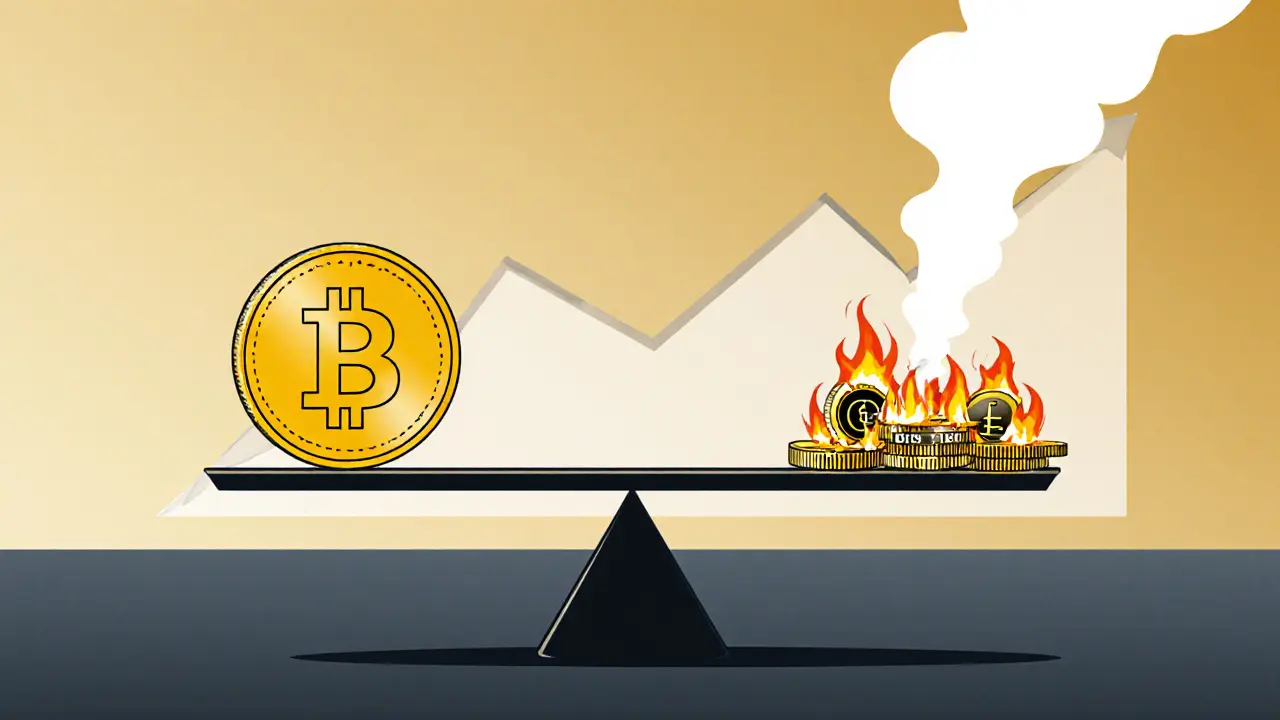

Deflationary cryptocurrencies like Bitcoin and BNB use supply reduction to create scarcity, but real value comes from utility, not just burns. Learn how tokenomics, real-world burns, and hybrid models are shaping the future of digital money.

BNB Burn: What It Is and Why It Matters for Binance and Crypto Investors

When you hear BNB burn, a scheduled process where Binance destroys a portion of its native BNB token to reduce total supply. Also known as BNB token burn, it’s one of the few crypto mechanisms that actually removes coins from circulation instead of printing more. Unlike most tokens that inflate over time, BNB gets smaller with every burn — and that’s intentional.

The Binance ecosystem, the network of exchanges, tools, and services built around Binance. Also known as Binance platform, it relies on BNB for fees, staking, and access to exclusive features. Every time you pay trading fees in BNB, you get a discount. And every time Binance burns BNB, it makes the remaining coins scarcer — which can push prices up. This isn’t marketing fluff. Binance has done this every quarter since 2017, and they’ve destroyed over 50% of the original supply. That’s not a rumor — it’s public data.

What’s interesting is how this ties into other crypto concepts you’ve seen here. The cryptocurrency supply reduction, the deliberate shrinking of a token’s total supply to create scarcity and potential price appreciation. Also known as token deflation, it is the core idea behind BNB burn. It’s the same logic that makes Bitcoin valuable — limited supply. But BNB takes it further by making it predictable. You know exactly when the next burn happens. You can even track how many coins were destroyed in real time. That transparency is rare in crypto.

And it’s not just about price. BNB burn supports the whole BNB tokenomics, the economic design of Binance Coin, including its utility, distribution, and supply rules. Also known as BNB economic model, it. Every burn reinforces trust. It shows Binance isn’t just collecting fees — it’s aligning its incentives with holders. If you own BNB, you’re not just holding a token. You’re part of a system that gets stronger as it shrinks.

You’ll find posts here that dive into airdrops, scams, and exchange reviews — but the BNB burn is one of the few crypto mechanics that actually works as promised. It’s not hype. It’s math. And it’s been running for years. Below, you’ll see how this concept connects to real events — like token launches on BSC, how burn cycles affect trading volume, and why some projects copy this model while others fail at it. This isn’t theory. It’s what’s happening right now, in real time, on one of the biggest blockchains in the world.