SafeMoon's controversial airdrop isn't tied to CoinMarketCap - it's a 1:1 token swap for existing holders. Learn what really happened after the CEO's fraud conviction, how the new team is rebuilding, and why you should be extremely cautious.

Cryptocurrency: Real Coins, Scams, Exchanges, and How to Stay Safe

When you hear cryptocurrency, a digital asset built on blockchain technology that lets people send value directly without banks. Also known as crypto, it’s meant to be open, secure, and decentralized—but too often, it’s used to trick people. Not every coin you see online is real. Some are made up overnight with no code, no team, and no purpose—just a flashy name and a promise of quick cash. Others are tied to exchanges that vanish without warning, leaving users locked out of their funds.

Behind every fake coin like XREATORS (ORT), a non-existent token with no blockchain presence or trading history, there’s a pattern: no whitepaper, no community, no way to verify who’s behind it. And it’s not just coins—crypto exchanges, platforms where you buy, sell, or trade digital assets like VAEX, UPTX, and Nivex are popping up with big AI promises and zero regulation. They disappear after collecting deposits, and by the time you realize it, there’s no customer support, no legal recourse, and no refund.

But not all crypto is risky. Some projects, like tokenized assets, real-world stocks or funds represented as blockchain tokens such as BLKon from Ondo Finance, give you access to traditional investments in a new way—though they come with their own liquidity risks. Then there’s staking rewards, earnings you get for locking up crypto to help secure a blockchain network, which can be a steady source of passive income—if you know how to calculate them and avoid inflated APY claims. And airdrops, free crypto tokens given out to users who complete simple tasks, like APENFT or RACA Radio Caca, can be legit if they come from established teams with clear rules.

What you’ll find here isn’t hype. It’s the truth behind the noise. We’ve dug into dead exchanges, exposed fake coins, broken down how staking actually works, and showed exactly what people got from real airdrops—good and bad. No fluff. No guesswork. Just what you need to know before you click, invest, or swipe your wallet.

Fraxswap v2 on Avalanche offers unique TWAMM technology for large crypto trades with minimal slippage, but its extremely low liquidity and lack of users make it impractical for most traders in 2026.

The Caduceus CMP airdrop in 2022 distributed over 174,500 tokens across MEXC and CoinMarketCap to build community. Learn how it worked, who won, and why the project never took off.

British Columbia has restricted cryptocurrency mining since 2022 to protect clean hydroelectric power for homes and green energy projects. As of 2026, the ban remains in place, with permanent rules expected by late 2025.

No official DogemonGo Christmas NFT airdrop exists in 2026. Learn how to spot scams, what the real Landlord NFT system does, and how to earn rewards the right way - through gameplay, not hype.

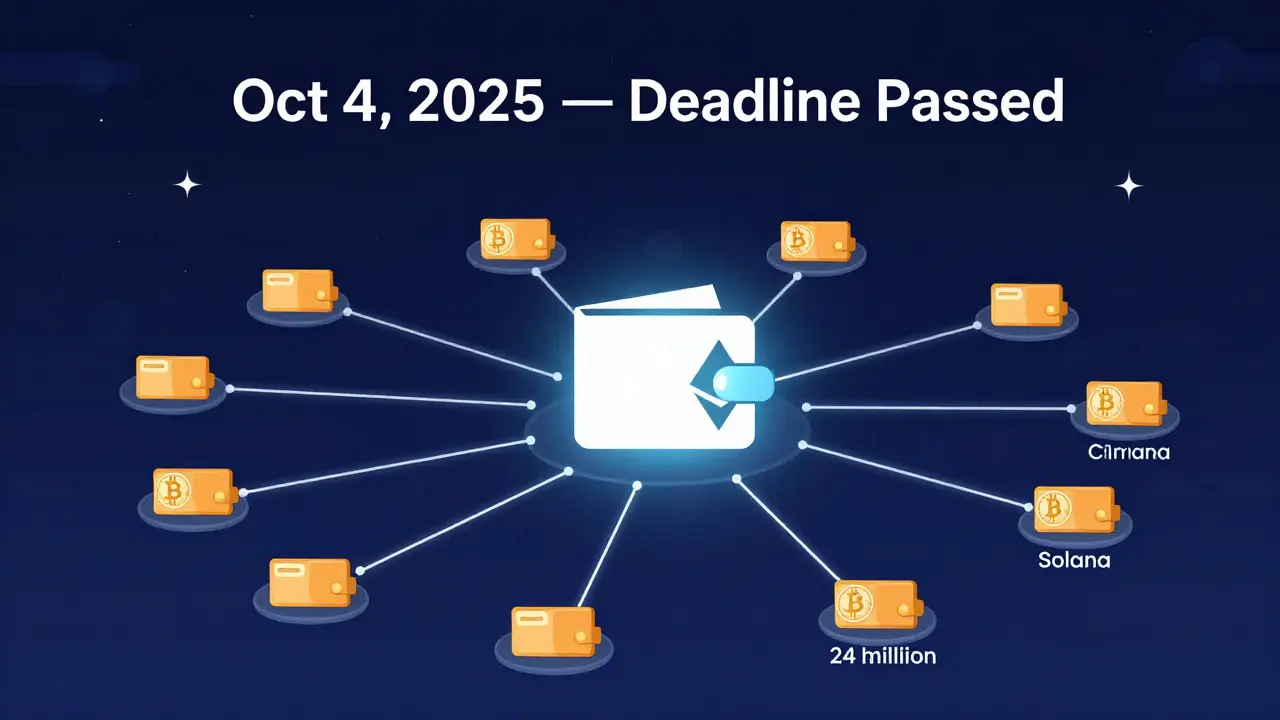

The Midnight (NIGHT) airdrop by Cardano's Glacier Drop distributed 24 billion tokens across eight blockchains in 2025. Learn how it worked, why it mattered, and what happens now that the claiming window has closed.

Aster (ASTER) is a next-gen decentralized exchange that combines spot, perpetual, and stock trading with MEV-free execution and yield-bearing collateral. Built on BNB Chain, Ethereum, Solana, and Arbitrum, it's now listed on Binance and offers unique tools for both beginners and pros.

There is no verified Fitmin Finance airdrop as of 2026. Any site claiming one is a scam. Learn how to spot fake crypto airdrops, protect your wallet, and find real opportunities on Fantom and other chains.

Koi Finance is a nearly invisible crypto exchange with minimal trading volume and a crashing token. Here's why it's not worth your time or money.

dFund (DFND) is a DeFi platform that lets users create decentralized hedge funds, lend crypto with credit scoring, and trade loans on a secondary market. Unlike most crypto coins, it solves real financial problems with transparent, automated systems.

Crypto trading volume dropped sharply in 2025 despite Bitcoin’s price surge, as new regulations forced exchanges to delist tokens and tighten rules. The result? A fractured market where compliance killed activity - but also cleaned it up.

HM Treasury's 2026 crypto policy brings UK crypto firms under FCA regulation, targeting stablecoin issuance, trading platforms, and custody services. DeFi is exempt, but businesses serving UK users must now comply. Here's what it means for traders, issuers, and investors.