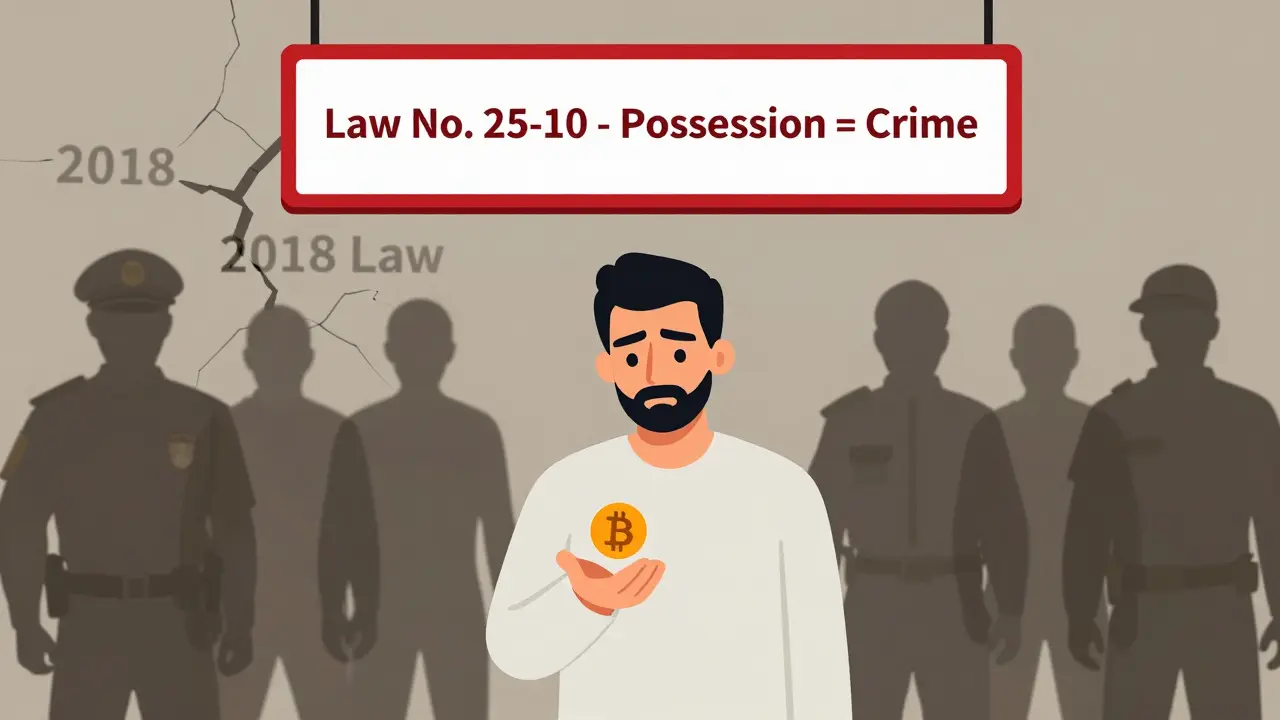

Algeria's 2018 Financial Law began a crypto ban that evolved into a total criminal prohibition by 2025. Now, owning, trading, or even discussing cryptocurrency can lead to jail time and heavy fines.

Digital Currency Ban: What Happens When Countries Crack Down on Crypto

When a government issues a digital currency ban, a legal prohibition on using or trading cryptocurrencies within its borders. Also known as cryptocurrency restrictions, it doesn’t erase crypto—it just forces it into the shadows. Countries like China, India, and Thailand have tried to shut down crypto trading, thinking they can stop people from using Bitcoin or USDT. But history shows bans rarely work the way they’re meant to.

Take China’s crypto ban, the strict 2021 crackdown that shut down exchanges and blocked access to foreign platforms. The government thought they’d kill crypto overnight. Instead, peer-to-peer trading exploded. People used VPNs, encrypted apps, and USDT to keep trading. Even today, in 2025, millions of Chinese users bypass the ban daily. It’s not a loophole—it’s human behavior. People want control over their money, and they’ll find a way. Meanwhile, crypto regulation, the legal framework governments use to control or monitor digital assets, is shifting. Thailand now licenses only nine exchanges. India taxes crypto at 30% and demands TDS on every trade. These aren’t bans—they’re control mechanisms. And they’re catching up to users who thought offshore trading would hide them.

What these policies miss is simple: crypto isn’t just about exchanges. It’s about wallets, private keys, and peer-to-peer networks. You can block a website, but you can’t block a seed phrase. You can fine a trader, but you can’t stop someone from sending USDT through a messaging app. The real story behind every digital currency ban isn’t enforcement—it’s adaptation. The posts below show exactly how that plays out: how traders in China keep moving crypto, how Indian users face 50% penalties for underreporting, how Thai residents lost access to Bybit overnight, and how scams fill the vacuum left by official platforms. You’ll see what works, what fails, and why the next ban will likely follow the same pattern. This isn’t theory. It’s what’s happening right now—on the ground, in real wallets, under the radar.