What is Ghosty Cash (SPKY) Crypto Coin? A Realistic Look at Privacy, Risks, and Reality

Dec, 27 2024

Dec, 27 2024

SPKY vs Monero Comparison Tool

Privacy & Risk Assessment

Enter your transaction amount to see how Ghosty Cash (SPKY) compares to Monero in privacy, speed, costs, and regulatory risks.

Comparison Results

Ghosty Cash (SPKY)

Monero (XMR)

Privacy Level

ModeratePrivacy Level

HighTransaction Time

2-3 minutesTransaction Time

1-2 minutesGas Fees

$0.02-$0.05Gas Fees

$0.005-$0.01Regulatory Risk

HighRegulatory Risk

LowMarket Cap

$200,000Market Cap

$2.1 billionCommunity Support

MinimalCommunity Support

LargeKey Takeaways

Ghosty Cash (SPKY) offers faster transactions but comes with significantly higher risks, including:

- Unproven privacy technology with no cryptographic proof

- Minimal regulatory protection

- Extremely low market liquidity

- No transparent development team

Important Warning

Based on your input, Ghosty Cash carries high risk for transactions over $25. This tool shows SPKY may not provide true anonymity, unlike battle-tested privacy coins like Monero.

Ghosty Cash (SPKY) isn’t another meme coin. It doesn’t promise to make you rich overnight. It claims to solve one of the toughest problems in crypto: privacy. But here’s the catch - it’s barely been around for a year, and no one knows who made it. If you’ve heard about it from a Telegram group or a YouTube video promising instant anonymous transactions, you need to know the full story before you touch a single SPKY token.

What Ghosty Cash Actually Does

Ghosty Cash (SPKY) is a token built on the Solana blockchain. It doesn’t try to be a new currency like Bitcoin or Ethereum. Instead, it tries to be a privacy tool - something that lets you send and receive crypto without anyone tracing where the money came from or where it went.

Most privacy tools, like Tornado Cash, work by collecting your money into a smart contract, mixing it with other people’s funds, and then sending it back out. The problem? That smart contract is a target. Tornado Cash got hacked for $1.2 million in 2023. And worse, the U.S. government sanctioned it in 2022.

Ghosty Cash says it avoids that risk entirely. Instead of holding your money, it uses something called Monero Tunnel and Transfer (MTT). The idea is simple: when you send SPKY, the system routes your transaction through the Monero network - which is already designed to be private - and then brings it back to Solana. No funds are stored. No smart contract holds your cash. That’s the big claim.

The Tech Behind the Claim

On paper, this sounds smart. Monero (XMR) has been the gold standard for private transactions since 2014. It uses ring signatures and stealth addresses to hide sender, receiver, and amount. Solana, on the other hand, is fast and cheap - but completely transparent. Combining them sounds like a win.

But here’s where things get shaky. No one has published a formal cryptographic proof of how MTT works. Independent researchers like Alex Petrov checked the whitepaper referenced on CoinCarp - and found no math, no diagrams, no peer-reviewed logic. Just a vague description.

Dr. Sarah Chen, chief cryptographer at Halborn, put it bluntly in a CoinDesk interview: “The claim of achieving true anonymity through cross-chain tunneling without holding funds requires rigorous cryptographic proof that hasn’t been publicly presented.”

Even worse, cross-chain routing introduces new risks. If Monero’s network slows down, or if Solana has a network congestion issue, your transaction could get stuck. There’s no fallback. And because Ghosty Cash isn’t built into Solana’s core protocol, it’s an add-on - a fragile layer on top of two complex systems.

Market Numbers Don’t Lie

Ghosty Cash has a total supply of 9 million SPKY tokens. Around 8-9 million are in circulation, depending on which exchange you check. Prices vary wildly: Coinbase says $0.017, Binance says $0.023, CoinCheckup says $0.057. That kind of inconsistency isn’t normal for a real asset - it’s a sign of low liquidity and thin trading.

Its market cap hovers around $200,000. That’s tiny. For comparison, Monero’s market cap is over $2 billion. Even smaller privacy projects like Railgun are worth over $40 million. Ghosty Cash is a drop in the ocean.

Only about 1,842 unique wallets hold SPKY tokens, according to Solscan. Daily active users? Between 12 and 15. That’s not a community. That’s a handful of people testing it out.

Real User Experiences

People who’ve tried Ghosty Cash aren’t impressed.

One Reddit user tried to send $50. The transaction finished in two minutes - fast, yes - but they couldn’t tell if it was actually private. Another lost $30 in gas fees trying to move ETH to Solana. The cross-chain feature didn’t work. Support never responded.

The interface is confusing. Documentation is nonexistent. Most guides on YouTube are made by random users, not the team. One video titled “Ghosty Cash SPKY Anonymization Walkthrough” has under 1,300 views.

On Telegram, the official channel has 1,247 members. But on an average day, only 5-7 messages are posted. That’s not a thriving ecosystem. That’s silence.

Why It’s Not Like Monero or Zcash

Some people compare Ghosty Cash to Monero or Zcash. That’s misleading.

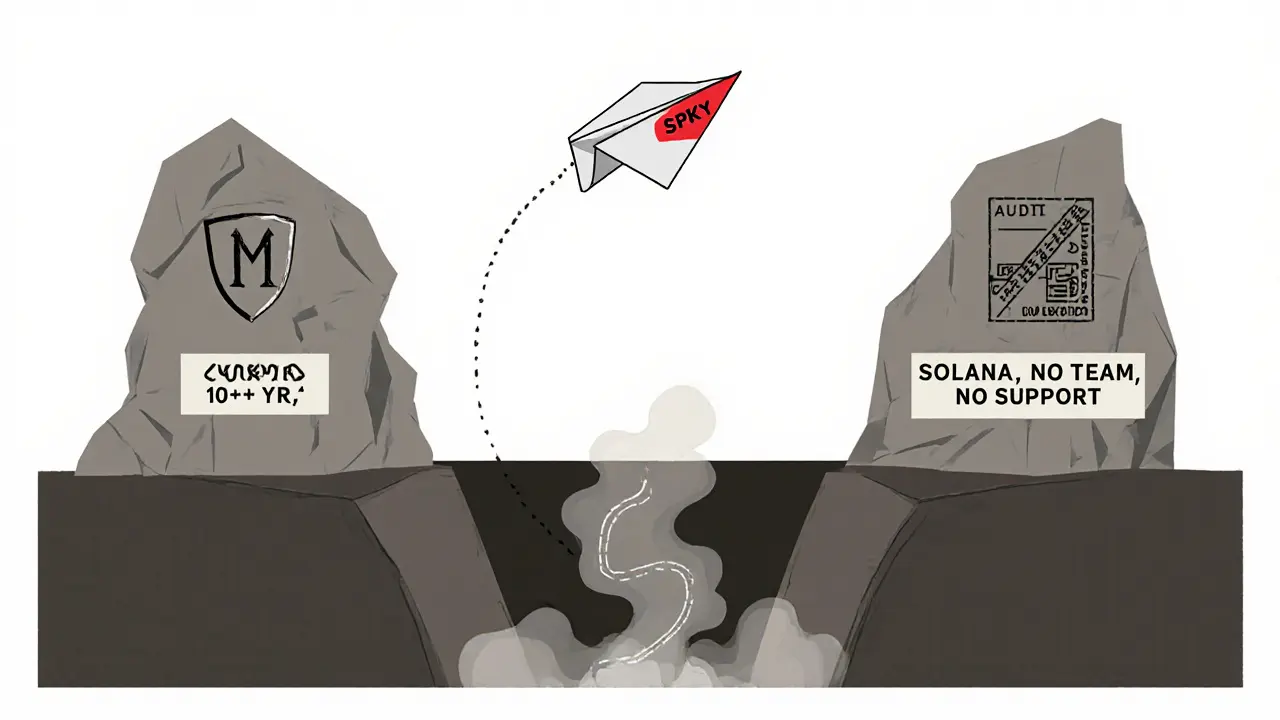

Monero and Zcash are blockchains. Their privacy is built into every transaction from the ground up. They’ve been audited, tested, and battle-tested for over a decade. Ghosty Cash is a token on Solana that tries to borrow privacy from another chain. It’s like putting a bulletproof vest on a bicycle and calling it a tank.

And unlike Monero, which has a global community of developers, Ghosty Cash’s team is anonymous. No GitHub commits. No public roadmap. No team members named. Just a website and a token.

Regulatory Risks Are Real

The U.S. Treasury’s FinCEN issued new guidance on privacy tools in October 2024. It didn’t name Ghosty Cash - but it didn’t need to. The message was clear: any service that helps users hide transaction history is under increased scrutiny.

Tornado Cash got sanctioned. Its developers were targeted. Its website was taken down. Ghosty Cash’s team claims they don’t hold funds, so they’re safe. But regulators don’t care about your technical architecture. They care about outcomes. If people use your tool to launder money, you’re in trouble - even if you didn’t touch the cash.

Blockchain compliance expert Elena Rodriguez warned in Law360: “Any service facilitating transaction anonymity faces increasing regulatory scrutiny regardless of technical implementation.”

Who Should Avoid It

If you’re looking for:

- A safe, audited privacy solution - avoid it.

- A token with long-term potential - avoid it.

- A way to send crypto without being tracked - understand the risks first.

- Reliable customer support - you won’t find it.

- Compatibility with Ethereum or other chains - it doesn’t work yet.

Even if you’re experienced in crypto, Ghosty Cash requires you to manage Solana wallets, understand cross-chain bridges, and trust a team with zero public identity. That’s not for beginners. It’s not even for most advanced users.

Who Might Consider It

There’s one scenario where Ghosty Cash makes sense: if you’re already on Solana, you need fast privacy, you understand the risks, and you’re willing to lose your money on an unproven experiment.

Some users say it’s faster than Tornado Cash. One Twitter user claimed a 10 SOL transfer took 90 seconds. That’s true - if it works. But 90 seconds doesn’t mean much if you’re risking your entire balance on a protocol with no audit, no team, and no future roadmap.

The Bottom Line

Ghosty Cash (SPKY) is not a cryptocurrency. It’s a high-risk experiment. It’s not a product. It’s a hypothesis.

It’s trying to solve a real problem - privacy - but it’s doing it with unproven tech, no transparency, and zero community trust. The market cap is tiny. The users are few. The support is non-existent. And the regulatory sword hangs over it like Damocles’.

If you’re curious, you can buy a few SPKY tokens. But treat it like a lottery ticket - not an investment. Don’t put in more than you can afford to lose. And never assume your transactions are truly private until someone with real expertise proves it.

For now, if you want real privacy in crypto, stick with Monero. It’s slow. It’s not on Solana. But it’s been tested. It’s audited. And it’s still standing after 10 years - while Ghosty Cash is still trying to prove it exists.

Matthew Prickett

November 23, 2025 AT 11:40Caren Potgieter

November 25, 2025 AT 06:38Omkar Rane

November 25, 2025 AT 08:25Daryl Chew

November 25, 2025 AT 17:47jocelyn cortez

November 27, 2025 AT 07:41Gus Mitchener

November 27, 2025 AT 22:46Jennifer Morton-Riggs

November 29, 2025 AT 22:11Kathy Alexander

November 30, 2025 AT 20:50Soham Kulkarni

December 1, 2025 AT 09:02Dave Sorrell

December 3, 2025 AT 07:30