Ourbit Crypto Exchange Review: Risks, Red Flags, and Why You Should Think Twice

May, 8 2025

May, 8 2025

Ourbit Risk Calculator

This tool assesses your risk level based on your holdings, leverage usage, and promotional activity on Ourbit. The more risky factors you have, the higher your risk score will be. Remember: Ourbit has been flagged by regulators, has poor security ratings, and offers terms that favor the exchange over users.

0%

Low Risk

WARNING: Your risk level indicates significant potential for loss or asset seizure. We strongly recommend withdrawing all funds immediately and moving to a regulated exchange.

If you're considering trading on Ourbit, stop for a second. This isn't another exchange you can sign up for and forget about. Ourbit looks flashy on the surface - instant trades, 200x leverage, $5,000 bonuses, and a slick mobile app. But beneath the marketing, the warnings are loud and clear from regulators, security researchers, and experienced traders. This isn't a platform you want your life savings on.

What Ourbit Claims to Offer

Ourbit markets itself as a full-service crypto exchange. It supports spot trading, futures contracts with up to 200x leverage, P2P trading, and even has an NFT marketplace. You can use trading bots, access APIs for automated strategies, and try demo accounts before risking real money. The mobile app promises fast execution, real-time charts, and 24/7 support. It sounds like everything you’d want in a modern exchange. But here’s the problem: features don’t equal safety. Many scam platforms offer the same bells and whistles - high leverage, bonuses, and fancy interfaces - to lure users in. What matters is what’s not there.The Regulatory Red Flags

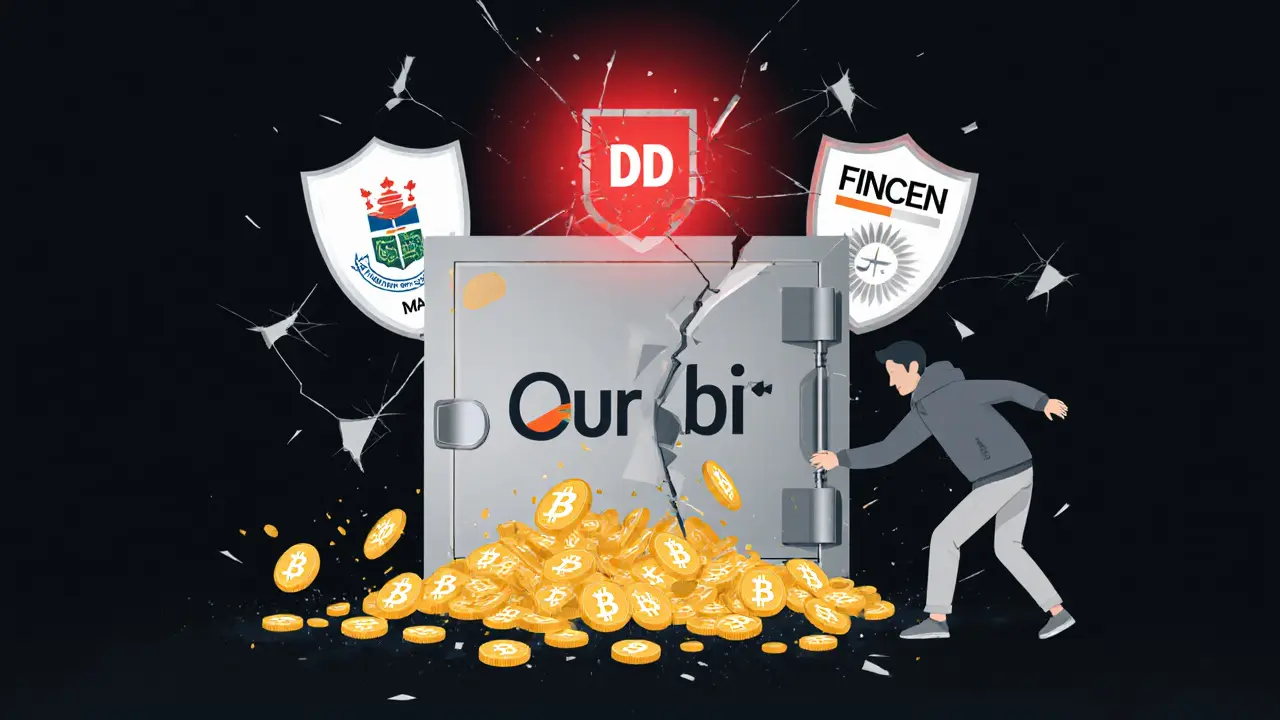

Regulators don’t issue warnings lightly. The Monetary Authority of Singapore (MAS) explicitly stated that Ourbit’s operations go beyond what its license permits. That’s not a minor oversight - it’s a violation. Similarly, FinCEN in the U.S. flagged Ourbit for exceeding its Money Services Business (MSB) license scope. These aren’t small agencies. They’re the ones that shut down illegal financial operations. If a platform can’t prove it’s legally allowed to operate in major markets like Singapore and the U.S., that’s not a technical glitch. It’s a legal liability. And if regulators are warning you, your funds are at risk of being frozen, seized, or lost if the platform gets shut down overnight.Security Rating: A ‘DD’ Score - The Lowest Possible

CER.live, a respected exchange security rating platform, gave Ourbit a ‘DD’ rating - the worst possible. Their score? Just 25%. Why? Because Ourbit has:- No independent penetration testing

- No bug bounty program

- No public security audit reports

- No certification from any recognized cybersecurity body

Terms of Service That Favor the Exchange - Not You

Read the fine print. Ourbit’s terms give them full control to:- Freeze your account without warning

- Suspend trading at any time

- Seize profits they claim are “illicit” - with no appeal

- Remove your registration data without notice

- Hold you fully responsible for any unauthorized access - even if their system was hacked

Too-Good-To-Be-True Promotions

You see a $5,000 bonus? A 50% fee discount with a referral code? That’s not generosity - it’s a red flag. Legitimate exchanges don’t give away thousands in free money. They make money from trading fees and liquidity. Promotions like this are classic scam tactics used to attract large deposits quickly before vanishing. Real exchanges offer small sign-up bonuses - $10, $25, maybe $50. Not five grand. And if you’re being pushed to refer friends with big rewards, that’s a pyramid-style incentive. It’s designed to grow the user base fast, not to build a sustainable platform.Missing Features That Matter

Beyond the risks, Ourbit lacks basic tools that serious traders rely on:- No TradingView integration - you can’t use advanced charting tools

- No OTC desk - you can’t trade large amounts without slippage

- No launchpad for new tokens - you miss out on early access to promising projects

- No auto-invest or recurring buy options - you can’t dollar-cost average easily

What Happens If Ourbit Disappears?

Crypto exchanges go down all the time. But when a regulated, audited exchange fails, users often get some form of compensation or recovery. When an unregulated platform like Ourbit collapses? Your money is gone. Forever. There’s no insurance. No FDIC. No legal recourse. The platform’s terms say they’re not liable for losses from hacking, protocol failures, or government actions. That means if Ourbit gets raided by regulators, or if a hacker drains their hot wallets, you’re not getting your Bitcoin back.

Alternatives That Actually Protect You

If you want to trade crypto safely, use exchanges with:- Clear regulatory licenses (FinCEN, MAS, FCA, etc.)

- Published security audits and bug bounty programs

- Insurance funds for user assets

- Transparent terms with fair dispute resolution

Final Verdict: Avoid Ourbit

Ourbit isn’t just risky - it’s dangerous. The combination of regulatory warnings, zero security certifications, predatory terms, and scam-like promotions creates a profile that matches known crypto frauds. The features look good, but the foundation is rotten. Don’t be fooled by the app store ratings or the flashy ads. Real security doesn’t come with a bonus code. It comes from transparency, regulation, and accountability - none of which Ourbit provides. If you’ve already deposited funds on Ourbit, withdraw them now - even if it means paying a fee. The longer you wait, the harder it will be to get out.Frequently Asked Questions

Is Ourbit a scam?

Ourbit isn’t officially labeled a scam by law enforcement, but it exhibits nearly every behavioral pattern of one: unregulated operations, extremely low security ratings, aggressive bonuses, and terms that protect the company - not users. Industry experts treat it as a high-risk platform with a strong likelihood of failure or regulatory shutdown.

Can I trust Ourbit with my crypto?

No. Ourbit has no independent security certifications, no public audits, and no insurance for user funds. Its security rating is the lowest possible (25% from CER.live). Even if your account looks secure, the exchange itself could be compromised or shut down at any moment - and you won’t get your money back.

Why do regulators warn about Ourbit?

The Monetary Authority of Singapore (MAS) and FinCEN have both warned that Ourbit operates outside the scope of its licensed activities. This means the company is likely offering financial services without legal authorization. Operating without a license is a serious violation that can lead to asset seizures, platform shutdowns, and criminal investigations.

Does Ourbit have two-factor authentication (2FA)?

Yes, Ourbit offers 2FA via Google Authenticator and SMS. But having 2FA doesn’t make the platform safe. Many compromised exchanges still had 2FA enabled - hackers bypassed it through phishing, social engineering, or by exploiting the exchange’s own systems. 2FA protects your account, but not the exchange’s infrastructure - and Ourbit’s infrastructure is unverified and untrusted.

What should I do if I already have funds on Ourbit?

Withdraw your funds immediately. Don’t wait for a “better time” or hope the platform improves. The longer your assets stay on Ourbit, the higher the risk of permanent loss. Transfer them to a regulated exchange like Kraken or Coinbase, or store them in a hardware wallet. Time is your biggest enemy here.

Are there any safe alternatives to Ourbit?

Yes. Kraken, Coinbase, and Binance (where available) are all regulated, audited, and offer user protection measures like insurance funds and transparent security practices. They don’t offer $5,000 bonuses, but they also don’t vanish overnight. For beginners, Kraken is one of the easiest to use with strong security. For advanced traders, Binance offers more tools - but always check local regulations first.

jocelyn cortez

November 23, 2025 AT 09:12Been there, lost money on a platform that looked too good to be true. Just withdraw. No second guesses.

Tyler Boyle

November 24, 2025 AT 14:06Look, I get the hype - 200x leverage sounds like free money, right? But let’s break this down properly. Regulators like MAS and FinCEN don’t just throw warnings around like confetti. If they’re flagging an exchange, it’s because the operational structure is fundamentally broken - not just ‘risky,’ but structurally unsound. Ourbit’s lack of penetration testing, bug bounties, or even a public audit report isn’t negligence, it’s negligence on steroids. Compare that to Kraken’s quarterly third-party audits or Coinbase’s insurance fund backed by Lloyd’s of London. One’s built for longevity, the other’s built for a quick exit. And don’t even get me started on those ‘$5,000 bonuses’ - that’s not a sign of generosity, that’s a liquidity trap. They’re not trying to win customers, they’re trying to collect deposits before the whole thing implodes. Plus, their terms of service are a lawyer’s dream and a user’s nightmare - they can freeze your account, seize your ‘illicit profits,’ and blame you for their own security failures. That’s not a platform, that’s a legal liability with a mobile app. And if you think 2FA saves you, you’re missing the point. 2FA protects your login, not their hot wallet full of unsecured crypto. If their infrastructure is a sieve, your keys are already compromised. Withdraw now. Not tomorrow. Not after your next trade. Now. Because when the lights go out, there’s no backup generator here - just silence and a frozen balance.

Jennifer Morton-Riggs

November 26, 2025 AT 10:10tbh i read the whole thing and just felt this weird pit in my stomach. like... i didn’t even know i was considering this exchange until i saw the bonus. now i’m just glad i didn’t sign up. also why do these platforms always look so pretty? it’s like they hire designers from apple and devs from a garage in russia.

Gus Mitchener

November 28, 2025 AT 04:45The epistemological crisis inherent in Ourbit’s model lies not merely in its regulatory non-compliance, but in its ontological inversion of trust: it commodifies the illusion of security while systematically dismantling the epistemic foundations required for rational user agency. In essence, it leverages performative UX design - the glittering interface, the real-time charts, the slick app - as a semiotic veil over a metaphysical void. The absence of security audits isn’t a technical gap; it’s an ontological negation of verifiability. One cannot trust a system whose very architecture refuses external validation. The ‘bonus’ is a Heideggerian das Man seduction - a collective delusion engineered to suppress critical inquiry. The user, lulled by aesthetic familiarity, becomes complicit in their own expropriation. This isn’t a scam - it’s a systemic epistemic collapse dressed in crypto-bro drag.

Kathy Alexander

November 29, 2025 AT 00:16Everyone’s panicking about Ourbit but nobody’s talking about how Kraken and Coinbase are just as bad - they’re just bigger and have lawyers. You think they don’t freeze accounts? You think they don’t have hidden terms? You think they don’t profit from your FOMO? The only difference is they’re not trying to hide it. They’re just doing it legally. So don’t pretend you’re safe on ‘trusted’ exchanges. You’re just paying more for the same illusion.

Soham Kulkarni

November 29, 2025 AT 10:34bro i just saw this and i was like oh no i almost signed up last week. thanks for the warning. i use binance but i dont trust it fully either. maybe i should move to cold wallet. also i think this post is very helpful for new people like me.

Tejas Kansara

December 1, 2025 AT 08:23Withdraw now. No excuses. Your crypto is safer in your hand than on any exchange.

Rajesh pattnaik

December 1, 2025 AT 08:41From India, I’ve seen so many fake exchanges come and go. Ourbit feels like one of those flashy apps from 2021 that promised moon missions and delivered dust. I’m glad someone laid it out so clearly. If you’re reading this and thinking ‘maybe I’ll try it with small amount’ - don’t. Even small amounts become big regrets. Stay safe, everyone.