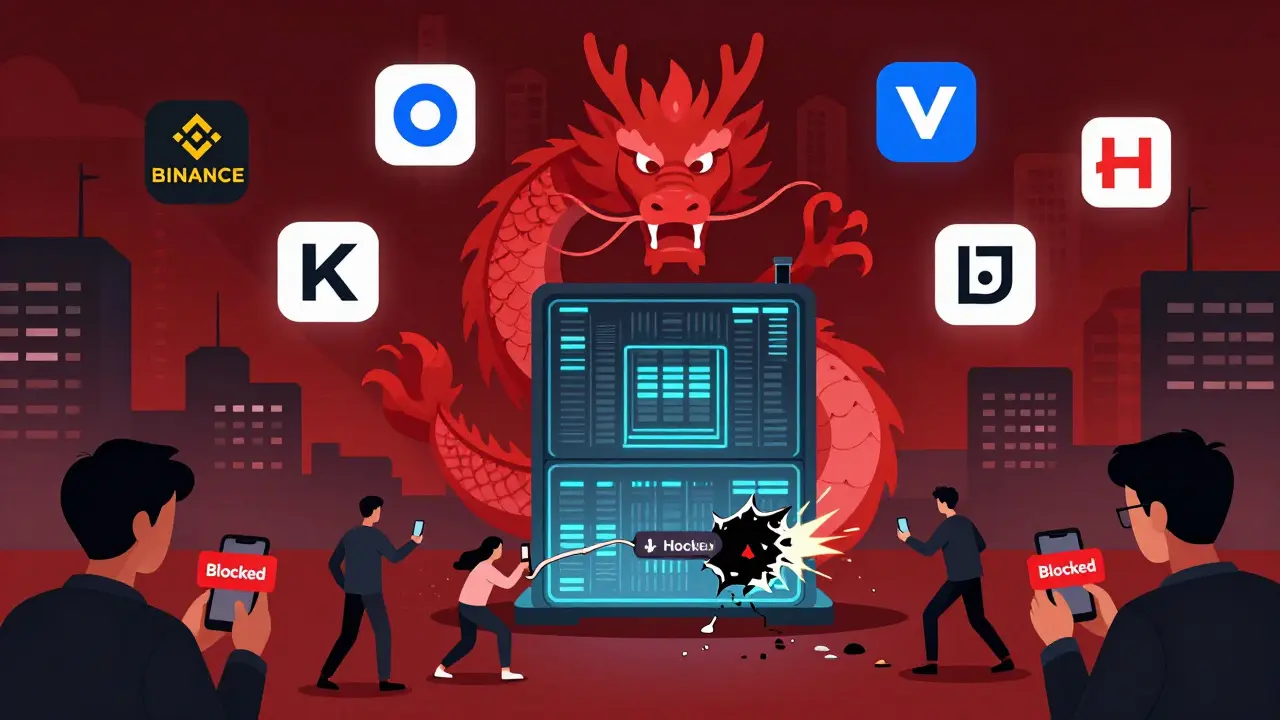

China has banned all major crypto exchanges since 2017, with strict enforcement through internet blocks, financial restrictions, and surveillance. Holding crypto isn't illegal, but trading is. Learn which exchanges are blocked and how Chinese users bypass the ban in 2025.

Binance China: What Happened and How Crypto Trading Still Lives in China

When Binance China, the local arm of the world’s largest crypto exchange, was forced to shut down in 2021 by Chinese regulators. It wasn’t the end of crypto in China—it was just the beginning of a quieter, more hidden version of it. The ban didn’t stop people from trading. It just pushed them underground. Today, you won’t find Binance China on the web, but you’ll still find Chinese traders buying and selling crypto through peer-to-peer networks, encrypted apps, and USDT as the silent backbone of it all.

What most outsiders don’t realize is that P2P crypto China, a decentralized, person-to-person trading system that bypasses centralized exchanges. Also known as peer-to-peer cryptocurrency, it’s how millions still get access to Bitcoin and Ethereum without breaking the law on paper. Traders use WeChat, Telegram, and VPNs to connect. Payments flow through bank transfers, Alipay, or WeChat Pay—sometimes even cash. And the currency of choice? USDT, Tether’s stablecoin, which trades at $1 and acts as the bridge between fiat and crypto in places where direct exchanges are banned. It’s not glamorous. It’s not easy. But it works. And in 2025, it’s thriving.

The Chinese government didn’t just ban exchanges. They cracked down on mining, advertising, and even crypto-related content. But crypto doesn’t care about borders or bans. It moves through people. And in China, people found ways. The risk is real—account freezes, fines, even arrests for large-scale operations. But for many, the reward is worth it: access to global markets, protection from inflation, and financial freedom outside the state-controlled banking system.

What you’ll find in the posts below isn’t just history. It’s a map. You’ll see how traders avoid detection, why USDT is more than just a token, and how the same tools that kept crypto alive in China are now being used in other restricted markets. You’ll also see how scams popped up in the vacuum left by Binance China—and how to spot them. This isn’t about breaking rules. It’s about understanding how crypto survives when governments try to erase it.