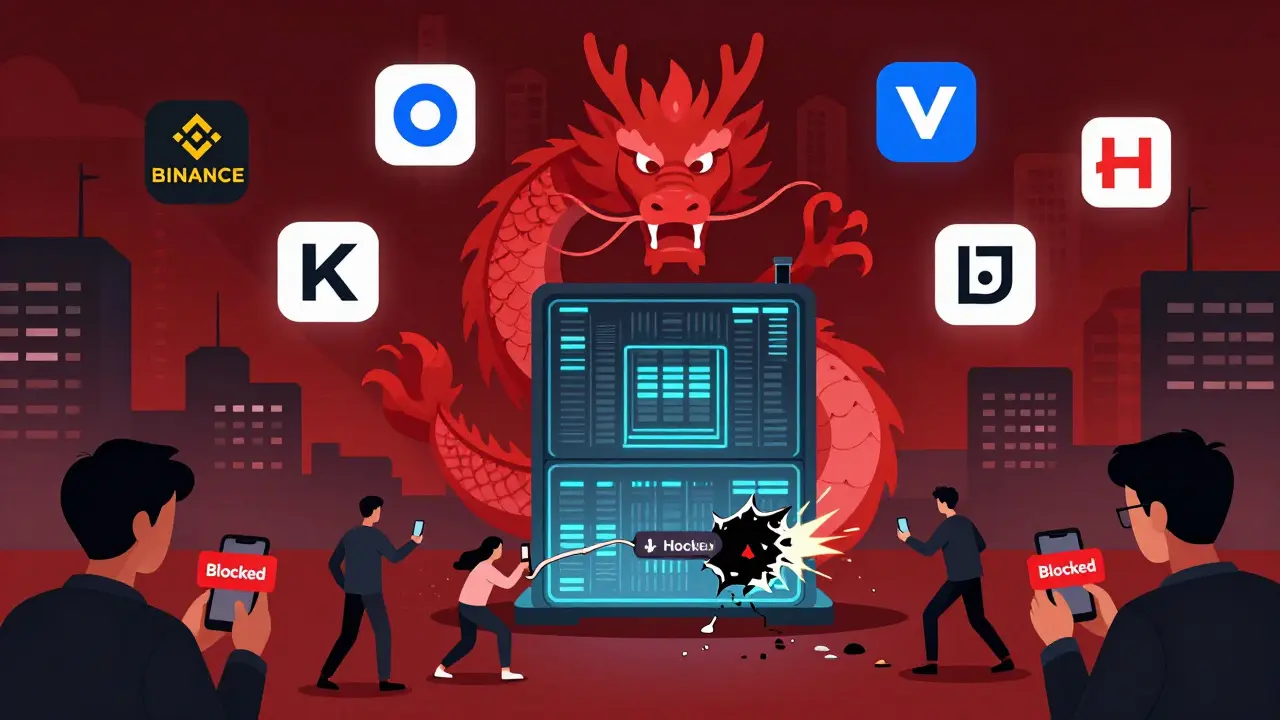

China has banned all major crypto exchanges since 2017, with strict enforcement through internet blocks, financial restrictions, and surveillance. Holding crypto isn't illegal, but trading is. Learn which exchanges are blocked and how Chinese users bypass the ban in 2025.

Crypto Exchanges Banned in China: What Happened and How Traders Adapt

When China shut down its crypto exchanges, regulated platforms that let users buy, sell, and trade digital assets. Also known as centralized crypto trading platforms, it was meant to cut off access to Bitcoin, Ethereum, and other coins. But the ban didn’t kill crypto—it pushed it into the shadows, where it’s still very much alive.

The crackdown in 2021 forced big names like Binance and OKX to stop serving Chinese users directly. But people didn’t stop trading. Instead, they turned to peer-to-peer (P2P) crypto trading, a system where individuals trade directly with each other, often using cash or bank transfers. This method bypasses exchanges entirely, making it harder for regulators to track. Most of these trades happen using USDT, Tether, a stablecoin pegged to the U.S. dollar. Because it holds its value and moves quickly across borders, USDT became the unofficial currency of underground crypto trading in China. Traders use encrypted apps, local payment methods like WeChat Pay, and sometimes even VPNs to hide their activity. It’s not perfect—there’s risk, scams, and legal gray zones—but it works.

What’s surprising is how resilient this system is. Even in 2025, with tighter surveillance and more AI-powered monitoring, P2P volumes in China remain high. People aren’t just speculating—they’re using crypto to protect savings from inflation, send money overseas, or pay for goods when traditional banking fails them. The ban didn’t stop demand; it just changed how it’s fulfilled.

What you’ll find in the posts below isn’t just news about the ban—it’s the real story of how people adapted. From how traders avoid detection to why USDT dominates, from the tools they use to the risks they take. This isn’t theoretical. These are real tactics, real stories, and real consequences. If you want to understand crypto in China today, this is where the truth lives.