Staying Informed About Changing Crypto Regulations Worldwide in 2025

Dec, 14 2025

Dec, 14 2025

Crypto Regulation Checker

Check Crypto Regulations by Country

Get a quick overview of key regulatory requirements and risks for crypto activities in different countries. Based on 2025 regulations as discussed in the article.

Select Your Country

United States

2025 RegulationsEuropean Union

MiCAR FrameworkHong Kong

SFC LicensingSingapore

Stablecoin FrameworkChina

Banned RegulationCrypto Regulation Overview

Select a country to see its current crypto regulations, key requirements, and compliance risks. This tool shows country-specific requirements based on the 2025 regulations discussed in the article.

It’s 2025, and if you’re still guessing whether your crypto transactions are legal, you’re already behind. Governments around the world aren’t just watching crypto anymore-they’re rewriting the rules, and fast. What was allowed last year might be illegal today. What was banned in January could be fully licensed by March. There’s no global rulebook. No single agency in charge. And if you’re running a business, trading, or even holding crypto, you need to know what’s changing, where, and why.

What’s Actually Changing in the U.S.?

The U.S. didn’t just tweak its crypto rules in 2025-it flipped the script. Under the Trump administration, the SEC stopped chasing crypto companies with lawsuits and started writing actual rules. On February 27, 2025, they made a massive call: memecoins are no longer securities. That means Dogecoin, Shiba Inu, and thousands of others won’t be treated like stocks anymore. It wasn’t a vote. It wasn’t a law. It was an agency decision that instantly changed how exchanges list tokens and how investors think about risk. The SEC also dropped investigations into OpenSea, Robinhood, and Coinbase without penalties. That’s not a sign of weakness-it’s a sign of strategy. The agency now wants clear rules, not court battles. Meanwhile, the FIT Act moved closer to passage, proposing a clean split: the SEC handles tokens that act like stocks, and the CFTC handles those that act like commodities like Bitcoin and Ether. That’s huge. For years, crypto companies had no idea which regulator to talk to. Now, there’s a map. But it’s not all smooth sailing. The Stablecoin Trust Act is coming. If it passes, any company issuing a stablecoin-like USDT or USDC-will need a federal license. They’ll have to prove every dollar is backed, keep reserves separate from company funds, and get audited by the Federal Reserve and OCC. That’s expensive. It’s also necessary. After Terra’s collapse in 2022, regulators won’t let another stablecoin fail without consequences. And then there’s OKX. In February 2025, they pleaded guilty to running an unlicensed money service business and paid $1.2 billion in fines. Why? Because even as the U.S. relaxed rules for most players, it doubled down on enforcement against firms that ignored basic banking laws. The message? Don’t hide. Don’t evade. Get licensed-or get punished.Europe’s MiCAR: More Rules, More Confusion

The European Union’s MiCAR regulation went fully live in 2025. It’s the most detailed crypto rulebook in the world. Every exchange, wallet provider, and token issuer must now register, prove they have enough capital, disclose every detail about their tokens, and protect users from fraud. Sounds good? It is. But here’s the catch: MiCAR doesn’t apply uniformly. Germany requires crypto firms to hold 10% of their assets in liquid reserves. France says 15%. Ireland lets firms use third-party auditors. Lithuania has faster licensing but stricter KYC. So if you’re a crypto company operating in 10 EU countries, you’re not following one rule-you’re following 10 versions of the same rule. That’s why some firms moved their headquarters to Luxembourg or Estonia, where processes are clearer and enforcement is more predictable. MiCAR also forced banks to start accepting crypto clients. Before, most European banks refused to touch anything crypto-related. Now, they have to. But they’re still scared. Many still freeze accounts if they detect a transaction with a decentralized exchange. So while the law says one thing, the banks say another. That’s the reality of crypto regulation in Europe: written rules, messy execution.Asia Is Winning the Crypto Race

While the U.S. and Europe debate, Asia is building. Hong Kong launched its own licensing regime in early 2025. Now, any exchange operating in the region must get a license from the SFC-no exceptions. They also introduced new rules for crypto derivatives and lending platforms. If you want to lend Bitcoin or trade ETH futures in Hong Kong, you need approval. No gray areas. Singapore didn’t just follow suit-they upgraded. They finalized their stablecoin framework in April 2025, requiring issuers to hold reserves in U.S. Treasuries or cash, with daily audits. They also banned unlicensed DeFi protocols from marketing to Singapore residents. That’s bold. Most countries ignore DeFi. Singapore says: if you’re targeting our citizens, you’re under our rules. Why does this matter? Because businesses are moving. Crypto startups that once set up in the U.S. or Switzerland are now opening offices in Singapore and Hong Kong. Why? Because they know exactly what’s allowed. They can build products without fearing a sudden raid. And investors? They’re following the money-and the rules.

Global Rules Are Starting to Align

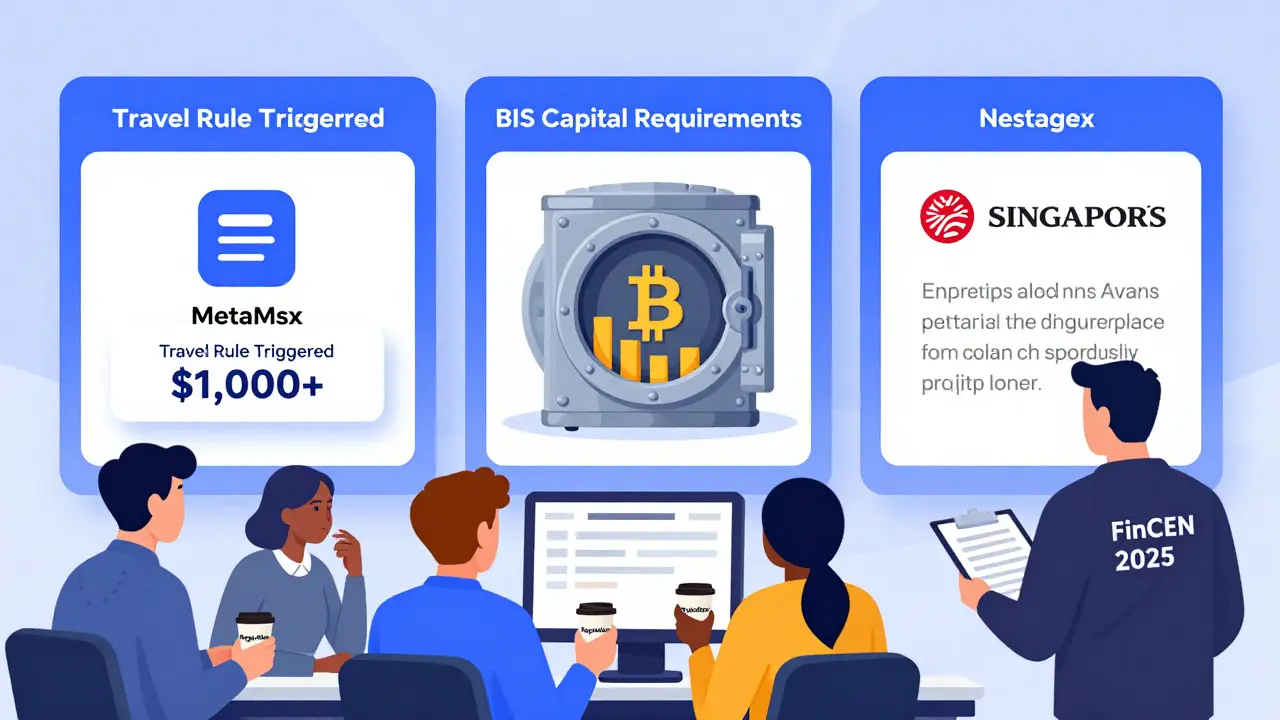

There’s no global crypto police. But there are global rulemakers. The Financial Action Task Force (FATF) updated its guidance in March 2025, demanding all countries enforce the “travel rule.” That means exchanges must share sender and receiver info for transactions over $1,000-even if they’re peer-to-peer. If you’re using a non-custodial wallet and sending $2,000 to a friend, your exchange might block it unless you provide ID. This is already happening in the EU and Japan. The U.S. is rolling it out slowly. The Bank for International Settlements (BIS) and Basel Committee are pushing banks to treat crypto like any other risky asset. Banks now need to hold more capital if they lend to crypto firms or hold Bitcoin on their books. That’s making institutions cautious-but also more serious. Big banks like JPMorgan and HSBC are now building crypto compliance teams, not just avoiding the space. And the Financial Stability Board (FSB) is pushing for global coordination. They’re not making laws. They’re making recommendations. But when 120 countries agree on a recommendation, it becomes a soft law. Countries that ignore it risk being labeled as high-risk jurisdictions. That means banks won’t do business with them. That’s a powerful incentive.What You Need to Do Right Now

You don’t need to be a lawyer. But you do need a system. Here’s how to stay ahead:- Set up Google Alerts for “crypto regulation [country name]” - especially for the U.S., EU, Singapore, Hong Kong, and Switzerland.

- Subscribe to official regulator newsletters: SEC, ESMA (EU), SFC (Hong Kong), MAS (Singapore).

- Use a compliance tool like Chainalysis or Elliptic to monitor transactions. If you’re a business, you need to know if you’re sending funds to a sanctioned wallet.

- Track legislation. Use sites like GovTrack (U.S.) or EUR-Lex (EU) to follow bills like the FIT Act or Stablecoin Trust Act. When they pass, rules change overnight.

- Know your wallet type. If you’re using a non-custodial wallet (like MetaMask), you’re not subject to rules-but if you’re using Coinbase or Kraken, they’re legally required to report your activity.

The Big Problem No One Talks About

Here’s the truth: crypto is borderless. Regulations are not. You can hold Bitcoin in Texas, send it to a wallet in Nigeria, trade it on a platform in Singapore, and cash out in Germany-all in one day. But each country treats it differently. The U.S. says Bitcoin is a commodity. The EU says it’s a financial instrument. Japan says it’s property. India says it’s taxable income. China says it’s illegal. So when you move crypto across borders, you’re not just moving digital money-you’re moving legal risk. That’s why FinCEN’s 2025 proposal is so dangerous. They want to classify Bitcoin and Ether as “monetary instruments” under the Bank Secrecy Act. That means every bank transaction over $3,000 would need to be reported. If you buy $5,000 worth of ETH on Coinbase and send it to your personal wallet, your bank might flag it. Even if you’re not breaking any law, you’ll get a call. That’s not regulation. That’s surveillance.What’s Next?

By the end of 2025, we’ll see three clear paths:- Regulated Hubs: Singapore, Hong Kong, Switzerland, and maybe the U.S. if the FIT Act passes. These places will attract businesses because they offer clarity.

- Restricted Zones: China, Russia, and parts of Africa. Crypto is banned or heavily controlled. Avoid them unless you’re a miner with deep pockets.

- Gray Zones: Most of Latin America, Southeast Asia, and Eastern Europe. Rules exist, but enforcement is weak. Risky for businesses, but attractive for individuals who want privacy.

Frequently Asked Questions

Are memecoins legal in the U.S. now?

Yes. As of February 27, 2025, the SEC officially stopped treating memecoins like securities. That means Dogecoin, Shiba Inu, and similar tokens are no longer subject to SEC registration or disclosure rules. But exchanges still need to comply with anti-fraud laws. If a project lies about its team or roadmap, you can still sue.

Do I need to report crypto transactions to the IRS?

Yes. Even with new rules, the IRS still requires you to report all crypto sales, trades, and income. The SEC doesn’t care about your taxes-FinCEN and the IRS do. If you sold Bitcoin for profit, earned interest on crypto, or got paid in ETH, you owe taxes. Use Form 8949 and Schedule D. Ignoring this hasn’t changed.

Can I use a non-custodial wallet to avoid regulation?

You can use one, but it doesn’t make you invisible. If you buy crypto on Coinbase and send it to MetaMask, Coinbase reports that transaction. If you later cash out through a U.S. exchange, they’ll ask where it came from. FinCEN’s new rules target unhosted wallets too. You won’t get fined for holding crypto privately-but if you’re moving large amounts, you’ll face scrutiny.

Is DeFi regulated in 2025?

Not directly-but indirectly, yes. In Singapore and Hong Kong, DeFi platforms that market to residents must comply with licensing rules. In the U.S., regulators still say DeFi protocols aren’t legal entities, so they can’t be sued. But if you run a DeFi app and earn income, you’re still taxed. And if your protocol is used for money laundering, you could be investigated under FATF rules.

What happens if I ignore crypto regulations?

If you’re an individual holding crypto, you’ll probably be fine-unless you’re moving millions. If you’re a business, you risk fines, asset freezes, or being barred from banking services. OKX paid $1.2 billion. Many smaller firms got shut down in 2025 for not registering as money transmitters. Ignoring rules doesn’t make you clever-it makes you a target.

Albert Chau

December 14, 2025 AT 19:38So the SEC just decided memecoins aren’t securities? Cool. So now Dogecoin’s officially a joke with legal standing. Guess I’ll start using it to pay for coffee-wait, no, Starbucks still won’t take it. Classic.

Meanwhile, the whole ‘FIT Act’ thing is just regulatory whiplash. One day you’re a security, next day you’re a commodity, next week you’re a public nuisance. Who even designed this system? A toddler with a flowchart?

And don’t get me started on the ‘Stablecoin Trust Act.’ You want banks to hold reserves? Great. Now tell me why I should trust a Fed-audited dollar when the Fed’s own balance sheet looks like a TikTok trend gone rogue.

Abhishek Bansal

December 15, 2025 AT 19:22India still bans crypto but everyone uses P2P. LOL. Regulators think they can stop people with laws? Bro, my uncle in Mumbai buys BTC via WhatsApp group with cash. No KYC. No trace. You can’t regulate dumb people with paper.

Also, why does everyone act like Singapore is the crypto utopia? They ban DeFi marketing but let hedge funds trade ETH futures? That’s not regulation. That’s corporate welfare with a smiley face.

Scot Sorenson

December 17, 2025 AT 10:54Oh wow. The U.S. is ‘relaxing’ rules? More like they’re throwing the whole regulatory playbook into a woodchipper and calling it ‘market innovation.’

Let me get this straight: you’re telling me the SEC, the same agency that spent 5 years suing Coinbase for ‘unregistered securities,’ now suddenly thinks memecoins are fine? But OKX gets fined $1.2B for not having a license? That’s not consistency. That’s selective enforcement dressed up as policy.

And don’t even get me started on the FATF travel rule. You want me to hand over my wallet address every time I send $1,000 to my cousin? That’s not financial regulation. That’s a surveillance state with a blockchain logo.

Meanwhile, the BIS and Basel Committee are acting like crypto is some kind of financial plague. Funny-they’re still holding Bitcoin in their reserves. Hypocrites in suits.

And yet, somehow, the people who built this entire ecosystem are the ones getting demonized. The system is rigged. You don’t need to be a genius to see it.

JoAnne Geigner

December 17, 2025 AT 13:43I really appreciate how thoughtful this breakdown is-thank you for laying out the global landscape so clearly.

It’s fascinating how regulation is becoming less about control and more about clarity. The U.S. shift from lawsuits to frameworks, the EU’s messy-but-structured MiCAR, Asia’s quiet dominance through precision… it’s like watching a puzzle slowly come together, even if the pieces are still shifting.

I’ve started using Chainalysis for my small business, and honestly? It’s been a game-changer. Not because I’m worried about breaking rules, but because I want to build trust. When clients see we’re compliant, they feel safer-and that’s worth more than any tax break.

Also, the point about non-custodial wallets… yes, you’re not legally bound, but ethically? If you’re moving large sums, you’re still part of the system. And maybe that’s the real shift: crypto isn’t about escaping regulation anymore. It’s about choosing how to engage with it.

Keep sharing these insights. We need more people thinking this way-not just reacting, but building responsibly.

With gratitude,

JoAnne

Taylor Fallon

December 18, 2025 AT 13:42Okay, I just had to say this: I love how the world is finally waking up to crypto’s real potential-not as a wild west, but as a new kind of financial infrastructure.

It’s not about whether you like Bitcoin or Dogecoin. It’s about what happens when money becomes programmable, borderless, and transparent.

Yes, the U.S. is messy. Yes, Europe is overcomplicated. But Singapore? Hong Kong? They’re not just regulating-they’re architecting the future. They’re saying: ‘We want innovation, but we want it safe, we want it accountable.’

And the fact that banks are finally hiring crypto compliance teams? That’s not surrender. That’s evolution.

I’ve been using Google Alerts for MAS and SFC updates since last year. It’s changed how I invest. I don’t gamble anymore-I strategize.

Also, if you’re using MetaMask, please don’t think you’re ‘free.’ You’re just not being tracked yet. When FinCEN rolls out the full travel rule, your wallet will be flagged. Not because you did anything wrong-but because you’re part of the system now.

Let’s not fear regulation. Let’s shape it. 💪✨

-Taylor

Sarah Luttrell

December 19, 2025 AT 22:26Wow. So the U.S. is finally ‘getting smart’? Took them long enough. Meanwhile, China banned it, Russia sanctions it, and Europe can’t even agree on how many decimal places to require for KYC.

But hey-Singapore? Of course. That tiny island nation with no natural resources but the world’s most boring, rule-following bankers? Yeah, they’re the crypto kings now. Because nothing says innovation like a 37-page compliance checklist.

And don’t even get me started on the FATF travel rule. You want me to ID myself every time I send crypto? So what’s next? Do I need to wear a badge when I use my wallet?

Meanwhile, I’m just over here holding my BTC like a true American patriot. While Europe debates, Asia bureaucratizes, and India runs P2P on WhatsApp… I’m sitting back, sipping my organic oat milk latte, and watching the whole circus.

At least we’re not China. 😌🇺🇸

-Sarah