VAEX Crypto Exchange Review: Why This Platform Disappeared from the Market

Oct, 17 2025

Oct, 17 2025

Crypto Exchange Verification Tool

Verify Exchange Legitimacy

Check if a crypto exchange is legitimate using the criteria discussed in the VAEX review article. This tool helps you identify potential "ghost exchanges" before depositing funds.

Enter an exchange name to verify its legitimacy.

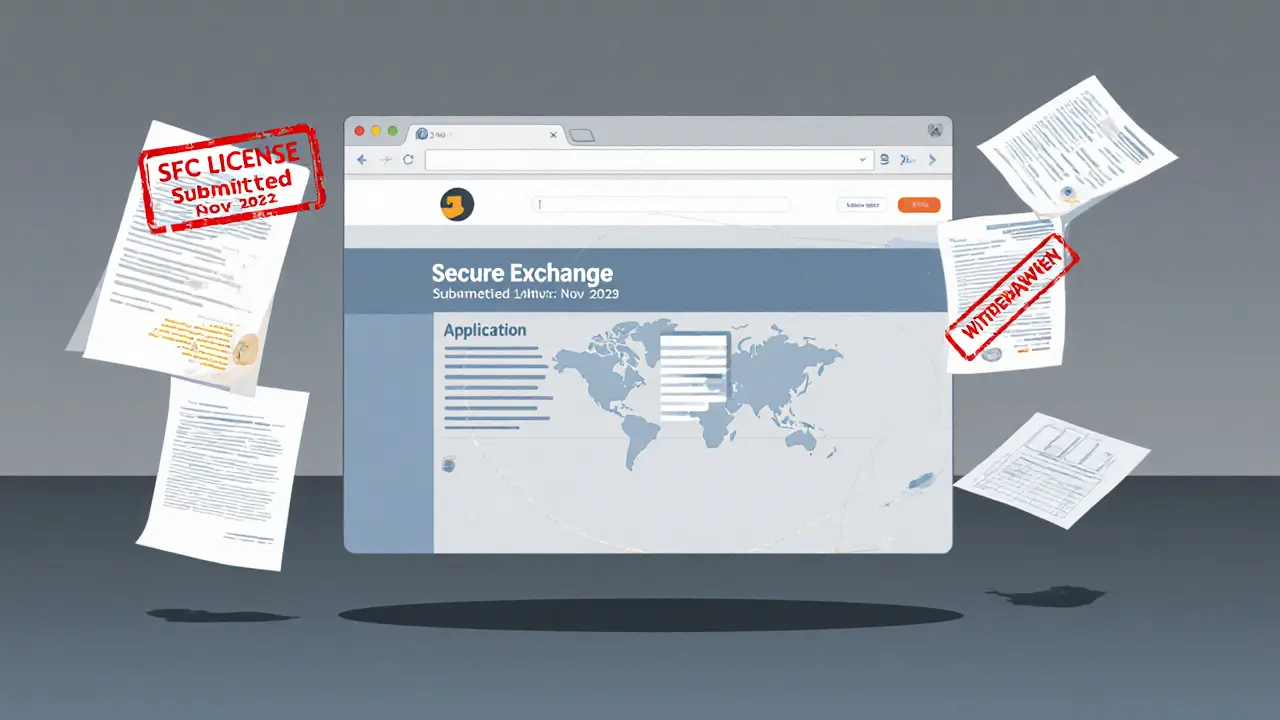

VAEX crypto exchange never became a real player in the crypto market. It didn’t fail quietly. It didn’t fade out slowly. It tried to enter Hong Kong’s regulated crypto space, submitted a license application in November 2023, and then vanished without warning in May 2024 - just days before the deadline that forced all unlicensed exchanges to shut down.

What Happened to VAEX?

VAEX, operated by Hong Kong-based VAEXC Limited, applied for a virtual asset trading platform license from the Hong Kong Securities and Futures Commission (SFC) in November 2023. At the time, over 30 exchanges were racing to get approved under Hong Kong’s new rules. The deadline was February 29, 2024, to apply. By May 31, 2024, any platform still operating without a license had to stop serving users.

VAEX didn’t make it past May 25, 2024. On that day, Fintech News Hong Kong confirmed VAEX had withdrawn its license application. No explanation was given. No press release. No customer notice. Just silence.

It wasn’t alone. Gate.HK and ByBit also pulled out around the same time. But unlike those platforms - which still operate in other regions - VAEX disappeared completely. No updates. No social media activity. No customer support. No trading volume.

Why Did VAEX Withdraw?

We don’t know for sure. But the clues point to one thing: they couldn’t meet Hong Kong’s standards.

The SFC didn’t just ask for paperwork. They demanded real security: cold storage with insurance, strict KYC/AML checks, proof of reserves, cybersecurity audits, and enough capital to cover potential losses. Exchanges like OSL Group met those requirements and got licensed. Others couldn’t.

VAEX likely faced one of three problems:

- They didn’t have enough money to cover the required capital reserves.

- Their security infrastructure wasn’t up to par - no independent audit, no proven cold wallet system.

- They were a shell company with no real team or infrastructure behind the name.

There’s no evidence VAEX ever traded real volume. CoinMarketCap lists it as an “Untracked Listing,” meaning their reported trading numbers didn’t meet minimum transparency thresholds. That’s not a glitch - it’s a red flag. If you can’t prove you’re trading anything, regulators won’t let you operate.

No Trading, No Users, No Trust

Check any major crypto platform today - Binance, Coinbase, Kraken, WEEX - and you’ll find hundreds of thousands of user reviews, Reddit threads, YouTube tutorials, and detailed fee breakdowns.

VAEX? Nothing.

No Trustpilot reviews. No Reddit discussions. No YouTube videos explaining how to deposit. No forum posts asking about withdrawal times. No customer service emails archived online. Not a single public user experience exists.

That’s not normal. Even new, small exchanges get talked about. If someone tried to use VAEX, they would’ve left a trace. But there’s nothing. That tells you everything: nobody used it. Or if they did, they didn’t survive long enough to complain.

What About the Website?

Go to VAEX’s website now. It loads. But it’s empty. No trading interface. No wallet login. No asset list. No fee schedule. No support contact. Just a homepage with a logo and a few generic phrases like “Secure Trading” and “Global Access.”

Compare that to WEEX, which lists over 500 trading pairs, shows real-time volume data, and has a mobile app with 10,000+ downloads. VAEX has none of that. It’s a digital ghost town.

Even the name gets confused. Slashdot once listed “Vaex” in a comparison with “Devron” - but they were talking about a Python data library, not a crypto exchange. That’s how little recognition VAEX has in the tech world.

Where Does VAEX Stand in 2025?

As of November 2025, VAEX is inactive. No one is trading on it. No one is depositing. No one is withdrawing. It’s not banned. It’s not suspended. It’s simply gone.

VanEck’s Crypto Monthly Recaps - which track every major exchange’s performance, volume, and regulatory status - don’t mention VAEX once in their June or August 2025 reports. CoinGecko doesn’t rank it. MarketWatch doesn’t list it. Even crypto news sites that cover failed exchanges didn’t bother writing about VAEX after its withdrawal.

It’s not a risky exchange. It’s not a hidden gem. It’s not even a cautionary tale - because no one ever got hurt by it. There were no users to lose money. No assets to freeze. No lawsuits. Just a name that briefly appeared on a government application list and then disappeared.

What You Should Learn From VAEX

VAEX isn’t a warning about regulation. It’s a warning about fake platforms.

Too many new crypto projects look professional on the surface - clean websites, fancy logos, vague promises of “high yields” or “exclusive access.” But if you can’t find:

- Real trading volume on CoinMarketCap or CoinGecko

- Independent security audits

- Any user reviews or community chatter

- Clear regulatory status

Then you’re dealing with a ghost.

VAEX didn’t get hacked. It didn’t get shut down by regulators. It never had anything to begin with. It was a placeholder - a name on a form - built to look like a real exchange, hoping someone would deposit funds before the whole thing collapsed.

Don’t make the same mistake. If you can’t verify a platform’s activity, don’t use it. Even if it says “licensed” or “secure,” if there’s no proof - walk away.

Alternatives That Actually Work

If you’re looking for a reliable exchange, don’t waste time on ghosts. Here are a few that have proven track records:

- Coinbase - Regulated in the U.S., insured custodial wallets, clear fee structure, trusted by millions.

- Kraken - Strong security, low fees, supports over 200 assets, transparent about compliance.

- WEEX - Popular in Asia, offers copy trading, mobile app with real user feedback, active volume.

- Bybit - Despite withdrawing from Hong Kong, still operates globally with strong liquidity and derivatives trading.

All of these have public user reviews, verified trading volumes, and clear regulatory filings. VAEX has none of that.

Final Verdict

VAEX crypto exchange doesn’t exist as a functioning platform. It was an application that never became a service. It’s not a scam in the traditional sense - there’s no evidence it stole money. But it also never offered anything real to begin with.

If you’re thinking of using VAEX, don’t. It’s not risky. It’s not operational. It’s just gone.

The crypto market is full of noise. VAEX was just another echo - loud enough to get noticed on a government form, but too quiet to ever matter to real users.

Rob Sutherland

November 21, 2025 AT 07:28It’s wild how some platforms just vanish like they were never real. No drama, no fanfare - just a blank webpage and a silence that screams louder than any exit notice. VAEX wasn’t even a failed experiment; it was a placeholder pretending to be a business. The fact that it applied for a license but never bothered to build anything? That’s not incompetence. That’s intention.

It’s like someone printed a restaurant menu, hung a sign outside, and then never bought ingredients. People still showed up, hoping for food. They never got any. And now we’re left wondering who was behind the curtain - and why they thought anyone would believe it was real.

The real tragedy? There are probably dozens of these ghosts floating around right now, waiting for the next regulatory deadline to disappear quietly. We need better tools to spot them before they even get to the application stage.

Tim Lynch

November 22, 2025 AT 22:56There’s a certain poetry to an exchange that never traded a single coin. VAEX didn’t collapse - it was never born. It existed only as a legal fiction, a name on a form, a hollow echo in the regulatory machine. The SFC didn’t shut it down. It just looked at the application, saw the emptiness behind it, and moved on.

It’s the ultimate crypto paradox: you need to prove you’re real to be allowed to exist… but if you’re real, you don’t need to fake it to get licensed. VAEX was the ghost haunting its own paperwork. No users. No volume. No audits. Just a logo and a dream that never left the drawing board.

It’s not a cautionary tale. It’s a monument to the absurdity of trying to regulate vapor.

Melina Lane

November 23, 2025 AT 07:24Y’all ever just feel like crypto’s become this giant game of musical chairs where no one actually brought a chair? VAEX didn’t steal anything - it just showed up without a seat and then walked away when the music stopped. I’m glad someone documented this. So many newbies think ‘licensed’ means ‘safe,’ but if there’s zero trace of real people using it, you’re not investing - you’re playing Russian roulette with a blank gun.

And honestly? I’m just mad that someone spent time designing a logo and website for nothing. That’s the real waste here. Not the money - the effort. Someone believed in this. And that’s sadder than any scam.

andrew casey

November 23, 2025 AT 19:11One must observe, with the precision befitting a scholar of financial architecture, that VAEX represents not merely a failure of compliance, but a categorical collapse in epistemological legitimacy. The absence of verifiable trading volume, coupled with the complete dearth of user-generated discourse, constitutes an ontological void - a non-entity masquerading as a market participant.

That the SFC permitted such a submission to proceed to the application stage is, in itself, a systemic indictment. One cannot regulate what does not exist. And yet, VAEX existed - as a semantic construct, a syntactic placeholder, a linguistic artifact devoid of material substance. To label it a ‘scam’ is to grant it too much dignity. It was not fraudulent. It was irrelevant.

The true scandal lies not in its disappearance, but in the fact that anyone ever considered it worthy of consideration.

Lani Manalansan

November 24, 2025 AT 00:49I’ve seen this pattern in other emerging markets - places where the allure of ‘crypto’ gets used to create the illusion of innovation without any real infrastructure. VAEX felt like a digital version of those pop-up shops in tourist areas: flashy sign, no inventory, gone by sunset.

It’s interesting how culture shapes trust. In places like Japan or Germany, you’d never see a platform like this even try to apply. There’s too much cultural weight behind institutional credibility. But in the crypto wild west, you can build a whole brand on a domain name and a pitch deck.

Still, I’m glad the post listed real alternatives. It’s easy to get lost in the hype, but the ones that last? They’re the ones with history, not just logos.

James Edwin

November 25, 2025 AT 09:09