Russia's 2025 cash withdrawal limits have crippled Bitcoin cash trading, forcing users to turn to foreign exchanges, barter, and private crypto banks. Here's how traders are adapting-and what alternatives are working now.

SpotLite Crypto Archive: June 2025 Crypto Trends and Airdrops

When you’re trying to make sense of SpotLite Crypto, a trusted hub for clear, no-nonsense crypto insights. It’s not another hype machine—it’s the place you go when you want real talk about crypto airdrops, blockchain trends, and how to pick the right crypto exchanges without getting scammed. In June 2025, the market didn’t roar—it refined. Big names dropped new tokens, but the real action was in the quiet moves: wallets getting smarter, exchanges tightening security, and new users finally finding guides that didn’t talk down to them.

What stood out? crypto airdrops weren’t just free tokens anymore—they came with strings attached. Projects like ZetaChain and Manta Network launched airdrops that required real activity: staking, testing mainnets, or even submitting bug reports. This wasn’t the wild west of 2021 anymore. You had to earn it. Meanwhile, blockchain trends shifted toward privacy layers and modular chains. Ethereum’s Layer 2s kept growing, but the real buzz was around zk-Rollups becoming cheaper and faster than ever. And for beginners? The guides got better. No more "just buy Bitcoin and HODL" nonsense. Instead, you found step-by-step breakdowns on how to set up a non-custodial wallet, how to check if an airdrop is legit, and why you should never reuse the same seed phrase across apps.

On the exchange side, things got messy. Binance and Coinbase kept their top spots, but smaller platforms like Bitrue and Bybit made quiet gains by lowering fees and adding more stablecoin pairs. SpotLite’s reviews cut through the noise—no sponsored fluff, just real user feedback and uptime stats. If you were trading in June, you cared about one thing: getting your trades executed without delays or hidden costs. That’s what mattered.

What you’ll find below isn’t a list of headlines. It’s a collection of posts that actually helped people navigate this phase of the market. Whether you were chasing an airdrop, comparing exchange features, or just trying to understand why a new chain got traction, these articles gave you the tools—not the guesses. No fluff. No hype. Just what worked, what didn’t, and why.

Thailand's SEC crypto regulations in 2025 require all exchanges serving Thai users to get licensed. Foreign platforms like Bybit and OKX have been blocked. Only nine exchanges are approved, with strict limits on coins, fees, and services.

Mimo.exchange is a niche crypto exchange focused on Euro-pegged stablecoins, but it suffers from poor uptime, zero user reviews, no regulatory compliance, and minimal liquidity. Avoid unless you're a DeFi specialist with high risk tolerance.

PRIVATEUM GLOBAL (PRI) is a privacy-focused cryptocurrency on Binance Smart Chain, offering fast, low-cost transactions with optional anonymity. Learn how it works, how it compares to Monero and Zcash, and whether it's viable for real-world use.

DogeMoon (DGMOON) is an inactive charity token with no airdrop. What you're seeing online is likely a scam mimicking its name. Learn why it's not worth your time and what to look for instead.

Boys Club (BOYS) is a nearly dead meme coin tied to old internet memes. With near-zero trading volume, conflicting data, and no real community, it’s not a viable investment - just a digital ghost.

The RACA Radio Caca × USM Metaverse airdrop offers 10,000 RACA tokens to 1,000 participants. Learn how to join for free, what you get, and why this isn't just another crypto giveaway.

APENFT distributed over 45 billion NFT tokens in 2025 through CoinMarketCap and exchange airdrops. Learn how to qualify, which wallets to use, and what’s next for the TRON-based NFT ecosystem.

Learn how staking rewards are calculated across major blockchains like Ethereum, what factors affect your earnings, and how to maximize your passive income without falling for misleading APY claims.

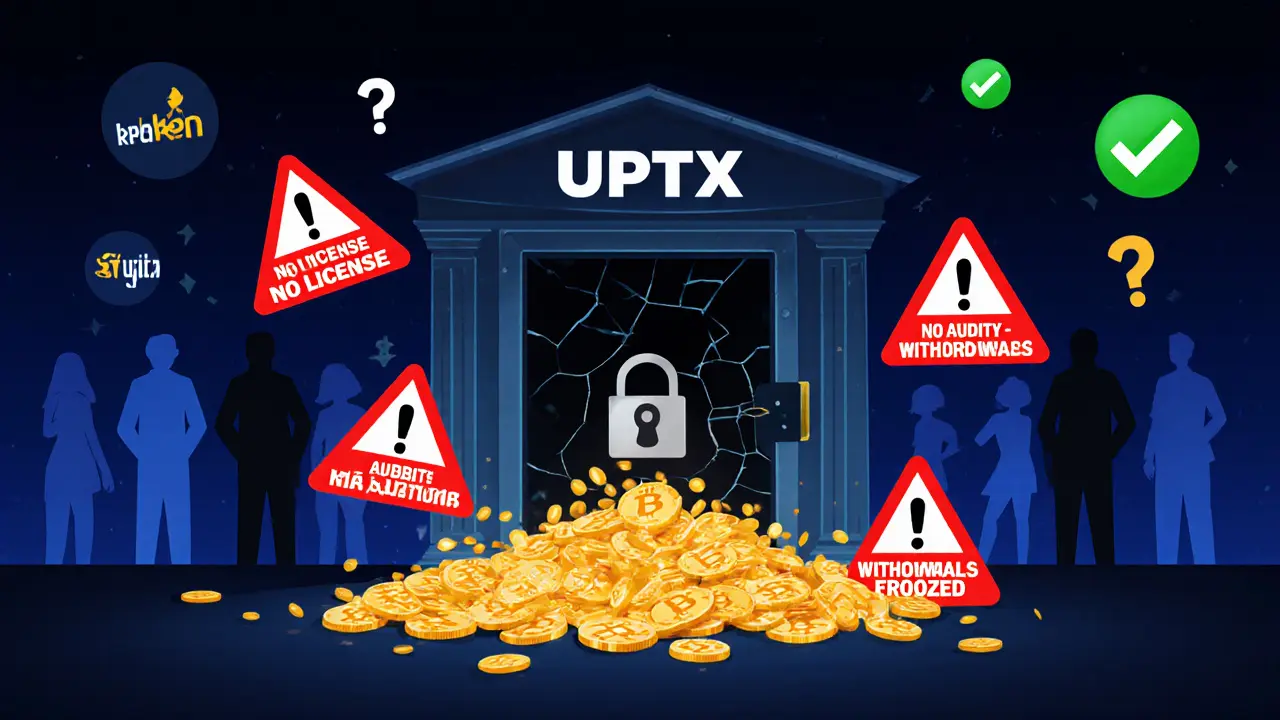

UPTX crypto exchange shows multiple red flags: untracked volume, no regulation, withdrawal issues, and zero expert coverage. Don't risk your funds on this unverified platform.

Cross-chain bridges connect isolated blockchains, letting you move assets like Bitcoin to Ethereum for DeFi. But with $2.1 billion stolen in 2022, security is critical. Learn how they work, which ones are safest, and what’s next.

Liquidity pools are the backbone of DeFi, enabling instant crypto trading without intermediaries. Learn how they work, the risks like impermanent loss, and how to safely earn fees by providing liquidity.