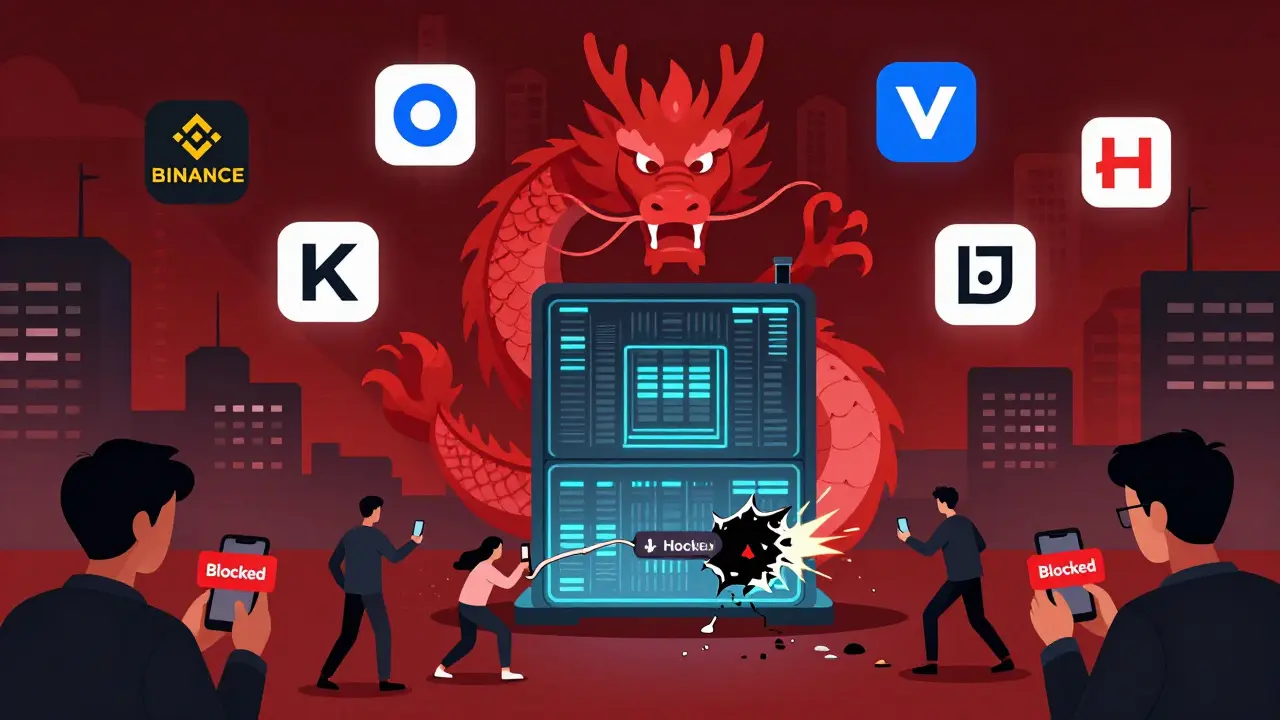

China has banned all major crypto exchanges since 2017, with strict enforcement through internet blocks, financial restrictions, and surveillance. Holding crypto isn't illegal, but trading is. Learn which exchanges are blocked and how Chinese users bypass the ban in 2025.

Cryptocurrency Restrictions in China: What’s Really Happening After the Ban

When China cracked down on cryptocurrency in 2021, it didn’t just shut down exchanges—it tried to erase digital money from daily life. But cryptocurrency restrictions in China, a sweeping government policy aimed at controlling financial flows and maintaining monetary sovereignty. Also known as China’s crypto ban, it targeted exchanges, mining, and public trading—but not individual ownership or peer-to-peer activity. The ban wasn’t about stopping crypto forever. It was about pushing it underground, where it’s harder to track, harder to regulate, and surprisingly, harder to kill.

What followed wasn’t silence. It was adaptation. P2P crypto China, a decentralized trading model where users buy and sell crypto directly with each other, often using local currency. Also known as peer-to-peer cryptocurrency, it became the lifeline for millions who still wanted to hold Bitcoin or USDT. Traders use encrypted apps, VPNs, and cash meetups to avoid detection. USDT China, the dominant stablecoin used to bypass capital controls and preserve value. Also known as Tether in China, it’s the de facto currency for underground crypto markets because it’s stable, fast, and widely accepted. Even banks that once refused crypto now quietly process P2P payments through third-party gateways. The government can block websites, but it can’t block people who know how to talk to each other.

And it’s not just about survival. It’s about evolution. The ban forced users to get smarter. They learned how to store crypto in cold wallets, how to verify trade partners without KYC, and how to spot scams in a market with zero oversight. Meanwhile, other countries like Thailand and Algeria are following China’s lead with their own bans—but they’re not seeing the same underground resilience. Why? Because China’s tech-savvy population, combined with its massive informal economy, created a perfect storm for crypto to keep running.

What you’ll find below aren’t just articles about a policy. They’re real stories from inside the system—how traders avoid detection, how USDT moves through hidden channels, and why the ban failed to stop crypto, even as it changed how it works. These aren’t theoretical debates. They’re tactics, tools, and truths from people who are still trading today.