Rokes Commons Exchange Crypto Exchange Review: Is It Legit in 2026?

Jan, 10 2026

Jan, 10 2026

There’s no such thing as a reliable crypto exchange called Rokes Commons Exchange - at least not one that’s recognized by any major financial regulator, industry analyst, or user review platform in 2026. If you’ve seen ads for it on social media, YouTube, or Telegram, you’re being targeted by a platform that doesn’t appear on any official list of trusted crypto brokers. Not on CoinMarketCap. Not on CoinGecko. Not on Binance’s partner list. Not even in the backup databases of blockchain forensics firms tracking suspicious addresses.

Zero Traceability, Zero Reputation

Try searching for Rokes Commons Exchange on Google, Bing, or even DuckDuckGo. You won’t find a legitimate website with verifiable contact info, a registered business address, or regulatory licensing. No press releases from Reuters or Bloomberg. No mention in reports from Chainalysis or Elliptic. No user testimonials on Trustpilot or Reddit’s r/CryptoCurrency. Even the domain registration records for rokescommonsexchange.com show private registration, no physical address, and a registration date from late 2024 - the same time a wave of similar fake exchanges popped up targeting new crypto investors.Compare that to real exchanges like Gemini, Kraken, or Coinbase - all regulated in the U.S., audited quarterly, and listed on the New York State Department of Financial Services’ approved crypto list. Rokes Commons doesn’t even pretend to follow those rules. No KYC process? No insurance for user funds? No transparent fee schedule? That’s not a startup - that’s a red flag.

How Fake Exchanges Like This Operate

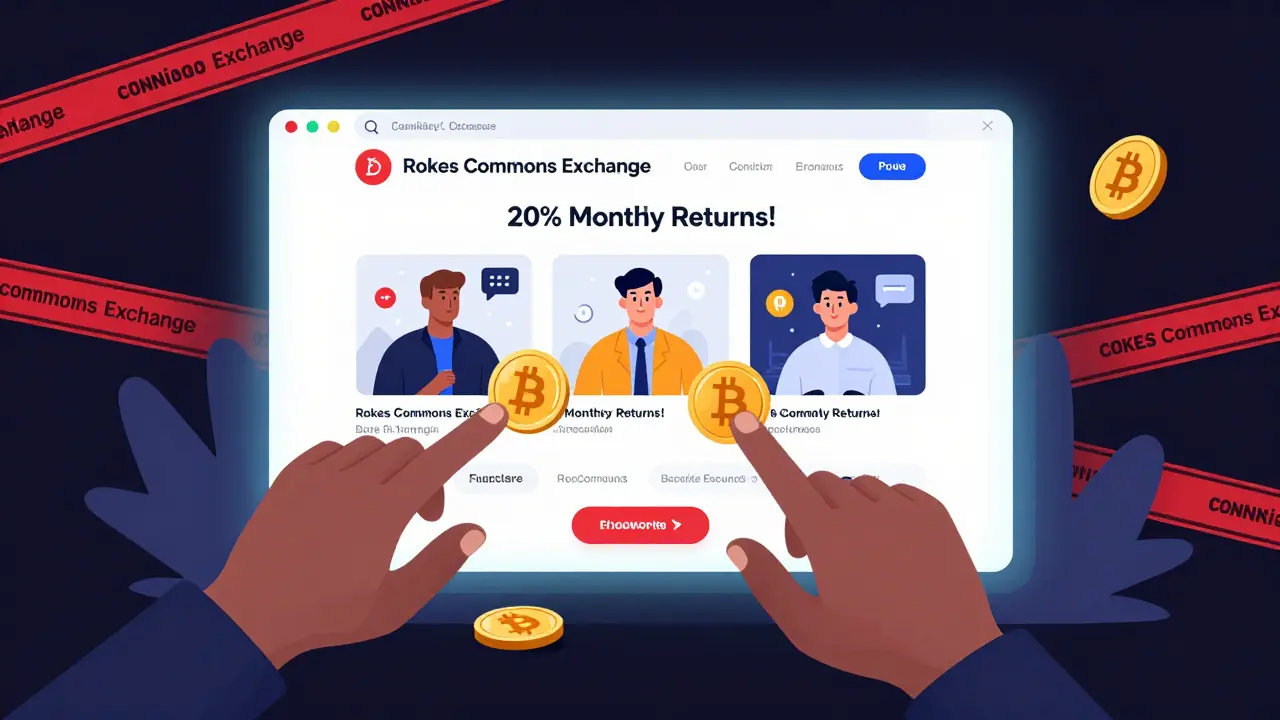

These platforms don’t need to be complex to fool people. Here’s how they work:- They use flashy websites with fake testimonials and stock photos of smiling traders.

- They promise 20% monthly returns - impossible without insider trading or Ponzi mechanics.

- They push you to deposit Bitcoin or Ethereum, then disappear after you try to withdraw.

- They create fake customer support chatbots that reply with copy-pasted answers.

- They change names every few months - Rokes Commons might become “CryptoZen” or “GlobalTradeX” next week.

One user in Arizona lost $18,000 to a platform called Rokes Commons in November 2025. He told the FBI’s IC3 division he was lured in by a YouTube ad featuring a fake “ex-Binance trader” claiming he made $400,000 in 30 days. The site looked real - until he tried to cash out. The withdrawal button turned into a spinning wheel. Then the site went dark. No emails returned. No phone number worked.

What Real Crypto Exchanges Do Differently

Legit exchanges don’t need to shout. They let their track record speak:- Gemini is licensed by the NYDFS and holds customer funds in cold storage with third-party audits.

- Kraken has been operating since 2011, survived the 2018 crypto crash, and offers FDIC-insured USD balances up to $250,000.

- Coinbase is publicly traded on NASDAQ, files regular SEC reports, and has over 110 million verified users.

They don’t promise miracles. They offer security, transparency, and customer support that actually answers your calls. Rokes Commons offers none of that.

Why You Should Never Deposit Money Here

If you send crypto to Rokes Commons Exchange, you’re not investing - you’re donating. Once your Bitcoin or Ethereum leaves your wallet and goes to their address, it’s gone. There’s no chargeback. No recourse. No legal protection. Unlike banks, crypto transactions are irreversible. And without a license, there’s no government agency to file a complaint with.Even if you think “I’ll just deposit $100 to test it,” that’s still a risk. Scammers use small deposits to verify your wallet is active. Then they target you with more aggressive scams - phishing links, fake customer service, or even fake “refund” offers that cost you more.

What to Do If You Already Deposited

If you sent funds to Rokes Commons Exchange:- Stop sending more money - no matter what they promise.

- Document everything: screenshots, transaction IDs, emails, chat logs.

- Report it to the FBI’s Internet Crime Complaint Center (IC3) at ic3.gov.

- File a report with the FTC at reportfraud.ftc.gov.

- Warn others on Reddit, Twitter, and crypto forums - don’t let them fall for the same trap.

Recovering funds is nearly impossible, but reporting helps authorities track patterns and shut down these operations before they hit more people.

How to Spot a Fake Crypto Exchange

Here’s your quick checklist before you deposit anything:- Is it listed on CoinMarketCap or CoinGecko? If not, walk away.

- Does it have a physical address? Real exchanges do. Scams use virtual offices.

- Is there a license number? Check it on your country’s financial regulator site (e.g., SEC, FCA, ASIC).

- Can you withdraw your crypto to your own wallet? If they lock it or charge insane fees, it’s a trap.

- Are the team members real? Google their names. Do they have LinkedIn profiles? Have they spoken at real conferences?

- Are the reviews fake? Look for repetitive language, identical photos, or reviews posted within minutes of each other.

If even one of these checks fails, it’s not worth the risk.

Safe Alternatives in 2026

Stick with exchanges that have proven track records:- For U.S. users: Coinbase, Kraken, Gemini

- For global users: Binance (where legal), Bybit, KuCoin

- For beginners: Crypto.com (easy app, FDIC insurance on USD)

- For privacy: Bisq (decentralized, no KYC)

All of these have been around for years, have real customer support, and are subject to audits. None of them promise you riches overnight.

Final Word

Rokes Commons Exchange doesn’t exist as a legitimate business. It’s a scam. Not a startup. Not a niche platform. Not a new player trying to break in. It’s a fraud designed to take your money and vanish. There’s no “maybe it’s legit” here. The evidence is clear: zero regulatory presence, zero user trust, zero transparency.If you see it advertised, close the tab. If a friend recommends it, tell them to check the facts first. Crypto is risky enough without adding fake exchanges to the mix.

Is Rokes Commons Exchange a real crypto exchange?

No, Rokes Commons Exchange is not a real or regulated crypto exchange. It does not appear on any major crypto data platforms like CoinMarketCap or CoinGecko, has no regulatory licensing, and is not mentioned in any credible financial publications. It is widely considered a scam platform designed to steal user funds.

Can I withdraw my crypto from Rokes Commons Exchange?

If you’ve deposited funds, you likely won’t be able to withdraw them. Users who’ve tried report the withdrawal button not working, endless processing messages, or the entire site going offline after a deposit. Once your crypto is sent to their wallet, it’s gone - there’s no customer service to help you recover it.

Why don’t major crypto sites list Rokes Commons Exchange?

Because it doesn’t meet basic standards for inclusion. Legit exchanges must be registered, audited, and have transparent operations. Rokes Commons has none of that. No regulatory filings, no public team, no verified contact info - so platforms like CoinGecko and Cointelegraph exclude it by design to protect users.

What should I do if I lost money to Rokes Commons Exchange?

Report it immediately to the FBI’s IC3 (ic3.gov) and the FTC (reportfraud.ftc.gov). Save all screenshots, transaction IDs, and communications. While recovering funds is extremely unlikely, reporting helps authorities track these scams and shut them down before they target more people.

Are there any safe crypto exchanges I can use instead?

Yes. Use regulated platforms like Coinbase, Kraken, or Gemini in the U.S., or Binance (where legal), Bybit, or KuCoin internationally. These exchanges are transparent, audited, and have real customer support. They don’t promise unrealistic returns - they focus on security and reliability.

Stick to the big names. Avoid anything that looks too good to be true. Crypto isn’t a lottery - it’s a market. And markets don’t reward greed. They reward caution.

jim carry

January 12, 2026 AT 05:45Just saw a YouTube ad for this 'Rokes Commons' thing yesterday. Looked slick-smiling guy in a suit holding a laptop, saying '10x in 30 days.' I almost sent $500 just to see if it was real. Thank god I checked Reddit first. This post saved me from becoming another statistic.

These scammers are getting smarter. The websites look like they were built by actual devs. But the domain registration? Private. No phone number. No address. Just a PayPal link disguised as a 'deposit gateway.' Classic.

I reported it to IC3. If you’re reading this and you’ve already sent crypto-don’t blame yourself. They’re pros at manipulation. Just document everything and move on.

Don’t let FOMO kill your portfolio. Crypto’s volatile enough without adding fraud to the mix.

Don Grissett

January 13, 2026 AT 13:40lol at people still falling for this. i mean come on. if it was legit why the hell would they not be on coingecko? you dont need to be a genius to figure this out.

also the name 'rokes commons' sounds like a middle schooler trying to sound fancy. like 'i read one article about communism and now i think crypto should be 'common' hahahaha'.

they use the same stock photos as every other scam. that guy with the beard and the blue shirt? he’s on 12 different 'exchanges' this month. i’ve seen him in ads for 'CryptoZen', 'GlobalTradeX', and 'BitPulse'-all the same face, different names.

if you deposit here, you’re not investing. you’re just funding some dude’s vacation in Bali. and no, he’s not coming back.

Veronica Mead

January 14, 2026 AT 02:26It is both profoundly disheartening and morally indefensible that predatory financial entities continue to exploit the naive enthusiasm of novice participants in emerging technological markets.

The absence of regulatory oversight, the deliberate obfuscation of corporate identity, and the calculated use of psychological manipulation through false testimonials and artificially inflated return projections constitute a systemic failure of both market integrity and public education.

One must ask: Why do we, as a society, continue to permit the proliferation of such entities without mandatory public advisories from financial institutions? Why is the burden of due diligence placed entirely on the individual, rather than on the platforms that enable their dissemination?

This is not merely a case of poor judgment-it is a failure of institutional accountability. The fact that entities like Rokes Commons can operate with impunity for months, even years, before being exposed speaks volumes about the fragility of our current financial literacy infrastructure.

I urge every reader to not only avoid such platforms but to actively advocate for legislative reform that mandates third-party verification for all crypto-related advertisements, particularly those targeting social media audiences under the age of 35.

Mollie Williams

January 14, 2026 AT 07:53There’s something quietly tragic about how easily we trade our skepticism for hope.

We don’t want to believe the world is rigged. We want to think that if we just find the right platform, the right signal, the right guru-then maybe, just maybe, we can break out of the grind. That’s not greed. That’s longing.

Rokes Commons doesn’t prey on fools. It preys on people who are tired of being told they’re not enough. It offers a fantasy where effort isn’t measured in hours, but in Bitcoin. Where your worth isn’t tied to your job title, but to your wallet balance.

And when that fantasy collapses, we blame ourselves. ‘I should’ve known.’ But the truth is, they didn’t leave a trail for us to follow-they buried it under glitter and promises.

Maybe the real scam isn’t the exchange. Maybe it’s the idea that anyone should have to risk everything just to feel like they’re not falling behind.

I wish we could build systems that reward patience instead of panic. That honor caution over charisma.

Surendra Chopde

January 15, 2026 AT 13:20Tre Smith

January 15, 2026 AT 19:13Let’s be clear: this isn’t even a ‘scam’ in the traditional sense. It’s a zero-effort fraud operation with no technical sophistication whatsoever.

They don’t need to hack wallets. They don’t need to write malware. They just need to copy-paste a WordPress theme, buy a $5 domain, and run a $200/day Facebook ad campaign targeting people who watched ‘The Wolf of Wall Street’ last week.

The real problem? The average crypto investor has never read a whitepaper, doesn’t know what cold storage means, and trusts a YouTube influencer because he said ‘diamond hands’ five times.

And yet, every time someone loses money to this garbage, the community acts like it’s a surprise. No. It’s predictable. It’s systemic. It’s the direct result of glorifying get-rich-quick culture under the banner of ‘decentralization.’

If you don’t know how to verify a platform’s legitimacy, you shouldn’t be touching crypto. Not because it’s dangerous-but because you’re not ready to be responsible for your own money.

Ritu Singh

January 17, 2026 AT 18:53What if… Rokes Commons is a psyop?

Think about it. What if the whole thing is designed by some shadow group to make people distrust crypto entirely? They let it thrive for a few months, let hundreds lose money, then ‘expose’ it with a post like this… and suddenly everyone thinks crypto = scam.

Who benefits? The banks. The Fed. The traditional finance giants who’ve been lobbying to kill decentralized finance for years.

They don’t need to shut down Rokes Commons themselves. They just need to let it exist long enough to scare people away from *all* crypto.

That’s why CoinMarketCap never lists it. That’s why no one talks about it until now.

It’s too convenient. The timing. The tone. The ‘warning’ that feels… manufactured.

What if the real scam isn’t the exchange?

What if the real scam is the narrative that says ‘trust the experts’?

They want you to go back to your bank account. To your 0.01% interest. To your 401(k) that’s invested in fossil fuels and surveillance tech.

Don’t fall for the reset.

Just because it’s labeled ‘scam’ doesn’t mean it’s not a tool.

Question everything-even the warnings.