GMX (Arbitrum) Crypto Exchange Review: Leverage, Liquidity, and How It Compares

Dec, 2 2025

Dec, 2 2025

GMX Leverage Calculator

Calculate how leverage affects your trading positions on GMX Arbitrum. Understand the impact on margin requirements and liquidation levels before trading.

GMX Arbitrum isn't just another crypto exchange. It’s a decentralized platform where you trade perpetual futures with up to 100x leverage, without handing over your keys or submitting KYC documents. If you’ve ever used Binance or Bybit and wondered if there’s a way to get the same speed and leverage without trusting a company with your funds, GMX is one of the few answers that actually works.

Launched in 2021 and rebuilt in 2023 with its V2 upgrade (called "Synthetics"), GMX on Arbitrum has become the go-to for traders who want deep liquidity, near-zero slippage, and real-time rewards-all on a blockchain that costs pennies per trade. As of December 2025, GMX handles over $263 million in daily volume on Arbitrum alone, making up nearly half of the entire Layer 2’s total value locked (TVL). That’s not a fluke. It’s the result of smart design, strong incentives, and a community that actually runs the platform.

How GMX Works (Without a Middleman)

Unlike centralized exchanges, GMX doesn’t hold your crypto. You connect your wallet-MetaMask, Rainbow, or any EVM-compatible one-and trade directly from your account. There’s no signup, no email verification, no identity checks. You just fund your wallet with ETH, USDC, or another asset on Arbitrum, connect to GMX, and start trading.

The magic happens through liquidity pools. When you trade on GMX, you’re not matched with another trader. Instead, you trade against a pool of assets funded by liquidity providers (LPs). These LPs deposit assets like ETH, BTC, or SOL into a pool called GLP (GMX Liquidity Provider token). In return, they earn a share of trading fees and rewards. The more liquidity in the pool, the smoother your trades become-even with large positions.

For example, if you want to go long 10x on BTC/USD, GMX doesn’t find someone else betting against you. It uses the GLP pool to fulfill your trade. That’s why slippage is so low. Even a $50,000 trade on GMX might move the price by less than 0.1%. On centralized exchanges, that kind of trade could cost you 1-2% in slippage.

Why Leverage Up to 100x? And Is It Safe?

GMX lets you trade with leverage from 5x all the way up to 100x, depending on the asset. BTC and ETH usually cap at 50x, while smaller tokens like ARB or AVAX can go as high as 100x. This isn’t just for hype-it’s designed for professional traders who need precision and speed.

But high leverage means high risk. GMX protects you from sudden liquidations with a few key features:

- Price feed aggregation: GMX pulls prices from 10+ major exchanges (Coinbase, Binance, Kraken, etc.) to avoid fake price spikes that trigger false liquidations.

- Isolated positions: Each trade is treated separately. If one position gets liquidated, it doesn’t drag down your others.

- Dynamic margin requirements: The system adjusts required collateral based on market volatility. During a flash crash, it won’t instantly liquidate you.

Still, 100x leverage is dangerous. One 1% move against you can wipe out your entire position. Most experienced traders use 10x-20x max. GMX doesn’t limit you, but it also doesn’t protect you from your own mistakes. You’re responsible for your risk management.

The Three Tokens: GMX, GLP, and esGMX

GMX’s tokenomics are complex, but they’re also what makes the platform sustainable. There are three tokens you need to understand:

- GMX: The governance token. Holders vote on protocol changes, like fee adjustments or new assets. You can also stake GMX to earn rewards.

- GLP: The liquidity provider token. When you deposit ETH, USDC, or BTC into the pool, you get GLP in return. You earn a share of all trading fees generated on GMX, plus bonus rewards.

- esGMX: A locked, non-transferable version of GMX. You earn esGMX by staking GMX. It’s like a reward that vests over time and can be converted to GMX later.

Staking GMX on Arbitrum gives you ETH and esGMX rewards. The annual yield fluctuates between 15% and 30%, depending on trading volume. In early 2025, users who staked $10,000 in GMX earned about $2,800 in ETH and esGMX over 12 months. That’s not guaranteed-it drops when volume slows-but it’s one of the highest yields in DeFi for a proven, non-pump-and-dump project.

GLP stakers earn even more. They get 100% of trading fees from the pool they’re in, plus a portion of the GMX rewards distributed to liquidity providers. Some users report GLP yields over 40% in high-volume months.

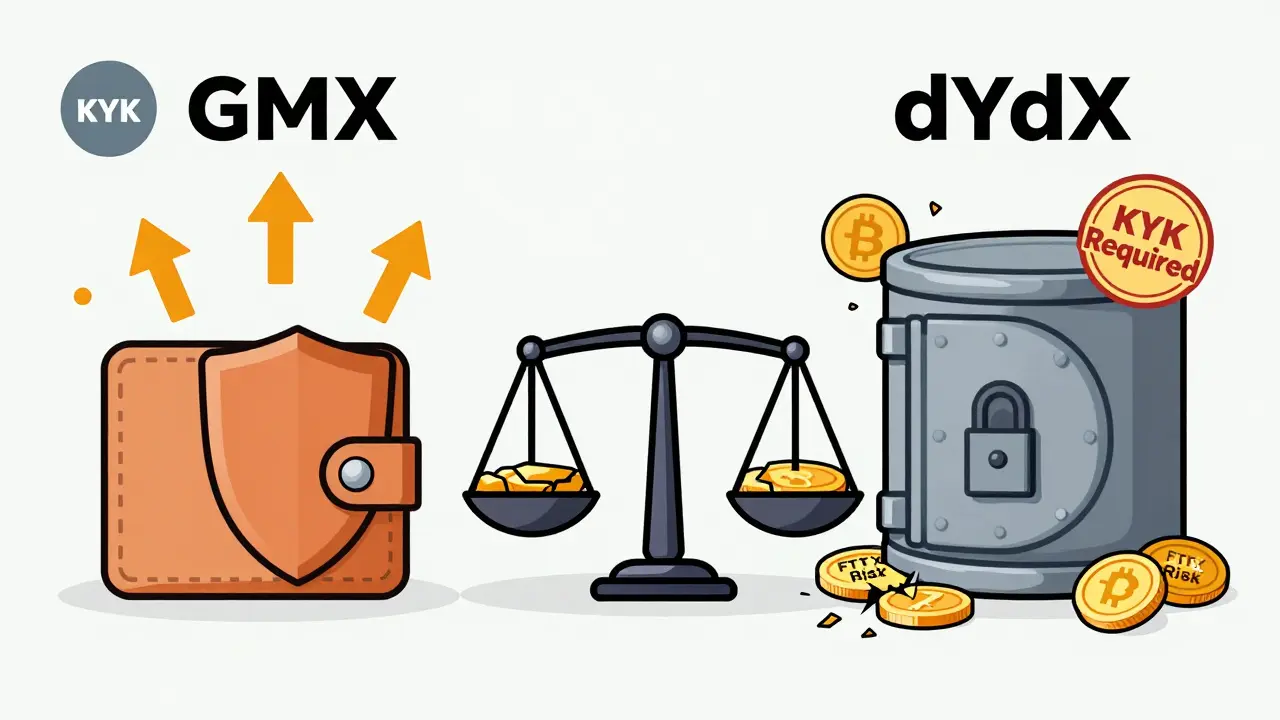

How GMX Compares to dYdX, Hyperliquid, and Centralized Exchanges

GMX doesn’t exist in a vacuum. Here’s how it stacks up:

| Feature | GMX (Arbitrum) | dYdX (Arbitrum) | Hyperliquid | Binance (Centralized) |

|---|---|---|---|---|

| Max Leverage | 100x | 20x | 100x | 125x |

| Trading Fees | 0.05%-0.10% | 0.02%-0.05% | 0.02% | 0.04%-0.10% |

| KYC Required | No | No | No | Yes |

| Liquidity Depth | Very High | High | Very High | Extremely High |

| Asset Selection | 15-20 major coins | 12-15 coins | 20+ coins | 500+ coins |

| Rewards for Traders | No | No | No | Yes (referrals, staking) |

| Rewards for LPs | Yes (ETH + esGMX) | Yes (DYDX tokens) | Yes (HYPE tokens) | No |

| Slippage on $50K Trade | <0.1% | 0.1%-0.3% | <0.05% | 0.2%-0.8% |

GMX wins on rewards for liquidity providers and non-custodial trust. dYdX has lower fees and a cleaner UI but caps leverage at 20x. Hyperliquid has better slippage and more assets but is newer and less battle-tested. Binance has more coins and better customer support-but if it collapses like FTX did, your funds are gone.

Who Is GMX For?

GMX isn’t for everyone. If you’re new to crypto and just want to buy BTC and hold it, skip this. But if you’re:

- Trading perpetuals regularly

- Comfortable with DeFi wallets and gas fees

- Looking for high yields without staking unstable tokens

- Worried about centralized exchange risks

Then GMX is one of the best tools you can use. It’s not a casino-it’s a professional-grade trading platform built on open-source code, audited contracts, and a DAO that’s been voting on upgrades since 2022.

Over 200,000 active users are already using it. The Arbitrum community gave GMX $10 million in ARB tokens in 2023-the largest grant in the network’s history. That’s not random. It’s a signal that this platform is here to stay.

Downsides and Risks

No system is perfect. GMX has real drawbacks:

- Complexity: Understanding GMX, GLP, and esGMX takes time. Beginners get lost in the reward mechanics.

- Limited assets: No meme coins, no obscure altcoins. Only BTC, ETH, SOL, AVAX, ARB, and a few others.

- No customer support: If something breaks, you’re on your own. Discord is helpful, but no live chat or phone line.

- Regulatory risk: The U.S. SEC could target no-KYC platforms. GMX’s decentralized structure helps, but it’s not bulletproof.

Also, if you’re not staking GMX or providing liquidity, you’re missing out on the biggest part of the platform’s value. Trading alone is like going to a restaurant and only paying for the food-you’re not getting the full experience.

How to Get Started

Here’s the fastest way to start trading on GMX Arbitrum:

- Buy ETH or USDC on Coinbase, Kraken, or another exchange.

- Send it to your MetaMask wallet.

- Bridge it to Arbitrum using the official Arbitrum Bridge or a trusted aggregator like Across Protocol.

- Go to gmx.io and connect your wallet.

- Choose "Trade" and pick your asset (BTC, ETH, etc.).

- Set your leverage (start with 10x if you’re new).

- Click "Open Position" and confirm the transaction.

For staking: Go to the "Earn" tab, stake your GMX tokens, and start earning ETH and esGMX within minutes. You can also deposit assets into the GLP pool to earn trading fees.

Most users say it takes 2-5 hours to feel confident. There are excellent guides on the GMX Academy and YouTube channels like DeFi Dad and Coin Bureau. Don’t rush it. One wrong click can cost you money.

Final Verdict

GMX on Arbitrum is the closest thing we have to a decentralized version of Binance or Bybit-with better rewards, no KYC, and real ownership. It’s not perfect, but it’s the most mature, well-funded, and community-run perpetual exchange in DeFi.

If you’re serious about leveraged trading and want to earn passive income while you do it, GMX is worth your time. The trading experience rivals centralized platforms. The rewards are better. And unlike FTX, your funds never leave your wallet.

It’s not for beginners. But if you’ve traded before and want to move into DeFi without giving up leverage or speed, GMX isn’t just an option-it’s the leading one.

Is GMX safe to use?

Yes, GMX is considered one of the safest decentralized exchanges for leveraged trading. It uses audited smart contracts, has a $5 million bug bounty program, and doesn’t hold user funds. Trades happen directly from your wallet, and the platform uses multi-source price feeds to prevent fake liquidations. However, you’re still responsible for managing your own risk-high leverage can lead to total losses if the market moves against you.

Can I trade on GMX without KYC?

Yes, GMX requires no KYC. You only need a crypto wallet like MetaMask connected to Arbitrum or Avalanche. This makes it popular among users who value privacy or live in regions with strict crypto regulations. However, this also means there’s no customer support or account recovery-if you lose your private key, you lose access.

What’s the difference between GMX and GLP?

GMX is the governance token used for voting and staking rewards. GLP is the liquidity provider token you receive when you deposit assets like ETH, BTC, or USDC into GMX’s trading pools. Holding GLP earns you a share of all trading fees and bonus rewards. You can’t trade GLP on exchanges-it’s only used within the GMX ecosystem to provide liquidity.

How much can I earn staking GMX?

Staking GMX on Arbitrum typically earns between 15% and 30% APY in ETH and esGMX rewards, depending on trading volume. During high-volume months, yields can exceed 40%. Rewards are distributed daily and can be claimed anytime. The more GMX you stake and the higher the platform’s trading volume, the more you earn.

Why does GMX use Arbitrum instead of Ethereum?

Arbitrum offers much lower transaction fees (around $0.05-$0.10 per trade) and faster confirmations (under 1 second) compared to Ethereum mainnet, where gas fees can exceed $10 and transactions take minutes. This makes Arbitrum ideal for high-frequency trading. GMX was built specifically for Layer 2 networks to deliver a centralized-exchange-like experience without sacrificing decentralization.

Paul McNair

December 2, 2025 AT 11:23Man, I remember when DeFi was just a bunch of weird smart contracts no one understood. Now we got full-blown leveraged trading platforms with $263M daily volume and people staking tokens just to earn ETH on the side. GMX feels like the first DeFi product that actually nails the UX without sacrificing decentralization. I’ve used Binance for years, but I’ve moved 80% of my trading here. No KYC, no babysitting, just trade and earn. And the GLP rewards? Absolute gold.

For newbies: don’t start with 100x. Start with 5x. Learn how the price feeds work. Watch the slippage. Then go wild. This isn’t a casino - it’s a professional trading floor with better incentives than Wall Street.

Mohamed Haybe

December 2, 2025 AT 23:44Marsha Enright

December 3, 2025 AT 05:24Hi everyone! 👋 Just wanted to say I started using GMX last month and it’s been life-changing. I was scared at first - all these tokens (GMX, GLP, esGMX) felt like a maze. But I followed the GMX Academy videos and took notes. Now I’m staking 50 GMX and depositing USDC into GLP. I’m earning about 28% APY in ETH and esGMX, and I’ve only had one liquidation - and it was because I ignored the volatility buffer. Oops 😅

Pro tip: Always check the funding rate before opening a position. And if you’re new, use 10x max. Seriously. I wish someone told me that sooner.

Also, the Arbitrum bridge is super fast now. Took me 2 mins to move $1k from Ethereum. No more waiting 3 hours like in 2021. 🙌

Andrew Brady

December 3, 2025 AT 22:02The entire GMX model is a regulatory time bomb. No KYC. No oversight. No accountability. This is exactly how the SEC will come down hard on DeFi - not because it’s dangerous, but because it’s untraceable. The fact that this platform handles over $260M daily and operates without a single licensed entity is a glaring violation of financial norms. And don’t tell me about ‘decentralization’ - if it’s used by 200,000 people for leveraged trading, it’s a financial institution. Period.

They’re using Arbitrum because it’s cheaper, yes. But also because it’s harder for regulators to track. This isn’t innovation. It’s evasion. And when the hammer falls, the ‘community’ will scatter like cockroaches under a light. Mark my words.

Mani Kumar

December 4, 2025 AT 12:26Tatiana Rodriguez

December 5, 2025 AT 04:28Okay I just had to say this - I’ve been reading all these comments and I feel like we’re all talking about the same thing but from completely different planets. Paul, you’re right - it’s a professional trading floor. Mohamed, you’re right - it’s a trap for the naive. Marsha, you’re right - it’s a learning curve. Andrew, you’re right - it’s a regulatory grenade. Mani, you’re right - it’s technically brilliant.

But here’s what no one’s saying: GMX works because it’s not trying to be everything. It’s not trying to be Binance. It’s not trying to be a bank. It’s not trying to be a charity. It’s just… a tool. A really, really well-built tool for people who want to trade without handing over their keys. And honestly? That’s revolutionary.

I used to think DeFi was all about ‘decentralization for the sake of it.’ Now I see it’s about ownership. You own your trades. You own your rewards. You own your risk. No middleman. No ‘we’ll get back to you.’ No ‘your account is frozen.’ Just code. And if you learn how to use it? You’re not just trading. You’re participating in something that’s actually different. And that’s worth the 2-hour learning curve.

Also - I staked my GMX. I’m earning ETH. I’m not rich. But I’m not scared anymore. And that’s enough for me.

Love you all. Keep trading smart. 🤍