Bitcoin's declining block reward schedule cuts mining rewards in half every four years, creating scarcity and limiting total supply to 21 million coins. Learn how halvings shape price, miner economics, and Bitcoin's long-term future.

Bitcoin supply cap: What it is, why it matters, and how it shapes crypto

When you hear Bitcoin supply cap, the hard limit of 21 million Bitcoin that can ever exist. Also known as Bitcoin maximum supply, it's not just a technical detail—it's the core reason Bitcoin behaves like digital gold instead of digital cash. Unlike every other cryptocurrency that can print more tokens, Bitcoin’s code locks the total at 21 million. No exceptions. No inflationary tweaks. No central bank deciding to print more. This is the one rule that never changes, even when everything else in crypto does.

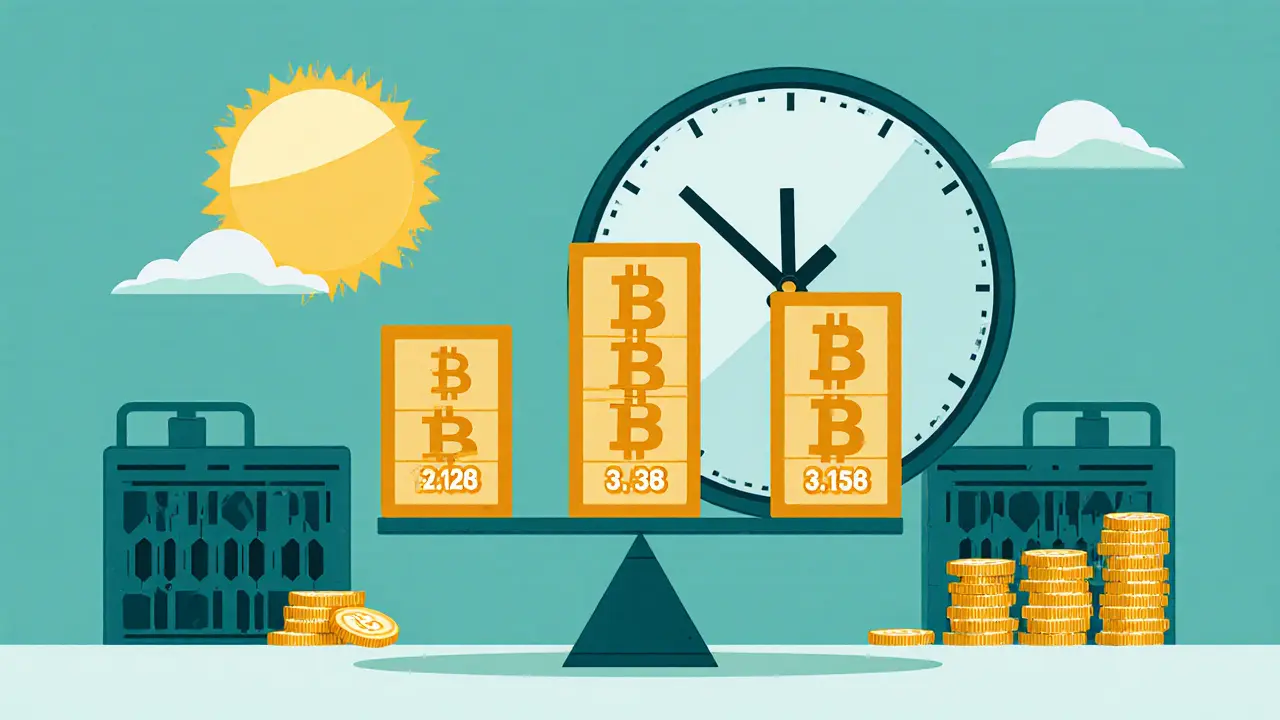

This cap directly ties into Bitcoin halving, the event that cuts miner rewards in half roughly every four years. Every time it happens, fewer new Bitcoin enter circulation, making each existing coin slightly rarer. That’s why the halving isn’t just a mining update—it’s a market event. It’s why people watch the calendar like it’s a stock split. And it’s why the Bitcoin scarcity, the idea that Bitcoin’s fixed supply creates inherent value. isn’t just theory—it’s what drives long-term holders to buy and hold, even when prices drop.

The Bitcoin supply cap also separates Bitcoin from every other crypto project. Most tokens have no hard limit. Some even have infinite supply. Others can be minted by their teams at will. Bitcoin doesn’t work that way. Its supply schedule is baked into the code, verified by every node on the network, and enforced by consensus. That’s why, even when a new coin promises "better tech," if it doesn’t have a fixed cap, it doesn’t have the same trust model. The cap isn’t just a number—it’s a promise.

And it’s not just about scarcity. It’s about predictability. You can calculate exactly how many Bitcoin will exist in 2030, 2040, or 2140. No guesswork. No surprise inflation. That’s why institutions, from pension funds to hedge funds, treat Bitcoin differently than other assets. They don’t just like the tech—they like the math.

What you’ll find below are real stories about what happens when this cap meets real markets. From airdrops that tried to ride Bitcoin’s hype without understanding its rules, to exchanges that misunderstood tokenomics and lost trust, to scams that pretended to offer "unlimited Bitcoin"—every post here ties back to one truth: Bitcoin’s supply cap isn’t just a feature. It’s the foundation.