central banks interested in DLT?

Because it solves real problems: slow cross-border payments, costly settlement processes, and lack of transparency. The Bank of England, for example, now uses DLT to settle £1.2 trillion daily with same-day processing. That’s 10x faster than the old system.

Is DLT environmentally friendly?

It depends. Bitcoin’s original Proof-of-Work used massive energy. But today, 68% of new DLT networks use Proof-of-Stake, which cuts energy use by 99.95%. Most enterprise DLT systems use even less energy than a single data center. The environmental impact is now minimal compared to traditional banking infrastructure.

What’s the biggest barrier to DLT adoption?

Integration with legacy systems. Most companies still run on decades-old software. Connecting those to modern DLT networks is complex and expensive. That’s why many start small-testing DLT on one process before scaling.

Will DLT replace banks?

Not replace-enhance. Banks are using DLT to cut costs, speed up settlements, and offer new services like tokenized assets. J.P. Morgan, for example, uses DLT to process $2.1 trillion in assets annually. The bank isn’t disappearing. It’s getting smarter.

Elizabeth Choe

February 9, 2026 AT 23:30Okay but let’s be real-DLT is like that one friend who shows up to every party and suddenly makes everything 10x smoother. No more fax machines? YES. No more waiting 5 days for a wire transfer? HELL YES. I just watched my cousin’s small business tokenize part of their warehouse and suddenly had 30 micro-investors. It’s wild. The future isn’t just digital-it’s divisible. 🚀

Crystal McCoun

February 11, 2026 AT 20:05I’ve been following this for years, and honestly? The real win isn’t the tech-it’s the trust. No more ‘I’ll send you the invoice tomorrow’ emails. No more ‘we lost your docs’ calls. DLT just… works. And when it works? It’s quiet. Elegant. Like a perfectly timed handshake. I’m not shouting about it-I’m just glad it’s here.

Elijah Young

February 12, 2026 AT 22:29The data is compelling. However, the assumption that DLT automatically eliminates fraud is misleading. Smart contract vulnerabilities still account for the majority of financial losses in the space. Audits are not optional. They are the new compliance layer. Organizations that treat this as a ‘set it and forget it’ system are courting disaster.

Beth Trittschuh

February 14, 2026 AT 05:16It’s funny… we’re building a world where trust is coded into machines, and yet we still don’t trust the code. 🤔 We’re so used to human intermediaries-banks, lawyers, notaries-that we forget: the real innovation isn’t the ledger. It’s the idea that a system can be fair without someone watching over it. Is that… liberating? Or terrifying? I think it’s both. And that’s why this matters.

Benjamin Andrew

February 14, 2026 AT 13:45Let’s not romanticize this. 63% of Fortune 500 are ‘using’ DLT? That includes pilot projects run by interns in IT departments. The real adoption metric is production-grade, cross-enterprise interoperability. And that number? Less than 5%. The rest is marketing fluff. Also, ‘tokenizing real estate’ sounds cool until you realize 90% of these tokens are illiquid and unregulated. Don’t be fooled by buzzwords.

Holly Perkins

February 16, 2026 AT 10:32so like… dlt is just blockchain but with more letters? lol

Will Lum

February 17, 2026 AT 23:29My buddy runs a logistics startup. They used BaaS on AWS to cut their docs time from 7 days to 2 seconds. No hype. No blockchain conference. Just a $1.2M investment and a smart dev team. This isn’t sci-fi-it’s Tuesday. If you’re not at least testing this, you’re already behind.

Sanchita Nahar

February 18, 2026 AT 14:24India needs this. Our banking system is still stuck in 1990. Why should I wait 3 days for money from my cousin in Canada? DLT is not a luxury. It’s a necessity. Let’s stop talking and start building.

Ben Pintilie

February 20, 2026 AT 10:24smart contracts = code with bugs 😅

Sakshi Arora

February 21, 2026 AT 04:04if dlt is so great why do we still need banks