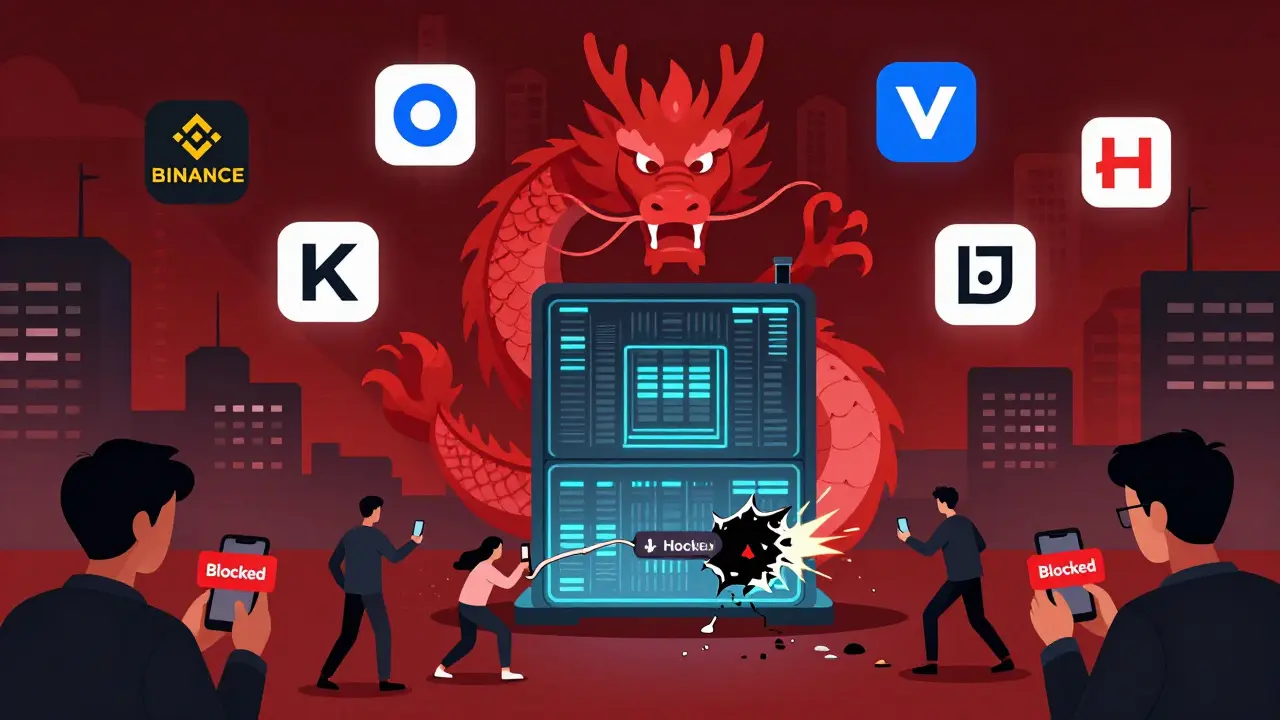

China has banned all major crypto exchanges since 2017, with strict enforcement through internet blocks, financial restrictions, and surveillance. Holding crypto isn't illegal, but trading is. Learn which exchanges are blocked and how Chinese users bypass the ban in 2025.

China Crypto Ban: What Happened and How It Changed Global Crypto

When China crypto ban, a sweeping government crackdown on cryptocurrency trading, mining, and related services launched in 2021. Also known as China's cryptocurrency prohibition, it didn’t just restrict coins—it rewired the entire crypto ecosystem. This wasn’t a minor policy tweak. It was the world’s largest economy pulling the plug on an industry it saw as a threat to financial control and energy stability.

The ban hit three big areas at once: crypto mining, the process of validating blockchain transactions using powerful computers, crypto exchanges, platforms where people bought and sold digital assets, and peer-to-peer trading, direct transfers between individuals using digital wallets. Miners in Sichuan and Xinjiang—once home to half the world’s Bitcoin hashing power—got shut down. Exchanges like Huobi and OKX moved operations overseas. Even ordinary users found their bank accounts frozen if they’d traded crypto.

But here’s what most people miss: the ban didn’t kill crypto. It just moved it. Mining rigs got shipped to Kazakhstan, the U.S., and even Russia. Chinese traders kept using P2P platforms like LocalBitcoins and Paxful, often paying cash or using gift cards. Meanwhile, China doubled down on its own digital currency—the Digital Yuan, a state-controlled central bank digital currency (CBDC)—which now powers everything from subway rides to government salaries. This wasn’t anti-blockchain. It was anti-decentralization.

The ripple effects were brutal and real. Bitcoin’s price dropped 50% in weeks. Crypto mining stocks collapsed. But it also forced the rest of the world to get serious about regulation. Countries that once ignored crypto now had a playbook: ban what’s risky, control what’s useful. Today, if you’re trading crypto in the U.S., Europe, or even India, you’re still feeling the weight of that 2021 decision.

Below, you’ll find deep dives into how the ban affected real projects, why some airdrops vanished overnight, and how exchanges like Bitpin and Coincall adapted—or didn’t. You’ll see how scams grew in the chaos, how mining rules changed in places like India, and why fake airdrops like Position Exchange’s Times Square billboard became so common. This isn’t just history. It’s the blueprint for every crypto regulation that’s coming next.

China has banned cryptocurrency trading and mining since 2021, but still leads in mining hardware and digital yuan development. Here's how its strict policies shape global crypto markets and why reversal is unlikely.

Despite China's 2021 crypto ban, peer-to-peer trading continues through VPNs, USDT, and encrypted apps. Learn how traders avoid detection, the risks involved, and why it's still thriving in 2025.