Bird Finance's BIRD airdrop has caused confusion due to multiple similar projects. This article explains what's real, current status in 2026, how to verify legitimacy, and risks to avoid scams. Stay informed before participating.

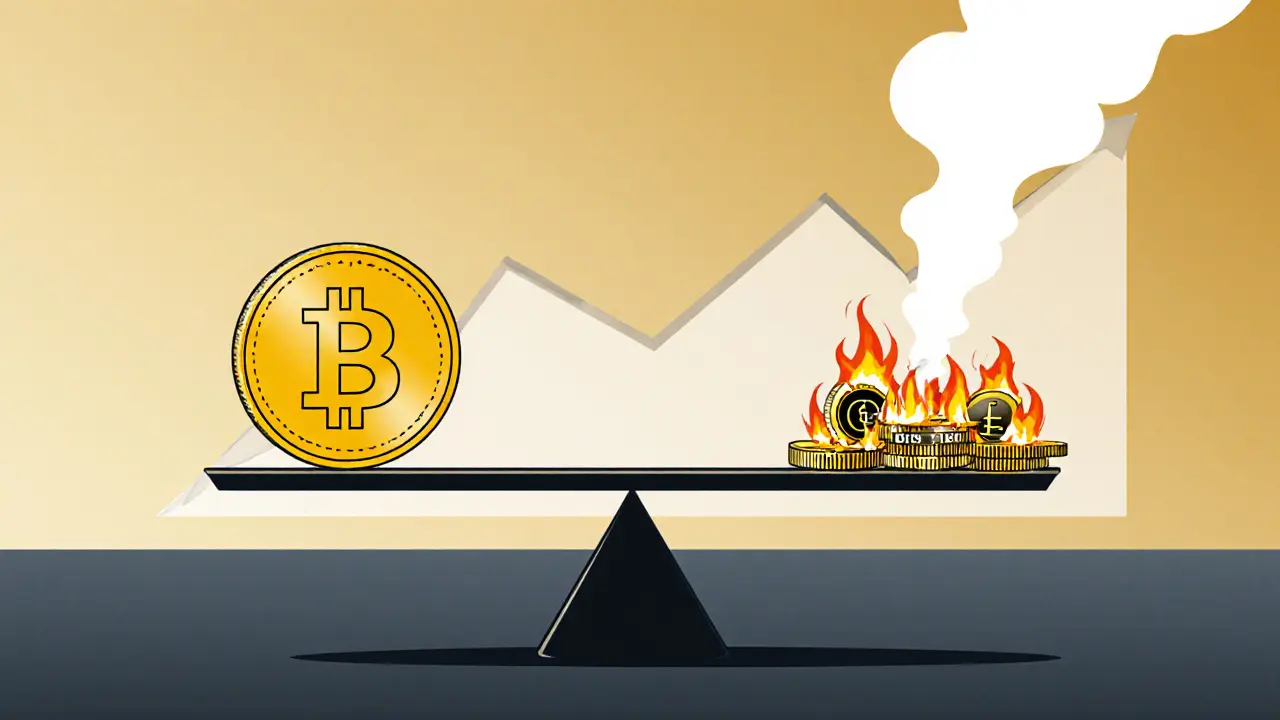

Tokenomics Explained: How Crypto Tokens Create Value and Why Most Fail

When you hear tokenomics, the economic design behind a cryptocurrency token, including how it’s created, distributed, and used. Also known as token economics, it’s not just a buzzword—it’s the reason some coins survive and others vanish overnight. Think of it like the rulebook for a game: if the rules are broken, the game collapses. A token might look flashy with a cool logo and a viral tweet, but if its supply is endless, rewards are unfair, or no one can actually use it, it’s just digital confetti.

Real token distribution, how tokens are allocated among founders, investors, users, and the public matters more than hype. Look at the token utility, the actual function a token serves inside its ecosystem, like paying fees, voting, or earning rewards. If a token doesn’t do something useful—like $RDNT letting you vote on lending rates or $3ULL giving you access to exclusive GameFi drops—it’s just a speculative asset waiting to crash. And when the hype dies, so does the price. That’s why projects like FEAR and BOYS disappeared: no utility, no demand, no future.

Then there’s blockchain economics, how incentives align with network behavior, like validator rewards or staking penalties. Even big names like Ethereum and Solana rely on this. If validators get paid fairly and get slashed for cheating, the network stays secure. But if a token’s rewards are too high and too easy, everyone mines or stakes, supply floods the market, and value evaporates. You see this in fake airdrops like TRO or Position Exchange—promises of free tokens with no real system behind them. They don’t have tokenomics; they have scams.

What you’ll find below isn’t just a list of posts. It’s a real-world autopsy of what works and what doesn’t. You’ll see how CYT and 3ULL used tokenomics to drive early adoption, why LON and RDNT built lasting utility, and how BOYS and BUILT collapsed because they skipped the basics. You’ll also learn how to spot fake airdrops, understand validator rewards, and recognize when a token’s design is built to last—or built to fail. No fluff. No guesswork. Just the facts behind the numbers.

Deflationary cryptocurrencies like Bitcoin and BNB use supply reduction to create scarcity, but real value comes from utility, not just burns. Learn how tokenomics, real-world burns, and hybrid models are shaping the future of digital money.