Mining Crypto in India: Legal Rules and Strict Restrictions in 2025

Jul, 4 2025

Jul, 4 2025

Crypto Mining Tax Calculator

Input Your Mining Details

Tax Breakdown

Enter your mining details to see your tax liability and profitability.

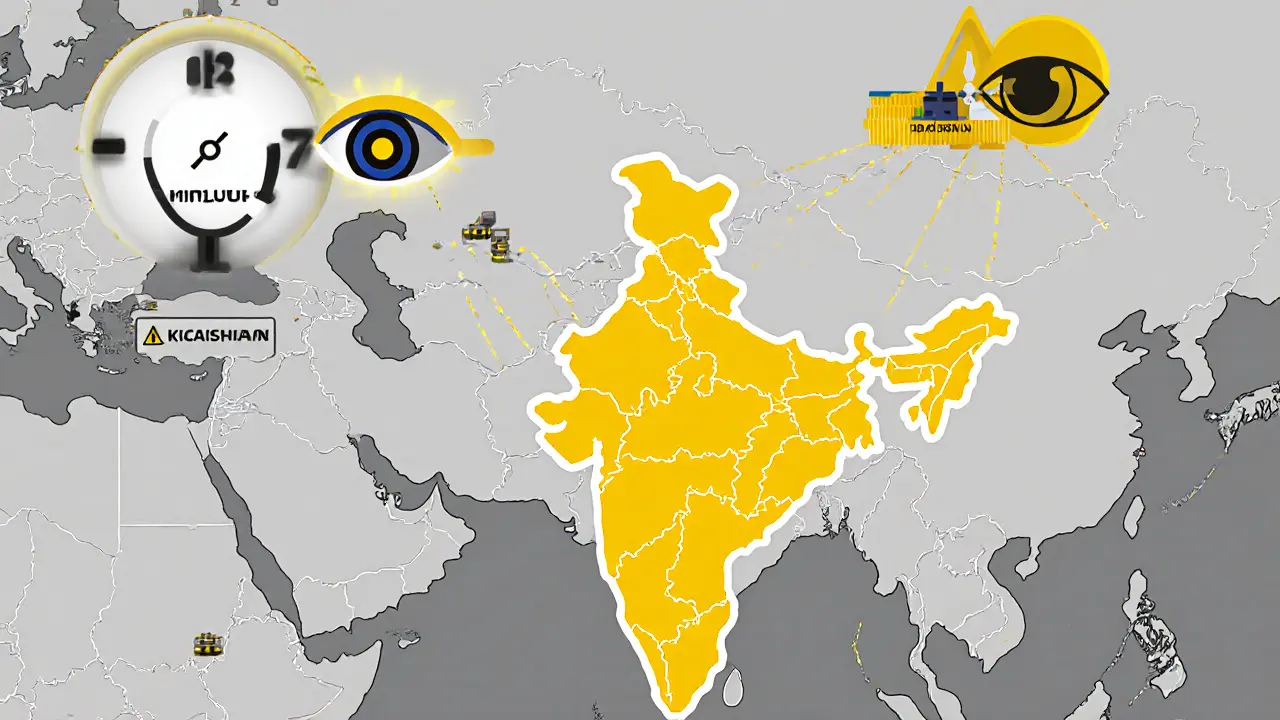

Miners in India aren’t breaking the law - but they’re walking a tightrope with no safety net. There’s no official ban on crypto mining, yet the government has built a system that makes it nearly impossible to do it legally and profitably. If you’re mining Bitcoin, Ethereum, or any other coin in India in 2025, you’re dealing with a 30% tax on every rupee you earn, no deductions for your electricity bill, and a government that’s watching your every transaction.

There’s No Law Against Mining - But There’s a Tax That Kills It

The Indian government doesn’t say you can’t mine cryptocurrency. But it doesn’t need to. The tax code does the job for them. Under the Virtual Digital Asset (VDA) rules introduced in 2022 and updated through 2025, any cryptocurrency you mine is treated as taxable income. And the tax rate? A flat 30%, plus a 4% cess. That’s higher than the top marginal income tax rate for most salaried workers. Here’s the kicker: you can’t deduct anything. Not your ASIC miners. Not your power bill. Not your cooling system. Not even the pool fees you pay to join a mining group. The only cost you’re allowed to subtract is the price you paid to buy the coins - which doesn’t apply if you mined them. So if you spend ₹5 lakh on equipment and ₹2 lakh on electricity to mine ₹10 lakh worth of Bitcoin, the government taxes you on the full ₹10 lakh. Your net profit? Zero. Your tax bill? ₹3.12 lakh. Add to that a 1% Tax Deducted at Source (TDS) on every crypto transaction - including when you sell your mined coins to pay your electricity bill. That’s another ₹10,000 gone before you even see your earnings. And if you use an exchange like Bybit or CoinDCX to convert your mining rewards to INR, you now pay 18% GST on the service fee. That’s three layers of tax on one activity: 30% income tax, 1% TDS, and 18% GST.Who’s Watching You? Five Agencies, One Target

You’re not just dealing with the taxman. You’re under surveillance from five different government bodies, each with its own rules and penalties. The Income Tax Department tracks your mining income through Schedule VDA in your annual tax return. You must report every coin you mine, the date, the value in INR at the time of receipt, and any TDS deducted. Miss a single entry? You could face a penalty of 50% to 200% of the tax due - and up to seven years in jail if they decide you’re hiding income. The Financial Intelligence Unit (FIU-IND) monitors all crypto transactions under the Prevention of Money Laundering Act (PMLA). They’ve already fined Binance ₹18.8 crore and Bybit ₹9.27 crore for failing to report user data. Now they’re tracking 25 offshore exchanges used by Indian miners - platforms like Huione, Paxful, and BitMex - and demanding transaction logs from Indian residents. The Reserve Bank of India (RBI) has never approved crypto mining, but it also hasn’t banned it. Instead, it issues public warnings every few months, reminding banks not to facilitate crypto-related transactions. Banks that do risk losing their license. The Securities and Exchange Board of India (SEBI) started monitoring crypto tokens in April 2025 that resemble securities. If your mining rewards include tokens that act like shares - like staking rewards or governance tokens - SEBI may classify them as unregistered securities. That’s a whole new legal risk. And then there’s Project Insight, NMS, and NUDGE - AI systems built by the tax department to automatically scan crypto wallets, exchange accounts, and blockchain data. These tools flag suspicious activity. If your wallet receives 10 BTC in one month and you’ve never filed a tax return, you’ll get a notice within days.What You Must Keep - And Why It Doesn’t Matter

The government expects you to keep detailed records: purchase receipts for your mining rigs, electricity bills, pool fee invoices, wallet addresses, and timestamps of every mined block. You need to log the INR value of each coin at the moment it hits your wallet - based on exchange rates from CoinMarketCap or CoinGecko. But here’s the irony: even if you keep perfect records, you can’t use them to reduce your tax. The law doesn’t allow deductions for operational costs. So your meticulous spreadsheets? They’re just for show. They don’t lower your bill. They only help the government prove you’re hiding income if you skip filing. If you’re a hobbyist mining one or two coins a month on a home PC, you might think you’re invisible. You’re not. The AI systems flag even small, irregular deposits. If your wallet receives 0.005 BTC in January, 0.003 BTC in March, and 0.002 BTC in July - and you’ve never reported it - you’re already on the radar.

Why Mining Is Dying in India - And Where It’s Going

In 2020, India had an estimated 50,000 active crypto miners. By 2025, that number is below 12,000. Most of those left are either using cheap hydro power in remote areas or running small rigs as side projects. Large-scale mining farms? Nearly gone. Why? Because the math doesn’t work. In Kazakhstan or Texas, miners break even because they deduct electricity, hardware depreciation, and cooling costs. In India, you can’t. Even with subsidized power, the tax burden makes mining unprofitable. One miner in Chhattisgarh told a local news outlet he was paying ₹1.2 lakh in taxes for ₹80,000 in mining rewards. He shut down. The result? Mining is going underground - or offshore. Many Indian miners now operate through foreign pools in Georgia, Kazakhstan, or Canada. They use VPNs, offshore wallets, and peer-to-peer exchanges to avoid detection. But that’s risky. If FIU-IND links your Indian bank account to an offshore wallet, you’re looking at a money laundering investigation. The government knows this is happening. That’s why they’re pushing for the OECD’s Crypto-Asset Reporting Framework (CARF) by 2027. Once adopted, Indian tax authorities will automatically receive data from foreign exchanges and mining pools. Your offshore mining won’t be hidden anymore.The Future: More Rules, More Uncertainty

The government hasn’t given up. In June 2025, it released a discussion paper proposing a full regulatory framework for crypto - including mining. It asked for public feedback on whether mining should be licensed, taxed differently, or outright banned. The options on the table:- License all mining operations (like telecom providers)

- Require mining equipment to be imported only through approved channels

- Cap electricity usage for crypto mining in high-demand states

- Introduce a separate mining tax based on hash rate, not income

- Ban all crypto mining entirely

What Should You Do If You’re Mining Right Now?

If you’re mining crypto in India in 2025, here’s your reality check:- File your taxes - even if you think you lost money. Not filing is a bigger risk than paying tax.

- Report everything - every coin, every date, every value. Use Schedule VDA in your ITR.

- Keep records - not because they help you, but because they prove you’re not hiding anything.

- Don’t use Indian exchanges - they report to FIU-IND. Use offshore platforms with caution.

- Don’t assume you’re safe - AI is watching. Your bank account is linked to your digital wallet.

Is There Any Hope for Change?

Some industry groups are pushing for reform. They argue that mining creates jobs, attracts tech investment, and uses surplus renewable energy. But the government isn’t listening. Their priority isn’t innovation - it’s control. The only real hope is if the Supreme Court steps in again. In 2020, it overturned the RBI’s crypto ban. But it also made it clear: Parliament can ban crypto anytime. And with the Finance Ministry now pushing for tighter rules, that day might come sooner than expected. For now, miners in India are stuck in limbo. No ban. No protection. Just a tax code that turns every mined coin into a liability.Is crypto mining legal in India in 2025?

Yes, mining cryptocurrency is not explicitly banned in India. However, it operates under strict tax and reporting rules under the Virtual Digital Asset (VDA) framework. While you won’t be arrested for mining, failing to report income or pay taxes can lead to heavy penalties or criminal charges.

How much tax do I pay on crypto mining in India?

You pay a flat 30% income tax on the value of mined cryptocurrency at the time you receive it, plus a 4% cess. On top of that, a 1% Tax Deducted at Source (TDS) applies when you sell or transfer the coins. If you use an exchange like Bybit, you also pay 18% GST on service fees. The total effective tax burden can exceed 49%.

Can I deduct mining equipment or electricity costs from my taxes?

No. Under India’s VDA tax rules, you cannot deduct any operational expenses - including mining hardware, electricity, cooling, or pool fees. The only allowable deduction is the cost of acquiring the asset, which doesn’t apply to mined coins. This makes mining financially unviable for most individuals.

What happens if I don’t report my crypto mining income?

If you fail to report mined cryptocurrency income, the Income Tax Department can impose penalties of 50% to 200% of the unpaid tax. In cases of deliberate concealment, you could face criminal prosecution with up to seven years in prison. AI systems like Project Insight automatically flag unreported crypto transactions.

Are mining rigs banned in India?

No, mining rigs are not banned. You can legally buy and own ASIC miners or GPUs. However, importing them may attract customs duties, and using them for commercial mining without reporting income risks tax evasion charges. There are no specific import restrictions yet, but future regulations could change this.

Will India ban crypto mining in the future?

It’s possible. While there’s no current ban, the government has signaled openness to stricter controls, including licensing, electricity caps, or even a full ban. The 2025 discussion paper on crypto regulation included all these options. The Supreme Court has already affirmed Parliament’s right to ban cryptocurrencies - so a future ban remains a real risk.

jocelyn cortez

November 22, 2025 AT 03:15It’s wild how the system just grinds people down without ever saying ‘you can’t.’ No ban, no arrest - just tax you into oblivion and call it ‘fiscal responsibility.’ I feel bad for anyone trying to do this legally. The math isn’t broken - it’s designed to fail.

Gus Mitchener

November 23, 2025 AT 23:19The VDA framework is a classic case of regulatory capture masquerading as fiscal prudence. By obliterating cost basis deductions, the state effectively enforces a consumption-based tax regime on productive capital investment - but without the efficiency of a VAT. The marginal utility of mining hardware depreciates faster than its book value under this regime, rendering any equilibrium calculus incoherent. You’re not taxed on profit - you’re taxed on entropy.

Jennifer Morton-Riggs

November 25, 2025 AT 08:08Okay but like… if you’re mining on your laptop at 2am and you get 0.0003 BTC, are they really gonna notice? 😅 I mean, I know the AI thing sounds scary but come on - they got better things to do than chase hobby miners. Also, why does everything have to be taxed three times? My electricity bill doesn’t get taxed. My Netflix subscription doesn’t get taxed. But my crypto does? That’s just… rude.

Kathy Alexander

November 25, 2025 AT 11:32Everyone’s acting like this is some new tyranny. Newsflash: every country taxes income. The real issue is that Indian miners are bad at accounting. If you can’t keep receipts for your GPU and power bill, you deserve to get crushed. Also, using offshore exchanges? That’s not clever - that’s just asking for a money laundering probe. You want to mine? Fine. But don’t act surprised when the system catches up to your chaos.

Soham Kulkarni

November 27, 2025 AT 08:30bro i mine in pune on old rtx 3060… pay 40k电费/month… get 12k in btc… pay 36k tax… end up with -24k. no joke. i keep receipts just to prove i’m not lying to govt. they dont care. they just want to see you suffer. its like they want us to quit. and honestly? i think they win.

Tejas Kansara

November 28, 2025 AT 17:16Stay calm. File. Keep records. Don’t panic. You’re not alone. Many of us are in the same boat. One day, things will change. Until then - keep going, quietly.