Deflationary cryptocurrencies like Bitcoin and BNB use supply reduction to create scarcity, but real value comes from utility, not just burns. Learn how tokenomics, real-world burns, and hybrid models are shaping the future of digital money.

Deflationary Cryptocurrencies: How Scarce Tokens Shape Crypto Value

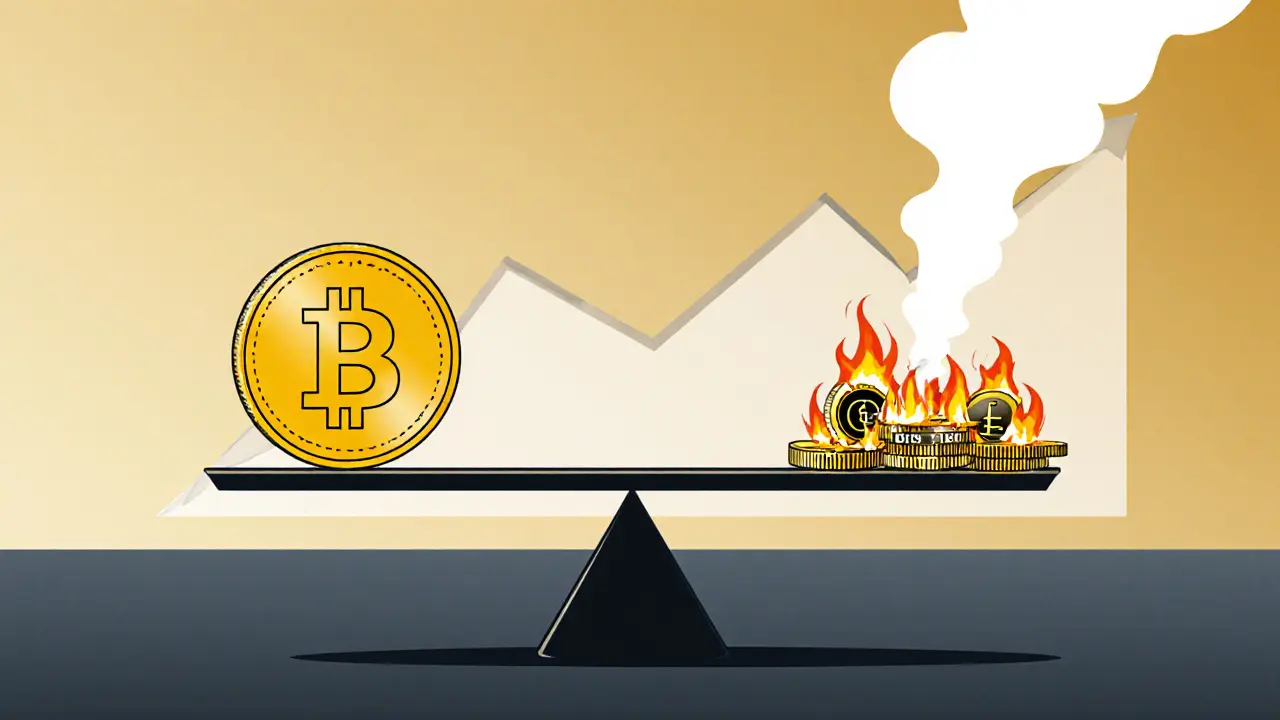

When you hear deflationary cryptocurrencies, digital assets designed to decrease in total supply over time to create scarcity and potentially increase value. Also known as token-burning coins, they’re built on the idea that less supply means higher demand—like gold, but coded into blockchain rules. This isn’t just theory. Projects like Bitcoin (with its halving schedule) and Binance Coin (with regular token burns) prove it can work in practice. But not every coin that calls itself deflationary actually delivers—and many are just marketing fluff.

What makes a cryptocurrency truly deflationary? It’s not just a low supply. It’s the token burn, a process where coins are permanently removed from circulation by sending them to an unrecoverable wallet address. Also known as supply reduction mechanism, this is how projects like BNB, SHIB, and others actively shrink their total supply. Compare that to fixed supply, a hard cap on how many coins can ever exist, with no new coins created after that limit. Also known as maximum supply coins, this is how Bitcoin works—21 million coins, full stop. The difference matters. A fixed supply is passive scarcity. A token burn is active scarcity. One just sits there. The other keeps shrinking.

But here’s the catch: scarcity alone doesn’t guarantee price growth. If no one wants to use the coin, burning tokens just makes the remaining ones harder to trade. That’s why many deflationary tokens fail—no real utility, no community, no reason to hold. Look at the posts below. You’ll see examples of tokens that burned coins but still crashed because no one cared. And others that used tokenomics smartly, built real products, and kept value even when markets turned.

What you’ll find here isn’t hype. It’s real cases: airdrops that promised scarcity but delivered nothing, exchanges that listed deflationary coins with no liquidity, and projects that actually made supply reduction work for users. You’ll learn how to spot the difference between a token burn that means something—and one that’s just a fancy name for a dead coin.