Impermanent loss calculators help DeFi users understand the hidden risk of providing liquidity to crypto pools. Learn how the top tools work, what they miss, and how to use them to protect your assets.

Blockchain & Crypto: Smart Contracts, DAOs, and Airdrops Explained

When you hear blockchain, a distributed digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively. Also known as distributed ledger technology, it’s the backbone of everything from digital money to automated contracts. It’s not just about Bitcoin anymore. Today, blockchain powers real-world systems that cut out middlemen, reduce fraud, and give users control—like insurance that pays out in hours instead of weeks, or games where you actually own your weapons.

Smart contracts, self-executing agreements with rules written directly into code are turning old industries upside down. In insurance, if a flight is delayed, your payout triggers automatically—no forms, no calls, no delays. That’s not sci-fi; it’s happening now. And DAO governance, a system where decisions are made by token holders without a central boss is evolving beyond simple voting. Real DAOs today use AI helpers, reputation scores, and quadratic voting to stop rich investors from dominating every decision. This isn’t theory—it’s what teams are fixing right now.

Then there’s the hype cycle: airdrops, free crypto tokens given out to users for joining a project or playing a game. Some are scams. Others? They’re your ticket into the next big play-to-earn game like SpaceY 2025, where you earn tokens just by colonizing Mars in a browser. But not every airdrop delivers—Dragon Kart’s NFT Weapon Box fizzled out fast, and you need to know why before you jump in.

What ties all this together? Control. Blockchain and crypto aren’t just new tech—they’re new ways to own, decide, and earn. You don’t need to be a coder to get value from this. Whether you’re tracking a live airdrop, wondering if DAOs are worth your time, or just trying to understand why a smart contract just paid you $50 for a delayed flight, this collection cuts through the noise. You’ll find real examples, hard truths, and clear steps—not fluff, not speculation, just what works.

Distributed ledger technology is transforming finance, supply chains, and government systems with real-time settlement, tokenization, and smart contracts. By 2030, it could add $1.76 trillion to the global economy.

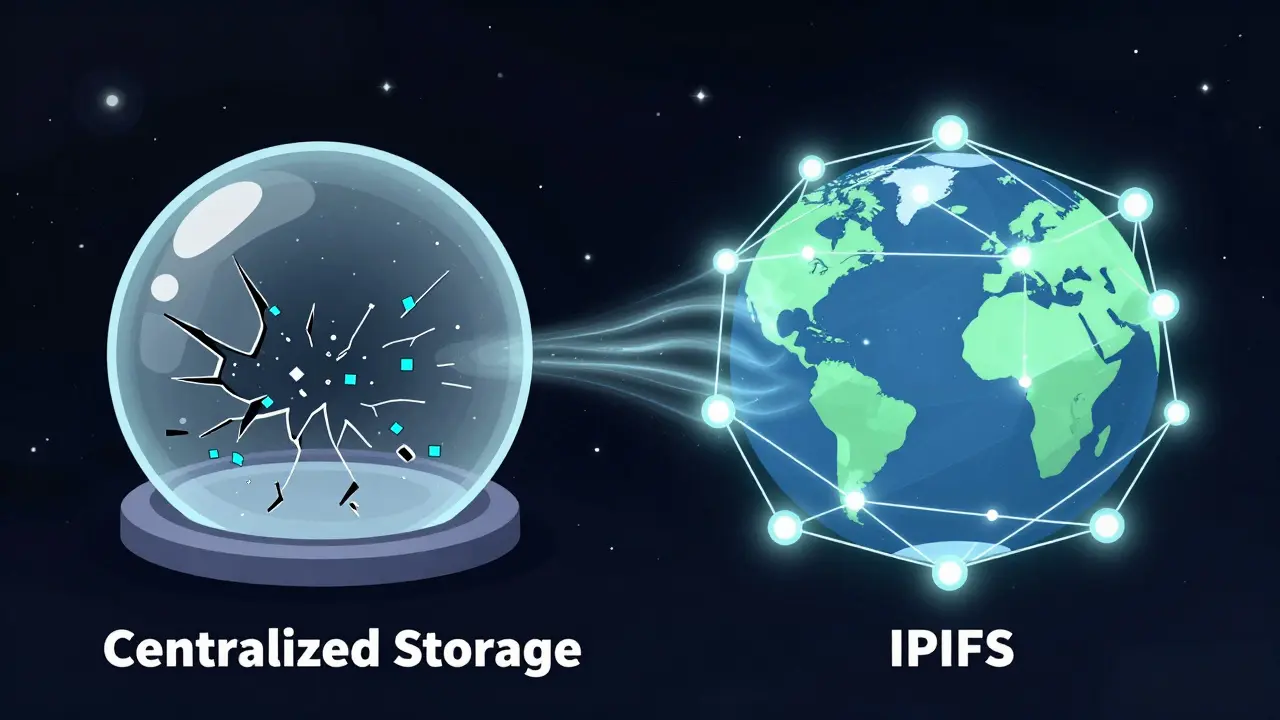

IPFS offers true decentralization for NFTs, while centralized storage risks losing your digital art forever. Learn how storage choices impact NFT longevity and what you should do to protect your assets.

Wrapped tokens let Bitcoin and other cryptocurrencies interact with DeFi apps on different blockchains. Learn how WBTC, wLINK, and others unlock lending, yield farming, and cross-chain liquidity without selling your assets.

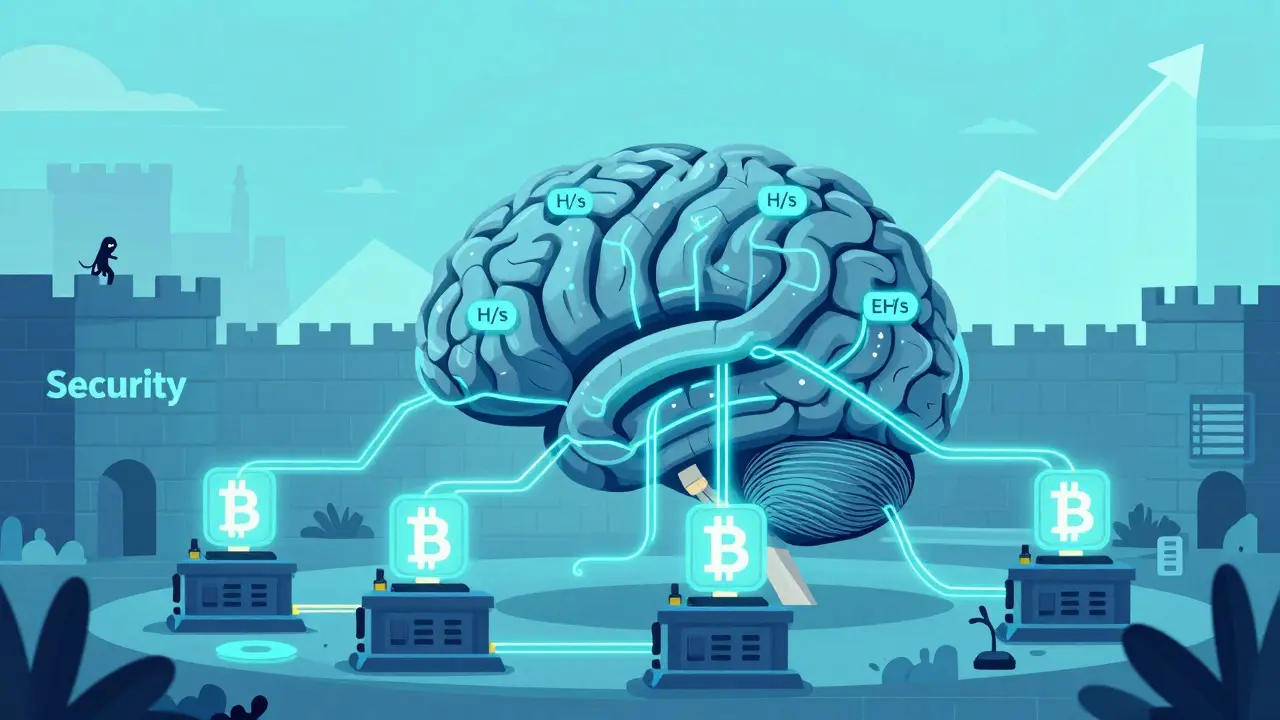

Mining difficulty controls how hard it is to mine Bitcoin and directly impacts miner profits. Rising difficulty forces out inefficient miners, favors large operations, and reshapes the entire mining economy - making survival dependent on cost control and hardware efficiency.

Buying an NFT doesn't mean you own the art. Learn what rights you actually get-and what you can't do with your digital artwork without breaking the law.

Digital signatures in cryptocurrency use private and public keys to verify transactions without revealing secrets. They ensure authenticity, integrity, and non-repudiation-making blockchain secure without banks.

Hash rate measures the computational power behind cryptocurrency networks like Bitcoin. Higher hash rates mean greater security, stability, and resistance to attacks. Learn how it works, why it matters, and how it impacts your crypto holdings.

Blockchains communicate through protocols like IBC and CCIP, enabling secure, direct transfers of assets and data between networks without centralized intermediaries. This interoperability unlocks new DeFi possibilities and improves user experience.

SpaceY 2025 (SPAY) is a blockchain-based Mars colonization game with a play-to-earn model. Learn how the SPAY airdrop worked, how to earn tokens through gameplay, and why this project stands out in the crowded blockchain gaming space.

DAO governance in 2025 is evolving beyond token voting. AI assistants, reputation systems, quadratic voting, and cross-chain coordination are making decentralized decision-making more fair, efficient, and scalable. Here's how real DAOs are fixing broken models today.

PlaceWar's NFT Tank Drop airdrop is a free distribution of functional in-game NFT tanks for early supporters. Learn eligibility rules, how to qualify, and what the tanks do in this detailed breakdown.