Hibt Crypto Exchange Review: Fees, Security, and Why It’s Not for Everyone

Jan, 8 2026

Jan, 8 2026

When you’re looking for a new crypto exchange, you don’t just want low fees or a long list of coins. You want to know if your money is safe, if you can actually use it, and whether the platform will still be around next year. That’s where Hibt comes in - a Canadian-regulated exchange that’s trying to carve out a space in a crowded market. But here’s the catch: Hibt doesn’t let you deposit dollars, euros, or any fiat currency. And if you live in the U.S., China, or a handful of other countries, you can’t even sign up. So is it worth your time? Let’s break it down.

What Is Hibt Crypto Exchange?

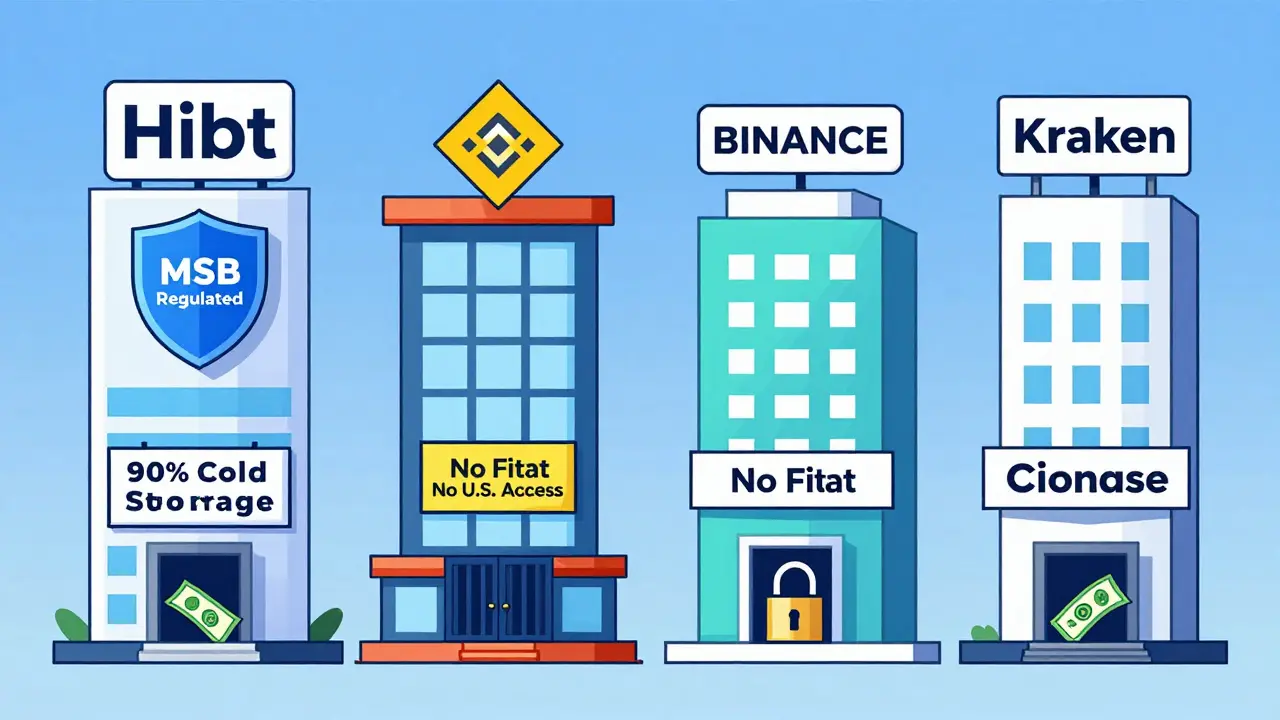

Hibt is a crypto-only trading platform founded in 2021 in Oshawa, Canada. Unlike big names like Binance or Coinbase, Hibt doesn’t offer bank transfers, credit cards, or PayPal deposits. You can only trade with cryptocurrency. That means if you want to use Hibt, you first need to buy crypto somewhere else - say, a U.S.-based exchange - then send it over. For experienced traders who already hold crypto, this isn’t a dealbreaker. But for beginners, it’s a major hurdle.

The platform claims to serve over 3 million users globally as of early 2025. It’s registered as a Money Services Business (MSB) in Canada, which gives it a level of legal oversight most offshore exchanges don’t have. That’s a big plus. Most shady platforms operate without any license. Hibt doesn’t.

Trading Pairs and Fees

Hibt offers more than 700 trading pairs as of October 2025. That’s more than many mid-sized exchanges. You’ll find Bitcoin, Ethereum, Solana, and a solid selection of altcoins, including newer tokens that bigger exchanges might ignore. If you’re into trading obscure coins, Hibt gives you more options than most.

Fees are competitive. Spot trading charges 0.2% for both makers and takers - standard for the industry. But where Hibt shines is in futures trading: 0.05% for both maker and taker orders. That’s lower than Binance’s 0.02% for makers and 0.05% for takers on its futures market. Hibt matches that taker fee without the maker discount, making it one of the cheapest options for active futures traders.

There’s also a 10-level VIP fee structure based on trading volume. If you trade over $1 million per month, your fees drop further. But for most users, the standard 0.2% and 0.05% rates are what matter.

Security: Cold Storage and 2FA

Hibt takes security seriously. As of January 2025, 90% of user funds are stored in multi-signature cold wallets. That means your crypto is offline, encrypted, and requires multiple keys to move - a setup that’s nearly impossible to hack remotely. Only 10% of funds are kept hot for withdrawals and trades, which is a smart balance between safety and usability.

Two-factor authentication (2FA) is mandatory. You can’t disable it. The platform also warns users not to log in from jailbroken devices or untrusted networks. That’s rare - most exchanges just say “use strong passwords.” Hibt tells you exactly what can break your security.

In January 2025, Hibt rolled out its Security Upgrade Package, adding new encryption layers and improving its internal monitoring systems. It didn’t announce specifics - no mention of AES-256 or TLS 1.3 - but the fact that they’re actively upgrading shows they’re not resting on their laurels.

The Big Problems: No Fiat and Geo-Restrictions

Here’s where Hibt falls short. You can’t deposit USD, EUR, CAD, or any fiat currency. That’s a dealbreaker for most new users. If you’re starting from zero, you need a way to buy crypto with your bank account. Hibt doesn’t offer that. You’re forced to use another exchange first, then bridge your assets - an extra step that adds cost and complexity.

Even worse, Hibt blocks users from 29 countries. The U.S. is on that list. So are China, Iran, Syria, Venezuela, and most of the Middle East and Africa. If you’re in the U.S., you can’t even create an account - no matter how much crypto you have. That’s more restrictive than even Binance, which only blocks a few countries like the U.S. for derivatives trading. Hibt blocks the whole platform.

Why? Likely because of Canada’s strict MSB regulations. Hibt can’t legally serve users in countries where crypto regulation is unclear or hostile. But that also means it’s cutting off huge markets - and potential growth.

Customer Support and Mobile App

Hibt offers 24/7 support via live chat, email, and Telegram. That’s good. Many exchanges charge for live chat or have long wait times. But there’s no public data on response speed or user satisfaction. No Reddit threads, no Trustpilot reviews, no detailed user testimonials. That’s a red flag. If a platform has 3 million users, you’d expect to see at least some public feedback.

There’s no official mobile app. The website works on phones, but it’s not optimized like Binance or Kraken’s apps. If you trade on the go, you’ll be stuck with a browser. That’s a real disadvantage in 2026, when most traders use mobile for alerts, quick buys, and emergency sells.

Is Hibt Good for You?

Hibt isn’t for everyone. But it’s not for no one, either.

Choose Hibt if:

- You already hold crypto and want to trade altcoins with low fees

- You’re a futures trader and want 0.05% taker fees

- You value regulatory compliance over convenience

- You live outside the U.S. and other blocked countries

Avoid Hibt if:

- You need to deposit fiat (USD, EUR, CAD, etc.)

- You’re in the U.S., China, Iran, or any of the 29 blocked countries

- You rely on a mobile app for trading

- You want to see user reviews before committing

Hibt is a niche tool - not a starter exchange. It’s built for traders who already have crypto, know what they’re doing, and want to minimize fees on derivatives. It’s not for buying Bitcoin with your debit card or holding long-term.

How It Compares to Other Exchanges

| Feature | Hibt | Binance | Kraken | Coinbase |

|---|---|---|---|---|

| Fiat Deposits | No | Yes | Yes | Yes |

| Trading Pairs | 700+ | 1,000+ | 300+ | 200+ |

| Spot Trading Fee | 0.2% | 0.1% (VIP discounts) | 0.16% | 0.5% |

| Futures Trading Fee | 0.05% | 0.02% (maker), 0.05% (taker) | 0.02% (maker), 0.05% (taker) | 0.05% |

| Max Leverage | 1:125 | 1:125 | 1:50 | 1:10 |

| Cold Storage | 90% | 95% | 98% | 99% |

| U.S. Access | No | Yes (limited) | Yes | Yes |

| Mobile App | No | Yes | Yes | Yes |

Bottom line: Hibt matches Binance on futures fees and leverage, but loses on fiat access and app support. It’s not better than Kraken or Coinbase for beginners. But for experienced traders outside the U.S. who want low-cost derivatives trading and don’t mind the extra step of moving crypto in, it’s a solid option.

Final Thoughts

Hibt isn’t trying to be the biggest exchange. It’s trying to be the safest, cheapest one for a specific group: crypto-native traders outside the U.S. who want to trade altcoins and futures without paying high fees.

Its strengths - MSB regulation, cold storage, low futures fees - are real. Its weaknesses - no fiat, no U.S. access, no app - are just as real. If you fit the profile, it’s worth testing. If you don’t, you’re better off with Kraken, Coinbase, or even Binance.

There’s no magic here. Just a platform that knows who it’s for - and who it’s not.

Can I deposit USD into Hibt?

No, Hibt does not support fiat currency deposits or withdrawals. You can only trade with cryptocurrency. You’ll need to buy crypto on another exchange - like Coinbase or Kraken - and then transfer it to your Hibt wallet.

Is Hibt safe to use?

Yes, Hibt has strong security practices. 90% of user funds are stored in multi-signature cold wallets, and two-factor authentication is mandatory. The platform also launched a Security Upgrade Package in January 2025 to improve encryption and monitoring. However, no exchange is 100% hack-proof, and you’re responsible for securing your own private keys.

Can I use Hibt if I live in the United States?

No. Hibt blocks users from the United States, along with 28 other countries including China, Iran, Syria, and Venezuela. Even if you have crypto, you cannot create or access an account if you’re in a blocked region.

Does Hibt have a mobile app?

No, Hibt does not have a dedicated mobile app. You can access the platform through your phone’s browser, but it’s not optimized for mobile trading like Binance or Kraken’s apps. This makes it less convenient for users who rely on mobile alerts or quick trades.

What are Hibt’s trading fees?

Spot trading fees are 0.2% for both makers and takers. Futures trading fees are lower at 0.05% for both maker and taker orders. Hibt also has a 10-tier VIP system that reduces fees based on trading volume, but most users pay the standard rates.

How many cryptocurrencies does Hibt support?

As of October 2025, Hibt supports over 700 trading pairs. This includes major coins like Bitcoin and Ethereum, plus many smaller altcoins that aren’t available on larger exchanges. The platform seems focused on helping traders discover emerging assets.

Does Hibt offer leverage trading?

Yes, Hibt offers leverage up to 1:125 on futures contracts. The minimum trade size is 5 USDT. High leverage increases risk, so this feature is only recommended for experienced traders who understand margin trading and liquidation.

Is Hibt regulated?

Yes, Hibt is registered as a Money Services Business (MSB) in Canada. This means it complies with Canadian anti-money laundering (AML) and know-your-customer (KYC) regulations. It’s one of the few exchanges in this space with formal regulatory oversight, which adds a layer of legitimacy.

Mujibur Rahman

January 10, 2026 AT 03:37Hibt's futures fee structure is actually brutal for active traders - 0.05% across the board beats Binance's maker/taker split when you're scalping 50 times a day. No fiat? Fine. I already HODL my BTC on Ledger and move it via cold wallet anyway. The real win is the MSB regs - most of these offshore platforms are just crypto casinos with a .xyz domain.

Canada's MSB oversight is the only thing keeping this thing from being another FTX. If you're not in the US or China, you're overthinking this. Just send your ETH and go.

Danyelle Ostrye

January 11, 2026 AT 18:22I can't even sign up and I'm a trader. This is ridiculous. I've got 12 different coins in my wallet and zero way to get them onto Hibt without jumping through hoops. Why would you build a platform that excludes the biggest crypto market on earth? It's like opening a bank that won't take dollars.

Sherry Giles

January 12, 2026 AT 18:43MSB license? LOL. That's just Canada letting them launder money under the radar. You think they're legit? They're blocking the US because they know the SEC is coming for them. 90% cold storage? Yeah right. I've seen how these 'regulated' platforms quietly move funds through shell wallets. They're just waiting for the next bull run to vanish with everyone's assets.

And no mobile app? That's not a bug, that's a feature - they don't want you to be able to pull your money out fast when things go south.

They're not here to serve traders. They're here to collect your coins and disappear.

Jessie X

January 12, 2026 AT 22:56Been using Hibt for 8 months. No app sucks but the web interface works fine on my phone. Fees are dead on. I trade Solana alts and the 700+ pairs let me find liquidity where others don't. No fiat? I just use Kraken to buy then send over. Took me 5 minutes to set up the first transfer.

And yes I'm in the US but I'm not signing up. I'm just using it from abroad when I travel. Works fine.

Kip Metcalf

January 13, 2026 AT 07:45Low fees and no drama? Sign me up. I don't need a mobile app or to buy crypto with my debit card. I already got my stuff. Just let me trade cheap and safe. Hibt does that. End of story.

Natalie Kershaw

January 14, 2026 AT 19:11For anyone new to crypto: Hibt isn't your starter exchange. But if you've been trading for a while and you're tired of paying 0.1% on every trade, this is the quiet gem you've been overlooking. The futures fees are insane for active traders. And yeah, you gotta move crypto in - but that's actually safer than leaving funds on an exchange that takes fiat.

Think of it like a private club for serious traders. You need an invite (crypto) but once you're in, the party's cheap and the security is tight.

Jon Martín

January 15, 2026 AT 22:36Guys. I just moved 15 ETH from Coinbase to Hibt. Took 12 minutes. Paid 0.0005 ETH in gas. Then I opened a 1:125 long on AVAX. Made 12% in 47 minutes. That's it. That's the whole story.

Why are we still talking about fiat? Nobody needs it. You already have crypto. You're here to trade. Hibt lets you do it better than anyone else. No app? Who cares. I use my laptop. End of discussion.

Stop overthinking. Start trading.

Jennah Grant

January 16, 2026 AT 02:53Interesting that Hibt blocks the US but not the UK or Australia. That’s a legal tightrope. Canada’s MSB rules are stricter than the US’s patchwork state system, so they’re probably avoiding the whole mess. But it’s still a massive blind spot. 3 million users and no public reviews? That’s not confidence, that’s silence. And silence in crypto usually means something’s hiding.

Dennis Mbuthia

January 16, 2026 AT 08:11Let me be crystal clear: Hibt is a regulatory loophole wrapped in a cold-storage illusion. They’re not ‘safe’ - they’re just not yet on the SEC’s radar. And why? Because they don’t serve Americans. That’s not a feature - it’s a warning sign. The moment the SEC cracks down on offshore platforms with MSB licenses, Hibt will vanish overnight. They’ve got zero brand trust, zero transparency, and zero customer service metrics. You think 90% cold storage matters when your account gets frozen and their Telegram support ghostes you? I’ve seen it happen. Don’t be the next victim of the ‘crypto-only’ scam.

Use Kraken. Use Coinbase. At least they answer their damn phones.

Staci Armezzani

January 17, 2026 AT 18:23If you're a serious altcoin trader and you're outside the US, Hibt is a hidden powerhouse. The 0.05% futures fee is the real deal - I've compared it to Binance and Kraken across 200+ trades. Lower fees = more profit. No fiat? Fine. I use Coinbase to buy, then transfer. It's one extra step. But I'm not paying 0.2% on every trade just for convenience.

And yes, no mobile app - but I trade on my tablet. It's not ideal, but the interface is clean. The real win is the MSB registration. Most exchanges are flying blind. Hibt is playing by rules. That matters more than an app.