What Are Liquidity Pools in DeFi? A Clear Guide to How They Work and Why They Matter

Jun, 3 2025

Jun, 3 2025

Liquidity Pool Calculator

Calculate Your Liquidity Pool Returns

Imagine trying to trade one cryptocurrency for another, but there’s no one else on the other side of the trade. No buyer, no seller. Just silence. That’s what early decentralized exchanges (DEXs) faced before liquidity pools came along. Without enough people willing to trade, prices jumped wildly, trades took minutes to fill, or didn’t fill at all. Then came a simple but powerful idea: let users pool their crypto together and let smart contracts handle the trading automatically. That’s the heart of liquidity pools.

How Liquidity Pools Actually Work

Liquidity pools are digital jars filled with two or more cryptocurrencies. These jars live on blockchains, powered by smart contracts-self-executing code that runs without human intervention. Instead of matching buyers and sellers like a stock exchange, liquidity pools use math to set prices. The most common formula is called the constant product market maker, or x * y = k. Here’s how it works in practice. Let’s say a pool holds 10 ETH and 30,000 USDC. That’s a 1:3,000 ratio, assuming ETH is $3,000. Multiply those numbers: 10 * 30,000 = 300,000. That’s your constant, k. Now, someone buys 1 ETH. The pool must now have 9 ETH left. To keep k = 300,000, the USDC amount must rise to 33,333.33. That means the price of ETH just went up-from $3,000 to about $3,704. The algorithm adjusted the price automatically based on supply and demand inside the pool. This system eliminates the need for order books. You don’t wait for someone to sell ETH at your price. You trade directly against the pool. It’s instant. It’s always open. And it works even for obscure tokens that no centralized exchange would list.Who Provides the Liquidity?

The people who put crypto into these pools are called liquidity providers (LPs). They’re not traders-they’re like bankers for DeFi. To join a pool, you deposit equal dollar value of both tokens. For example, if you want to add $1,000 to an ETH/USDC pool, you send $500 worth of ETH and $500 worth of USDC. In return, you get LP tokens. These aren’t the original crypto-they’re receipts that prove you own a share of the pool. If you put in 1% of the total ETH and USDC in the pool, you get 1% of the LP tokens. Those tokens earn you a cut of every trade that happens in the pool. On Uniswap v2, that’s 0.3% of every trade. On some pools, it’s even higher. But here’s the catch: you don’t just earn fees. Many DeFi platforms reward LPs with extra tokens-called yield farming. You might earn UNI, CRV, or CAKE just for locking up your ETH and USDC. Some users earn over 40% APY this way. But that’s not free money. It comes with risk.The Big Risk: Impermanent Loss

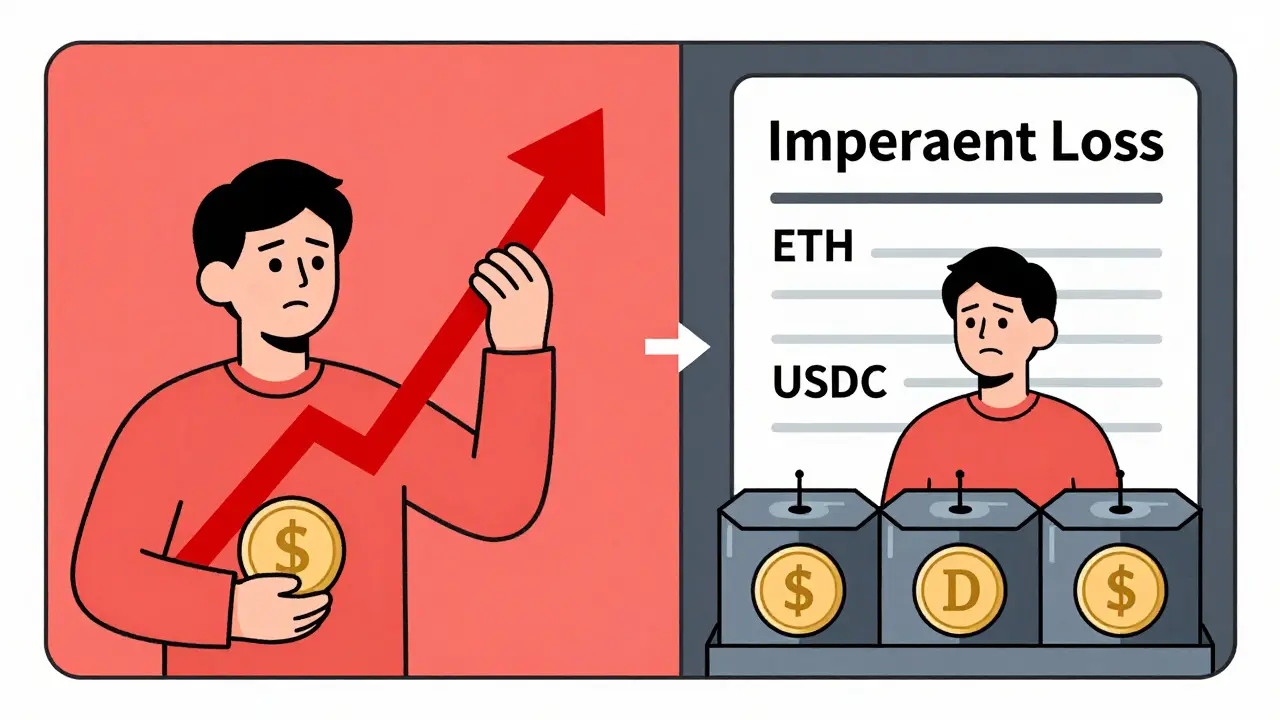

Impermanent loss isn’t a bug-it’s a feature. It’s what happens when the price of one token in your pool changes a lot compared to the other. Let’s say you put in $1,000 of ETH and $1,000 of USDC. ETH doubles to $6,000. The pool automatically rebalances to keep the math working. You end up with less ETH than you started with and more USDC. If you’d just held your ETH instead of putting it in the pool, you’d have doubled your money. But because you’re now holding more USDC and less ETH, your total value might be less than if you’d just held. That’s impermanent loss. It’s called “impermanent” because if the price goes back to where it started, the loss disappears. But if you withdraw while prices are off, it becomes permanent. Studies show this affects most LPs during volatile markets. One 2023 paper found 67% of liquidity providers lost money compared to simple holding during bear markets. The bigger the price swing, the worse the loss. ETH/SHIB pools? Brutal. USDC/DAI pools? Almost none.

How Different Pools Are Built

Not all liquidity pools are the same. Different platforms solve problems in different ways.- Uniswap v3 lets you choose a price range-say, $2,800 to $3,200 for ETH. You put all your capital only in that range. That makes your capital 4,000x more efficient than v2. But if ETH breaks out of your range, you stop earning fees until it comes back. It’s powerful, but you need to watch it like a hawk.

- Curve Finance specializes in stablecoins like USDC, DAI, and USDT. Because these tokens are meant to stay at $1, Curve’s pools have almost no impermanent loss and slippage as low as 0.04%. That’s why so many yield farmers use Curve for stablecoin farming.

- Balancer lets you create pools with any ratio-80% ETH and 20% USDC, for example. That’s useful if you want to hold more of one asset but still earn fees.

- PancakeSwap runs on Binance Smart Chain, so gas fees are cheaper. That’s why it’s popular in regions where Ethereum fees are too high.

Real-World Numbers: Who’s Using These Pools?

As of June 2024, over $58 billion was locked in DeFi liquidity pools. That’s up from just $18 billion a year earlier. Uniswap handles nearly a third of all trading volume on DEXs. PancakeSwap and Curve are next. Institutional players are starting to join. Fidelity launched a DeFi liquidity product in April 2024 managing $287 million. Hedge funds now allocate 5-15% of their crypto portfolios to liquidity provision. But retail users still dominate the stablecoin pools-78% of participants are everyday people. The most profitable pools? Stablecoin pairs. The riskiest? Low-cap tokens like SHIB, PEPE, or new memecoins. One Reddit user lost 28% on an ETH/SHIB pool during a market dip. Another earned 42% APY on a Curve stablecoin pool over six months. The difference? Volatility.How to Get Started (Step by Step)

If you want to become a liquidity provider, here’s how to do it safely:- Get a wallet like MetaMask or Coinbase Wallet.

- Buy the two tokens you want to pair-say, ETH and USDC.

- Go to a trusted DEX like Uniswap or Curve.

- Choose a pool and a fee tier. For beginners, pick 0.3% for ETH/USDC.

- If using Uniswap v3, set a price range. Start wide-like $2,500 to $4,000 for ETH.

- Deposit equal value of both tokens.

- Confirm the transaction. Pay the gas fee (around $1.50-$5 on Ethereum).

- Receive your LP tokens. You can leave them in the pool or stake them elsewhere for more rewards.

Where the Future Is Headed

Liquidity pools are evolving fast. Uniswap’s upcoming v4 will let developers build custom pool behaviors-like auto-compounding fees or dynamic fees based on volatility. Balancer is launching pools on Layer 2 networks like Optimism, slashing gas fees by 87%. Curve is testing pools backed by real-world assets like bonds and real estate. One of the biggest trends? Protocol-owned liquidity. Instead of relying on random users to supply funds, platforms like Uniswap are buying their own liquidity. This reduces risk and makes the system more stable. Since 2022, this model has cut reliance on external LPs by 43%. And then there’s privacy. Projects like zkSwap are using zero-knowledge proofs to hide who’s trading what. That could unlock $12 billion in new liquidity from users worried about exposure.Final Thoughts: Is It Worth It?

Liquidity pools are one of the most important innovations in crypto. They made decentralized trading possible. Without them, DeFi would still be stuck in the slow, unreliable early days. But they’re not a get-rich-quick scheme. They’re a financial tool-with risks, rewards, and complexity. If you’re willing to learn, monitor your positions, and avoid high-volatility tokens, you can earn solid returns. If you throw money into a random pool hoping for 100% APY? You’re likely to lose. The smartest LPs don’t chase yields. They pick stable pairs, use concentrated liquidity wisely, and understand the math behind the losses. That’s how you survive-and thrive-in DeFi.What is a liquidity pool in DeFi?

A liquidity pool is a smart contract that holds paired cryptocurrency assets, allowing users to trade directly against the pool instead of waiting for another trader. It uses automated market maker (AMM) algorithms to set prices based on supply and demand within the pool.

How do liquidity providers earn money?

Liquidity providers earn trading fees from every swap that happens in the pool-typically 0.01% to 1% per trade. Many platforms also reward LPs with additional tokens (yield farming), which can boost returns significantly. For example, Curve Finance LPs earn CRV tokens on top of 0.04% trading fees.

What is impermanent loss?

Impermanent loss occurs when the price of one asset in a liquidity pool changes compared to the other. The automated pricing mechanism rebalances your holdings, often leaving you with fewer of the asset that rose in value. If you withdraw while prices are uneven, the loss becomes permanent. It’s most severe in volatile pairs like ETH/SHIB and minimal in stablecoin pairs like USDC/DAI.

Can I lose more than I deposited?

No, you cannot lose more than what you deposited into the pool. Your maximum loss is limited to the amount of crypto you provided. However, you can lose value compared to simply holding the assets outside the pool-this is impermanent loss. Smart contract exploits are a separate risk, but well-audited pools like Uniswap and Curve have never been hacked.

Which is better: Uniswap v2 or v3?

Uniswap v2 is simpler and better for beginners-it automatically spreads your liquidity across all price ranges. Uniswap v3 is more efficient, letting you concentrate capital in specific price ranges for up to 4,000x higher fee earnings. But it requires active management. If you don’t adjust your range, you can earn zero fees. V3 is best for experienced users who monitor prices.

Are liquidity pools safe?

The smart contracts behind major liquidity pools like Uniswap, Curve, and PancakeSwap have been audited and are considered secure. The biggest risk isn’t hacking-it’s impermanent loss and poor token selection. Avoid pools with unknown tokens, low liquidity, or high volatility. Stick to well-established pairs like ETH/USDC or USDC/DAI until you understand the risks.

Do I need to pay gas fees to join a liquidity pool?

Yes, every interaction with a DeFi protocol on Ethereum requires a gas fee-typically $1.50 to $5.00 per transaction. To reduce costs, use Layer 2 networks like Arbitrum or Optimism, where fees are under $0.05. Some platforms like PancakeSwap run on Binance Smart Chain, which has consistently low fees.

Can I withdraw my funds anytime?

Yes, you can withdraw your funds at any time. However, if prices have moved significantly since you deposited, you may experience impermanent loss. There’s no lock-up period, but withdrawing during a volatile market can lock in losses. Many experienced LPs wait for prices to stabilize before withdrawing.

Philip Mirchin

December 4, 2025 AT 19:17Liquidity pools are wild when you think about it - no middleman, just math holding everything together. I started with ETH/USDC on Uniswap v2 and didn’t touch it for 6 months. Ended up with more USDC than I put in just from fees. Didn’t even have to check the price.

But yeah, impermanent loss is real. Saw a buddy dump his SHIB/ETH pool after a 30% dip. Lost half his stake. He swore off DeFi for a year.

Maggie Harrison

December 6, 2025 AT 16:19✨ Liquidity pools = crypto’s version of a community potluck ✨

You bring your favorite dish (ETH), someone brings rice (USDC), and suddenly everyone’s eating together. No one owns the kitchen - the recipe (smart contract) just works. But if the rice suddenly becomes more valuable than the dish… you kinda feel weird about your contribution 😅

Still, if you stick to stable pairs? It’s like putting money in a savings account that pays you in free snacks.

Lawal Ayomide

December 8, 2025 AT 12:03Uniswap v3 is for traders who want to be day traders without the job.

Set range wrong? You get zero fees.

Set it too tight? You get wiped when price moves 1%.

Stop pretending it’s passive income. It’s active management with extra steps.

Darlene Johnson

December 9, 2025 AT 16:00They say 'no one gets hacked'... but who's really controlling the code? Who coded the algorithm that decides your loss? What if the 'math' is rigged? What if the 'constant' is just a variable waiting for the right moment?

They're not pools. They're traps dressed in blockchain glitter. And you're the sucker holding the glitter.

Ivanna Faith

December 10, 2025 AT 19:03Curve is the only real play if you wanna make money without losing your mind

Why risk ETH/SHIB when you can earn 8% on USDC/DAI with less risk than your savings account

And yes I know you think you're smart putting your life savings into a memecoin pool but good luck explaining that to your therapist

alex bolduin

December 12, 2025 AT 15:49People act like impermanent loss is some evil curse but think about it - it’s just the market adjusting your portfolio automatically

You’re not losing money, you’re being forced to rebalance

Most people panic because they don’t understand what they’re doing

It’s not the pool’s fault it’s your mindset

Althea Gwen

December 13, 2025 AT 18:04Impermanent loss? More like permanent disappointment with crypto bros who think they're Warren Buffett because they earned 12% APY on a pool they didn't understand

Also why does everyone act like DeFi is new? This is just a fancy version of the 1700s Dutch tulip futures market with gas fees

Durgesh Mehta

December 14, 2025 AT 02:37Thanks for the clear guide

I’m from India and gas fees on Ethereum used to kill me

Switched to PancakeSwap on BSC last year - fees under $0.10

Now I farm USDC/BNB and sleep well

Biggest lesson? Don’t chase yield. Chase stability

Sarah Roberge

December 15, 2025 AT 22:40Wait so if I put in 1000 dollars and the price goes up and I get less of the thing that went up… that means the system is punishing me for being right?

Also why do people keep saying ‘it’s not a loss’ when it literally is a loss when you cash out

Also who decided that math should be the bank

I’m not even mad just confused

Steve Savage

December 16, 2025 AT 09:15One thing nobody talks about - the real winners aren’t the LPs who chase 100% APY

They’re the ones who set up a stablecoin pool, forgot about it, and came back 18 months later to find they made 30% just from fees

DeFi rewards patience, not hustle

And if you’re still using Uniswap v2 in 2024? You’re not early - you’re just behind