Bitcoin's declining block reward schedule cuts mining rewards in half every four years, creating scarcity and limiting total supply to 21 million coins. Learn how halvings shape price, miner economics, and Bitcoin's long-term future.

Mining Rewards: How Miners Earn Crypto and Why It Matters

When you hear mining rewards, the crypto payments given to miners for validating transactions and adding blocks to the blockchain. Also known as block rewards, they’re the engine that keeps networks like Bitcoin running. Without these rewards, no one would spend the electricity, hardware, and time to secure the network. It’s not a bonus—it’s the core incentive. And while Bitcoin’s rewards halve every four years, other chains still pay out big, making this one of the most direct ways to earn crypto without buying it.

But mining rewards aren’t the same across all blockchains. proof-of-work, the original consensus method used by Bitcoin and early cryptocurrencies relies on miners solving complex math problems. The first one to solve it gets the reward. That’s why you see people stacking ASICs in warehouses. But not every chain works this way. Ethereum switched to proof-of-stake, a system where validators earn rewards by locking up crypto instead of running power-hungry machines. That shift cut Ethereum’s energy use by 99.95%. So when you hear about mining rewards today, you’re really talking about two different worlds: the old-school, energy-heavy kind, and the newer, stake-based kind that’s slowly replacing it.

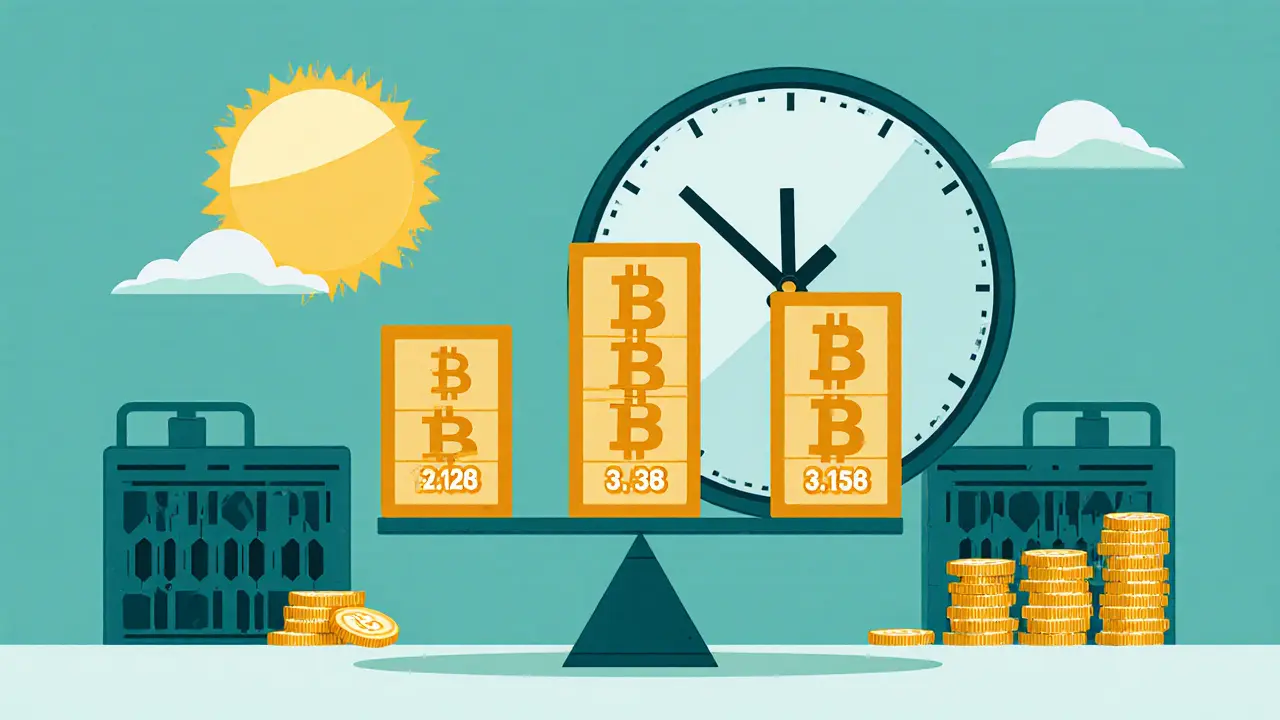

And here’s the twist: mining rewards are shrinking. Bitcoin started with 50 BTC per block. Now it’s 3.125 BTC—and it keeps dropping. Meanwhile, newer chains like Litecoin or Dogecoin still offer higher payouts, but competition is fiercer. Even then, many miners in places like India are walking away because of taxes, power costs, and regulations. If you’re thinking about mining, you’re not just chasing rewards—you’re betting on electricity prices, hardware lifespan, and whether the network will even survive. The real question isn’t how much you’ll earn. It’s whether you’ll still be mining next year.

What you’ll find below are real stories about mining, rewards, and what happens when the math doesn’t add up. From India’s strict mining rules to how validator rewards in proof-of-stake networks actually work, these posts cut through the hype. You’ll see what’s still profitable, what’s a trap, and why some projects stopped mining altogether. No fluff. Just what’s happening now.