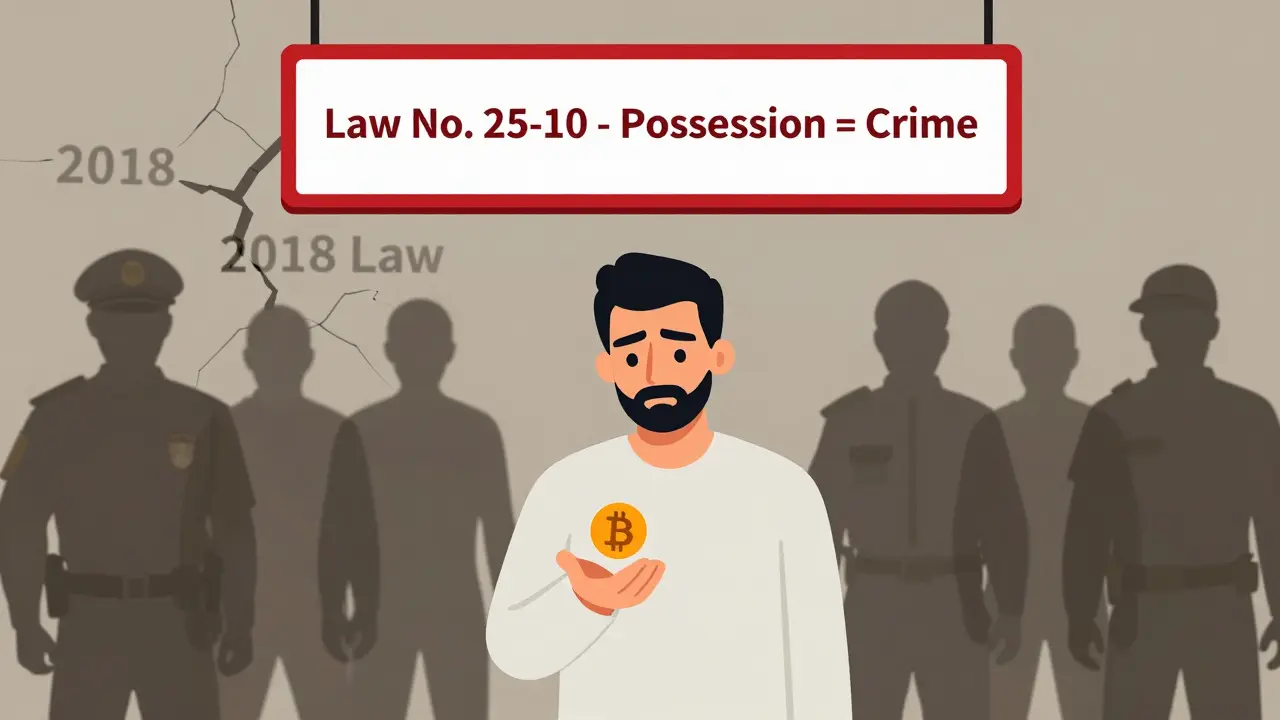

Algeria's 2018 Financial Law began a crypto ban that evolved into a total criminal prohibition by 2025. Now, owning, trading, or even discussing cryptocurrency can lead to jail time and heavy fines.

2018 Financial Law: How Crypto Regulations Shaped Today's Trading Landscape

When we talk about 2018 Financial Law, a wave of global regulatory moves that defined how governments treated digital assets. Also known as crypto regulatory framework, it was the year governments stopped pretending crypto was a passing trend and started writing real rules. This wasn’t just about taxes—it was about control. Countries began drawing lines: what you could trade, where you could trade it, and who had to report it. These rules didn’t disappear. They evolved. And today, every crypto tax form you fill out, every exchange you use, and every airdrop you chase traces back to decisions made in 2018.

That year, the U.S. IRS declared crypto property, not currency. That single move forced millions to track every trade, not just cash-outs. Meanwhile, China moved to shut down exchanges, India started taxing gains at 30%, and countries like Japan and Switzerland rushed to create licensing systems. These weren’t isolated actions—they were a global chain reaction. Crypto tax policy, the system that determines how much you owe when you sell or trade digital assets became a minefield overnight. Financial compliance, the process of following legal rules for reporting and holding assets turned from a back-office task into a daily habit for traders. And crypto exchange rules, the legal requirements platforms must meet to operate legally went from vague suggestions to strict licensing hoops.

Look at the posts below. You’ll see how today’s China P2P traders use VPNs because of 2018’s early restrictions. You’ll see why India’s 30% tax and 1% TDS feel so harsh—they’re the direct result of rules first tested in 2018. Portugal’s tax-free holding rule? That’s a reaction to the same pressure. Even scams like Bitskrix and BitbabyExchange thrive because the 2018 crackdown left a gap: legitimate platforms got regulated, but the unregulated space exploded. The 2018 Financial Law didn’t kill crypto. It forced it to grow up. And now, every time you trade, stake, or claim an airdrop, you’re still navigating the system it built.