What Is Hash Rate in Cryptocurrency? A Simple Guide to Network Power and Security

Dec, 11 2025

Dec, 11 2025

Hash Rate Converter

Note: Bitcoin's current hash rate is approximately 600 EH/s. The higher the hash rate, the more secure the network.

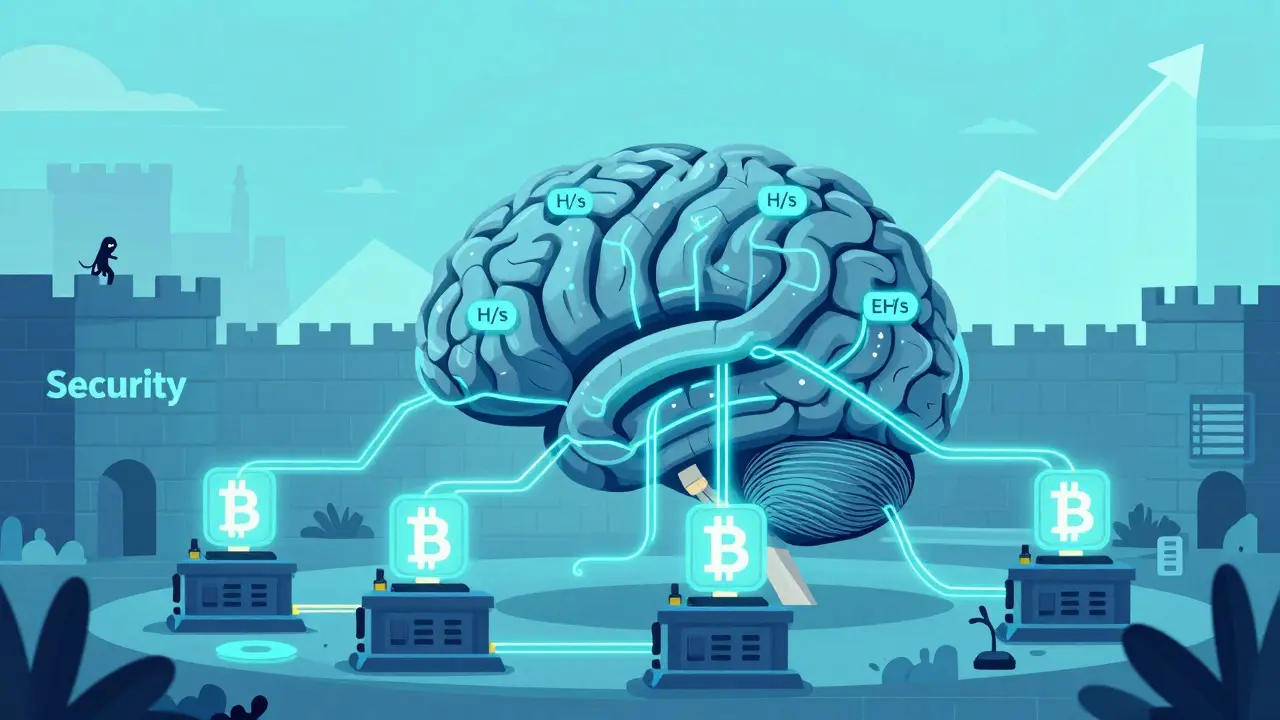

Hash rate is the measure of how fast a cryptocurrency network is solving complex math problems to validate transactions and add new blocks. Think of it like the total computing muscle behind a blockchain. The higher the hash rate, the more secure and stable the network. It’s not just a number-it’s the backbone of security for Bitcoin and other proof-of-work coins.

How Hash Rate Actually Works

Every time a miner tries to solve a cryptographic puzzle to create a new block, they’re making a guess. Each guess is called a hash. Hash rate measures how many of those guesses the entire network makes per second. If your mining rig can do 1 billion hashes in one second, that’s 1 GH/s (gigahash per second). Bitcoin’s network, as of mid-2024, does about 600 exahashes per second (EH/s)-that’s 600 quintillion guesses every second.

This isn’t just about speed. It’s about security. The more guesses happening across the network, the harder it is for a bad actor to take control. To pull off a 51% attack on Bitcoin, you’d need to control more than half of that 600 EH/s. Based on current hardware prices and electricity costs, that would cost over $15 billion just to buy the machines, not counting power bills. That’s why Bitcoin’s hash rate is its strongest defense.

Units of Hash Rate: From H/s to EH/s

Hash rate uses metric units, just like kilobytes or megabytes. Here’s how they break down:

- 1 H/s = 1 hash per second

- 1 KH/s = 1,000 hashes per second

- 1 MH/s = 1 million hashes per second

- 1 GH/s = 1 billion hashes per second

- 1 TH/s = 1 trillion hashes per second

- 1 PH/s = 1 quadrillion hashes per second

- 1 EH/s = 1 quintillion hashes per second

Early Bitcoin mining in 2009 ran at about 0.00076 MH/s. Today, the network is over 789 quintillion times faster. That growth didn’t happen by accident. It’s the result of better hardware, cheaper electricity, and miners racing to earn rewards.

Why Hash Rate Matters for Security

High hash rate = high security. It’s that simple. If a network has low hash rate, it’s easier to overpower. For example, Bitcoin Cash runs at around 4.2 EH/s-less than 1% of Bitcoin’s. That makes it far more vulnerable to a 51% attack. In fact, Bitcoin SV, at just 1.8 EH/s, has been attacked multiple times in the past.

MIT’s Digital Currency Initiative found that Bitcoin’s current hash rate requires roughly 4.5 x 10^26 operations per second to overpower. That’s more than all the computers on Earth combined could realistically do. Even if someone tried, the cost would far outweigh any profit from double-spending.

But hash rate isn’t just about raw power. Location matters too. Nearly half of Bitcoin’s hash rate comes from just three countries: the U.S. (35.3%), Kazakhstan (6.5%), and Canada (6.0%). If any one of those regions suddenly shuts down mining-say, due to regulation or blackout-the network could temporarily lose 50% of its security. That’s why experts warn: aggregate hash rate doesn’t tell the whole story.

Hash Rate vs. Mining Difficulty

Bitcoin doesn’t let hash rate run wild. Every 2,016 blocks-roughly every two weeks-it automatically adjusts the difficulty of the math puzzles. If the network gets faster (hash rate goes up), the puzzle gets harder. If miners shut off (hash rate drops), the puzzle gets easier. The goal? Keep block times at 10 minutes.

This adjustment keeps the system stable. Without it, blocks would come too fast when mining power spikes, or too slow when miners leave. That’s why you’ll sometimes see hash rate go up but mining rewards stay flat. The difficulty just increased to match.

What Happened to Ethereum’s Hash Rate?

Ethereum used to be the second-largest proof-of-work network, with a hash rate peaking near 1 GH/s in 2021. But in September 2022, it switched to proof-of-stake. No more mining. No more hash rate.

This was a huge shift. Ethereum no longer relies on brute computational power to secure its network. Instead, validators lock up ETH as collateral. It’s more energy-efficient-but it changes the security model. Proof-of-stake networks don’t have hash rates. They have “staked value.” That’s why you’ll never see Ethereum’s hash rate on a chart anymore.

Real-World Mining: What Miners Actually Experience

Miners don’t just care about peak hash rate-they care about stability. One Reddit user reported that after 18 months of running an Antminer S19 XP, his rig lost 17.3% of its original hash rate due to heat damage. That’s common. Mining hardware degrades over time.

Even mining pools-the groups miners join to combine power-don’t always deliver what they promise. An independent audit found that Slush Pool users saw an average 8.2% variance between advertised and actual hash rates. Some miners buy used equipment online, only to find out it’s delivering 40% of the claimed power. One Twitter user lost $2,350 that way.

On the flip side, small tweaks can pay off. One miner boosted his hash rate 15% by updating firmware. That extra power earned him $1,842 more in a single month.

Hash Rate Is a Market Signal

Traders watch hash rate like a heartbeat. When it rises, it often means miners are confident-maybe because Bitcoin’s price is going up or they expect a future reward increase. When it drops suddenly, it can signal trouble: miners are shutting down because electricity costs are too high, or regulations are cracking down.

After the April 2024 Bitcoin halving, hash rate dipped briefly as older, inefficient machines turned off. But within weeks, it surged past previous highs. Why? Because the new, more efficient Antminer S21 chips hit the market. Miners who could afford them doubled down.

Now, there’s even a futures market for hash rate. BitMEX launched hash rate derivatives in March 2024. Traders can bet on whether Bitcoin’s hash rate will be higher or lower next month. It’s a sign that hash rate has become a financial asset in its own right.

Energy Use and the Environmental Debate

Bitcoin’s hash rate isn’t cheap to run. Cambridge University estimates Bitcoin’s network uses 121.49 terawatt-hours per year-more than the entire country of Greece. That’s a lot of electricity.

But here’s the nuance: 62.8% of that energy now comes from sustainable sources, according to the Bitcoin Mining Council. Many miners use stranded gas, hydro power, or excess renewable energy that would otherwise go to waste. In Texas, miners use surplus wind power at night. In Iceland, they use geothermal.

Still, critics argue that even “green” mining is wasteful. That’s why Ethereum switched to proof-of-stake. And why new coins like Chia use proof-of-space-relying on unused hard drive space instead of raw computing power.

Who Controls the Hash Rate?

Bitcoin’s network looks decentralized. But the truth is more concentrated. As of mid-2024, the top 10 mining pools control 78.4% of Bitcoin’s total hash rate. The top five control over 63%. That’s a big shift from 2020, when power was more spread out.

That concentration creates risk. If one pool gets hacked-or if a government forces a major mining company to shut down-it could cause a sudden drop in hash rate. That’s why some experts say we need better distribution, not just more power.

Meanwhile, big companies are taking over. Marathon Digital Holdings runs 17.3 EH/s across 13 U.S. data centers. Riot Platforms is aiming for 30 EH/s by mid-2025. These aren’t hobbyists with rigs in their garages. These are corporations with multi-million-dollar budgets.

What’s Next for Hash Rate?

Hash rate is expected to hit 800-900 EH/s by early 2025. New ASIC chips are getting faster and more efficient. Immersion cooling tech-where mining rigs are submerged in liquid-is starting to reduce degradation from 15-20% per year to just 5-8%.

But growth may slow. Hardware improvements are hitting physical limits. The next big leap won’t be in raw power-it’ll be in efficiency, location, and regulation.

As countries like New York restrict mining, others like Paraguay and Argentina are stepping in. The global hash rate map is shifting. And with hash rate derivatives now trading, the financial side of mining is becoming as important as the technical side.

How to Track Hash Rate

You don’t need to be a miner to watch hash rate. Free tools like Blockchain.com’s Hash Rate Chart show real-time data with 7-day moving averages to smooth out spikes. Glassnode offers deeper analytics, but it costs $999/month.

For casual users: look for steady growth. Sudden drops? Check for regulatory news or price crashes. Sudden spikes? Look for new hardware launches. Don’t panic over daily swings. Hash rate moves in trends, not ticks.

Is hash rate the same as mining difficulty?

No. Hash rate is the total computing power on the network. Mining difficulty is how hard the math puzzles are. They’re linked: when hash rate goes up, difficulty increases to keep block times at 10 minutes. When hash rate drops, difficulty goes down. One measures power; the other measures challenge.

Can you mine Bitcoin with a regular computer or GPU today?

Not profitably. Bitcoin mining now requires specialized ASIC chips that are thousands of times faster than GPUs. A high-end GPU might do 60 MH/s. A single Antminer S21 does 200 TH/s-that’s over 3,000 times faster. Even if you got free electricity, your electricity bill would eat up any profit.

Why does hash rate matter if I’m not a miner?

Because it protects your Bitcoin. Higher hash rate means the network is harder to hack. If a bad actor tried to reverse transactions or double-spend, they’d need to control more than half the network’s power. With Bitcoin at 600 EH/s, that’s nearly impossible. Your coins are safer when the hash rate is high.

Does a rising hash rate mean Bitcoin’s price will go up?

Not directly. But historically, there’s a strong correlation. When miners invest in more hardware, it usually means they expect future rewards to be worth the cost. That often happens when prices rise or are expected to rise. So while hash rate doesn’t cause price increases, it’s a good sign miners believe in the network’s future.

What’s the difference between Bitcoin’s hash rate and Ethereum’s after the switch?

Bitcoin still uses proof-of-work, so it has a hash rate. Ethereum switched to proof-of-stake in 2022, so it has no hash rate anymore. Instead, Ethereum’s security comes from how much ETH is staked by validators. One is about computing power; the other is about economic commitment.

Final Takeaway

Hash rate isn’t just a tech term-it’s the heartbeat of Bitcoin’s security. More hash rate means a stronger, more trustworthy network. It’s what keeps your coins safe from hackers, manipulators, and bad actors. Even if you’re not mining, you’re still benefiting from it.

Watch it. Understand it. But don’t panic over short-term dips. The long-term trend has been up-for over 15 years. And as long as miners keep investing, the network will keep getting stronger.

Abhishek Bansal

December 12, 2025 AT 22:49Albert Chau

December 14, 2025 AT 18:47Bridget Suhr

December 16, 2025 AT 06:01Jessica Petry

December 18, 2025 AT 02:17Scot Sorenson

December 19, 2025 AT 04:07Ike McMahon

December 20, 2025 AT 10:28Anselmo Buffet

December 22, 2025 AT 06:13Joey Cacace

December 23, 2025 AT 03:12Taylor Fallon

December 23, 2025 AT 19:18PRECIOUS EGWABOR

December 24, 2025 AT 13:28