Bitcoin's declining block reward schedule cuts mining rewards in half every four years, creating scarcity and limiting total supply to 21 million coins. Learn how halvings shape price, miner economics, and Bitcoin's long-term future.

Bitcoin Scarcity: Why Limited Supply Makes It Digital Gold

When we talk about Bitcoin scarcity, the fixed and predictable limit of 21 million Bitcoin that can ever exist. Also known as Bitcoin’s hard cap, it’s the core reason Bitcoin behaves like digital gold—not like a stock or a meme coin that can be printed at will. Unlike traditional money, where central banks can print more bills or create digital reserves, Bitcoin’s supply is coded into its protocol. No one, not even its creator, can change it. This isn’t a marketing claim—it’s math enforced by thousands of computers worldwide.

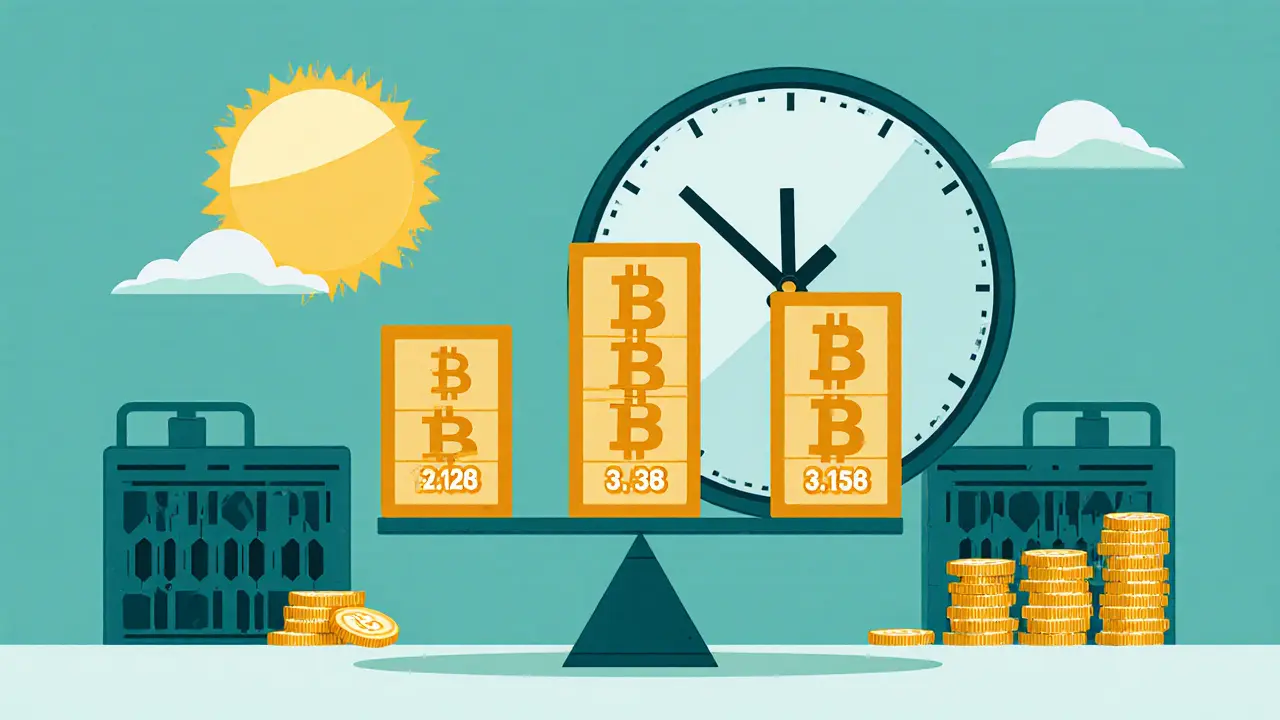

This scarcity isn’t just about the total number. It’s about how new Bitcoin enters circulation through Bitcoin mining, the process where miners solve complex puzzles to validate transactions and earn newly minted Bitcoin as a reward. Every four years, that reward gets cut in half in an event called the halving, a scheduled reduction in Bitcoin mining rewards that slows down new supply. The last halving in 2024 dropped the reward from 6.25 to 3.125 Bitcoin per block. The next one will cut it again. This predictable decay is why Bitcoin’s inflation rate is falling toward zero—unlike fiat currencies that lose value every year.

People often confuse scarcity with price. Just because Bitcoin is scarce doesn’t mean it’s always expensive. But over time, when demand grows and supply shrinks due to halvings, the pressure on price increases. That’s why early adopters who held onto their Bitcoin saw it go from pennies to tens of thousands. It’s not magic—it’s basic economics: limited supply + rising demand = higher value.

Other cryptocurrencies can copy Bitcoin’s code, but they can’t copy its scarcity. Many have unlimited supplies, or their creators can mint more tokens whenever they want. That’s why Bitcoin stands out. It’s the only major crypto with a hard cap that’s been tested for over 15 years, through crashes, hype cycles, and global financial shifts. Its scarcity isn’t theoretical—it’s operational, visible, and unchangeable.

What you’ll find below are real stories about how this scarcity plays out in the wild: from airdrops that failed because they didn’t understand supply limits, to exchanges that tried to fake scarcity with fake tokens, to DeFi projects that borrowed Bitcoin’s model and got it wrong. Some posts show how people got scammed by pretending to offer "limited" tokens. Others explain why Bitcoin’s design still works when everything else collapses. This isn’t theory—it’s what happens when money is built to last, not to be manipulated.