Bitcoin's block rewards are programmed to halve every four years, creating a predictable and declining inflation rate. This unique mechanism is driving institutional adoption and setting Bitcoin apart from all other digital assets.

Bitcoin Halving: What It Is, Why It Matters, and How It Shapes Crypto Markets

When you hear Bitcoin halving, a scheduled event that cuts the reward for mining new Bitcoin blocks in half. Also known as Bitcoin reward reduction, it’s one of the few predictable forces in crypto that directly affects supply, miner behavior, and long-term price pressure. Unlike stocks or fiat, Bitcoin has a fixed cap of 21 million coins—and the halving is how it slowly gets there. Every 210,000 blocks, or roughly every four years, miners who verify transactions get paid half as many new Bitcoins. That means less new supply hitting the market, and if demand stays steady—or grows—that’s often when prices start to move.

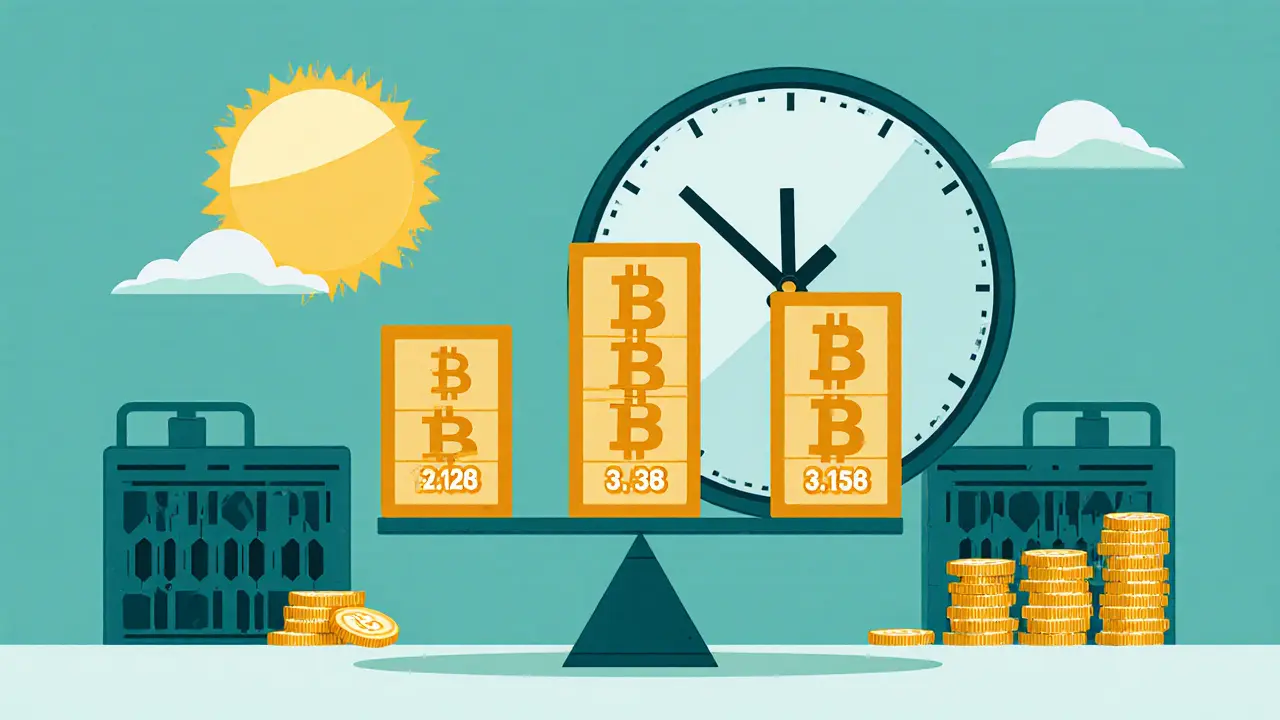

This isn’t just a technical detail. It’s a core part of Bitcoin’s design, built by Satoshi Nakamoto to mimic scarcity like gold. The first halving happened in 2012, then 2016, 2020, and the next one is coming in 2024. Each time, the mining reward dropped from 50 to 25, then 12.5, then 6.25 BTC, and now it’s down to 3.125 BTC per block. That’s a 99% reduction since day one. Miners, who rely on these rewards to cover electricity and hardware costs, have to adapt—some go out of business, others get more efficient, and some push for higher transaction fees. Meanwhile, investors watch closely because past halvings have often preceded major bull runs, though not always right away. It’s not magic, but it’s a powerful economic lever.

Related to this are crypto mining, the process of validating Bitcoin transactions and securing the network through computational power, and blockchain economics, how incentives, supply limits, and network rules shape value over time. These aren’t abstract ideas—they show up in real ways. For example, when mining rewards shrink, miners might sell less Bitcoin to cover costs, which reduces selling pressure. Or, if the price doesn’t rise fast enough, entire mining regions shut down, temporarily reducing network hash rate. The halving forces everyone—miners, traders, holders—to adjust. It’s the only time in crypto where the rules change for everyone at once, and it’s built into the code, not decided by a board or government.

What you’ll find in the posts below isn’t just theory. It’s real cases: how fake airdrops exploit confusion around Bitcoin events, how exchanges like Coincall and Bitpin adapt to market shifts after halvings, and how DeFi tokens like RDNT or FLUX tie into broader crypto cycles. You’ll also see how scams use the word ‘halving’ to trick people into giving up private keys or signing fake transactions. There’s no magic bullet, but understanding the halving helps you see through the noise. Whether you’re holding Bitcoin, mining it, or just watching from the sidelines, this event shapes the market in ways you can’t ignore.

Deflationary cryptocurrencies like Bitcoin and BNB use supply reduction to create scarcity, but real value comes from utility, not just burns. Learn how tokenomics, real-world burns, and hybrid models are shaping the future of digital money.

Bitcoin's declining block reward schedule cuts mining rewards in half every four years, creating scarcity and limiting total supply to 21 million coins. Learn how halvings shape price, miner economics, and Bitcoin's long-term future.