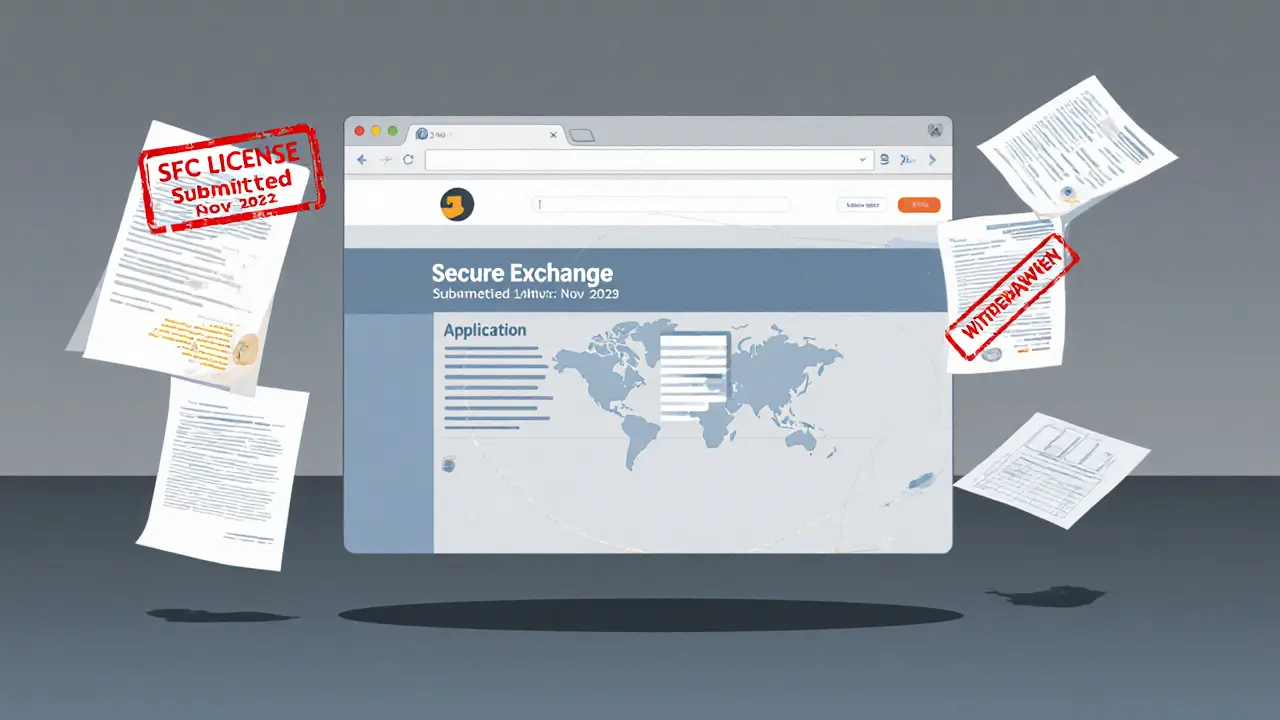

VAEX crypto exchange withdrew its Hong Kong license application in May 2024 and has been inactive since. No trading volume, no user reviews, no regulatory approval - it never became a real platform.

VAEX Shutdown: What Happened and Why It Matters for Crypto Users

When VAEX, a crypto exchange that promised fast trades and low fees shut down without warning, hundreds of users woke up to empty accounts and silent customer service. It wasn’t an outage. It wasn’t a technical glitch. It was a full exit scam, a deliberate fraud where the team vanished with user funds. VAEX had no regulation, no transparent team, and no real liquidity—just flashy ads and fake trading volume. By the time users realized something was wrong, the domain was down, the Telegram group deleted, and the founders gone.

VAEX wasn’t alone. It’s part of a growing list of defunct crypto exchanges, platforms that lure users with unrealistic returns, then disappear—like YodeSwap, CPDAX, and UPTX. These platforms don’t fail because of market crashes. They fail because they were never real to begin with. They rely on anonymity, unverified teams, and the hope that users won’t ask questions. The red flags are always there: no KYC, no audits, no public code, no media coverage. VAEX’s shutdown wasn’t an accident—it was the end of a carefully planned deception.

What’s worse is how many people still fall for this. New traders see a platform with a slick website and think it’s legit. They don’t check if the exchange is listed on CoinGecko or CoinMarketCap. They don’t look for independent reviews. They don’t ask who’s behind it. VAEX’s collapse shows how dangerous it is to trust hype over verification. If a platform doesn’t have a public team, a history, or a paper trail, it’s not a business—it’s a trap.

Below, you’ll find real stories and breakdowns of exchanges that vanished, scams that looked real, and how to protect yourself before it’s too late. These aren’t just cautionary tales. They’re survival guides for anyone trading crypto today.