Validator Rewards and Economics: How Proof-of-Stake Networks Pay Validators

May, 27 2025

May, 27 2025

Validator Reward Calculator

Estimate Your Validator Rewards

Calculate your estimated annual percentage yield (APY) based on network type, staked amount, and validator commission.

How Validators Earn Rewards in Proof-of-Stake Blockchains

When you hear about people earning crypto just by holding it, you might think it’s magic. But it’s not. It’s called staking, and the people who actually keep the network running are called validators. These aren’t random users-they’re operators running specialized hardware, keeping their nodes online 24/7, and making sure transactions are processed correctly. In return, they get paid. Not in dollars, but in the native cryptocurrency of the network they’re securing.

Unlike Bitcoin’s energy-hungry mining system, where miners race to solve complex math puzzles, proof-of-stake (PoS) blockchains like Ethereum, Solana, and Cosmos select validators based on how much crypto they’ve locked up-called their stake. The more you stake, the higher your chance of being chosen to propose or verify the next block. But it’s not just about luck. Validators earn rewards for doing their job right-and lose money if they mess up.

The Two Types of Validator Rewards

Validator income doesn’t come from one place. It’s split into two layers: consensus rewards and execution rewards.

Consensus rewards are new tokens created by the network itself. Think of them like inflation-but intentional inflation designed to pay people for securing the chain. On Ethereum, for example, these rewards come from the protocol’s token issuance rate. They’re calculated based on how much total crypto is staked and how well each validator performs. If you’re online, attesting to blocks correctly, and not going offline too often, you earn these.

Execution rewards are different. These are transaction fees paid by users who send crypto or interact with smart contracts. When a validator proposes a block, they get to keep all the fees from the transactions inside it. This includes something called Maximal Extractable Value (MEV)-extra profit validators can make by reordering or including special transactions in a way that benefits them. On Ethereum, these fees go directly to the validator’s designated fee recipient address. On Solana, it’s similar: high transaction volume means more fees, which means more income.

So your total reward isn’t just one number. It’s consensus rewards (predictable, based on network rules) + execution rewards (variable, based on network usage). Some months, fees spike because of NFT drops or DeFi activity. Other months, you’re mostly living off the base inflation rewards.

How Commission Structures Work

Not everyone can run a validator. You need technical skills, reliable servers, good internet, and at least 32 ETH to run one on Ethereum. That’s over $100,000 at current prices. Most people don’t have that kind of capital-or the patience to debug a node crash at 3 a.m.

That’s where delegators and staking pools come in. Regular users can delegate their crypto to a validator who runs the node for them. In return, the validator takes a cut-called a commission. Most charge between 5% and 15%. Some go as low as 0% to attract more stake, while others charge 20% if they offer extra services like insurance, analytics dashboards, or automated recovery.

Let’s say a validator has 10,000 ATOM staked from others, plus 1,000 ATOM of their own. The network rewards the whole pool with 1,000 ATOM this month. The validator charges a 10% commission. So they take 100 ATOM. The remaining 900 ATOM gets split among all delegators based on how much they staked. The validator also earns their share from their own 1,000 ATOM stake-minus the commission. So they end up with 100 ATOM (commission) + 90 ATOM (from their own stake) = 190 ATOM total. Everyone else gets their portion too.

This creates a marketplace. Validators compete not just on uptime, but on commission rates, transparency, and reliability. A validator with 99.9% uptime and a 7% fee will usually attract more stake than one with 95% uptime and a 5% fee. Performance matters as much as price.

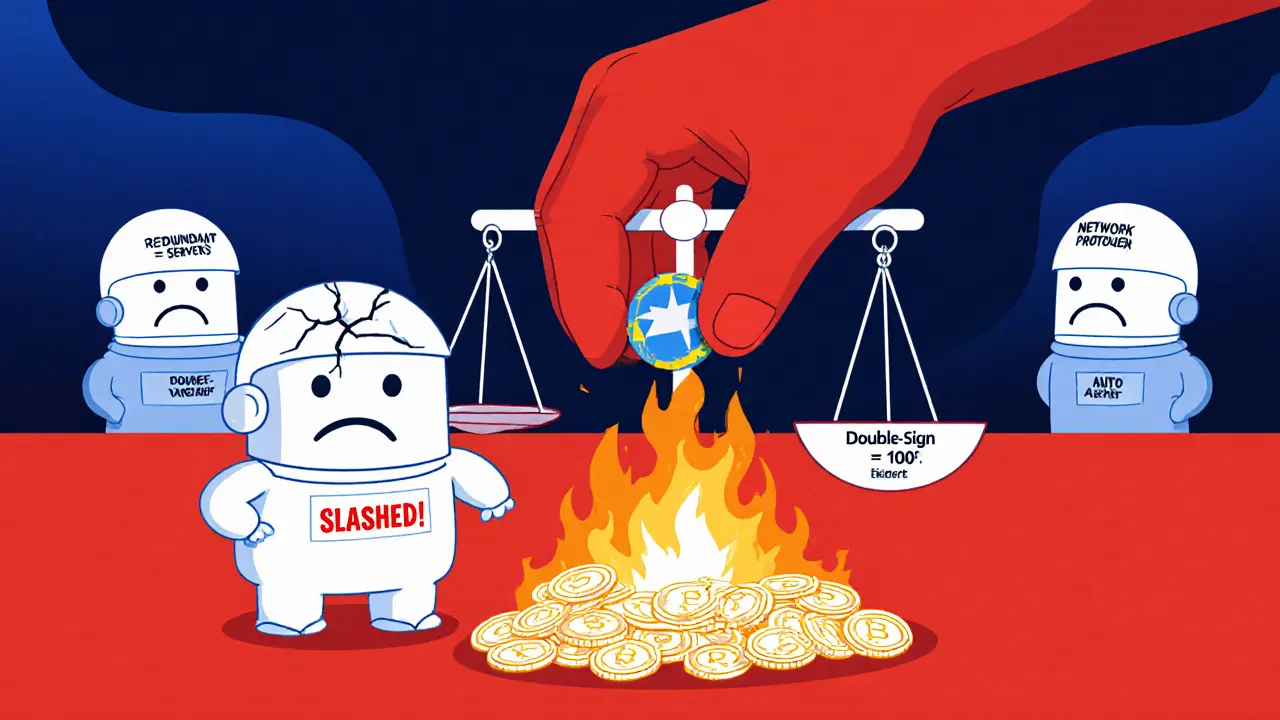

Penalties: The Other Side of the Coin

Validators don’t just get paid for doing good-they get punished for doing bad. And the punishments are harsh.

If a validator goes offline for too long, they miss rewards. But worse, they might get slashed. Slashing means a portion of their staked tokens is permanently destroyed. Why? Because in PoS, dishonest behavior threatens the whole network. If a validator signs two different blocks at the same height (called a double vote), or tries to cheat the consensus, the protocol automatically penalizes them.

On Ethereum, slashing can remove anywhere from 1% to 100% of your stake, depending on how many other validators are also being slashed at the same time. If it’s a single validator, you might lose 0.5 ETH. If it’s a widespread outage or attack, the penalty scales up to prevent network instability.

This isn’t theoretical. In 2023, a major validator on Ethereum lost over 10 ETH after a misconfigured monitoring tool caused repeated downtime. That’s more than $30,000 gone in minutes. That’s why professional operators use redundant servers, automated alerts, and backup key management systems. Slashing isn’t a bug-it’s a feature. It’s what makes the system secure.

Staking Pools and Liquid Staking

Staking pools let small holders participate without running their own nodes. Platforms like Lido, Rocket Pool, or Solana’s stake pools aggregate thousands of small stakes into one large validator. The pool operator handles everything: hardware, software, security, and compliance.

Liquid staking takes it a step further. Instead of locking your ETH for months, you get a token-like stETH or mSOL-that represents your staked position. You can trade it, use it in DeFi, or lend it out, all while still earning staking rewards. It’s like having your cake and eating it too.

But there’s risk. If the pool gets slashed, you lose value. If the protocol fails, your liquid token might not be redeemable. That’s why users look at pool size, operator reputation, and insurance coverage before choosing. The biggest pools now manage billions in assets. But decentralization suffers if 70% of all staked ETH goes through just three providers.

Networks Compared: Ethereum vs. Solana vs. Cosmos

Not all PoS networks are built the same. Their reward models reflect different priorities.

- Ethereum uses a dual-layer model: steady consensus rewards (currently around 3.5-4.5% APY) + variable execution fees. It’s designed for long-term security, not high yields. Validators earn less per block but benefit from massive, stable demand.

- Solana rewards high throughput. With over 1,800 validators and thousands of transactions per second, fees add up fast. APY can hit 7-8%, sometimes higher during peak usage. But the network’s speed also means more complexity-validators need powerful hardware and fast connections to stay competitive.

- Cosmos Hub uses proportional rewards. Every validator with equal voting power gets the same base reward. Then they compete on commission. This keeps the network more decentralized. A small validator with 0% commission can still earn well if they’re reliable.

Each model has trade-offs. Ethereum prioritizes security and decentralization. Solana prioritizes performance and fee income. Cosmos prioritizes fairness and community control. Your choice depends on what you value more: stability, yield, or decentralization.

Who’s Running These Validators?

Five years ago, validators were mostly crypto enthusiasts running rigs in their basements. Today, it’s a professional industry.

Exchanges like Coinbase, Kraken, and Binance run massive validator operations. Institutional staking firms like Figment, Stakefish, and Allnodes offer services to institutions and retail users alike. Even hedge funds and venture capital firms now allocate portions of their portfolios to staking.

This institutionalization brings reliability. These operators have dedicated teams, SLAs, insurance, and compliance departments. But it also concentrates power. Over 40% of Ethereum’s staked ETH is controlled by just five entities. That’s a centralization risk. If one of them gets hacked or goes offline, it could trigger cascading penalties across the network.

The community is aware of this. That’s why some networks now cap how much stake a single validator can hold. Others use reputation systems to reward smaller operators. The battle between efficiency and decentralization is far from over.

The Future of Validator Economics

Validator rewards aren’t static. They evolve with the network.

As Ethereum’s issuance rate drops over time (due to EIP-1559 burning more ETH than is minted), consensus rewards will shrink. That means execution fees will need to carry more weight. Will users pay enough to keep validators profitable? So far, yes. But if usage drops, validators could earn less.

New revenue streams are emerging. Some validators now offer data availability services for rollups. Others run cross-chain bridges or provide oracle data. These aren’t part of the core protocol yet-but they’re becoming important income sources.

Regulation is coming too. In the U.S., the SEC has signaled that staking services may be classified as securities. That could force platforms to change how they operate, report income, or even restrict access to non-accredited investors.

Long-term, the goal is sustainability. A healthy validator economy needs enough reward to attract participants, but not so much that it causes inflationary pressure. It needs penalties that deter attacks, but not so harsh that they scare off small operators. And it needs enough decentralization to remain trustless.

Right now, it’s working. Hundreds of billions of dollars are locked in staking. Thousands of validators keep the networks running. But it’s fragile. One poorly designed upgrade, one major outage, or one regulatory crackdown could change everything.

What You Need to Know Before Becoming a Validator

- You need reliable hardware: at least 16GB RAM, SSD storage, and a stable internet connection.

- You need 24/7 uptime. Missing more than 5% of attestations can hurt your rewards.

- You need to understand key management. Losing your signing key = losing your stake.

- You need to monitor your node. Use tools like Prometheus, Grafana, or dedicated dashboards.

- You need to understand slashing risks. Never run duplicate validators or use the same key on two machines.

- You need to pay taxes. Validator rewards are taxable income in most countries.

If you’re not technical, use a reputable staking pool. If you are, start small. Test on a testnet first. Don’t stake your life savings on your first try.

How much can I earn as a validator?

Earnings vary by network and conditions. On Ethereum, you can expect 3.5% to 5% annual returns from consensus rewards alone. Add execution fees during high-traffic periods, and it can reach 6-8%. Solana validators often earn 7-9% due to higher transaction volume. Cosmos Hub averages 7-10% with low commission validators. These are not guaranteed-network parameters change, and fees fluctuate.

Can I lose money staking?

Yes. If you’re a validator and your node goes offline too often, you miss rewards. If you’re slashed for double-signing or malicious behavior, you lose a portion of your staked tokens-sometimes up to 100%. Even delegators can lose value if the pool they’re using gets slashed. Staking isn’t risk-free. It’s a trade: you earn rewards in exchange for taking on technical and financial risk.

Do I need to run my own node to earn rewards?

No. Most people delegate their stake to a validator or use a staking pool. Platforms like Lido, Coinbase, or Kraken let you stake with as little as 0.001 ETH. You’ll earn a share of the rewards minus the pool’s commission. Running your own node gives you more control and potentially higher returns-but it requires technical skill and constant maintenance.

What’s the difference between staking and mining?

Mining (proof-of-work) requires powerful computers solving math problems, using massive amounts of electricity. Staking (proof-of-stake) requires locking up crypto as collateral. Validators are chosen based on stake size and randomness, not computational power. Staking uses 99% less energy than mining and doesn’t require expensive hardware. It’s more accessible, but still requires responsibility and technical awareness.

Are validator rewards taxed?

Yes. In the U.S. and most countries, validator rewards are treated as ordinary income when you receive them. If you later sell the tokens, you may owe capital gains tax. You need to track each reward transaction, its value in USD at the time of receipt, and your cost basis. Many users use crypto tax software like Koinly or TokenTax to automate this. Ignoring taxes can lead to penalties.

asher malik

November 22, 2025 AT 17:59Julissa Patino

November 23, 2025 AT 11:33Daryl Chew

November 23, 2025 AT 19:59Tyler Boyle

November 24, 2025 AT 12:44jocelyn cortez

November 25, 2025 AT 07:19Tejas Kansara

November 25, 2025 AT 19:42Lisa Hubbard

November 26, 2025 AT 01:52Dave Sorrell

November 26, 2025 AT 11:40Jenny Charland

November 26, 2025 AT 18:20preet kaur

November 26, 2025 AT 22:39