UAE Removal from FATF Greylist: How It Changed the Crypto Industry

Aug, 28 2025

Aug, 28 2025

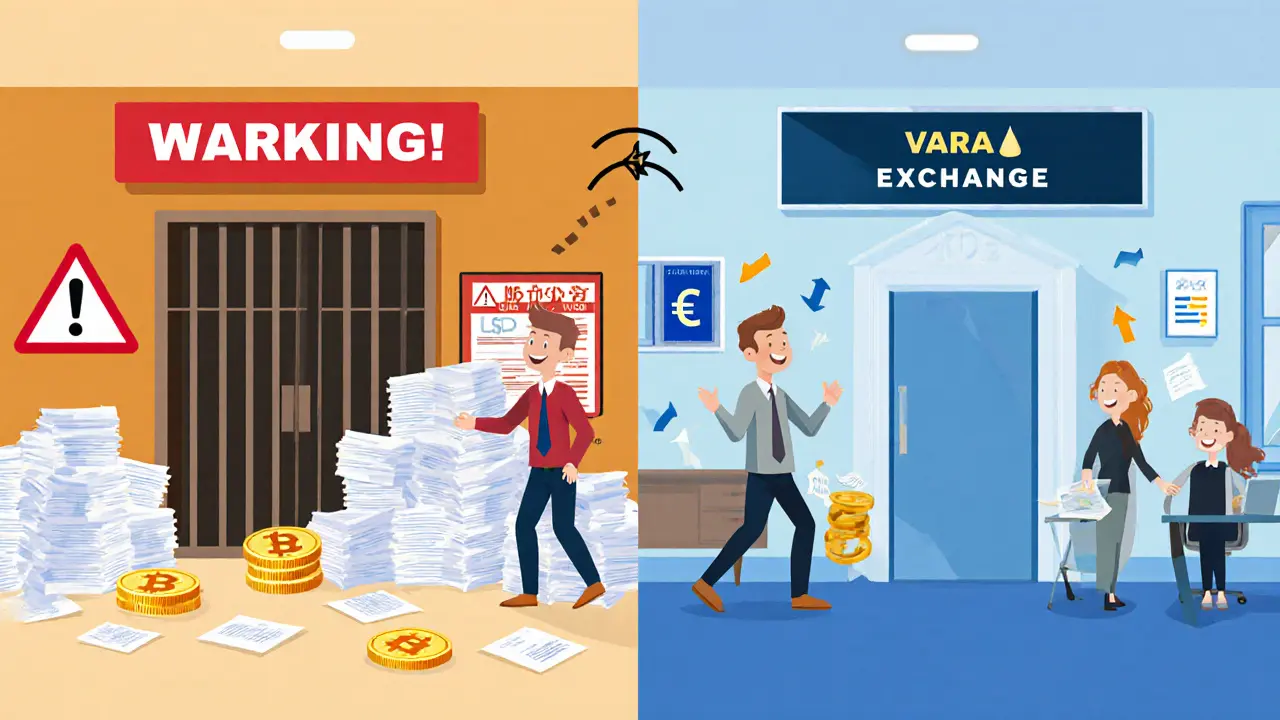

The UAE was officially removed from the FATF grey list on February 23, 2024. That’s not just a bureaucratic win - it’s a game-changer for crypto businesses operating in or near the region. For years, being on the grey list meant banks worldwide treated UAE-based companies with suspicion. Crypto exchanges, wallet providers, and token issuers struggled to open bank accounts, process fiat deposits, or even get payment processors to work with them. Now? That’s changing fast.

What the FATF Grey List Actually Meant for Crypto

The FATF grey list isn’t about banning countries. It’s a red flag. When a country is on it, international banks assume their financial system is risky. That means enhanced due diligence - more paperwork, longer delays, higher fees, or outright refusal to do business. For crypto firms in the UAE, this wasn’t theoretical. In 2022 and 2023, multiple exchanges reported being cut off from USD and EUR banking channels. Some had to relocate operations to Singapore or Switzerland just to keep functioning. The problem wasn’t that the UAE was a haven for criminals. It was that its systems didn’t meet global standards. Regulators couldn’t trace suspicious crypto flows, didn’t have enough staff to monitor digital asset firms, and lacked clear rules tying crypto businesses to AML laws. FATF flagged these gaps in 2022. The UAE didn’t ignore them. They fixed them - and fast.What the UAE Did to Get Off the List

The UAE didn’t just tweak a few policies. They rebuilt their financial crime defense from the ground up. Here’s what changed:- They created a specialist financial crimes court - the first of its kind in the region - to handle crypto-related money laundering cases.

- They gave the Financial Intelligence Unit (FIU) more power, staff, and tech tools to track crypto transactions across exchanges and VASPs (Virtual Asset Service Providers).

- All crypto businesses now must register with the UAE’s Virtual Assets Regulatory Authority (VARA) or the Securities and Commodities Authority (SCA), depending on their license type.

- They introduced real-time transaction monitoring for digital assets, requiring exchanges to report any transfer over $1,000 to the FIU.

- They started penalizing non-compliant firms - suspending licenses, imposing fines up to AED 5 million, and even prosecuting individuals.

How Crypto Businesses Are Benefiting Right Now

Since the removal, crypto companies in the UAE are seeing real changes:- Banking access returned: Major international banks like HSBC, Standard Chartered, and Emirates NBD have reopened accounts for licensed crypto firms. Some are even offering dedicated crypto banking services.

- Payment processors are back: Stripe, Wise, and Payoneer now process crypto-related payments for UAE-based businesses - something nearly impossible in 2023.

- Investors are returning: Venture capital firms that paused UAE investments in 2022 are now actively pitching crypto startups there. In Q1 2025, UAE-based crypto startups raised $310 million - up 140% from 2023.

- Partnerships are booming: Binance, Kraken, and Coinbase have expanded their UAE teams. Even traditional banks like First Abu Dhabi Bank now offer crypto custody services.

What’s Still Missing? Crypto-Specific Rules

Here’s the catch: the UAE’s reforms were broad. They improved AML/CFT systems for all financial firms - banks, gold traders, law firms, and crypto exchanges alike. But there’s still no dedicated law that defines how crypto should be taxed, how DeFi protocols are regulated, or what counts as a “virtual asset” under criminal law. VARA’s rules are strong, but they’re still evolving. For example:- There’s no clear guidance on whether NFT marketplaces need to collect KYC for every buyer.

- Stablecoin issuers aren’t required to prove full reserve backing by law - only by license conditions.

- DAOs (decentralized autonomous organizations) still operate in a legal gray zone.

The Ripple Effect: Global Trust

The UAE’s removal didn’t just please FATF. It convinced the European Union too. In June 2025, the EU dropped the UAE from its own high-risk list - after holding it there for over a year despite FATF’s decision. That’s huge. It means:- EU banks can now freely transact with UAE crypto firms without extra checks.

- UAE-based crypto firms can now apply for licenses in EU countries like Germany and France with much higher approval odds.

- Token issuers can list on EU exchanges without fearing regulatory backlash.

What’s Next? The Real Test Begins

The FATF doesn’t stop monitoring after removal. In fact, they’re coming back. The UAE’s next full evaluation - the fifth round - starts in 2026. That means:- Every crypto firm must keep detailed records for at least five years.

- Regulators will audit compliance logs, transaction reports, and staff training records.

- Any new crypto scam or money laundering case could trigger a re-listing.

Why This Matters for Crypto Investors and Users

If you’re a crypto investor, the UAE’s removal means:- More stable, regulated exchanges to choose from.

- Lower risk of platform collapses due to sudden bank freezes.

- Faster withdrawals and deposits in fiat currencies.

- Greater legal protection if something goes wrong.

What Other Countries Can Learn

The UAE’s story shows that grey listing isn’t a death sentence - it’s a wake-up call. Countries like Nigeria, Kenya, and Indonesia are still struggling with FATF compliance. The UAE proves you don’t need perfect laws. You need:- Political will to punish bad actors.

- Real resources for regulators - not just paper rules.

- Transparency - publish your enforcement stats.

- Cooperation with global standards, not resistance to them.

Did the UAE’s removal from the FATF grey list make crypto trading easier?

Yes. Since February 2024, licensed crypto firms in the UAE have regained access to international banking, payment processors, and investor capital. Onboarding times for customers dropped from weeks to hours. Withdrawals in USD and EUR are now processed reliably, something that was nearly impossible in 2023.

Are all crypto businesses in the UAE now safe to use?

No. Only firms licensed by VARA or SCA are regulated. Unlicensed platforms still exist and are illegal. Always check the official VARA registry before using any exchange or wallet service. The FATF removal doesn’t protect you from scams - it just makes regulated platforms more trustworthy.

Can I now open a crypto account in the UAE as a foreigner?

Yes, but only through licensed providers. Most major exchanges now allow international users to open accounts, but they require full KYC - passport, proof of address, and source of funds documentation. The process is stricter than before, but also more reliable. You won’t get a quick, anonymous account - but you’ll get a secure one.

Is crypto taxed in the UAE?

Currently, there is no federal capital gains tax on cryptocurrency in the UAE. However, businesses must pay corporate tax if they earn over AED 375,000 annually. Individuals are not taxed on personal crypto gains, but if you’re running a trading business, you may need to register and pay corporate tax. Always consult a tax advisor - rules could change as the UAE aligns with global standards.

Will the UAE get put back on the FATF grey list?

It’s possible - but unlikely if current trends continue. The FATF will conduct a full review in 2026. The UAE has committed to ongoing reforms, including mandatory staff training, real-time transaction reporting, and public enforcement disclosures. As long as they keep enforcing rules and don’t relax oversight, they’ll stay off the list.

sky 168

November 20, 2025 AT 15:01The UAE didn't just clean up its act they rebuilt it from the ground up. No more hand waving. No more excuses. Real enforcement. Real tracking. Real consequences. That's what crypto needs not just in the UAE but everywhere.

Devon Bishop

November 21, 2025 AT 20:45im still shocked how fast banks came back. i had a friend whos exchange got cut off in 2023 and they moved to switzerland. now theyre back in dubai with a whole new team. the difference is night and day. stripe and wise are live again. no more 3 week waits for wire confirmations. its insane how much this changed overnight.

sammy su

November 22, 2025 AT 22:24just a heads up dont trust unlicensed platforms even after this. i saw a guy lose 40k last month to some fake exchange that looked legit. varas registry is your best friend. check it every time. its not hard. takes 2 mins. save yourself the pain.

Khalil Nooh

November 22, 2025 AT 22:52This is the blueprint. This is how you turn a regulatory nightmare into a global hub. The UAE didn't beg for approval. They didn't lobby. They didn't wait. They rolled up their sleeves and fixed what was broken. They invested in people. They hired experts. They built courts. They published data. And now? The world is knocking. Other countries need to stop making excuses and start making moves. This isn't about crypto. This is about governance. This is about trust. And the UAE just won.

Lynn S

November 23, 2025 AT 10:12Let's be honest. The UAE was never a criminal haven. They were just sloppy. And now, after spending billions and rewriting entire legal frameworks, they're being praised like saints. Meanwhile, countries with actual crypto bans are being ignored. The hypocrisy is staggering. This isn't about compliance. It's about geopolitical alignment. FATF doesn't care about rules. They care about who's on their side.

Jack Richter

November 24, 2025 AT 17:41so... can i still use binance? or do i need to go through varas site first? just wanna know if i need to do paperwork or if its still chill.