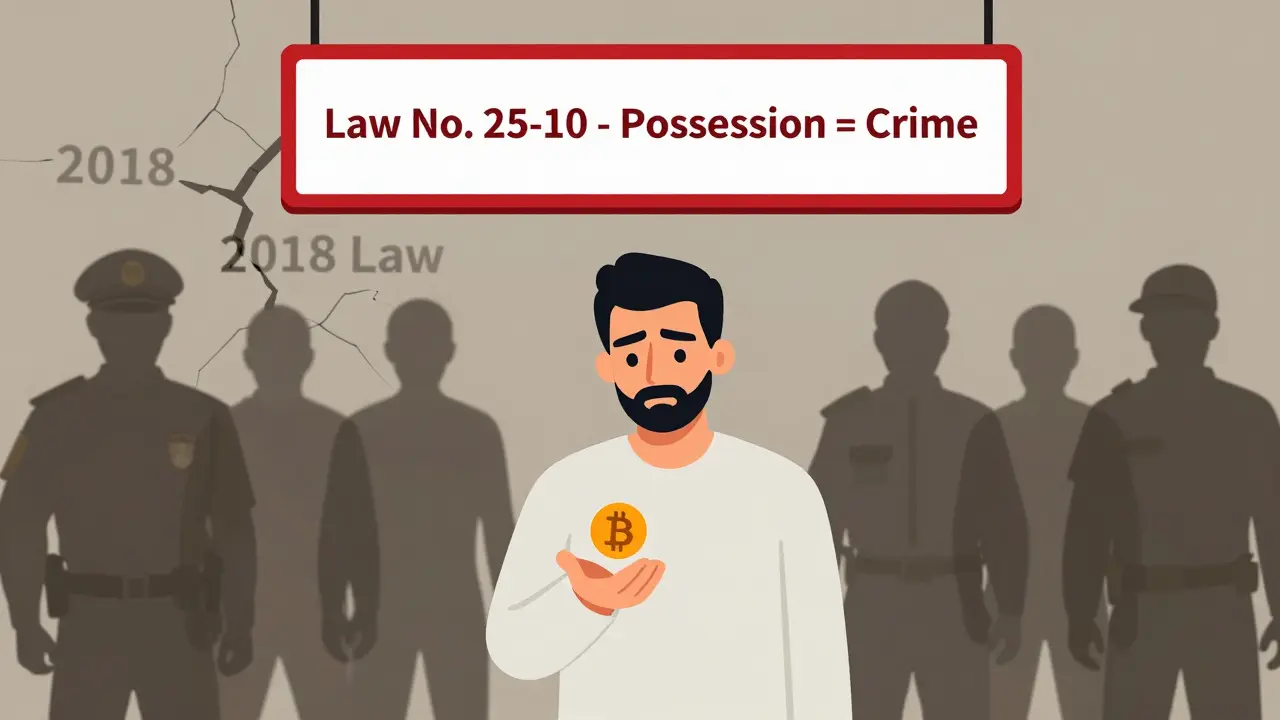

Algeria's 2018 Financial Law began a crypto ban that evolved into a total criminal prohibition by 2025. Now, owning, trading, or even discussing cryptocurrency can lead to jail time and heavy fines.

Cryptocurrency Prohibition: What Bans Really Mean for Traders and Holders

When a government enacts a cryptocurrency prohibition, a legal restriction that blocks or severely limits the use, trading, or ownership of digital assets. Also known as crypto ban, it doesn’t always mean crypto disappears—it just goes underground. Countries like China, India, and Thailand have tried to shut down exchanges, block websites, and punish users. But crypto doesn’t vanish. It adapts.

Take China’s crypto ban, a sweeping 2021 crackdown that outlawed crypto trading platforms and mining operations. The government didn’t ban holding Bitcoin—it banned exchanges, banks, and payment processors from touching it. So people turned to peer-to-peer trading using USDT, encrypted apps, and VPNs. In 2025, P2P markets in China are still active, quietly moving billions. This isn’t a loophole—it’s a workaround built by real people who need financial freedom.

Crypto tax enforcement, the government’s system for tracking, taxing, and penalizing crypto activity. India, for example, hits traders with a 30% tax on gains, 1% TDS on every trade, and 18% GST on platform fees. Even if you trade on a foreign exchange, the taxman still wants his cut. Offshore accounts don’t help. Reporting is mandatory. Penalties? Up to 50% of what you owe, plus interest and possible prosecution. Meanwhile, places like Portugal changed their rules to attract investors—holding crypto over a year means zero capital gains. The difference? One country tries to crush crypto. The other tries to profit from it.

Then there’s crypto exchange regulations, the legal framework that forces platforms to register, verify users, and follow strict rules. Thailand’s SEC now blocks all unlicensed exchanges. Bybit and OKX? Blocked. Only nine local platforms are allowed. That’s not innovation—it’s control. But it also means users have fewer risky options. In the U.S., regulators don’t ban crypto—they sue it. In Europe, MiCA is coming, forcing exchanges to prove they’re safe before they can operate.

What all these rules have in common? They’re reactions—not solutions. Governments fear loss of control. They worry about money laundering, capital flight, or citizens bypassing traditional banking. But they don’t stop people from using crypto. They just make it harder, riskier, and more expensive.

You’ll find posts here that show how traders in China still buy Bitcoin using WeChat. How Indian users are getting fined for not reporting their Coinbase trades. How Thailand’s approved exchanges now charge more and offer fewer coins. How some crypto projects vanish overnight because they can’t comply with new rules. This isn’t about whether crypto should be banned. It’s about what happens when it is—and how real people keep going anyway.