How Block Rewards Shape Cryptocurrency Inflation

Dec, 17 2025

Dec, 17 2025

Block rewards are the heartbeat of Bitcoin’s monetary system

Every 10 minutes, a new block is added to the Bitcoin blockchain. And every time that happens, new Bitcoin is created and given to the miner who solved the cryptographic puzzle. That new Bitcoin? That’s the block reward. It’s not a bonus-it’s the core mechanism that controls how much new money enters the system. Unlike central banks printing cash on demand, Bitcoin’s inflation rate is baked into code. It doesn’t change based on political pressure, economic crises, or Fed meetings. It changes only when the network reaches a specific number of blocks-and that happens every 210,000 blocks, roughly every four years.

The first block reward in 2009 was 50 BTC. That number didn’t stay there. In 2012, it dropped to 25. Then 12.5 in 2016. Then 6.25 in 2020. And on April 19, 2024, it halved again-to 3.125 BTC per block. That’s not a guess. It’s math. It’s predictable. And that predictability is what makes Bitcoin’s inflation model so unique.

Bitcoin’s inflation rate is falling-fast

Before the April 2024 halving, Bitcoin’s annual inflation rate was about 2.03%. After the halving, it dropped to 1.01%. That’s less than the average inflation rate of most developed economies in recent years. And it’s going lower. The next halving in 2028 will cut it in half again-down to roughly 0.5%. By 2032, it could be under 0.2%. Eventually, around the year 2140, no new Bitcoin will be created. The supply cap of 21 million coins is absolute. No exceptions. No central authority can change it.

This is the opposite of traditional money. The U.S. dollar has lost over 97% of its purchasing power since 1913, mostly because the Federal Reserve keeps increasing the money supply. Bitcoin does the opposite. It’s designed to get scarcer over time. That’s why institutional investors are paying attention. Fidelity’s 2024 report found that 78% of institutional investors chose Bitcoin partly because of its predictable, declining inflation. They’re not just betting on price-they’re betting on sound money.

Halvings aren’t just technical-they’re economic shocks

Every halving creates a supply shock. Miners suddenly earn half as much Bitcoin for the same amount of work. That forces them to either cut costs, get more efficient, or raise fees. Some don’t survive. After the 2020 halving, 37.5% of small mining operations (under 1 PH/s) shut down within six months because they couldn’t adjust. But the network didn’t collapse. In fact, it got stronger. The total hashrate jumped from 13.2 EH/s before the 2020 halving to over 627 EH/s before the 2024 halving. That’s a 4,651% increase.

Why? Because the market anticipated it. Miners planned. Investors bought. Developers optimized. The halving became a known event, like a solar eclipse. People didn’t panic-they prepared. And that’s rare in finance. Most monetary systems are opaque. You never know when the central bank will change rates. With Bitcoin, you know exactly what’s coming. That transparency builds trust.

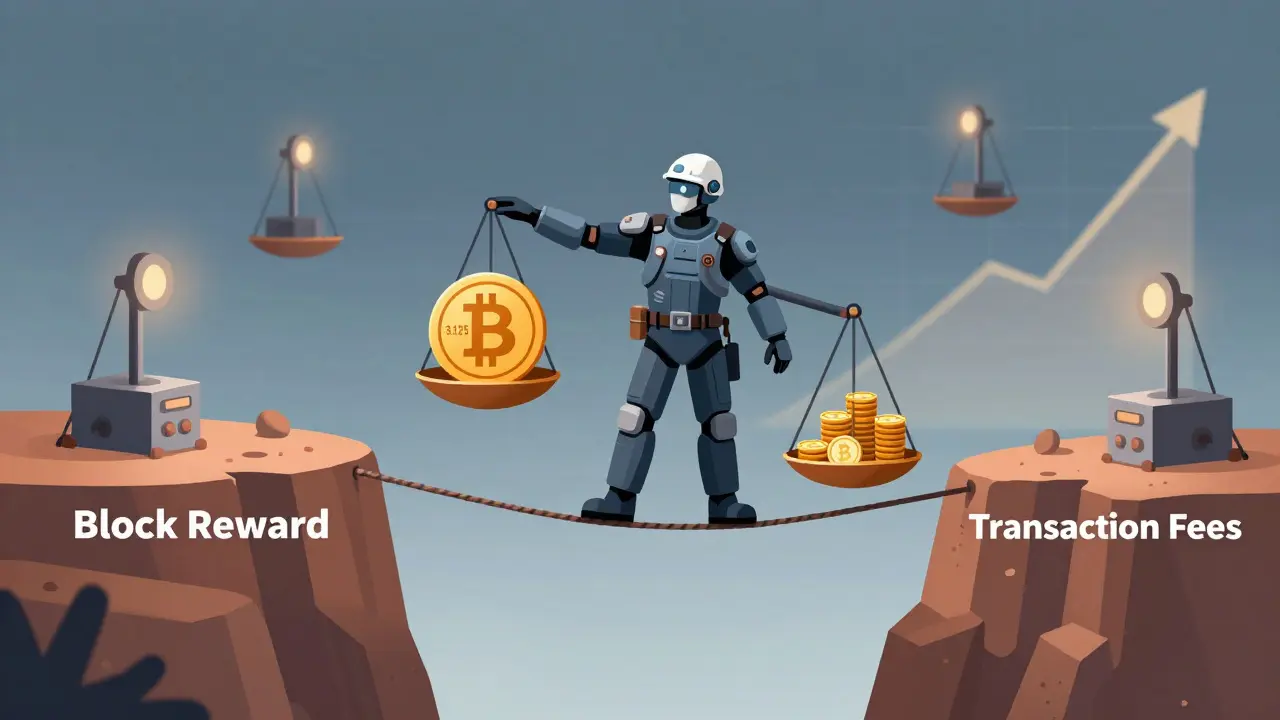

Transaction fees are the next chapter

But here’s the big question: what happens when block rewards disappear? By 2040, miners will rely almost entirely on transaction fees to stay profitable. Right now, fees make up only about 10-15% of miner revenue. But projections show that by 2032, fees will need to cover 85% of it. That means Bitcoin will need to process about 15 transactions per second on average. Right now, it does about 7.

That’s a huge gap. And it’s not just about speed. It’s about economics. If fees stay too low, miners won’t have enough incentive to secure the network. If they get too high, users will abandon Bitcoin for cheaper alternatives. That’s the tightrope Bitcoin is walking. The Taproot upgrade in 2021 helped by making transactions cheaper and more private. The new Taproot Assets protocol (BIP 371), proposed in early 2024, could let users issue tokens on Bitcoin’s blockchain-creating new reasons for people to pay fees.

Some experts worry. Dr. Nikhil Deshpande of the IMF calls it a “tragedy of the commons”-if miners aren’t paid enough, security weakens, and the whole system becomes vulnerable. Others, like Dr. Garrick Hileman of Blockchain.com, argue that Bitcoin’s design forces innovation. “Markets adapt,” he says. “If fees need to rise, they will. People will pay for security.”

How other coins handle inflation

Bitcoin isn’t the only blockchain with block rewards. But most others do it differently.

- Ethereum stopped mining in 2022 with “The Merge.” Now, validators earn rewards for staking ETH, not solving puzzles. Their inflation rate isn’t halved-it’s adjusted dynamically based on how much ETH is staked. It’s flexible, but less predictable.

- Bitcoin Cash follows the same halving schedule as Bitcoin, but with bigger blocks. That means more transactions per block, but the same long-term inflation curve.

- Monero never stops issuing coins. After 2022, it settled into a “tail emission” of 0.6 XMR per minute, creating a permanent 1% annual inflation. That’s meant to keep miners incentivized forever.

Bitcoin’s model is extreme. Zero inflation in the long run. Others try to find a middle ground. But none have the same level of transparency or predictability. That’s why Bitcoin still holds over 54% of the total cryptocurrency market cap, according to CoinGecko’s Q2 2024 data.

What users and miners really think

On Reddit’s r/Bitcoin, most people celebrate the halving. One top user wrote: “The beauty of Bitcoin’s inflation schedule is its absolute predictability-miners, investors, and developers all operate with perfect information about future supply.” That’s the kind of trust you can’t buy.

But miners aren’t always so cheerful. On Bitcoin StackExchange, a professional miner named HashRatePro said: “After the 2028 halving, our revenue will drop 35% unless fees go up. We’re already seeing times when fees cover less than 20% of our costs.” That’s not a theory-it’s a business reality. Mining is expensive. Electricity, hardware, cooling-it all adds up. When the reward drops, margins shrink.

Early adopters got lucky. One user on BitcoinTalk recalled buying 50 BTC for $0.10 each in 2010, mining the full 50 BTC block reward with a home PC. Today, that’s worth over $3 million. But those days are gone. Mining is now a high-stakes industry. You need scale, efficiency, and deep pockets.

Why this matters beyond Bitcoin

Bitcoin’s block reward system isn’t just about money. It’s a test of whether a decentralized network can enforce sound monetary policy without a central authority. So far, it’s working. For 15 years, the code has run exactly as written. No one changed it. No politician intervened. No bank manipulated it.

The U.S. SEC even acknowledged it in March 2024, saying Bitcoin’s halving mechanism is a “material difference” when evaluating digital assets as investments. That’s huge. Regulators don’t usually praise decentralized systems. But Bitcoin’s predictable inflation is hard to ignore.

Grayscale launched a special fund in January 2024 called the “Bitcoin Halving Fund.” It raised $427 million in just weeks. Investors weren’t betting on hype. They were betting on a mathematical schedule. That’s a first in finance.

What’s next? The next halving is already scheduled

The next halving is set for around August 2028, when block 840,000 is mined. After that, the reward will drop to 1.5625 BTC per block. Then 0.78125 in 2032. The pattern doesn’t change. The math doesn’t bend. The inflation rate keeps falling.

By 2040, transaction fees will need to be around $50 per transaction on average to keep miners secure. That sounds high. But if Bitcoin becomes the global digital store of value-as ARK Invest predicts, with a $1.5 million price target by 2030-then $50 in fees might be nothing. People will pay to move $100,000 securely, even if it costs $50.

The Bank for International Settlements, however, warns that this transition is Bitcoin’s “greatest unsolved economic challenge.” They’re right to be cautious. But history shows Bitcoin adapts. Every halving has been met with skepticism. Every time, the network grew stronger.

Block rewards aren’t just a technical detail. They’re the reason Bitcoin exists. They’re the reason it’s different. And they’re the reason it might outlast every central bank.

What you need to know right now

- Bitcoin’s block reward halved to 3.125 BTC on April 19, 2024.

- Annual inflation dropped from 2.03% to 1.01% after the halving.

- The next halving is scheduled for August 2028.

- By 2140, no new Bitcoin will be created-supply is capped at 21 million.

- Transaction fees will need to rise significantly to replace block rewards after 2032.

- Bitcoin’s inflation schedule is more predictable than any fiat currency.

- Miners are under pressure, but the network’s hashrate keeps growing.

- Other cryptocurrencies use different models-but none match Bitcoin’s transparency.

Elvis Lam

December 17, 2025 AT 13:15Block rewards aren't just code-they're a monetary revolution. The fact that Bitcoin's inflation is mathematically guaranteed to decline while fiat currencies keep printing like there's no tomorrow is why institutions are dumping Treasuries for BTC. You can't manipulate what's hardcoded into a global, decentralized ledger. This isn't speculation-it's arithmetic with teeth.

Jesse Messiah

December 18, 2025 AT 16:21Love how the network just keeps getting stronger even after each halving. Miners get squeezed, sure-but the ones who survive? They’re the elite. Efficiency wins. And the hashrate jump from 13 EH/s to 627? That’s not luck. That’s evolution. Bitcoin doesn’t break under pressure-it gets sharper.

Rebecca Kotnik

December 19, 2025 AT 23:00It is profoundly significant, and indeed, historically unprecedented, that a monetary system can be engineered with such deterministic precision-where the rate of new issuance is not subject to the whims of political expediency, economic anxiety, or institutional self-interest, but rather governed by immutable cryptographic rules, publicly verifiable, and globally synchronized. The transition from block rewards to transaction fee dominance, while economically complex, represents not a failure of design, but an inevitable maturation of a decentralized economic organism. The fact that this system has functioned continuously for fifteen years without a single deviation from its original protocol, despite immense pressure, global scrutiny, and competing paradigms, speaks to an extraordinary level of resilience and integrity that no central bank, no matter how technologically advanced, has ever achieved.

Terrance Alan

December 20, 2025 AT 17:37Everyone talks about scarcity like its magic but nobody wants to admit the truth-miners are getting screwed. The whole system is one big Ponzi where early adopters cashed out and now the rest of us are supposed to pay for security with fees we can't afford. And don't even get me started on these crypto bros acting like this is some holy grail. It's just digital gold with a cult following and a bunch of overpriced ASICs.

Sally Valdez

December 21, 2025 AT 01:48Bitcoin is just a glorified meme. The US dollar is backed by the world's strongest military and economy. You think a bunch of code running on computers in China and Kazakhstan is going to outlast that? Wake up. The halving is just a marketing stunt to get gullible millennials to buy high. Real money has guns behind it.

Jonny Cena

December 22, 2025 AT 08:23Hey, just wanted to say-this is actually one of the clearest breakdowns of Bitcoin’s economics I’ve read. The part about transaction fees replacing rewards by 2032? That’s the real challenge. But I think the market will find a way. People pay for security all the time-think of insurance, vaults, audits. Bitcoin’s just asking for a fee to keep your value safe. And if it’s worth $1M per coin? $50 fee feels like a bargain.

George Cheetham

December 22, 2025 AT 11:56What fascinates me most isn’t the halving itself, but the psychological shift it induces. Every time the reward drops, the network doesn’t just adapt-it redefines value. Miners become engineers. Investors become students of entropy. Users become custodians. Bitcoin doesn’t just change money-it changes how humans relate to time, scarcity, and trust. And that’s why, even if the price crashes tomorrow, the idea will outlive every central bank. Because it’s not about the coin. It’s about the contract-with the future.