Impermanent Loss Calculators and Tools: How to Measure DeFi Risk Before You Provide Liquidity

Feb, 18 2026

Feb, 18 2026

When you put your crypto into a liquidity pool on Uniswap, PancakeSwap, or SushiSwap, you’re not just earning trading fees. You’re also taking on a hidden risk called impermanent loss. It’s not a glitch. It’s not a bug. It’s built into the math of how decentralized exchanges work. And if you don’t understand it before you deposit your tokens, you could lose money - even if the price of your assets goes up.

Impermanent loss happens because of how Automated Market Makers (AMMs) balance trades. These platforms use a formula - x * y = k - to keep the ratio between two tokens in a pool constant. When one token’s price changes relative to the other, the pool automatically rebalances by selling more of the appreciating asset and buying the falling one. This means you end up with fewer of the asset that went up in value than if you’d just held it in your wallet. That gap? That’s impermanent loss.

Here’s the twist: the word “impermanent” is misleading. The loss isn’t temporary because prices might bounce back. It’s called impermanent because it only becomes real when you withdraw your funds. If prices return to their original ratio before you pull out, the loss disappears. But if they don’t? The loss sticks. And in today’s volatile crypto markets, that’s more common than you think.

How Impermanent Loss Actually Works

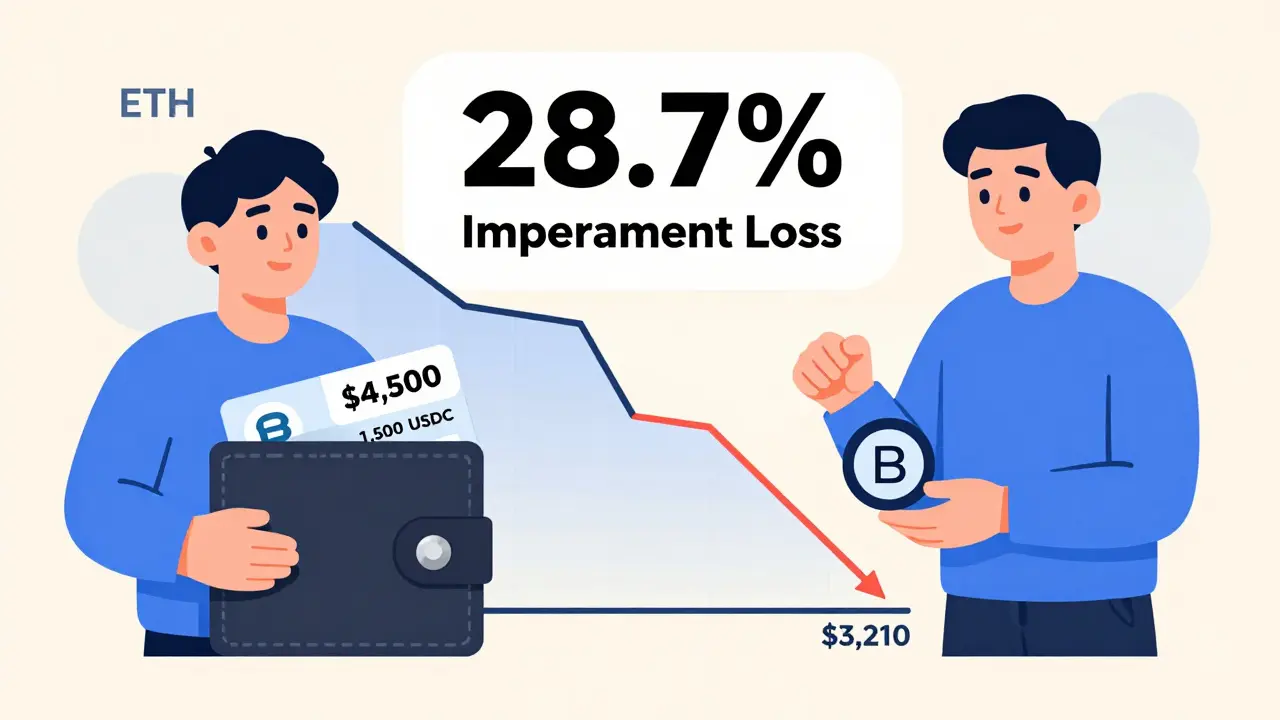

Let’s say you deposit 1 ETH and 1,500 USDC into a 50/50 liquidity pool. At that moment, 1 ETH = 1,500 USDC. You’re not betting on price direction. You’re betting that the pool will earn enough fees to make up for any imbalance.

Now, ETH surges to $3,000. Someone buys ETH from the pool using USDC. The pool’s ratio shifts: it now holds less ETH and more USDC to keep the x * y = k formula balanced. When you withdraw, you get back, say, 0.7 ETH and 2,100 USDC. That’s worth $3,210 total.

If you’d just held your 1 ETH and 1,500 USDC, you’d have $4,500. So even though ETH doubled, your pool position is worth $1,290 less. That’s a 28.7% opportunity cost. That’s impermanent loss.

And here’s the kicker: the bigger the price move, the worse the loss. A 1.5x change? Around 5.7% loss. A 2x change? 13.4%. A 5x move? Over 50%. That’s why people lose money in ETH/USDC pools during bull runs - not because ETH went down, but because they didn’t hold it.

The Best Impermanent Loss Calculators in 2026

Not all calculators are created equal. Some just show you a number. Others help you make real decisions. Here are the top three tools used by active liquidity providers today.

CoinGecko’s Impermanent Loss & APY Calculator

Launched in late 2020, CoinGecko’s tool is the most popular for a reason: it’s simple, fast, and free. You pick two tokens, set the initial price ratio, then slide a bar to adjust how much the price changed. It instantly shows you the percentage loss and compares it to potential fee earnings.

What makes it stand out? It adds APY estimates. You can plug in the pool’s 24-hour trading volume and total liquidity to see if fees will cover the loss. For example, if ETH/USDC has a 0.3% fee rate and $100M in daily volume, you might earn 12% APY - enough to offset a 10% loss from a 1.8x price move.

But it has limits. It doesn’t pull data from your wallet. You have to guess your pool size and timing. And it doesn’t handle Uniswap V3’s concentrated liquidity. Still, for quick checks, it’s the go-to.

Koinly’s Impermanent Loss Tracker

If you’re serious about DeFi, Koinly is the most powerful tool you can use. It connects directly to your wallet (MetaMask, Trust Wallet, etc.) and pulls every transaction you’ve ever made in liquidity pools. It then calculates your exact impermanent loss based on real price changes over time.

Instead of asking you to guess a 50% price move, it shows you: “On January 12, ETH rose from $2,100 to $2,800. You deposited 0.8 ETH and 1,680 USDC. Your pool value dropped $412.37 due to rebalancing.”

It also factors in fees earned, gas costs, and even tax implications. Koinly’s premium version ($49/month) gives you real-time alerts, historical charts, and API access for multiple wallets. Over 42,000 users rely on it to track their actual DeFi performance - not theoretical numbers.

CryptoTaxPrep’s Visual Rebalancing Tool

This free tool is perfect for visual learners. Instead of just showing a percentage, it draws a before-and-after chart of your token quantities. You input your initial deposit, then adjust the price slider. The tool animates how many tokens you’d have left in the pool versus what you’d hold outside.

One user on Reddit said: “I finally got it when I saw I had 0.6 ETH instead of 1.0. It wasn’t abstract anymore.” That’s the power of this tool. It turns math into a picture.

It doesn’t calculate APY or connect to wallets. But if you’re trying to understand *why* impermanent loss happens - not just how much - this is the clearest tool out there.

What These Calculators Don’t Tell You

Even the best tools miss key things.

First, they don’t account for gas fees. If you keep moving in and out of pools to “avoid” impermanent loss, you’ll burn through ETH in transaction costs. One user lost 2.3 ETH over three months chasing price reversals - and ended up worse off.

Second, they assume perfect price feeds. If you’re using a low-liquidity token like a new memecoin, the price data might be 5-10 seconds behind. That means your loss calculation could be off by 3-8%.

Third, they ignore compounding. Most calculators assume fees are paid out once. But if you reinvest them, your returns grow. CoinGecko’s tool doesn’t compound. Koinly does - if you’re a premium user.

And then there’s the psychological trap. Many users think “impermanent loss” means “I didn’t lose money.” But as Laura Shin pointed out in her podcast: “It’s not impermanent. It’s just recoverable - and rarely is.”

When Impermanent Loss Is Worth It

Not all liquidity provision is risky. Some situations make impermanent loss a small price to pay.

- Stablecoin pairs (USDC/USDT, DAI/USDC): Price changes are tiny. Losses are often under 0.5%. Fees? Sometimes 10-20% APY. Easy win.

- High-fee pools: Pools with low liquidity but high volume (like ETH/RETH or SOL/USDC) earn more fees. You can absorb a 15% loss if fees give you 30% APY.

- Long-term holds: If you believe in the asset and plan to hold for years, short-term volatility doesn’t matter. You’re not trading - you’re lending.

But avoid pools where:

- One token is a new, low-volume coin (e.g., a token with $2M TVL and $50K daily volume).

- The pair is volatile and uncorrelated (e.g., BTC/ETH - they move differently).

- You’re using Uniswap V3 without understanding range orders. Concentrated liquidity can amplify losses if prices move outside your set range.

How to Use These Tools Like a Pro

Here’s a simple step-by-step process:

- Choose your pair. Stick to major pairs: ETH/USDC, WBTC/USDT, SOL/USDC.

- Check the pool’s 24-hour volume and TVL. If volume is less than 5% of TVL, avoid it.

- Use CoinGecko’s calculator. Plug in the last 7-day price change. If the loss is over 10%, ask: “Will fees cover it?”

- For serious users: connect your wallet to Koinly. Track your actual loss over time.

- Never withdraw to “avoid” loss unless you’re sure prices won’t recover. Gas fees will eat your gains.

Also, keep a log. Write down:

- When you deposited

- What you deposited

- Price ratio at deposit

- Estimated loss from calculator

- Actual APY earned

After 3 months, compare your actual return to your estimate. You’ll learn faster than any tutorial.

What’s Next for These Tools

The next wave is integration. Uniswap Labs confirmed in October 2023 that impermanent loss estimates will be built directly into their interface. Imagine seeing a red warning on your deposit screen: “Price volatility risk: 14% potential loss.” That’s coming in 2025.

CryptoTaxPrep is building AI models that predict loss probability based on historical volatility. Koinly is adding multi-chain tracking. CoinGecko is expanding to Layer 2s and cross-chain pools.

One thing won’t change: the math. As long as AMMs use x * y = k, impermanent loss exists. The tools just help you see it before you act.

Frequently Asked Questions

Is impermanent loss real money I lost?

Yes - but only when you withdraw. If you hold the position and prices return to their original ratio, the loss disappears. But if you withdraw while the price is different, the difference is permanent. Most people misunderstand this and think it’s just a theoretical number. It’s not. It’s opportunity cost made real.

Can I avoid impermanent loss entirely?

Not if you’re using AMMs. The math forces it. But you can reduce it: use stablecoin pairs, avoid highly volatile tokens, and stick to high-volume pools. Some new AMMs (like Curve) use different formulas that minimize loss for stable assets. But for ETH, BTC, or SOL - you can’t escape it.

Do I pay taxes on impermanent loss?

The IRS doesn’t treat impermanent loss as a taxable event. But when you withdraw and swap tokens, that’s a sale - and you owe tax on the gain or loss at that moment. If you deposited 1 ETH and withdrew 0.8 ETH worth $2,000, and your cost basis was $1,500, you have a $500 gain. The impermanent loss itself isn’t taxed - but the withdrawal is.

Why do some calculators show negative loss?

That’s a red flag. No legitimate calculator shows negative impermanent loss. If a tool says you gained from impermanent loss, it’s either broken or confusing fees with loss. Impermanent loss is always a negative number - it’s the gap between holding and providing liquidity. Fees are separate. Add them together to find your net result.

Which calculator should I use as a beginner?

Start with CoinGecko’s tool. It’s free, fast, and shows you the core concept. Use it to test scenarios: “What if ETH goes up 50%?” Then, if you’re actively providing liquidity, sign up for Koinly. It connects to your wallet and gives real data - not guesses.

Final Thought

Impermanent loss isn’t something to fear. It’s something to measure. Just like you wouldn’t buy a stock without checking its P/E ratio, you shouldn’t deposit into a liquidity pool without running the numbers. These calculators aren’t magic. They’re mirrors. They show you the hidden cost of earning yield. And once you see it clearly, you’ll make better - and safer - DeFi decisions.