Bitcoin's declining block reward schedule cuts mining rewards in half every four years, creating scarcity and limiting total supply to 21 million coins. Learn how halvings shape price, miner economics, and Bitcoin's long-term future.

Block Reward Schedule: How Crypto Miners and Validators Get Paid

When you hear about block reward schedule, the predetermined system that controls how new cryptocurrency tokens are issued to network participants. It's not just a technical detail—it's the engine that keeps Bitcoin, Ethereum, and dozens of other blockchains running. Also known as token issuance schedule, it determines how much new crypto enters circulation, who gets it, and when it slows down or stops. This system is what makes crypto networks self-sustaining without banks or central authorities.

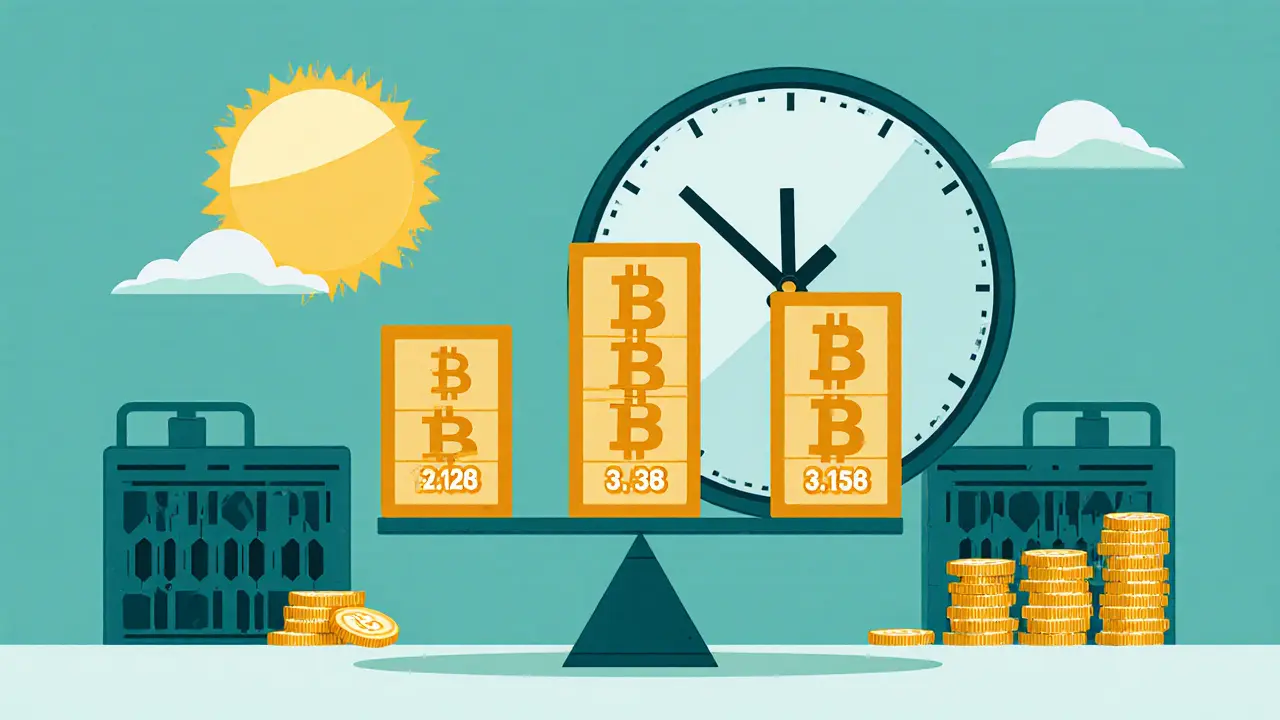

There are two main ways block rewards are handed out: mining rewards, the payments given to miners who solve complex math problems to secure proof-of-work chains like Bitcoin, and validator rewards, the earnings for stakers who lock up crypto to validate transactions on proof-of-stake networks like Ethereum or Solana. These aren’t the same thing. Bitcoin’s block reward started at 50 BTC and cuts in half roughly every four years. Ethereum stopped mining entirely in 2022 and now pays validators based on how much ETH they stake and how many people are on the network. One is about brute-force computing power; the other is about economic commitment.

The block reward schedule isn’t just about money—it shapes incentives, security, and even price. When rewards drop, miners or validators must rely more on transaction fees to stay profitable. If fees don’t rise enough, networks can become less secure. That’s why Bitcoin’s halvings are watched like clockwork—they’ve historically triggered market cycles. Meanwhile, Ethereum’s validator rewards fluctuate daily based on total staked ETH, making them harder to predict but more responsive to network demand. You can’t understand crypto economics without knowing how these rewards are structured, when they change, and what happens when they shrink.

Most of the posts here show how people chase airdrops, analyze tokens, or avoid scams—but behind every token’s value is a reward system that controls its supply. Whether it’s a new GameFi coin paying out tokens to early users or a Layer 1 blockchain adjusting validator commissions, the same logic applies: who gets paid, and how much, defines the network’s health. You’ll find posts here about Radiant Capital’s lending rewards, validator economics on Ethereum, and even how fake airdrops mimic real reward structures to trick users. The truth is, if you don’t know how the block reward schedule works, you’re guessing at why prices move. This collection cuts through the noise to show you exactly how crypto pays its keepers—and why that matters more than any tweet or hype cycle.