Deflationary cryptocurrencies like Bitcoin and BNB use supply reduction to create scarcity, but real value comes from utility, not just burns. Learn how tokenomics, real-world burns, and hybrid models are shaping the future of digital money.

Crypto Scarcity: Why Limited Supply Drives Value in Digital Assets

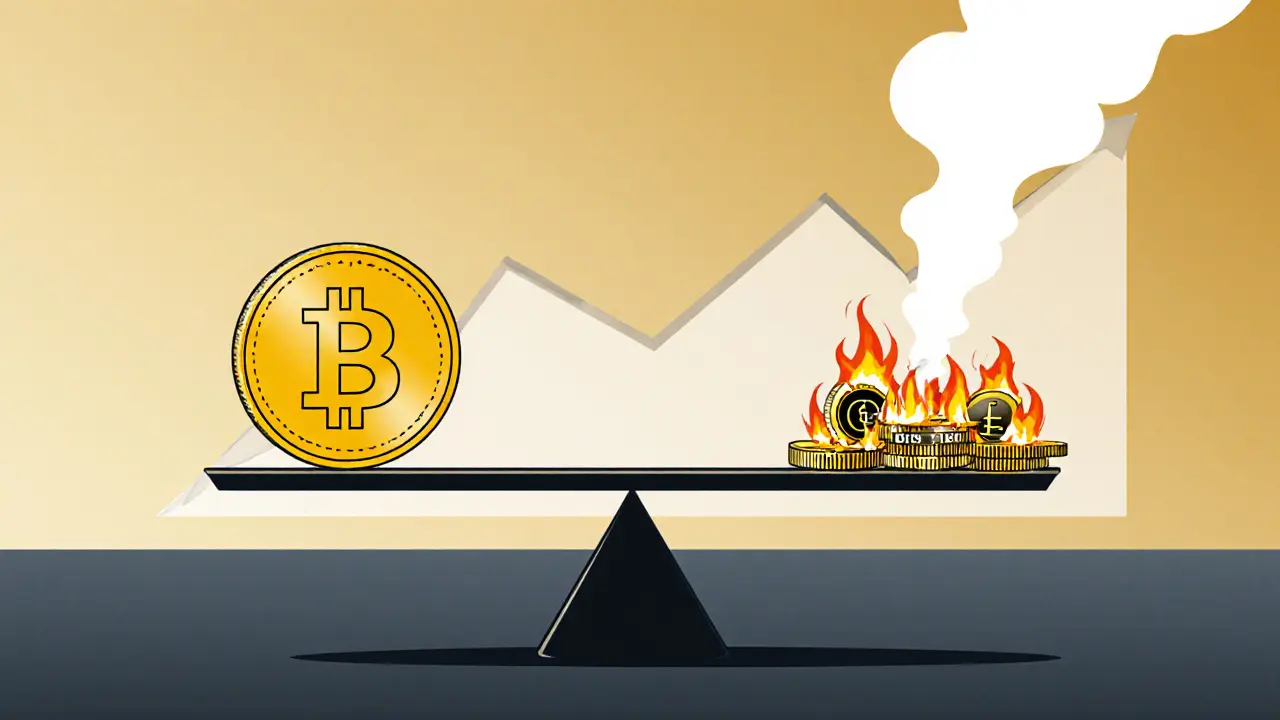

When we talk about crypto scarcity, the deliberate limitation of a cryptocurrency’s total supply to create value through rarity. Also known as digital scarcity, it’s the core reason Bitcoin has value—not because it’s digital, but because only 21 million will ever exist. Unlike traditional money that central banks can print endlessly, most serious cryptocurrencies are built with hard caps. This isn’t just a technical detail—it’s an economic promise. And when that promise breaks, like with tokens that suddenly dump millions of new coins on the market, prices crash fast.

True tokenomics, the design of a cryptocurrency’s economic system, including supply, distribution, and incentive structures isn’t just about how many coins exist—it’s about how they’re released, who controls them, and whether the supply can actually be changed. Look at blockchain economics, the study of how incentives, supply limits, and network participation shape long-term value. Projects like Bitcoin and Monero stick to fixed supplies. Others, like many meme coins or poorly designed DeFi tokens, have no real cap—or worse, the team can mint more anytime. That’s not scarcity. That’s inflation in disguise. And users notice. When a token’s supply isn’t locked, trust evaporates. You see this in the posts below: the ones that survive are the ones with clear, unchangeable limits. The ones that vanish? They promised scarcity but delivered endless supply.

Scarcity alone doesn’t guarantee success. You also need demand. But without scarcity, demand has nowhere to land. That’s why fake airdrops, inflated tokenomics, and unbacked NFTs keep failing—they’re built on the illusion of value, not the reality of limits. The posts here don’t just list projects—they expose which ones actually honor scarcity and which ones are just spinning numbers. Whether it’s a token with zero trading volume, a staking reward system that floods the market, or a coin that’s been abandoned after a one-time distribution, the pattern is clear: crypto scarcity is the invisible hand that separates lasting assets from digital ghosts.