Use Cases for Wrapped Tokens in DeFi: How Bitcoin and Other Assets Power Cross-Chain Finance

Jan, 14 2026

Jan, 14 2026

Imagine holding Bitcoin but wanting to earn interest on it-without selling it. Or using your Chainlink tokens to lend on a platform that only accepts ERC-20s. That’s where wrapped tokens come in. They’re not magic. They’re not speculation. They’re a practical fix for one of blockchain’s biggest problems: isolation.

Bitcoin sits on its own chain. Ethereum runs its own show. Solana, Polygon, Avalanche-each has its own rules, its own users, its own liquidity. Without wrapped tokens, your Bitcoin is stuck. You can’t lend it on Aave. You can’t swap it on Uniswap. You can’t farm yields on Curve. You’re locked out. Wrapped tokens break those walls.

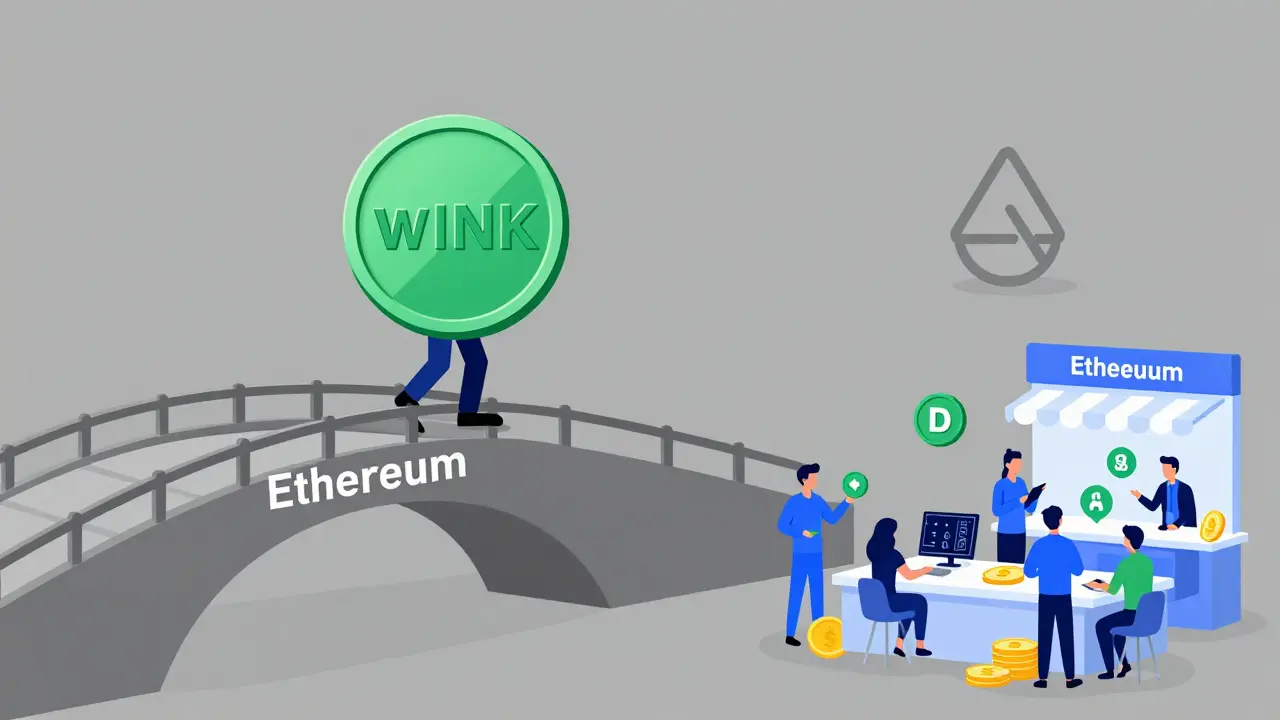

How Wrapped Tokens Work (No Jargon)

Here’s the simple version: you send 1 BTC to a trusted vault. In return, you get 1 WBTC-an ERC-20 token on Ethereum that’s backed 1:1 by your Bitcoin. That WBTC acts like any other token on Ethereum. You can send it, trade it, stake it. When you want your Bitcoin back, you send the WBTC to the same system. It burns the WBTC and releases your original BTC.

The whole thing runs on smart contracts. Custodians-usually well-known entities like BitGo or Kyber Network-hold the real Bitcoin. DAOs sometimes oversee the process to keep things transparent. No one can create extra WBTC without locking real BTC. No one can steal your BTC unless they break the vault, and even then, the system is designed to detect and reverse it.

This isn’t just for Bitcoin. Wrapped versions exist for Litecoin (wLTC), Chainlink (wLINK), Filecoin (wFIL), Tezos (wXTZ), and even Stellar (wXLM). The pattern is the same: lock the original, mint the wrapped, unlock when you’re done.

Use Case 1: Let Bitcoin Join Ethereum’s DeFi Party

WBTC is the OG wrapped token. It launched in 2019 and now represents over 200,000 BTC-worth more than $12 billion as of early 2026. That’s more than half of all Bitcoin locked in DeFi.

Before WBTC, Bitcoin holders had two choices: sell BTC for ETH and risk price swings, or sit idle. With WBTC, you keep your Bitcoin, but now you can:

- Lend it on Aave and earn 3-5% APY

- Borrow USDC against it without selling

- Provide liquidity on Uniswap or Curve and earn trading fees

- Stake it in yield protocols like Yearn Finance

It’s not just about earning more. It’s about flexibility. You’re no longer forced to choose between holding Bitcoin and participating in DeFi. WBTC lets you do both.

Use Case 2: Unlock Liquidity for Small-Chain Assets

Not all tokens are built for mass adoption. Take Filecoin (FIL). It’s a storage network. Great tech. But its native chain doesn’t have the same DeFi infrastructure as Ethereum. Most users don’t know how to use FIL outside its own ecosystem.

Enter wFIL. Now, FIL holders can move their tokens to Ethereum, Polygon, or Arbitrum and plug them into familiar DeFi tools. They can swap wFIL for stablecoins, lend it, or add it to liquidity pools. Suddenly, a token with limited trading volume gains access to billions in daily trading activity.

The same goes for wLINK. Chainlink’s oracle service is vital for DeFi, but its native chain doesn’t support lending protocols. With wLINK, users can use their LINK holdings as collateral on Compound or earn rewards on SushiSwap-all while still benefiting from Chainlink’s real-world data feeds.

This isn’t just convenience. It’s survival. Tokens that can’t integrate with major DeFi ecosystems risk fading into obscurity. Wrapped tokens give them a lifeline.

Use Case 3: Reduce Fees and Speed Up Transactions

Ethereum’s gas fees can hit $50 during peak times. That’s not practical for small trades or micro-lending. But what if you could use your Bitcoin as collateral-on a cheaper chain?

That’s where wrapped tokens shine. You can wrap your BTC into WBTC, then bridge it to Polygon or Arbitrum. Now you’re using WBTC on a network where gas fees are under $0.01. You get all the DeFi benefits without the Ethereum cost.

Same with Tezos. XTZ holders can wrap their tokens into wXTZ and use them on Avalanche or Binance Smart Chain. Suddenly, they’re not stuck paying high fees on a slow network. They can move fast, cheap, and still keep their asset exposure.

This is capital efficiency in action. You’re not moving your assets-you’re moving their representation. The real value stays safe. The wrapped version does the heavy lifting.

Use Case 4: Boost Liquidity for Low-Volume Tokens

Stellar’s XLM has a loyal following but low trading volume on most DEXs. That means thin order books, big slippage, and few users. No one wants to trade a token that moves $100,000 a day.

But wrap it into wXLM and list it on Uniswap or PancakeSwap? Now it’s trading alongside ETH, USDC, and WBTC. Liquidity pools grow. Traders notice. Volume spikes. The original XLM network benefits too-more demand for the base asset means more activity, more adoption, more value.

This isn’t theoretical. Data from DeFiLlama shows that wrapped versions of low-volume tokens often see 3-10x more trading volume than their native counterparts. That’s not just liquidity. That’s market validation.

Use Case 5: Bridging Real-World Assets to DeFi

Wrapped tokens aren’t just for crypto. They’re being used to bring real assets on-chain. Think gold, real estate, or even government bonds.

Companies like Tokeny and Centrifuge are issuing wrapped tokens backed by physical assets. A $10,000 gold bar? Wrapped into a token. Now it can be traded, fractionalized, and used as collateral in DeFi protocols. A rental property in Texas? Wrapped into a token. Now you can lend against it on Aave.

It’s not perfect yet. Regulatory hurdles remain. But the mechanism is the same: lock the asset, mint the token, trade it. The future of finance isn’t just crypto-it’s everything.

Security: Who’s Holding Your Assets?

Wrapped tokens aren’t risk-free. The biggest risk isn’t the smart contract-it’s the custodian.

If the company holding your Bitcoin gets hacked, or goes rogue, your WBTC could become worthless. That’s why the most trusted wrapped tokens use multi-sig wallets, regular audits, and public reserve proofs. WBTC, for example, publishes daily on-chain attestations showing that every WBTC has a matching BTC in reserve.

Always check: Is the custodian reputable? Is the minting process transparent? Is there a redemption mechanism that works reliably? If the answer is no, skip it. Wrapped tokens are useful-but only if you trust the middleman.

What’s Next for Wrapped Tokens?

They’re not going away. As more chains emerge, and more users want cross-chain access, wrapped tokens will keep growing. We’re already seeing wrapped NFTs, wrapped stablecoins, and even wrapped fiat currencies.

The next wave? Automated wrapping. Imagine a wallet that automatically wraps your BTC into WBTC when you open a lending position, and unwraps it when you close. No manual steps. No bridges to manage. Just seamless, invisible integration.

Wrapped tokens are the plumbing of DeFi. You don’t notice them-until they’re missing. And once you’ve used them, you won’t go back to being stuck on one chain.

What’s the difference between wrapped tokens and native tokens?

Native tokens run on their own blockchain-like Bitcoin on Bitcoin’s chain or ETH on Ethereum. Wrapped tokens are copies of those assets, created on a different blockchain. WBTC is a wrapped version of Bitcoin that runs on Ethereum. It’s not Bitcoin-it’s a token that represents Bitcoin. You can trade it like ETH, but its value is tied to Bitcoin’s price.

Are wrapped tokens safe?

They’re as safe as the custodian holding the real asset. WBTC, for example, uses BitGo-a trusted institution with multi-sig wallets and daily audits. But if you use a wrapped token from an unknown team with no transparency, you’re taking a big risk. Always check who’s backing it and whether they publish reserve proofs.

Can I unwrap my tokens anytime?

Yes, if the system is well-designed. Most major wrapped tokens like WBTC, wLINK, and wFIL allow you to burn the wrapped version and get your original asset back. The process usually takes minutes to hours, depending on the network. Always test with a small amount first.

Do wrapped tokens cost money to use?

Yes. There’s usually a small fee to wrap or unwrap-often around 0.1% to 0.5%. Plus, you’ll pay gas fees when you move the wrapped token on its new chain. But these costs are often far lower than selling your asset and buying a new one.

Why not just use bridges instead of wrapped tokens?

Bridges move assets directly between chains. Wrapped tokens create a representation. The key difference? Wrapped tokens are usually more secure and easier to integrate into DeFi apps. Bridges have been hacked for billions in losses. Wrapped tokens rely on custodians, which are easier to audit and regulate. For everyday DeFi use, wrapped tokens are simpler and more reliable.

Bill Sloan

January 14, 2026 AT 21:50Chidimma Okafor

January 15, 2026 AT 20:34ASHISH SINGH

January 16, 2026 AT 05:54Callan Burdett

January 17, 2026 AT 04:42Alexis Dummar

January 18, 2026 AT 02:41Lauren Bontje

January 18, 2026 AT 22:10Deb Svanefelt

January 19, 2026 AT 21:57Haley Hebert

January 20, 2026 AT 18:11Jill McCollum

January 22, 2026 AT 02:15Kelly Post

January 22, 2026 AT 12:07