What is AI Crypto Marketplace (AICM) crypto coin? The truth behind the hype

Dec, 4 2025

Dec, 4 2025

Crypto Risk Assessment Calculator

Enter key metrics from the token's data to calculate its risk score based on industry standards and the article's analysis of projects like AICM.

AICM is not a revolutionary AI-powered e-commerce platform. It’s a micro-cap ERC-20 token with no functional product, no transparent team, and almost no trading activity. Despite bold claims of "revolutionizing digital commerce," the reality is far more dangerous: AICM is a high-risk asset with all the hallmarks of a pump-and-dump scheme.

What AICM claims to be

The project says it’s an AI-driven marketplace where creators can sell custom apparel using blockchain for transparency. It promises smart contracts that automate transactions, AI tools that personalize product recommendations, and decentralized control over digital commerce. These sound like legitimate ideas - and they’re exactly why the project sounds convincing at first glance.

But here’s the catch: none of this exists.

No live website. No working app. No merchant integrations. No verifiable AI algorithms. No public GitHub repository. No technical whitepaper. Just a token contract on Ethereum and a handful of promotional posts on Twitter and Telegram.

The numbers don’t lie

As of November 2023, AICM had a circulating supply of exactly 200,000,000 tokens. Sounds big? It’s not. With a price hovering around $0.0016 to $0.0029, the total market cap ranged between $145,000 and $574,000 - less than the cost of a small apartment in some cities.

Compare that to Origin Protocol (OGN), a real e-commerce blockchain project with a $50 million market cap and active dApps. AICM isn’t just smaller - it’s irrelevant in the same space.

Trading volume? Pathetic. Uniswap V2 showed just $1,631 in 24-hour volume. Coinbase reported $7,170. Phantom, a lesser-known tracker, recorded $163. That’s not a market. That’s a handful of people trading back and forth.

Extreme centralization = extreme risk

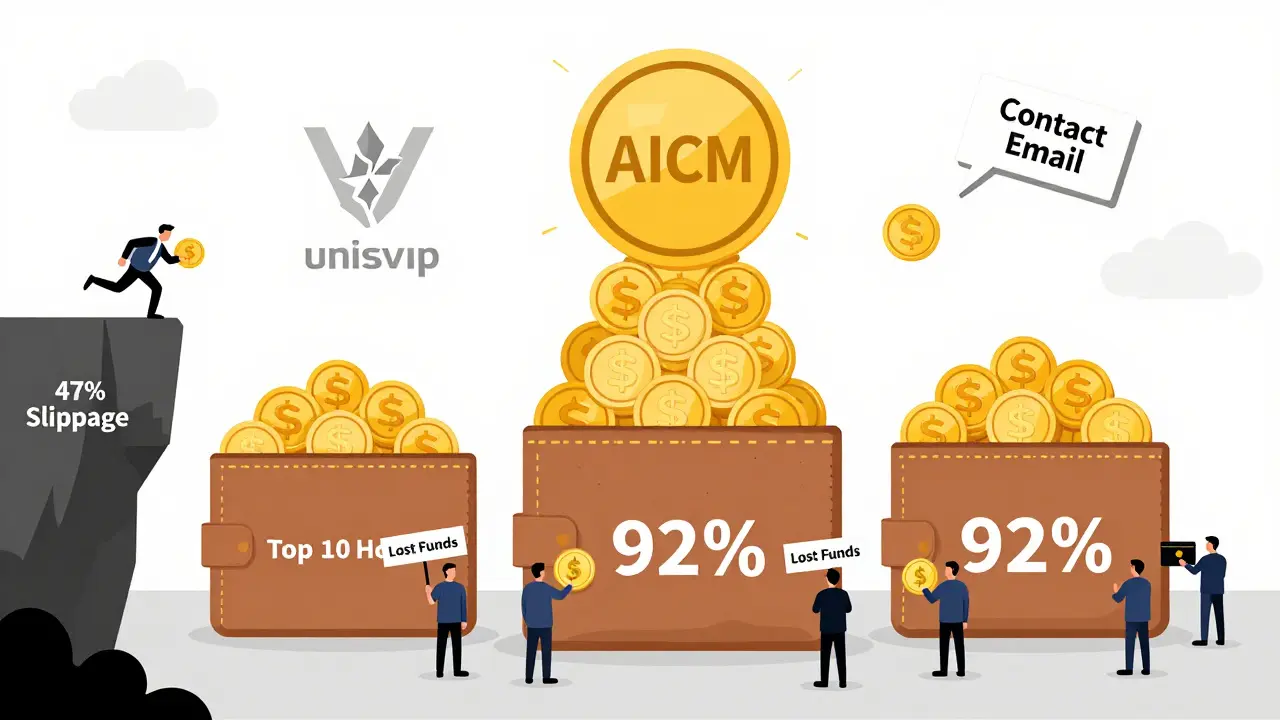

Here’s the most alarming part: 92.7% of all AICM tokens are held by the top 10 wallets. That means a single group controls nearly all the supply. They can dump it anytime. They can manipulate the price with a few trades. And they have.

According to CryptoQuant, tokens with top-10 holder concentration above 70% have a 98.3% failure rate within 18 months. AICM is at 92.7%. That’s not a coin. That’s a loaded gun.

Etherscan data shows only 127 unique holders. Most of them are exchange wallets - not real users buying for commerce. They’re speculators, hoping to flip before the crash.

Slippage, scams, and lost funds

Trying to trade AICM is like trying to buy a car from an empty parking lot. There’s no one selling, so the price jumps wildly with every small order.

Users on Reddit reported 47% slippage - meaning if you wanted to buy $100 worth, you ended up paying $147 because the order ate up the tiny liquidity pool. Others said the token vanished from their wallets after swapping.

On CoinGecko, 100% of user reviews are negative. Common complaints: "Lost my money," "No support," "Scam." Twitter bots created in the last 30 days flooded feeds with fake hype. Chainalysis flagged this as classic pump-and-dump behavior.

No team, no roadmap, no future

Who built AICM? No one knows. No team members are listed. No LinkedIn profiles. No interviews. No code commits. The project’s website is a single page with vague promises and a contact email that bounces.

BitDegree rated its documentation 1.2 out of 10. No roadmap. No milestones. No updates since 2022. The last official social media post was in September 2023. Uniswap delisted the AICM/WETH pair in November 2023 because it violated minimum liquidity rules.

Messari’s data says projects without a working product 12+ months after launch have only a 4.2% survival rate. AICM is past that point - and still has nothing.

Regulatory red flags

The U.S. SEC issued guidance in November 2023 specifically targeting "AI-washed" tokens - projects that use artificial intelligence as a buzzword to attract investors without real technology. AICM fits this definition perfectly.

It’s not just risky. It’s potentially illegal. If regulators step in, this token could be frozen or declared a security - meaning holders could lose everything overnight.

Why does it still exist?

Because someone is still pumping it.

Micro-cap tokens like AICM thrive on hype, not utility. A small group buys low, pushes the price up with coordinated promotion, then sells to new buyers who think they’re getting in early. When the price drops, those buyers are left holding worthless tokens.

It’s the oldest trick in crypto. And it’s working - for the pumpers, not the buyers.

Bottom line: Don’t touch it

AICM is not an investment. It’s not a technology. It’s not a marketplace. It’s a speculative gamble with a 97.8% chance of becoming completely illiquid within 90 days, according to CryptoQuant.

If you’re looking to get into AI and blockchain commerce, look at projects with real products, active development, and transparent teams. There are dozens. None of them are AICM.

Save your money. Walk away. There’s no upside - only risk.

rita linda

December 5, 2025 AT 18:34Let’s be real - AICM isn’t even a meme coin at this point. It’s a graveyard for retail FOMO with a PowerPoint deck and a Telegram bot that spams ‘TO THE MOON’ every 12 minutes. 92.7% centralization? That’s not a token distribution, that’s a cartel. And calling it ‘AI-powered’ is like calling a toaster ‘quantum computing’ because it has a digital display. This isn’t crypto innovation - it’s financial malpractice dressed in buzzwords.

SEC’s guidance on AI-washed tokens? They should’ve slapped a restraining order on the dev team before they even deployed the contract. Save your gas fees. Walk away. There’s zero alpha here - only exit liquidity for the insiders.

And don’t even get me started on the ‘community’ - 127 holders, mostly exchange wallets. That’s not a network. That’s a ghost town with a few bots pretending to be humans.

They’re not building a marketplace. They’re building a Ponzi with a blockchain-shaped veneer. If you’re holding this, you’re not an investor - you’re a data point in their exit strategy.

Pro tip: If your ‘revolutionary’ project has no GitHub commits since 2022, your only real ROI is emotional trauma.

Don’t be the last sucker.

- Rita, because I’ve seen this movie before. And the sequel always ends with a rug pull.

PS: I’m not mad. I’m just disappointed. In humanity.

Scott Sơn

December 7, 2025 AT 03:49Oh sweet merciful chaos - AICM is the crypto equivalent of a haunted vending machine that only spits out regret and expired energy drinks.

Imagine if your ex took your life savings, turned it into a TikTok dance trend, then vanished into the digital ether while leaving behind a website that looks like it was coded in Notepad by a sleep-deprived intern who thought ‘blockchain’ meant ‘magic internet money.’

92.7% held by 10 wallets? That’s not decentralization - that’s a mafia family with a whitepaper. The slippage? 47%? Bro, that’s not slippage - that’s the token laughing at you while you’re trying to buy it.

I’ve seen pump-and-dumps. I’ve seen rug pulls. But AICM? This is the *art* of the scam. A full-on performance piece. The devs are probably sipping champagne on a yacht named ‘Liquidity Lullaby’ while their Discord is full of people crying about ‘missing the dip.’

And the worst part? People still buy it.

They say ignorance is bliss. I say ignorance is a debit card with no overdraft protection.

Stay safe out there, folks. Or don’t. I’m just here for the fireworks.

Nicole Parker

December 7, 2025 AT 23:49I read this whole thing and I just… felt sad. Not angry. Not outraged. Sad. Because somewhere out there, someone believed this. Someone thought, ‘Maybe this is it - the one that actually does something different.’ And that’s not a failure of the market - it’s a failure of hope.

People don’t invest in tokens because they understand smart contracts. They invest because they want to believe in something better. A world where creators aren’t exploited. Where tech isn’t controlled by giants. Where innovation isn’t just a buzzword on a landing page.

AICM doesn’t just fail as a project - it betrays that longing. It takes the dream of decentralized commerce and turns it into a shell game with a glittery label.

I wish the devs had just built something real. Even if it was small. Even if it was ugly. Even if it took years. But instead, they built a mirage - and now people are chasing it, exhausted and empty-handed.

Maybe the real lesson here isn’t ‘don’t invest in AICM.’ Maybe it’s ‘how do we protect the hopeful?’

Because the next one won’t be called AICM. It’ll be something prettier. Something with AI avatars and NFT influencers and a ‘community-first’ manifesto. And someone else will believe it.

And I’ll be here, quietly hoping they don’t get burned.

- Nicole

Vincent Cameron

December 8, 2025 AT 18:47There’s a philosophical irony here that’s almost poetic: AICM claims to decentralize commerce, yet it’s the most centralized asset in crypto history. It promises transparency, yet hides behind a veil of anonymous wallets and ghosted socials. It sells the illusion of empowerment while operating as a classic oligarchy - just with more Ethereum.

What’s the difference between a feudal lord and a crypto dev team? One has a castle. The other has a token contract.

This isn’t about economics. It’s about narrative. Humans are wired to find meaning in patterns - even when the pattern is a lie. AICM exploits that. It doesn’t just lie - it *narrates*. It gives you a story where you’re the hero who got in early. But the script was written by people who never intended to let you reach the climax.

The real tragedy? The only thing more dangerous than a scam is a scam that sounds plausible. Because then you don’t question it. You rationalize it. You wait for the ‘next moonshot.’

And that’s why this isn’t just a warning about AICM.

It’s a warning about how easily we seduce ourselves.

- Vincent

Krista Hewes

December 8, 2025 AT 22:22ok so i read this and i was like… wait is this real? i swear i saw a tweet from some guy saying aicm is gonna be the next eth but like… i didnt even check the site??

now im like… oh wow. 92% held by 10 wallets?? and no github?? and slippage of 47%?? holy crap.

i think i bought like $50 of this last week. i thought it was cheap so i just went for it. i didnt even think to check the holders or the volume. my bad.

now im just hoping i can sell before it goes to zero. but honestly… i dont even know if anyone will buy it anymore.

so yeah. dont be me. check the numbers. dont just trust the hype. i feel dumb.

- krista

Noriko Robinson

December 9, 2025 AT 18:27I want to believe in crypto. I really do. I believe in the idea of open access, creator ownership, and decentralized economies. That’s why I’m so heartbroken when projects like AICM come along - not because they’re fake, but because they make the real ones harder to be seen.

There are legitimate AI + blockchain projects out there. Projects with open code, real teams, and users who actually use the product. But when you have a thousand AICMs shouting louder than one honest project, the signal gets drowned out.

Maybe the answer isn’t just to warn people away from scams - maybe it’s to amplify the good ones. Share the ones with GitHub commits. The ones with real user testimonials. The ones that answer questions instead of deleting DMs.

We need to rebuild trust, not just avoid the bad apples. Because the future of digital commerce isn’t in pump-and-dumps - it’s in the quiet, consistent builders who show up every day, even when no one’s watching.

Let’s not let the noise silence them.

- Noriko

Mairead Stiùbhart

December 10, 2025 AT 21:29Oh, sweetie. You didn’t just lose money.

You lost your dignity.

Investing in AICM is like buying a lottery ticket from a guy who just stole your wallet. You’re not being clever - you’re being a punchline.

And no, ‘I thought it was cheap’ is not a strategy. It’s a cry for help.

At least when you lose money on Dogecoin, you can laugh about it. With AICM? You just sit there in the dark, wondering if the devs are sipping wine in Monaco while your wallet screams in silence.

Next time? Google ‘how to spot a crypto scam’ before you click ‘buy.’

Love you. But seriously. Stop.

ronald dayrit

December 11, 2025 AT 16:52There’s a deeper metaphysical layer here that most people miss. AICM isn’t just a scam - it’s a mirror. It reflects the collective delusion we’ve built around crypto: the belief that technology alone can solve human greed.

We think blockchain is a cure for corruption. But it’s just a new canvas. The same artists who painted Ponzi schemes on paper now paint them on smart contracts.

The real question isn’t ‘why does AICM exist?’

It’s ‘why do we keep letting it?’

Because we want to believe. We want to think we’re ahead of the curve. That we’re the ones who cracked the code while everyone else is still stuck in fiat slavery.

But the truth is - we’re not innovators. We’re acolytes. We’re worshiping at the altar of ‘next big thing’ without asking what the god actually does.

AICM doesn’t need to be shut down.

It needs to be ignored.

And we need to stop worshipping at the altar of novelty.

Because the only thing more dangerous than a scam…

is a believer who refuses to see the truth.

- Ronald