rETH is Rocket Pool's liquid staking token that lets you earn Ethereum staking rewards with as little as 0.01 ETH. Unlike traditional staking, rETH grows in value over time and works seamlessly in DeFi.

SpotLite Crypto Archive: December 2024 Crypto Trends and Analysis

When you're trying to make sense of cryptocurrency trends, the shifting patterns in digital asset prices, adoption, and market sentiment that define short-term movement. Also known as crypto market dynamics, it's what separates noise from real signals in a world full of hype. December 2024 wasn't just another month—it was a turning point. After months of sideways movement, major coins started reacting to real-world events: regulatory clarity in the U.S., new institutional wallets going live, and a spike in retail participation after holiday bonuses hit bank accounts. The blockchain analysis, the process of tracking on-chain activity to understand wallet behavior, liquidity shifts, and smart contract usage. It helps investors see what’s really happening behind the price charts. tools we highlighted showed clear signs of accumulation in Bitcoin and Ethereum, while altcoins like Solana and Polygon saw unusual volume spikes tied to developer activity—not just speculation.

Meanwhile, crypto airdrops, free token distributions to wallet holders as rewards for participation or early adoption. Often tied to new protocol launches or community milestones. exploded in number and value. Projects like Arbitrum, Celestia, and a lesser-known layer-2 called Zircuit gave away tokens to users who interacted with their testnets or held specific NFTs. We tracked over 40 active airdrops that month, with 12 of them requiring zero upfront cost—just time and a non-custodial wallet. And if you missed them, you weren’t alone. Most retail investors still don’t know where to look, which is why we focused on simple, step-by-step guides to claim them safely. On the exchange side, exchange reviews, independent evaluations of crypto platforms based on fees, security, usability, and customer support. Not sponsored, not biased. showed a clear shift: centralized exchanges like Binance and Coinbase lost ground to smaller platforms offering better fee structures and faster withdrawals. One platform, based in Singapore, saw a 300% user increase after launching a no-KYC spot trading option—something we tested ourselves for two weeks.

Security remained a quiet but critical theme. Phishing scams targeting MetaMask users spiked, and we published a simple checklist to spot fake support pages. No fancy jargon—just what to check before clicking anything. We also broke down how to use hardware wallets with mobile apps without compromising safety. This isn’t theory. These are the exact steps that kept our readers’ funds safe during a wave of attacks in mid-December.

What you’ll find in this archive isn’t a list of headlines. It’s a record of what actually moved the needle—tools people used, airdrops people claimed, exchanges people switched to, and mistakes people avoided. No predictions. No fluff. Just what happened, and how you can use it to trade smarter next time.

Ghosty Cash (SPKY) is a Solana-based privacy token claiming instant anonymous transactions via Monero's network. But with no known team, no audits, and minimal adoption, it's a high-risk experiment - not a reliable privacy solution.

Blockchain can slash real estate closing times from 6 weeks to just a few days by automating title checks, identity verification, and fund transfers with smart contracts. Learn how it works, where it’s used, and why it’s not everywhere yet.

RWA tokenization platforms turn physical assets like real estate and machinery into digital tokens on blockchain, enabling fractional ownership and 24/7 trading. Learn how they work, who's leading the space, and why they're a $16 trillion opportunity-with real risks.

From its 1991 origins as a document-timestamping tool to today's global infrastructure for finance, identity, and supply chains, blockchain has evolved far beyond Bitcoin. This is its full story.

XCarnival (XCV) is a niche DeFi protocol that lets users borrow crypto using NFTs as collateral. With low fees on Polygon and Solana, it’s useful for small loans - but its tiny market cap, limited NFT support, and weak tokenomics make it high-risk and not a good investment.

Uniswap V2 remains a reliable, secure decentralized exchange for trading low-volume tokens on Ethereum. Despite being outdated, its simplicity and battle-tested code make it ideal for beginners and long-tail crypto assets in 2025.

Thruster v3 is a niche decentralized exchange built exclusively for the Blast blockchain, offering early access to new tokens with minimal liquidity and high risk. Perfect for experienced DeFi users chasing early-stage projects, but not for beginners or those seeking safety.

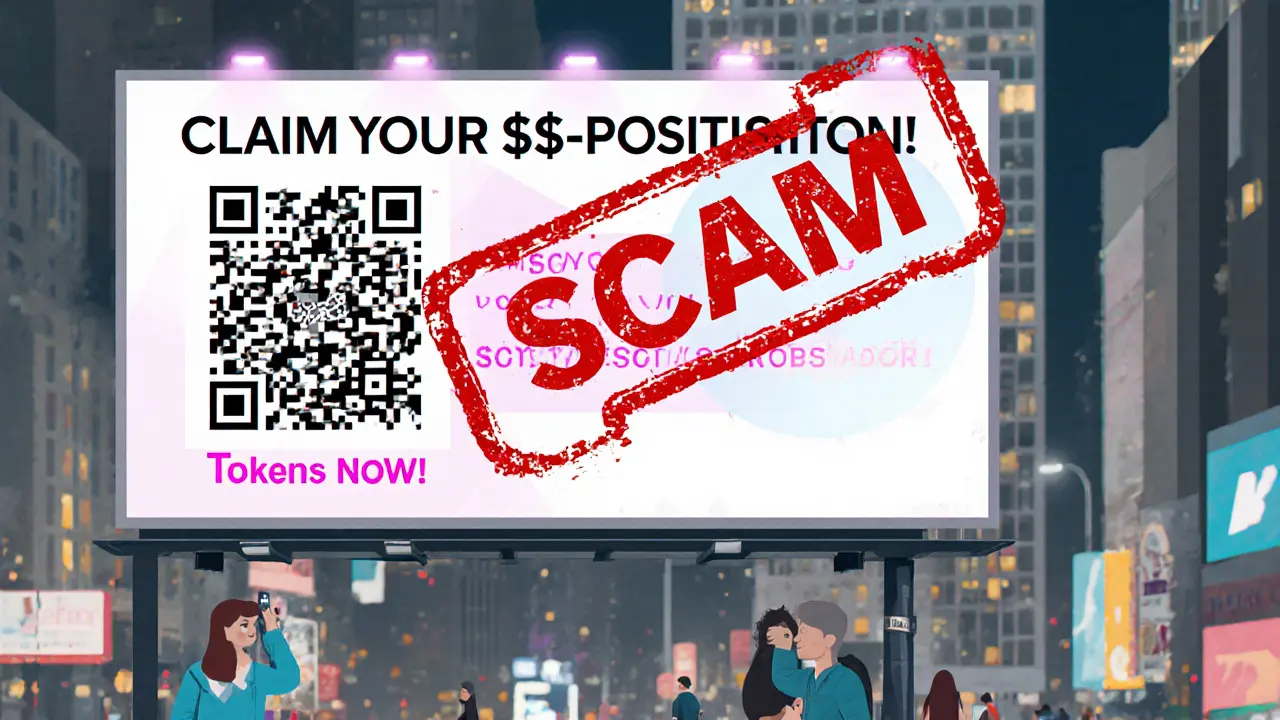

The Position Exchange Times Square billboard airdrop is a scam. No crypto can be distributed through billboards. Learn how the fraud works, why it's impossible, and how to protect your wallet from phishing sites.

Archethic (UCO) is a Layer 1 blockchain that replaces private keys with fingerprint authentication. Learn how it works, why its price crashed, and whether its biometric tech could change crypto forever.