Koinde Crypto Exchange Review: What You Need to Know Before Trading

Dec, 12 2025

Dec, 12 2025

Crypto Exchange Safety Checker

This tool evaluates whether a crypto exchange meets minimum safety standards based on the Koinde review criteria. Check the boxes below to see if the exchange meets key safety requirements.

Safety Criteria

Check all requirements that the exchange meets (at least 4/5 required for minimum safety)

When you’re looking to trade Bitcoin against the US Dollar or Turkish Lira, you might come across Koinde. But here’s the problem: there’s almost nothing reliable out there about it. No user reviews. No security audits. No mention on major crypto forums. Just a website that says it’s a platform for BTC, USD, and TRY. That’s not enough to trust your money with.

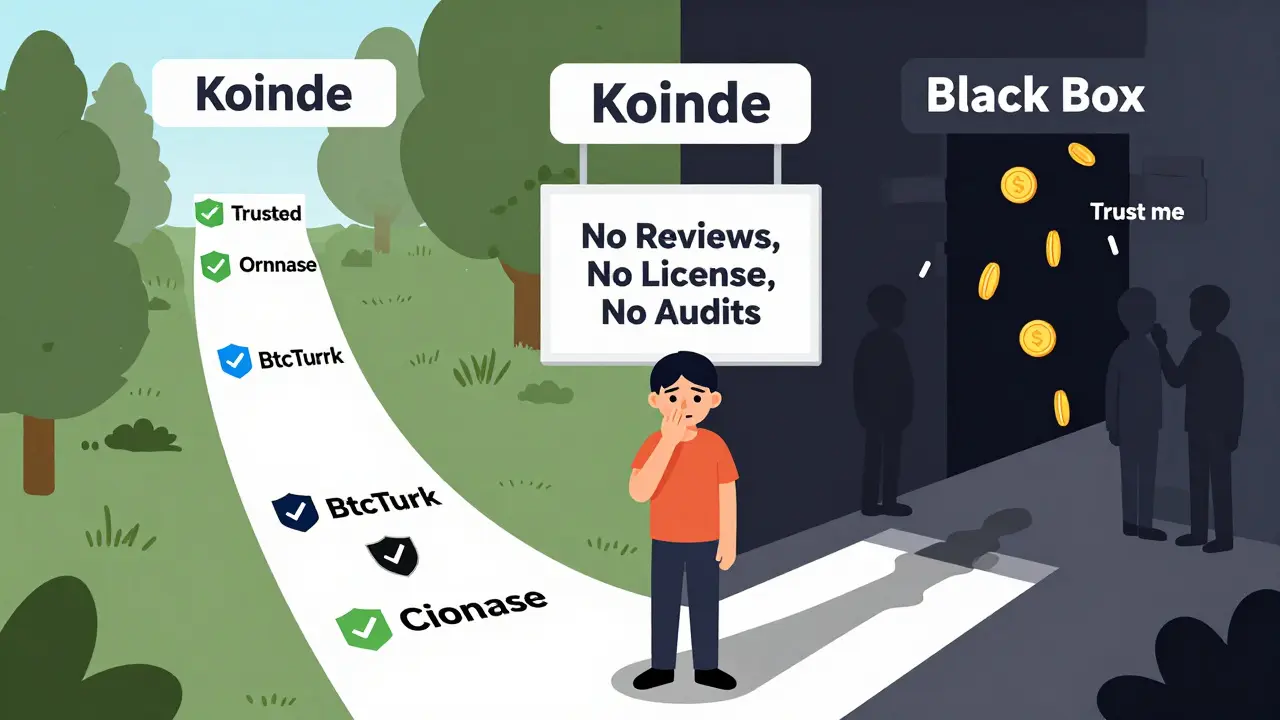

If you’re thinking about using Koinde, you’re not alone. People in Turkey and neighboring regions are searching for local crypto exchanges that handle fiat currencies easily. Koinde claims to fill that gap. But without real data, you’re walking into a black box. And in crypto, black boxes are where money disappears.

What Koinde Actually Offers

Koinde’s website lists only three trading pairs: BTC/USD, BTC/TRY, and possibly BTC/EUR (though that’s not confirmed). That’s it. No Ethereum. No Solana. No stablecoins like USDT or USDC. Just Bitcoin. That’s not a full exchange-it’s a Bitcoin-focused trading terminal. If you only care about buying or selling Bitcoin with USD or Turkish Lira, this might look tempting. But even then, you need more than just pairs.

There’s no mention of trading fees. No clarity on deposit limits. No details on withdrawal times. Most legitimate exchanges list these upfront. Koinde doesn’t. That’s a red flag. If a platform hides its fees, it’s either trying to trick you or it’s not serious about transparency.

The site also doesn’t say who runs it. No team page. No LinkedIn profiles. No press releases. No founding date. That’s unusual. Even small exchanges like Kraken or Bitpanda had public founders and early press coverage. Koinde feels like a website built in a weekend, not a business.

Security: The Big Unknown

Security is the most important thing in crypto. If you’re not sure how your coins are stored, you’re not trading-you’re gambling.

Koinde doesn’t say whether it uses cold storage. Doesn’t mention two-factor authentication (2FA). No info on insurance for user funds. No audits from firms like CertiK or SlowMist. No mention of any past hacks or breaches. And here’s the thing: if they had a clean security record, they’d brag about it. The silence speaks louder than any marketing page.

Compare that to Binance, which publishes monthly proof-of-reserves. Or Coinbase, which keeps 98% of assets in cold storage and is insured by Aon. Koinde offers zero proof. That’s not just incomplete-it’s dangerous.

Regulation: No License, No Safety Net

Regulation isn’t just paperwork. It’s your backup plan if things go wrong.

Does Koinde hold a license from any financial authority? The SEC? Turkey’s BDDK? The FCA? Nothing. No regulatory disclosures. No compliance statements. That means if the platform vanishes tomorrow, you have no legal recourse. No one to call. No government agency to file a complaint with.

In Turkey, crypto exchanges are under increasing scrutiny. The government has cracked down on unlicensed platforms before. If Koinde isn’t registered with BDDK, it’s operating illegally. And if it’s illegal, your funds aren’t protected-ever.

User Experience: No Proof, No Trust

Have you seen user reviews? Check Trustpilot. Check Reddit. Check Twitter. Search for “Koinde review” and you’ll find almost nothing. No real people talking about their deposits. No complaints about withdrawals. No success stories. That’s not normal. Even new exchanges get at least a handful of reviews within weeks.

Some platforms have no reviews because they’re brand new. But Koinde’s domain was registered years ago. So why no feedback? Either no one uses it, or people who did had bad experiences and left quietly. Either way, silence is a warning.

There’s no mobile app listed. No API for traders. No charting tools. No limit orders. Just a basic buy/sell interface. If you’re a beginner, that might seem simple. But if you’re serious about trading, you’ll hit a wall fast. You need tools to manage risk, not just buttons to press.

Who Is This For?

Let’s be clear: Koinde isn’t for most people.

If you’re in Turkey and you’re desperate to buy Bitcoin with Turkish Lira and you’ve tried every other option, you might be tempted. But even then, there are better choices. Paribu, BtcTurk, and Cointrader are licensed, regulated, and have years of user history. They support more coins. They have apps. They have customer service you can actually reach.

If you’re outside Turkey, there’s almost no reason to use Koinde. You can trade BTC/USD on Coinbase, Kraken, or Gemini with lower fees, better security, and full regulatory backing. Why risk your money on a platform with no track record?

Koinde might be targeting a niche market. But niche doesn’t mean safe. It just means less scrutiny-and that’s exactly when scams thrive.

The Bottom Line

There’s not enough trustworthy information to say Koinde is safe. There’s also not enough to say it’s a scam. But in crypto, absence of proof isn’t proof of innocence-it’s proof of risk.

Don’t deposit money until you see:

- A published security audit

- Proof of regulatory licensing

- At least 50 verified user reviews from multiple sources

- Clear fee schedules and withdrawal times

- A public team with real names and LinkedIn profiles

Right now, Koinde checks none of those boxes. That’s not a platform you trade on. That’s a gamble you don’t need to take.

If you’re looking for a reliable way to trade Bitcoin with USD or TRY, go with established names. They’re not perfect, but they’ve survived market crashes, hacks, and regulatory waves. Koinde hasn’t survived anything yet-because no one’s really using it.

Alternatives to Koinde

If you’re in Turkey and want to trade BTC with TRY:

- BtcTurk - Licensed by BDDK, supports 20+ coins, mobile app, 24/7 support

- Paribu - One of Turkey’s oldest exchanges, high liquidity, fiat on-ramps

- Cointrader - Local platform with Turkish language support, fast withdrawals

If you’re outside Turkey and want BTC/USD:

- Coinbase - US-regulated, insured custodial storage, easy for beginners

- Kraken - Strong security, low fees, advanced trading tools

- Bitstamp - One of the oldest exchanges, EU-regulated, reliable withdrawals

These platforms have been tested. Koinde hasn’t.

Is Koinde a scam?

There’s no direct evidence that Koinde is a scam, but there’s also no credible proof that it’s legitimate. No regulatory license, no security audits, no user reviews, and no public team. These aren’t minor gaps-they’re major red flags. In crypto, if you can’t verify a platform’s basics, assume it’s risky until proven otherwise.

Can I trust Koinde with my Bitcoin?

No, not with current information. If you deposit Bitcoin or fiat into Koinde, you’re trusting a platform that doesn’t disclose how it stores funds, whether it’s insured, or if it’s even legally allowed to operate. Most reputable exchanges publish this information openly. Koinde doesn’t. That’s not caution-it’s negligence.

Why does Koinde only support Bitcoin?

It could mean they’re avoiding the complexity of adding more coins, or they’re focusing on a specific market where Bitcoin is the most popular. But it could also mean they lack the technical infrastructure or capital to support more assets. Either way, limiting yourself to one coin reduces your options and increases your risk if Bitcoin’s price drops.

Does Koinde have a mobile app?

There is no official mobile app listed on their website or available on Google Play or the Apple App Store. If you’re being asked to download an app from a third-party site, that’s a major red flag. Legitimate exchanges always offer apps through official channels.

What should I do if I already deposited money on Koinde?

Stop using the platform immediately. Try to withdraw your funds as soon as possible. If withdrawals are delayed or blocked, don’t wait. Document everything-screenshots, emails, transaction IDs. Reach out to local financial authorities if you’re in Turkey, or report to the FTC if you’re in the US. There’s no guarantee you’ll get your money back, but acting fast gives you the best shot.

If you’re looking for a crypto exchange that actually works, don’t settle for silence. Choose one that’s open, transparent, and has been tested by thousands of users. Your money deserves more than a website with three trading pairs and no answers.

Vidhi Kotak

December 13, 2025 AT 18:31Been using BtcTurk for years-no drama, no surprises. Koinde? Zero reviews, zero transparency. If it were legit, someone would’ve posted about it by now. Stick with the platforms that have been through the fire.

Also, why would you risk your BTC on a site that doesn’t even list its team? That’s not niche-that’s sketchy.

Kim Throne

December 15, 2025 AT 07:04While the concerns raised in this post are valid from a regulatory and operational standpoint, it is important to note that the absence of public documentation does not, in and of itself, constitute evidence of malfeasance. However, in the context of decentralized finance, where trust minimization is paramount, the burden of proof lies squarely with the platform. Absent audit reports, licensing disclosures, or verifiable user testimonials, prudence dictates non-engagement.

Caroline Fletcher

December 15, 2025 AT 14:15lol so Koinde is just a government psyop to track crypto buyers??

Also I’m pretty sure the CIA runs it. They’ve been using fake exchanges since 2017 to catch anarchists. You think they’d let some random guy in Turkey build a site with 3 trading pairs? Come on.

Also the domain was registered on 9/11. Coincidence? I think not.

Heath OBrien

December 15, 2025 AT 20:09People still fall for this shit??

Why do you think no one talks about it? Because everyone who used it lost everything and deleted their accounts.

Also why are you even here? Go trade on Binance or get your wallet stolen. Either way I’m not losing sleep over it.

;-)

Toni Marucco

December 16, 2025 AT 22:27This is a textbook case of market inefficiency meeting information asymmetry. Koinde operates in a vacuum-no audits, no regulation, no visibility-yet it persists. That persistence suggests either a highly targeted niche demand (Turkish Lira liquidity crunch) or a sophisticated social engineering operation designed to exploit regulatory gray zones. The fact that it’s been live for years without traction implies either apathy or fear. And fear, in crypto, is the most rational response.

It’s not about whether Koinde is a scam-it’s about whether you’re willing to be the first person to prove it isn’t. Spoiler: you’re not.

Kathryn Flanagan

December 18, 2025 AT 12:15I just want to say, if you're in Turkey and you're trying to buy Bitcoin because your lira keeps losing value, I get it. I really do. I’ve seen friends lose their life savings to inflation, and I know how tempting it is to grab onto anything that looks like a lifeline. But Koinde? It’s not a lifeline-it’s a rope with a knot that’s already coming loose. Please, please, please go to BtcTurk or Paribu. They’ve got apps, they’ve got customer service, they’ve got people who answer the phone at 2 a.m. when your transaction is stuck. Koinde? You’ll be texting into the void. And you’ll be the one holding the void when it collapses. Don’t be that person. Your future self will thank you.

And if you’re outside Turkey? Just use Coinbase. It’s easier. It’s safer. It’s literally the same Bitcoin. You don’t need to risk it all for a website with no team photo.

amar zeid

December 18, 2025 AT 20:02Interesting analysis. I checked the domain registration history-registered in 2020, but no WHOIS updates since 2021. Also, the SSL certificate was issued by a reseller with no verified business address. That’s not just sloppy-that’s intentional obfuscation.

Also, the site loads without JavaScript. That’s rare for modern crypto platforms. Either they’re ultra-minimalist or they’re avoiding client-side tracking. Either way, not reassuring.

Alex Warren

December 20, 2025 AT 07:20Koinde doesn't list withdrawal times. That's not an oversight. That's a warning sign. Legitimate platforms disclose this because they want you to trust them. Silence = evasion.

Also, no API? No charting? That's not for beginners. That's for people who don't plan to trade-just deposit and disappear.

Steven Ellis

December 21, 2025 AT 11:09I appreciate the thorough breakdown. What struck me most was the absence of any community presence-not even a Reddit thread or a Twitter account with more than 200 followers. In 2024, even the most obscure DeFi project has at least a Discord server and a handful of Reddit posts. Koinde’s silence isn’t just eerie-it’s statistically improbable for a functioning exchange.

And if you’re in Turkey, you’re not just risking your money-you’re risking your legal standing. BDDK has already shut down unlicensed platforms. If Koinde vanishes tomorrow, you won’t even be able to file a police report. That’s not risk. That’s surrender.