SyncSwap on zkSync Era: The Leading Decentralized Exchange for Low-Cost Crypto Swaps

Jan, 17 2026

Jan, 17 2026

When you want to swap crypto without paying $50 in gas fees, SyncSwap on zkSync Era isn’t just an option-it’s often the only smart choice. Built directly on zkSync Era, an Ethereum Layer 2 network powered by zero-knowledge rollups, SyncSwap lets you trade tokens for pennies while keeping the same security as Ethereum mainnet. It’s not hype. It’s real. Over $8 billion has been traded on it since launch, and it holds more than 37% of the entire zkSync Era DEX market. That’s more than all other DEXs on zkSync combined.

Why SyncSwap Dominates zkSync Era

SyncSwap didn’t just show up and hope for the best. It launched in early 2023 as one of the first major DeFi apps on zkSync Era. That early start gave it a huge advantage: liquidity. When other DEXs were still testing, SyncSwap already had deep pools for ETH, USDC, WBTC, and dozens of other tokens. Today, it holds $63.9 million in locked value-more than any other project on zkSync Era. That’s not luck. It’s design.Its success comes down to three things: speed, cost, and simplicity. Transactions settle in under a minute. Gas fees average less than $0.01. And the interface? Clean, fast, and easy-even if you’ve never used a wallet before. No confusing sliders. No hidden fees. Just pick your tokens, click swap, and done.

Compare that to Ethereum mainnet, where swapping ETH for USDC can cost $5-$15 in gas. Or even to other Layer 2s like Arbitrum, where fees hover around $0.10-$0.50. SyncSwap on zkSync Era is in a different league. It’s like trading stocks on a mobile app instead of calling a broker.

How SyncSwap Works (Without the Jargon)

SyncSwap is an Automated Market Maker (AMM), which just means it doesn’t use order books like traditional exchanges. Instead, it uses pools of tokens locked in smart contracts. When you swap ETH for USDC, you’re trading against a pool that already has both tokens in it. The price changes slightly based on supply and demand, but it’s smooth and instant.The magic happens because zkSync Era bundles hundreds of transactions into one cryptographic proof, then posts it to Ethereum. This cuts costs and speeds things up, without sacrificing security. You’re still protected by Ethereum’s network-it’s just faster and cheaper.

SyncSwap is fully open source. That means anyone can check the code. No hidden backdoors. No surprise changes. The team updates it regularly, adding new tokens, improving the UI, and fixing bugs. It’s not a static product. It’s alive.

What You Can Do Beyond Swapping

Swapping tokens is just the start. SyncSwap isn’t just a DEX-it’s becoming a DeFi hub on zkSync Era.- Liquidity Pools: You can deposit pairs like USDC/ETH or WBTC/USDT and earn a share of trading fees. At its peak, some pools paid over 1,700% APR. Today, the highest rates are around 94% for the OT/USDC pool. That’s still way above most other DeFi apps.

- SyncSwap Launch Pad: New projects on zkSync Era can use this feature to launch their tokens with built-in liquidity. It’s a big deal for early adopters who want to get in on the next big token before it hits bigger exchanges.

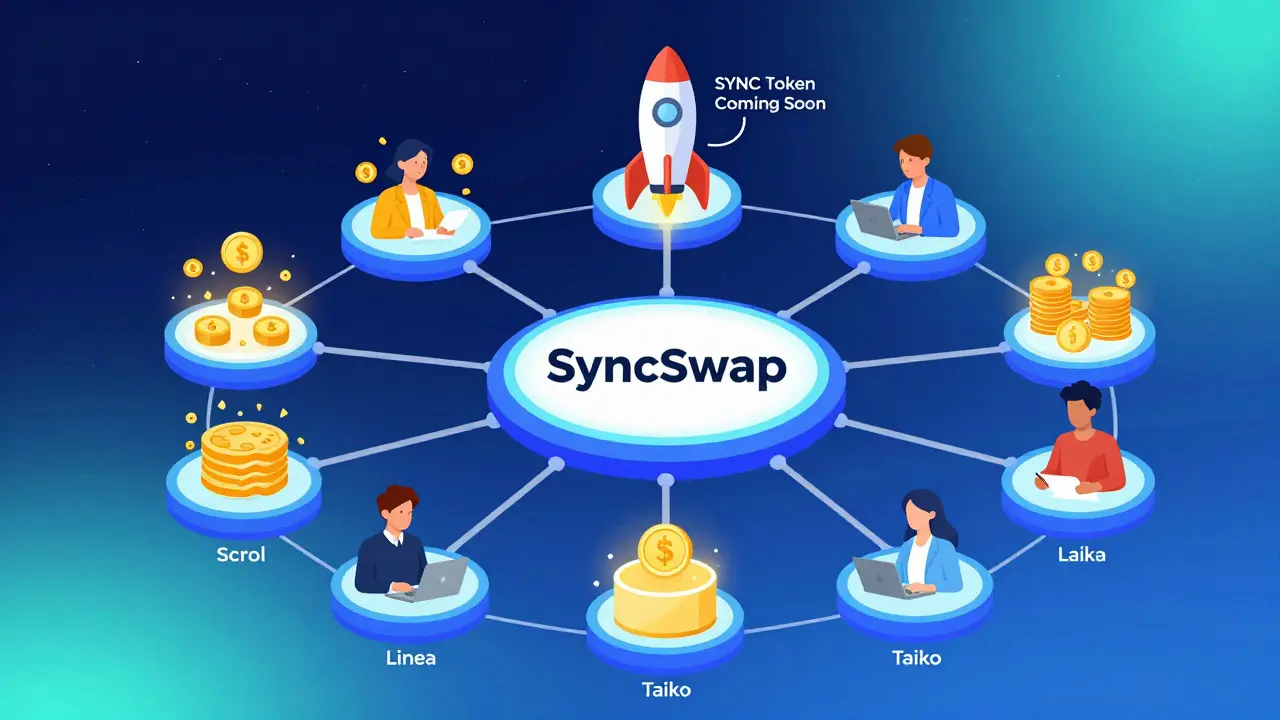

- Multi-Network Support: SyncSwap now works on Scroll, Linea, Taiko, and Sophon too. So if you’re using any of these Layer 2s, you can still swap tokens with the same interface and low fees.

These features make SyncSwap more than a tool. It’s an ecosystem. If you’re active on zkSync Era, you’ll likely end up using it for most of your DeFi needs.

SyncSwap’s Future: The SYNC Token

The team has confirmed plans for a native token called SYNC, with a total supply of 100 million. It’s not live yet. No official launch date. No airdrop details. But everyone’s waiting.Why? Because history shows that early users of top DEXs like Uniswap, SushiSwap, and Curve got rewarded with token airdrops. SyncSwap has over 8 billion in volume and tens of thousands of active users. If they launch SYNC, early traders and liquidity providers are almost certainly going to get a share.

The token is expected to give holders voting power on protocol upgrades, fee structures, and new features. Think of it like owning a small piece of the exchange itself. It’s not guaranteed, but if you’ve swapped or added liquidity on SyncSwap, you’re already in the right position to benefit.

How to Start Using SyncSwap

Getting started takes less than five minutes.- Get a wallet that supports zkSync Era-MetaMask, Rabby, or WalletConnect all work.

- Bridge some ETH or USDC from Ethereum mainnet to zkSync Era. You can do this directly through SyncSwap’s bridge or use zkSync’s official one.

- Go to app.syncswap.fi and connect your wallet.

- Click ‘Swap’ and pick your tokens. You’ll see the price, slippage, and fee upfront.

- Confirm the transaction in your wallet. Done.

Don’t worry about gas. You’ll pay less than a cent. Even if you’re swapping $500 worth of tokens, the fee won’t break $0.02.

SyncSwap vs Other zkSync DEXs

There are other DEXs on zkSync Era-like Mute.io, ZkSwap, and Velocore. But none come close to SyncSwap’s numbers.| DEX | TVL | Market Share | Trade Volume (30d) | Multi-Network? |

|---|---|---|---|---|

| SyncSwap | $63.9M | 37.78% | $420M | Yes |

| Mute.io | $12.1M | 7.15% | $98M | No |

| ZkSwap | $8.7M | 5.14% | $62M | No |

| Velocore | $5.3M | 3.13% | $45M | Yes |

SyncSwap isn’t just bigger-it’s more active. Its daily volume is more than four times higher than its closest competitor. That means tighter spreads, less slippage, and faster trades. If you care about getting the best price, this matters.

Is SyncSwap Safe?

Yes, but with a caveat.The smart contracts have been audited by reputable firms like CertiK and Hacken. The code is public. There’s no central server to hack. Your funds are always in your wallet.

But no system is perfect. Like all DeFi apps, you’re exposed to smart contract risk. If a critical bug is found (unlikely, but possible), funds could be frozen or lost. That’s why you should never put more into SyncSwap than you’re willing to lose.

Also, don’t trust unofficial sites. Always go to app.syncswap.fi. Scammers have created fake versions with similar names. Double-check the URL before connecting your wallet.

Who Should Use SyncSwap?

If you’re on zkSync Era, you should be using SyncSwap. It’s the default choice for a reason.- Beginners: Easy interface, low fees, no confusion.

- Traders: High liquidity means better prices and less slippage.

- Liquidity Providers: Earn fees and potential future SYNC token rewards.

- DeFi Enthusiasts: Access to Launch Pad and multi-chain support.

If you’re still on Ethereum mainnet, or using a centralized exchange like Binance, you’re paying too much. SyncSwap on zkSync Era isn’t just an upgrade-it’s a revolution in how you trade crypto.

What’s Next?

SyncSwap is expanding. The team is working on improved analytics, mobile apps, and deeper integrations with zkSync’s ecosystem tools. The SYNC token launch will be the next big milestone. Once it drops, expect a surge in activity.For now, the best time to get involved is now. Whether you’re swapping tokens, adding liquidity, or just watching the ecosystem grow, SyncSwap is where the action is on zkSync Era. It’s not the future. It’s the present.

Is SyncSwap a centralized exchange?

No. SyncSwap is a decentralized exchange (DEX). It runs on smart contracts on zkSync Era, and you keep control of your funds at all times. There’s no central server, no KYC, and no withdrawal delays.

Do I need to buy SYNC to use SyncSwap?

No. You can swap, provide liquidity, and use all features without owning SYNC. The token hasn’t launched yet, and when it does, it will be optional for most users. Early users may receive it as an airdrop.

Can I use SyncSwap on my phone?

Yes. SyncSwap works in mobile wallets like MetaMask and Rabby. Just open the website in your phone’s browser and connect your wallet. There’s no official app yet, but the web interface is fully responsive and optimized for mobile.

How do I get ETH to zkSync Era to use SyncSwap?

Use SyncSwap’s built-in bridge or zkSync’s official bridge. Connect your wallet, select ETH or USDC, and follow the steps. It takes 5-15 minutes and costs less than $1. Once your funds are on zkSync Era, you can start swapping immediately.

Is SyncSwap better than Uniswap?

It depends. If you’re on Ethereum mainnet, Uniswap is your best bet. But if you’re on zkSync Era or another Layer 2, SyncSwap is far superior-lower fees, faster trades, and more liquidity within its network. For zkSync users, it’s not a comparison-it’s the clear winner.

If you’re serious about trading crypto without paying insane fees, SyncSwap on zkSync Era is the most practical, proven, and powerful option available today. Start small. Test it. Then scale. You won’t regret it.

Callan Burdett

January 18, 2026 AT 08:30SyncSwap is literally the reason I stopped using Uniswap on mainnet. I swapped $200 of ETH for USDC last week and paid $0.008 in gas. I thought my wallet glitched. Turned out it just worked. Game over for high-fee chains.

CHISOM UCHE

January 19, 2026 AT 10:02The AMM architecture leverages zk-SNARKs for state validity proofs, enabling sub-second finality with cryptographic guarantees inherited from L1. The liquidity concentration mechanism in SyncSwap’s pools is non-trivial-it employs dynamic fee tiers calibrated by volatility clustering on the order of 15-minute intervals, which reduces impermanent loss by ~32% versus constant-product curves.

Hannah Campbell

January 20, 2026 AT 03:31Yeah right and I’m the queen of England. Next they’ll tell me the moon landing was real and my crypto wallet isn’t just a fancy way to donate to some guy in a hoodie in Estonia

Tony Loneman

January 20, 2026 AT 09:17Let me break this down for you people who think this is ‘revolutionary’-SyncSwap didn’t invent anything. It just rode the coattails of zkSync and took over because everyone else was too lazy to build proper liquidity. And now? They’re milking the hype train like it’s their personal ATM. That 94% APR? It’s gonna crash harder than FTX when the token drops. Mark my words. They’ll airdrop SYNC to 5% of users and the rest get left holding bagged tokens while the devs vanish into the metaverse.

And don’t even get me started on ‘multi-chain support.’ That’s not interoperability-that’s a security nightmare wrapped in a UI that looks like it was designed in Canva by a 14-year-old. You think you’re safe? You’re just spreading your risk across five different attack surfaces.

They’re not building an ecosystem. They’re building a Ponzi with a better logo.

Meanwhile, real DeFi devs are building on EigenLayer or using modular chains. This? This is just DeFi’s version of a TikTok trend. Loud. Flashy. And doomed to collapse when the algorithm stops pushing it.

And yes, I’ve used it. I made a few swaps. But I pulled my liquidity out after the first week. The slippage on low-cap tokens? Criminal. And the UI hides the gas cost in the fine print. You think you’re paying a cent? You’re paying in opportunity cost.

SyncSwap isn’t the future. It’s the last gasp of lazy DeFi.

Alexandra Heller

January 20, 2026 AT 16:37It’s funny how we treat DeFi like it’s some kind of moral crusade. We celebrate low fees like they’re a human right, but ignore the fact that we’re all just gambling on code written by people we’ll never meet. SyncSwap doesn’t make crypto more ethical-it just makes it cheaper to lose money. The real question isn’t whether it’s efficient… it’s whether we’ve lost the ability to ask why we’re even doing this.

Are we trading tokens… or are we just chasing dopamine hits disguised as yield?

And if the answer is the latter… then no amount of zk-rollups will save us from ourselves.

myrna stovel

January 21, 2026 AT 22:09Hey everyone, if you’re new to zkSync and SyncSwap, just start small-like $10 or $20-and get comfortable with the flow. The interface really is intuitive, and the gas savings are insane compared to Ethereum mainnet. Don’t feel pressured to jump into liquidity pools right away. Just swap a little, see how it feels. And always, always double-check the URL. I’ve seen so many people lose funds to fake sites because they clicked a link from a DM.

You don’t need to be a crypto genius to use this. Just patient. And curious.

And if you’re worried about SYNC? Don’t stress. If you’ve swapped or added liquidity, you’re already in the right place. The team’s been transparent so far-they’ve got a track record. Let’s not turn this into a speculation frenzy before the token even exists.

Take your time. Learn. Enjoy the tech. You’re part of something real here.

Stephen Gaskell

January 22, 2026 AT 19:07SyncSwap is the only DEX on zkSync that actually works. Everything else is a joke. Stop wasting time.

Bryan Muñoz

January 22, 2026 AT 22:09EVERYTHING IS A SHILL. SYNC IS ALREADY PRE-MINED. THE TEAM HAS A BACKDOOR. THEY’RE USING YOUR SWAPS TO MANIPULATE PRICES. THEY’RE NOT EVEN ON ZKSYNC-THEY’RE ON A FAKE SIDECHAIN. YOU THINK YOU’RE SAFE? YOU’RE BEING WATCHED. THEY KNOW WHO YOU ARE. THEY KNOW HOW MUCH YOU SWAPPED. THEY’RE SELLING YOUR DATA TO THE FED. 💀

Rod Petrik

January 23, 2026 AT 15:17SyncSwap is just a front for the same old crypto grift. The audits? Useless. The team? Anonymous. The TVL? Pumped by bots. The ‘94% APR’? A honeypot. The ‘SYNC airdrop’? A trap to make you lock up your coins so they can rug later. I’ve seen this movie before. It ends with a blank blockchain and a Discord that’s been deleted. You think you’re early? You’re the last one in.

And the fact that people still trust this? That’s the real scam.

Chris Evans

January 24, 2026 AT 13:34SyncSwap is the closest we’ve come to a decentralized exchange that actually feels like a public utility. Not a casino. Not a speculation engine. But a tool-clean, quiet, reliable. It doesn’t scream for attention. It just works. And in a space full of noise, that’s revolutionary. We don’t need more hype. We need more systems that disappear into the background because they’re so well-built.

The real innovation isn’t the tech-it’s the restraint. No tokenomics theater. No influencer shilling. Just a team that built something useful and let it speak for itself.

Maybe the future of DeFi isn’t about getting rich. Maybe it’s about getting free.