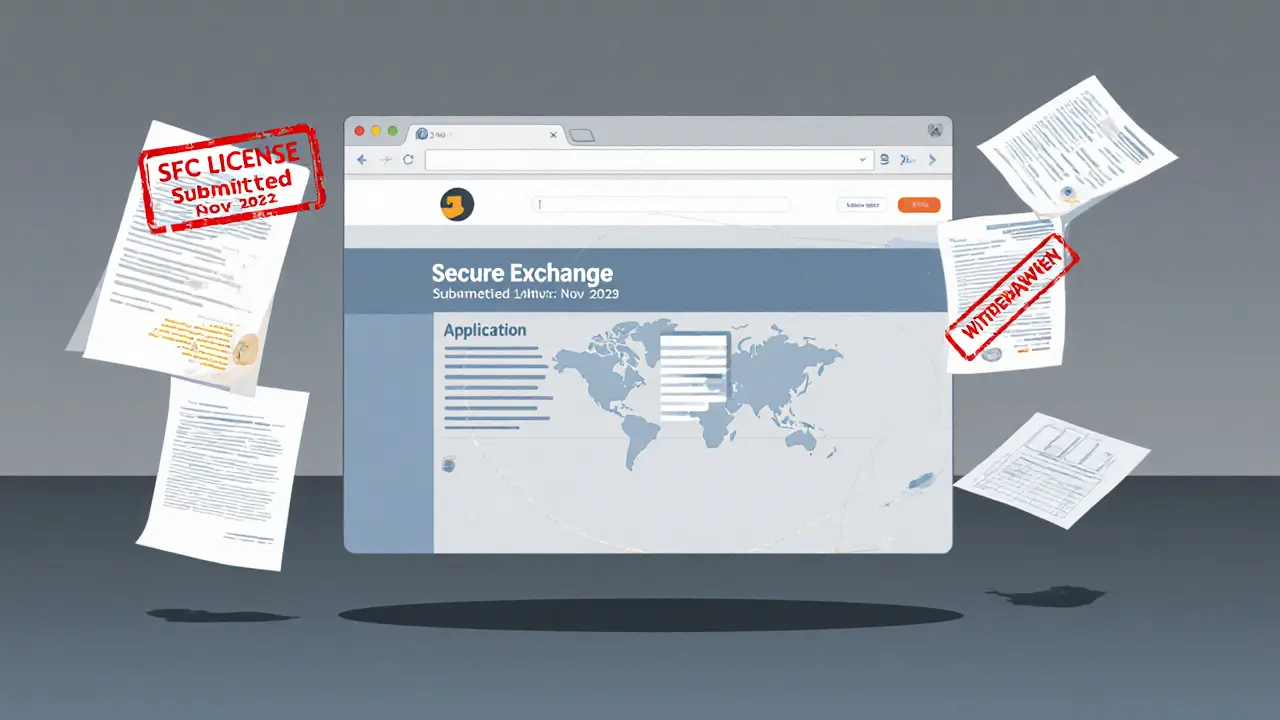

VAEX crypto exchange withdrew its Hong Kong license application in May 2024 and has been inactive since. No trading volume, no user reviews, no regulatory approval - it never became a real platform.

Hong Kong Crypto License: What You Need to Know About Regulation and Compliance

When it comes to Hong Kong crypto license, a legal requirement for virtual asset service providers operating in Hong Kong under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance. Also known as a Virtual Asset Service Provider (VASP) license, it’s no longer a suggestion—it’s the only way to legally offer crypto trading, custody, or exchange services in the region. Since June 2023, the Securities and Futures Commission (SFC) has enforced strict rules that force platforms to apply for licensing or shut down. This isn’t just about compliance; it’s about trust. If you’re trading, investing, or running a business in crypto and you’re connected to Hong Kong, you need to understand this system—or risk losing access to your funds.

The Virtual Asset Service Provider (VASP) license, a regulatory framework issued by Hong Kong’s SFC to authorize crypto platforms to operate legally requires companies to prove they have strong security, clear ownership, anti-fraud systems, and real-time transaction monitoring. It’s not easy. Only a handful of exchanges like HashKey and OSL have gotten approved so far. That’s because the SFC doesn’t just check paperwork—they audit infrastructure, interview team members, and test how fast they can freeze suspicious accounts. For users, this means fewer shady platforms, but also fewer choices. If a platform doesn’t display its license number publicly, don’t trust it. The government doesn’t warn you—your money does.

What about individual traders? You don’t need a license to buy Bitcoin or hold Ethereum in your wallet. But if you’re running a crypto business—like a peer-to-peer service, a token launch, or even a local ATM—you’re now in the crosshairs. The Hong Kong Monetary Authority (HKMA), the central banking authority that works with the SFC to oversee financial stability and anti-money laundering efforts in Hong Kong is tightening ties with banks to block accounts linked to unlicensed crypto activity. One user got their bank account frozen because they deposited $10,000 in ETH from an unlicensed exchange. No charges, no warning—just silence. That’s the new reality.

And it’s not just about exchanges. The crypto regulation Hong Kong, the comprehensive legal framework governing virtual assets, including licensing, taxation, and investor protection rules enforced by the SFC system now includes rules for stablecoins, NFTs, and DeFi protocols that interact with local users. If a project markets itself to Hong Kong residents—even through a Discord server—it could be considered targeting the market. That’s why some projects now block Hong Kong IPs. It’s not censorship. It’s survival.

There’s a reason Hong Kong is becoming one of the most transparent crypto hubs in Asia. The license system isn’t perfect, but it’s working. Scams have dropped by over 60% since 2023. Withdrawals from licensed platforms now take minutes, not days. And users are finally starting to ask: "Do they have the license?" Not "Is this safe?" But "Is it legal?" That shift is powerful. You don’t need to be a lawyer to understand this. You just need to know where to look.

Below, you’ll find real stories from traders who got caught in the gray zone, reviews of licensed exchanges, and breakdowns of what the SFC actually checks during audits. No fluff. No theory. Just what you need to stay safe, stay legal, and keep your crypto where it belongs—yours.